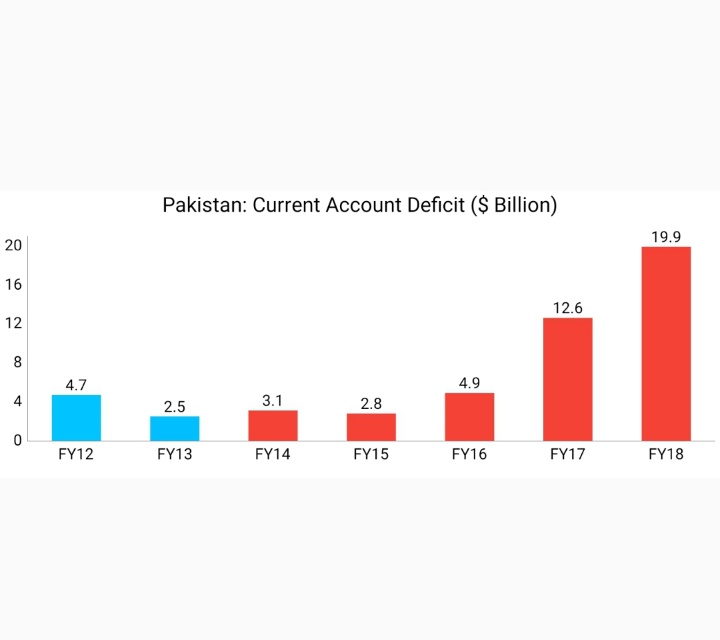

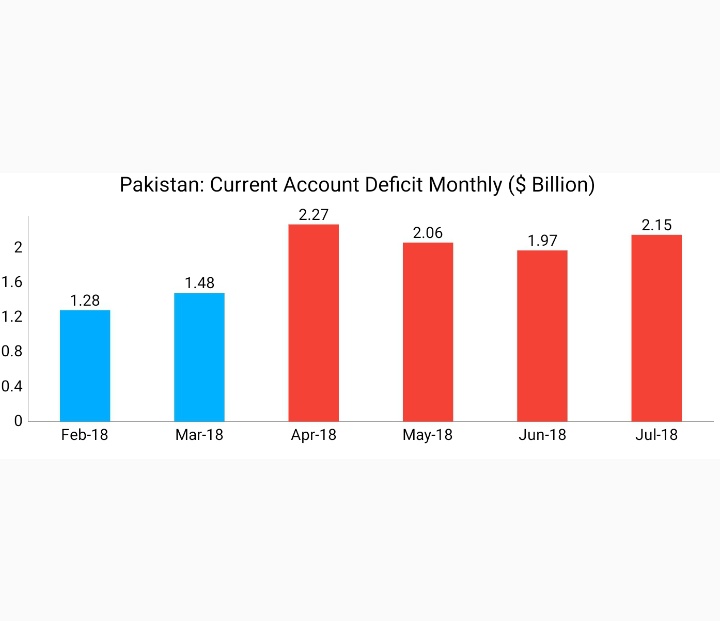

Last 4 months before the new govt coming into power we were running a CAD of $2bn a month this means at an annualised pace of $24bn

Source:

sbp.org.pk/ecodata/BOP-Se…

sbp.org.pk/ecodata/BOP_ar…

2/N

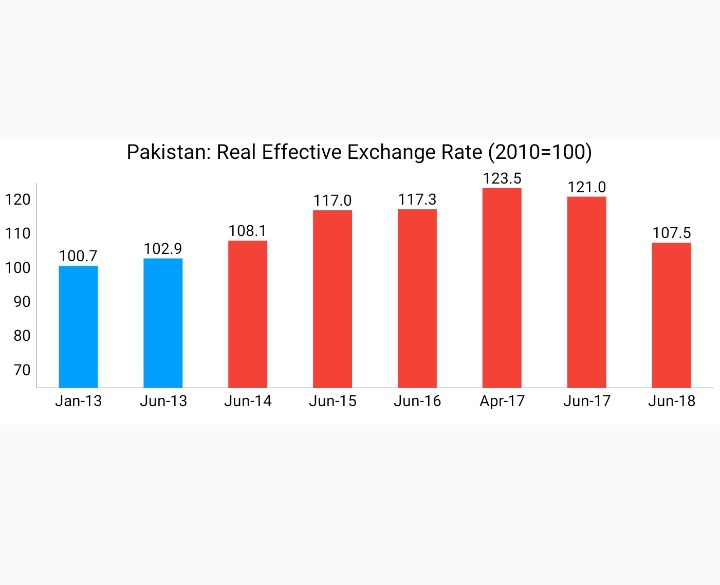

REER value of 100 reflects fair valuation

REER had appreciated to 123.5 by April-17

Source:sbp.org.pk/departments/st…

3/N

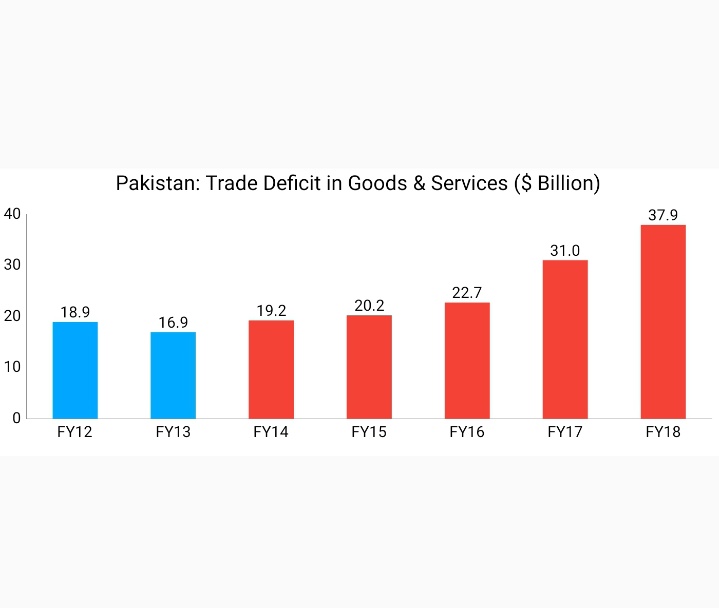

Trade Deficit more than doubled to $37.9bn by FY18, from $16.9bn in FY13

Real effective exchange rate (REER)

Free on board (FOB)

