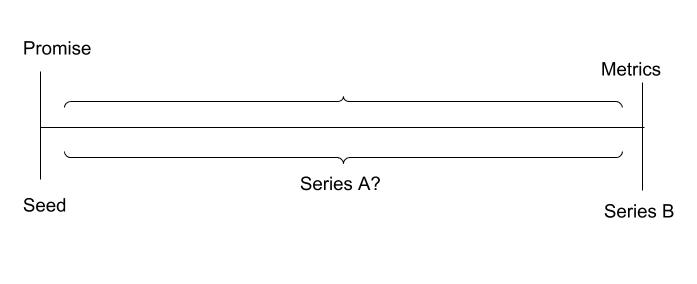

Most of the same principles apply, but here are a few differences 👇

- Aaron Harris, blog.ycombinator.com/when-to-raise-…

The longer a company has been in business—or the less good a founder is at telling a story—the more concrete & certain the metrics of that biz need to be"

If you have a traction, lead with numbers and let them do the selling for you.

If you don't, you're pitching your vision. Make sure to emphasize how much you've learned & de-risked, & know that "beggars can't be choosers".

At A, it's the opposite—you're getting one person to be very interested to give you a lot more money

Optimize for partner, but don't discount firm brand. It's a big signal for next round

The wider you go the more feedback you get, and the more shots on goal you get. There's potentially diminishing returns after 20 or so, and risks that you overextend yourself where you can't be 100% for all of them

Plus VCs want to feel special

Ideally from a position of power. The less you need the money, the better.

So ideally you don't even go out to fundraise. You get "pre-empted" after a few convos where ppl insinuate their interest

Then you say "we weren't planning on raising but we got inbound