Source:

sbp.org.pk/ecodata/Export…

finance.gov.pk/survey/chapter…

4/N

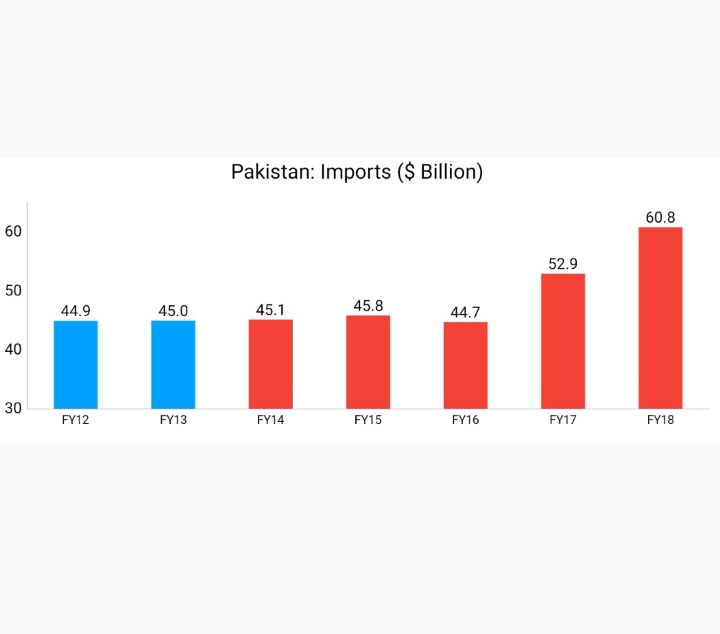

Imports (FOB) increased from 17.4% of GDP in FY13 to 18% of GDP in FY18

Source:

pbs.gov.pk/sites/default/…

finance.gov.pk/survey/chapter…

5/N

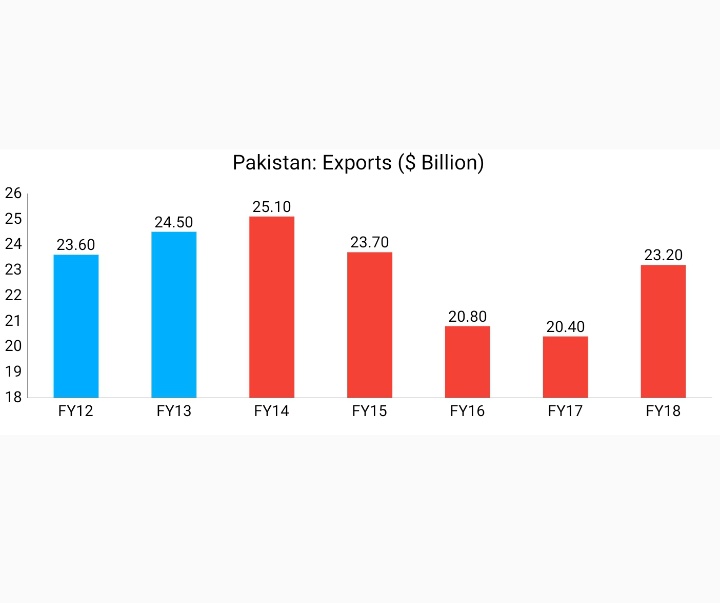

Exports (FOB) fell from 10.7% of GDP in FY13 to 7.9% of GDP in FY18

State Bank of Pakistan (SBP)

Public Sector Enterprises (PSEs)

Source:

pbs.gov.pk/sites/default/…

finance.gov.pk/survey/chapter…

6/N

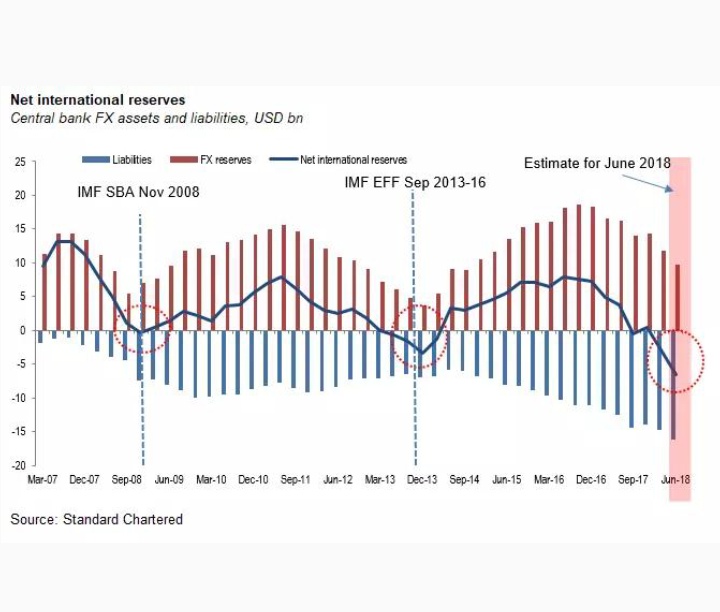

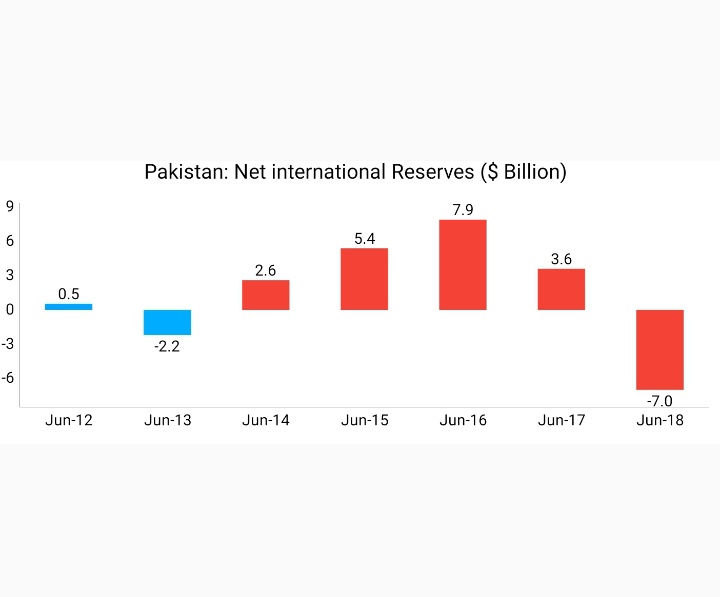

NIR fell from -$2.2bn in FY13 to -$7bn in FY18

Source:

sbp.org.pk/ecodata/Liquid…

sbp.org.pk/ecodata/Forex_…

8/N

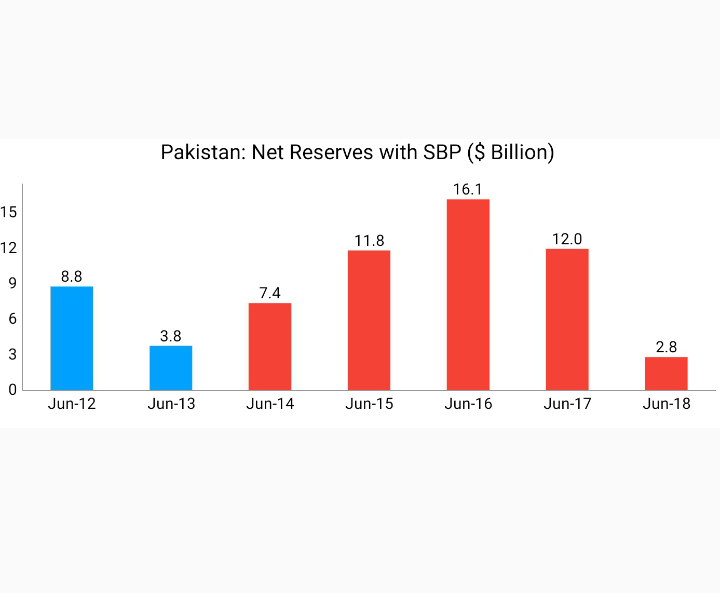

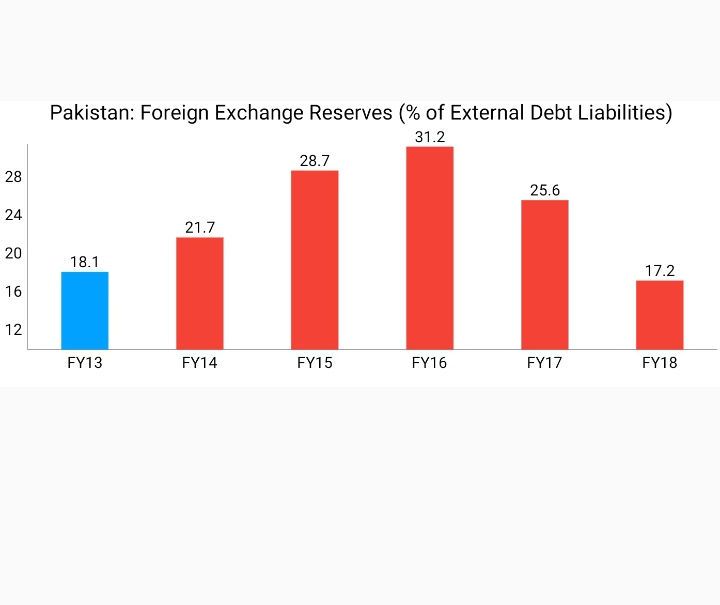

With CAD averaging $2bn a month & SBP's Net Reserves falling to $2.8bn this indicated risks of a sovereign default

Source:

sbp.org.pk/ecodata/Forex_…

sbp.org.pk/ecodata/pakdeb…

9/N

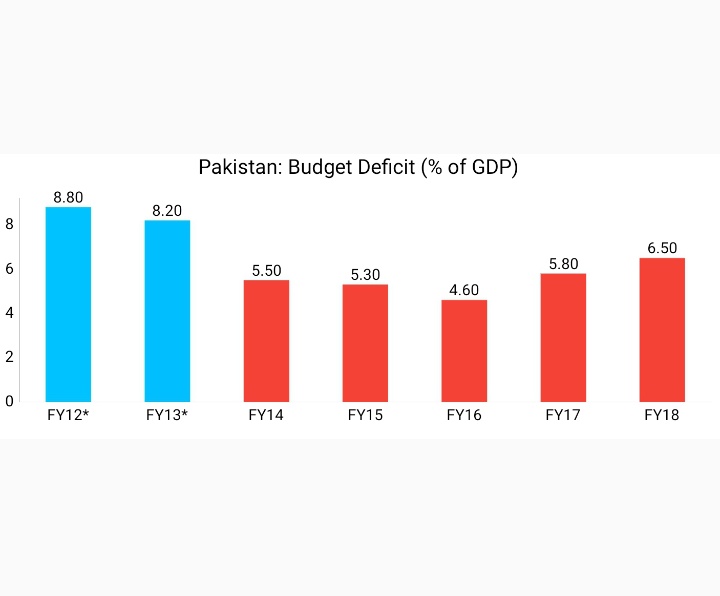

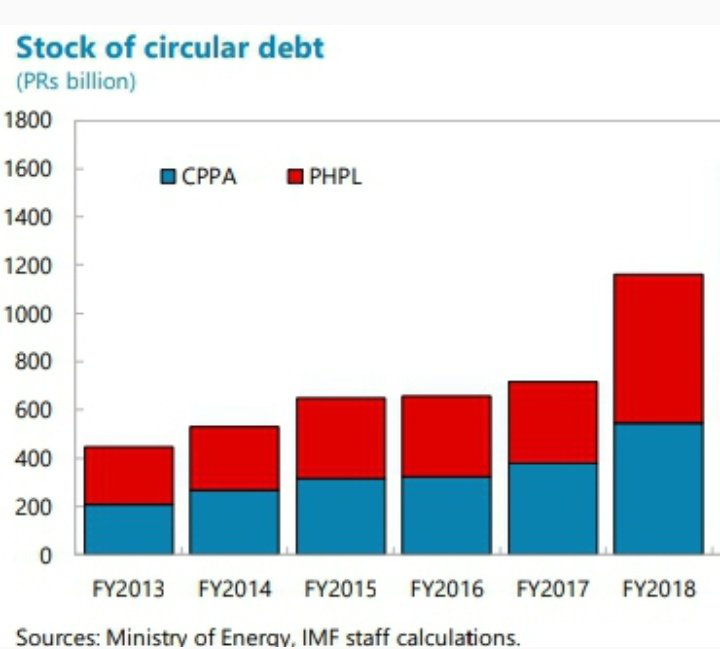

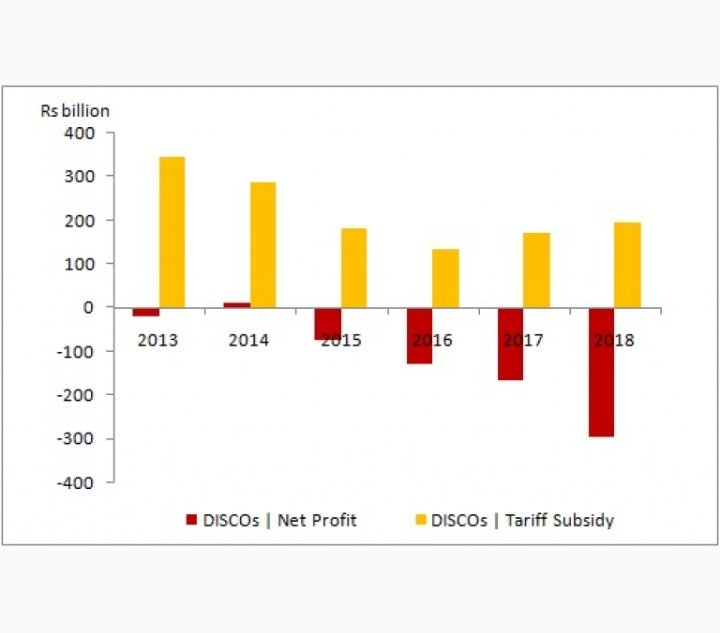

Financial losses of PSEs were at a record high level of 1.4%

of GDP, implying overall fiscal & quasi fiscal deficit of about 8% of GDP & Energy sector circular debt of Rs1.2tr

Source:

finance.gov.pk/publications/F…

finance.gov.pk/A_Roadmap_for_…

10/N

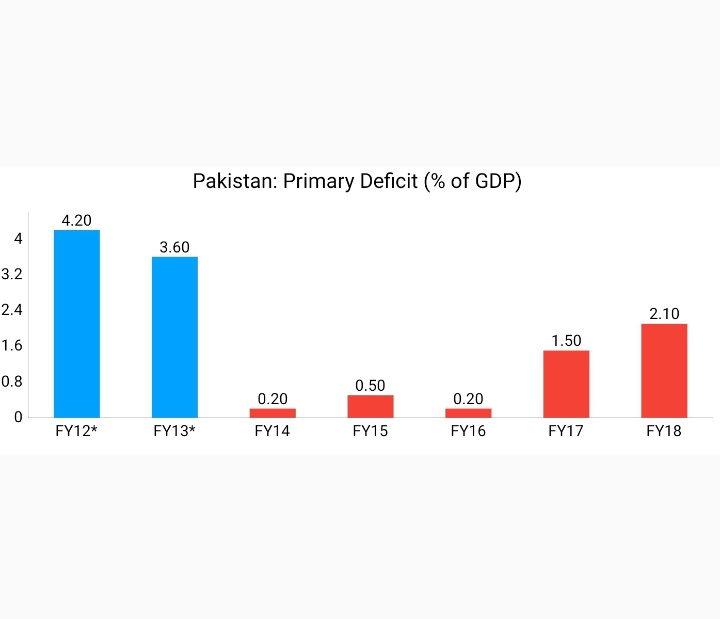

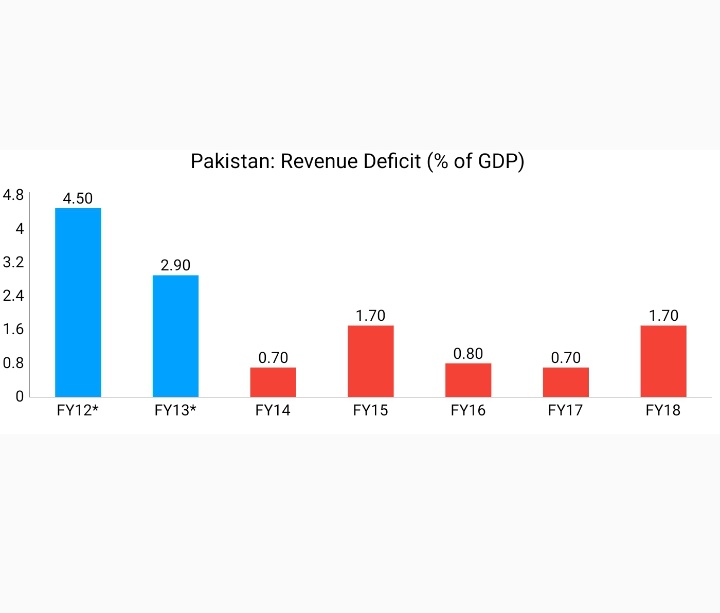

The persistence of revenue deficit indicates that the govt is not only borrowing to finance its development exp, but partially also financing its current exp

Source:

finance.gov.pk/publications/D…

finance.gov.pk/publications/D…

12/N

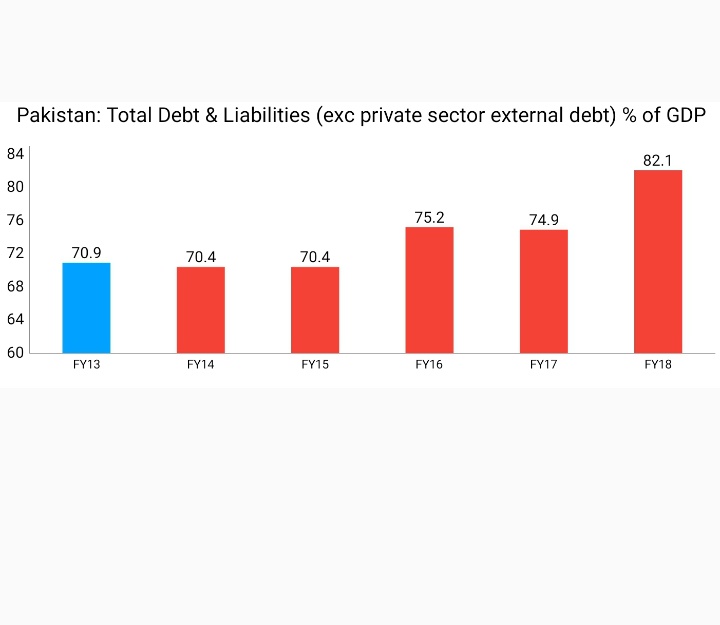

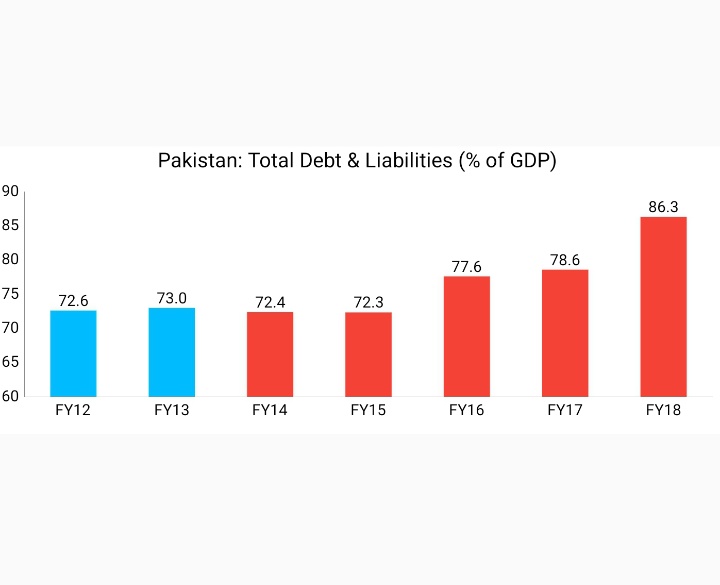

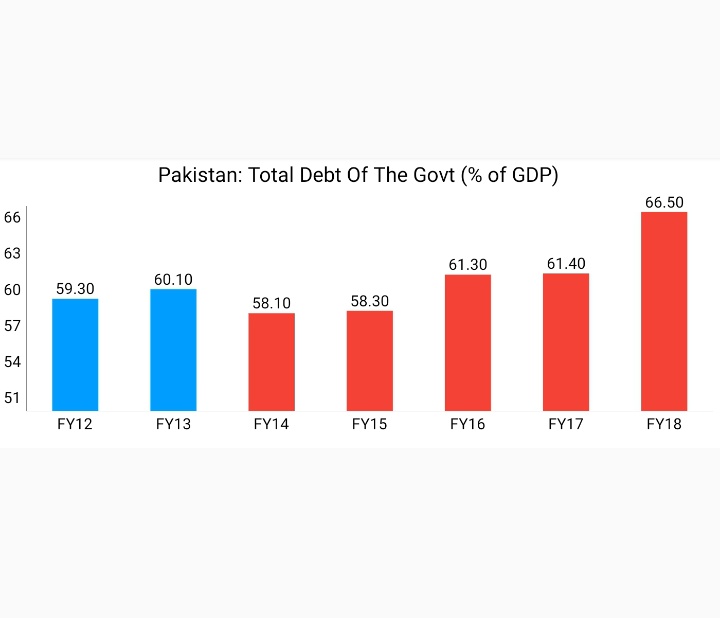

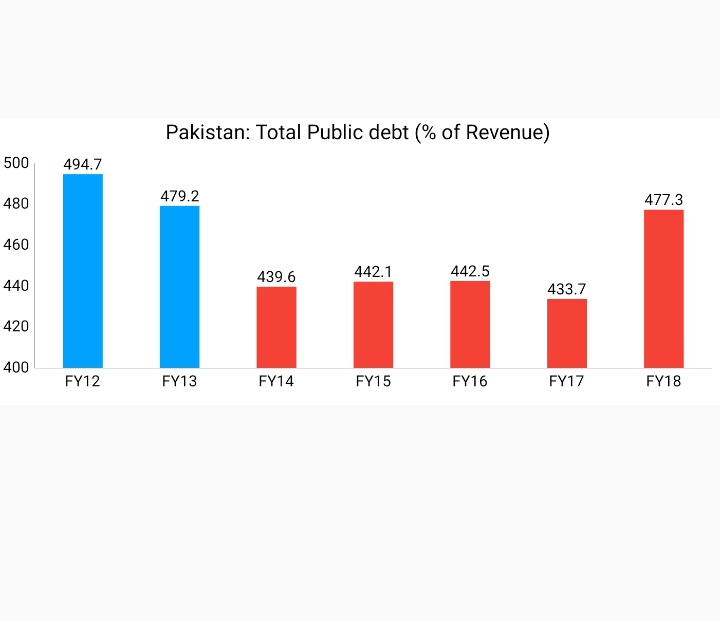

In absolute terms, it surged from Rs16,338bn in FY13 to Rs29,879bn in FY18 - up 83%

TDL includes Govt, Private sector, PSEs Debt & commodity operations etc

Source:sbp.org.pk/ecodata/Summar…

13/N

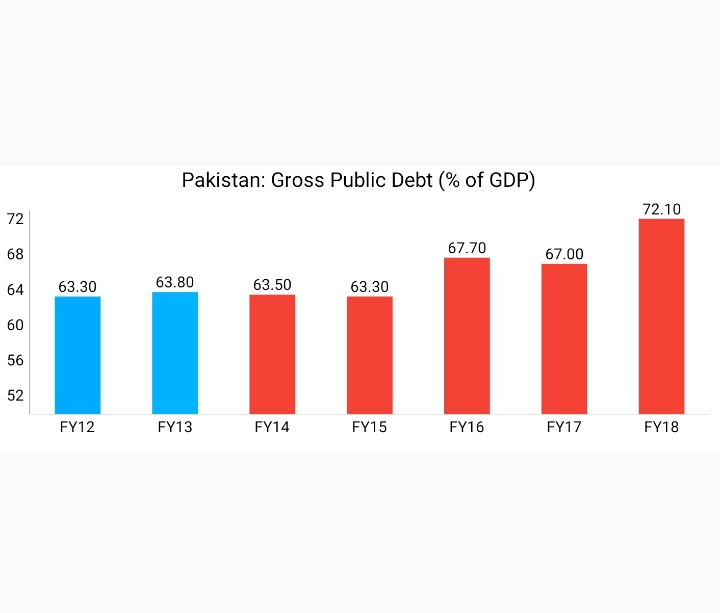

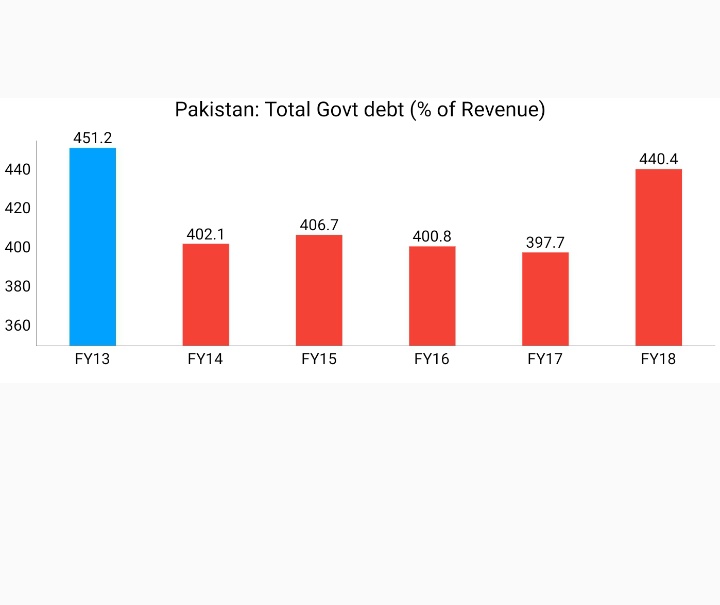

In absolute terms, it increased from Rs14,292bn in FY13 to Rs24,953bn in FY18 - an increase of 75%

Source:sbp.org.pk/ecodata/Summar…

14/N

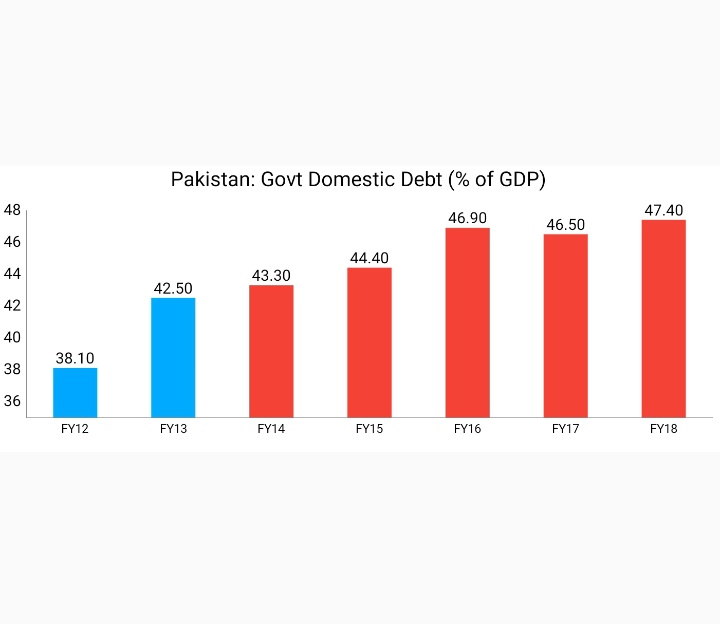

In absolute terms, It increased from Rs9,520bn in FY13 to Rs16,416bn in FY18 - an increase of 72%

Source:sbp.org.pk/ecodata/Summar…

15/N

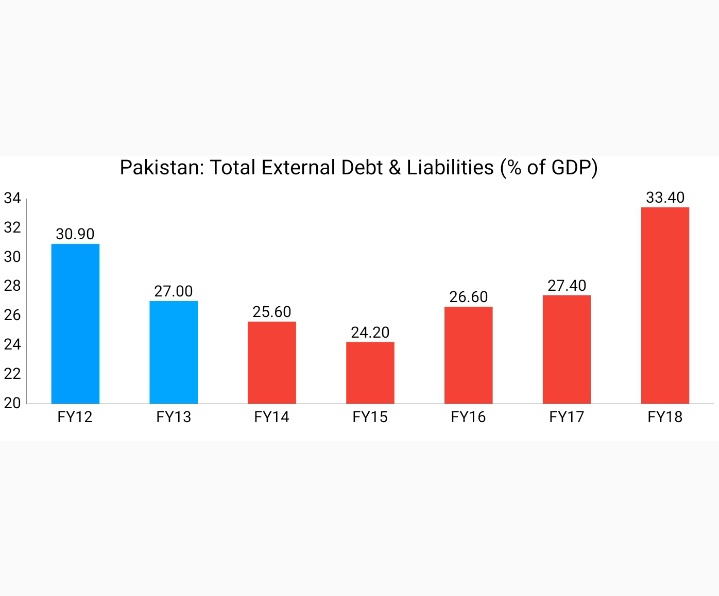

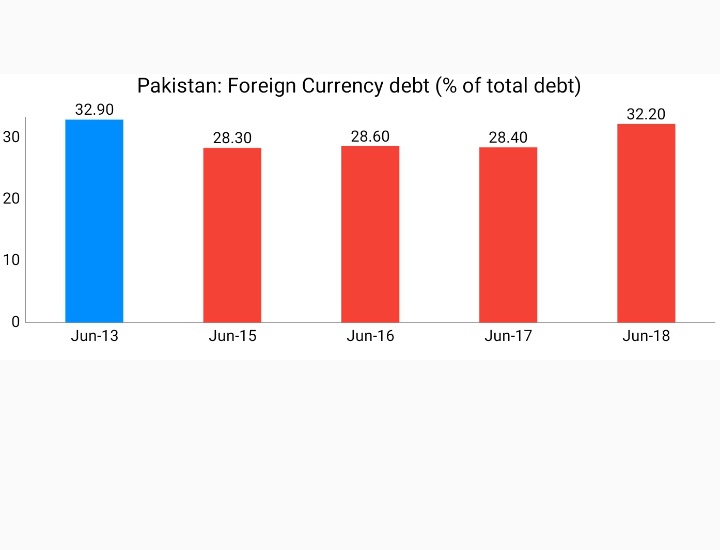

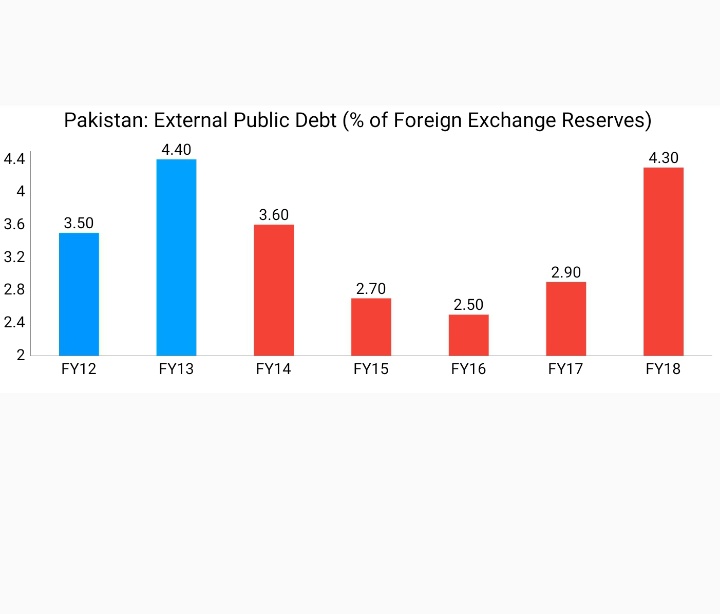

In absolute terms, It increased from $60,899 million in FY13 to $95,237 million in FY18 - an increase of 56.4%

Source:sbp.org.pk/ecodata/pakdeb…

16/N

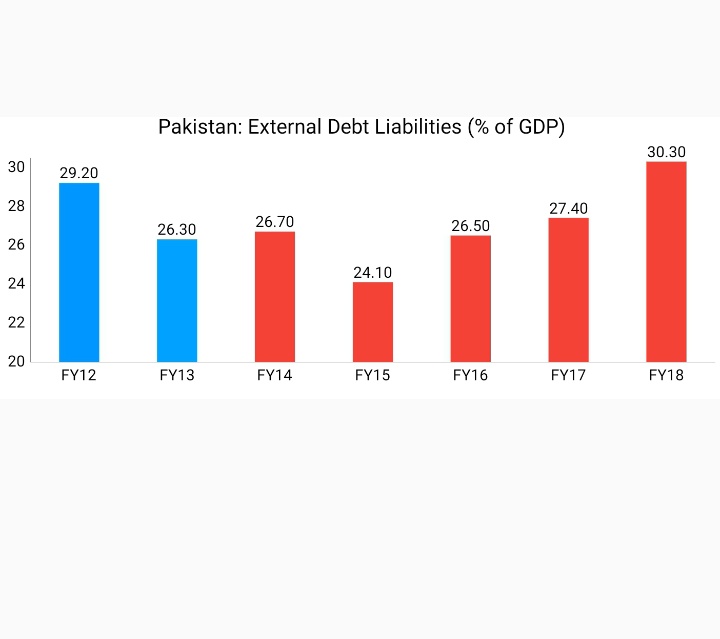

In absolute terms, It increased from Rs13,457bn in FY13 to Rs23,024bn in FY18 - an increase of 71%

Source:sbp.org.pk/ecodata/Summar…

17/N

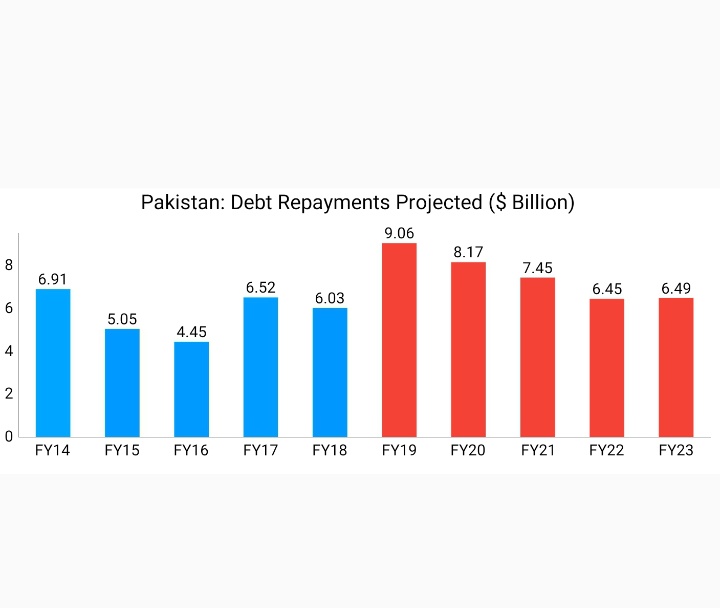

In Blue bars are the actual Debt Repayments

In Red bars are the debt Repayments due

Source:

nation.com.pk/06-Jan-2019/go…

finance.gov.pk/publications/D…

18/N

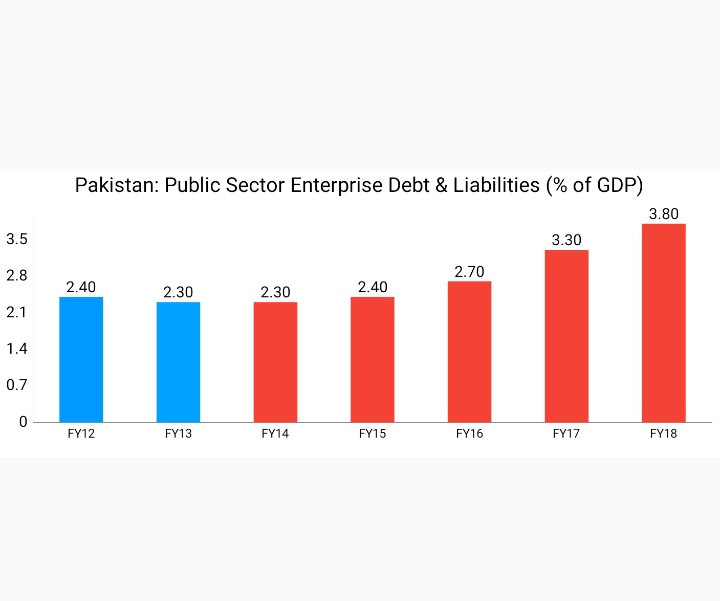

In absolute terms, it surged from Rs538.1bn in FY13 to Rs1,299.5bn in FY18 - an increase of 141.5%

Central Power Purchasing Agency (CPPA)

Source:

sbp.org.pk/reports/stat_r…

sbp.org.pk/reports/stat_r…

19/N

It is the amount of cash shortfall within the CPPA which it cannot pay to power supply companies

Source:

senate.gov.pk/uploads/docume…

senate.gov.pk/uploads/docume…

imf.org/~/media/Files/…

20/N

Source:brecorder.com/2019/05/06/494…

21/N

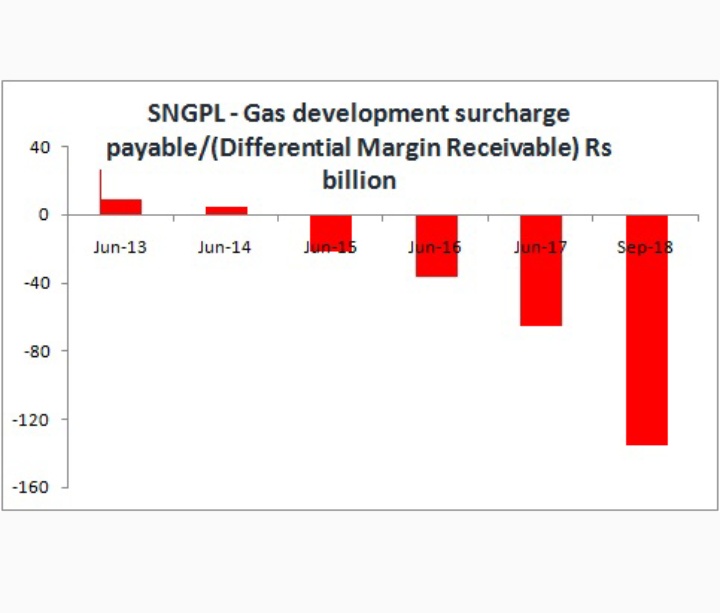

Differential margin is created by disparity between prescribed gas prices by OGRA & notified consumer tariff(includes subsidies)

22/N

This explains why gas prices increased

Source:

brecorder.com/2019/05/06/494…

brecorder.com/2019/05/09/495…

23/N

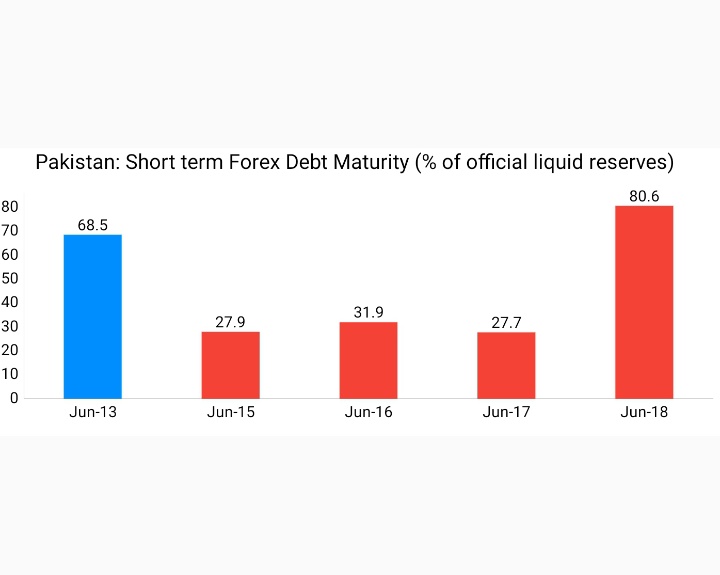

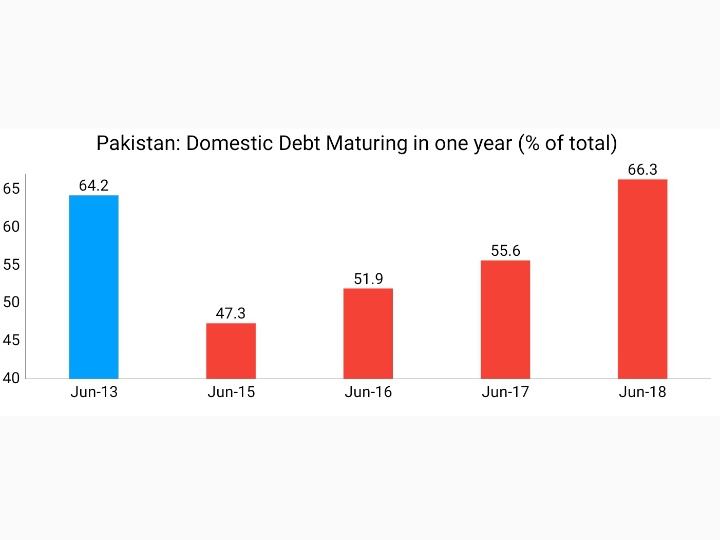

Source:

finance.gov.pk/dpco/RiskRepor…

finance.gov.pk/Quarterly_Risk…

24/N

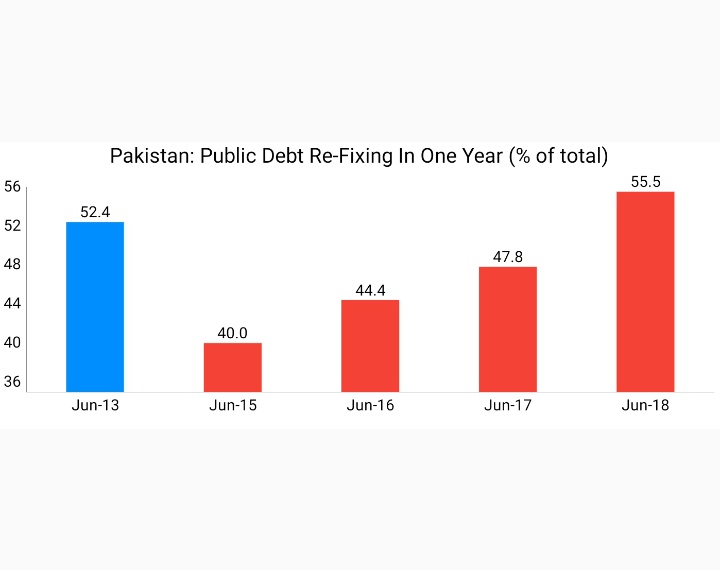

Source:

finance.gov.pk/Quarterly_Risk…

finance.gov.pk/RiskReportOnDe…

25/N

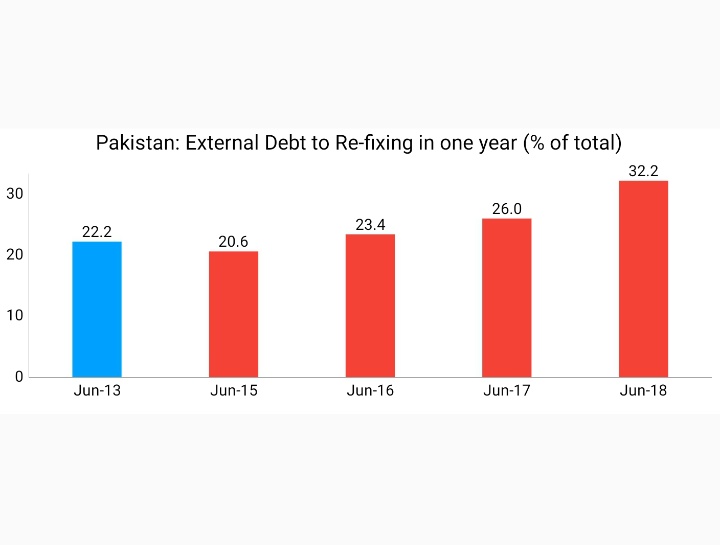

Source:

finance.gov.pk/dpco/RiskRepor…

26/N

Source:

finance.gov.pk/dpco/RiskRepor…

27/N

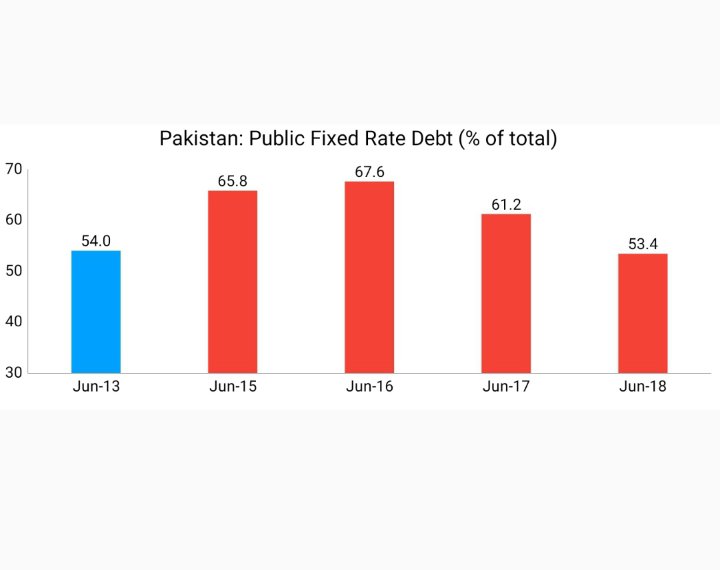

Source:

finance.gov.pk/dpco/RiskRepor…

tribune.com.pk/story/1821958/…

28/N

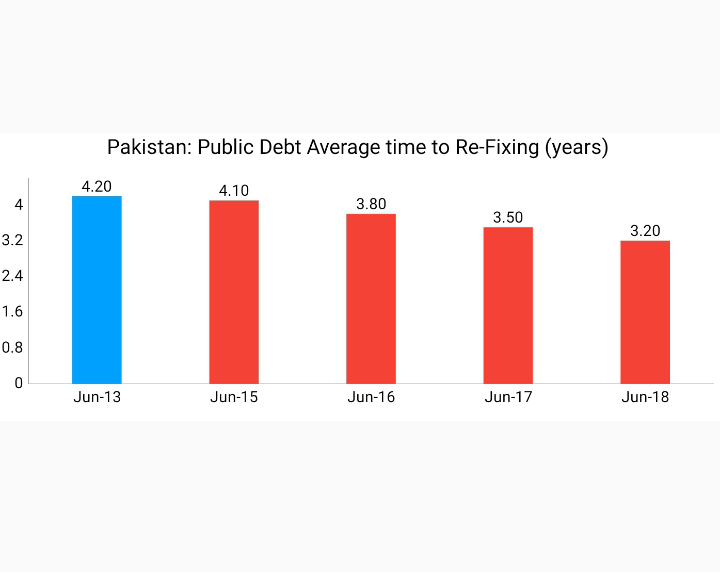

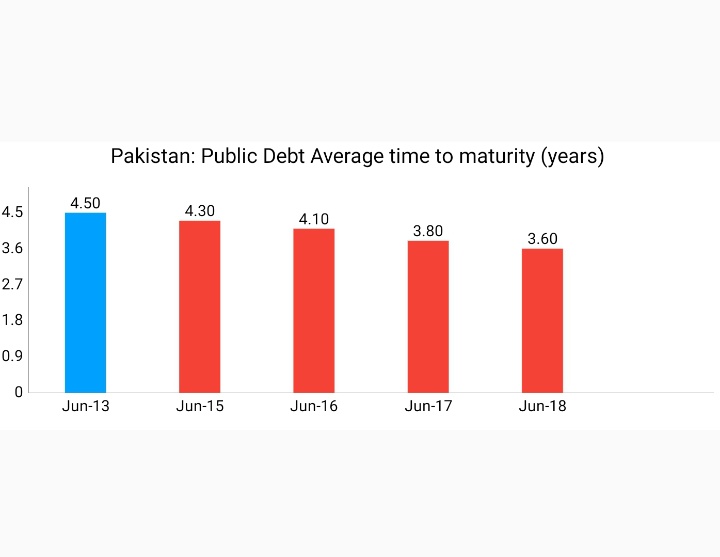

Average time to Re-Fixing of Public Debt fell from 4.2 yrs in Jun'13 to 3.2 yrs in Jun18

Source:

finance.gov.pk/dpco/RiskRepor…

29/N

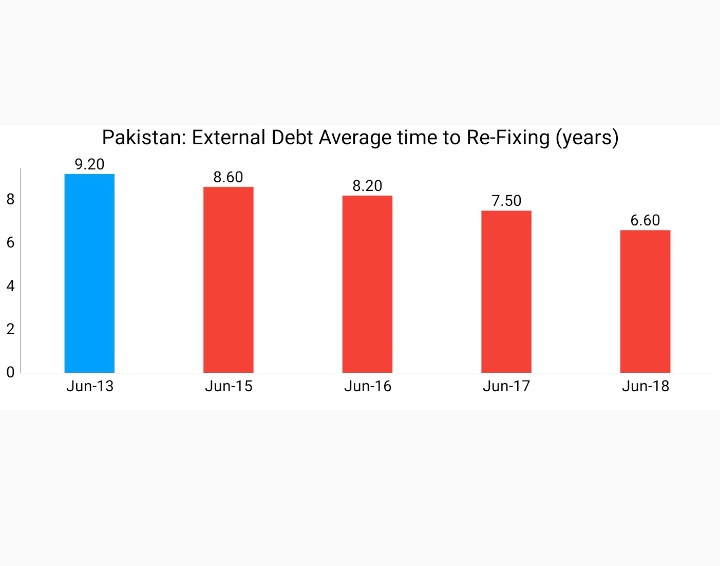

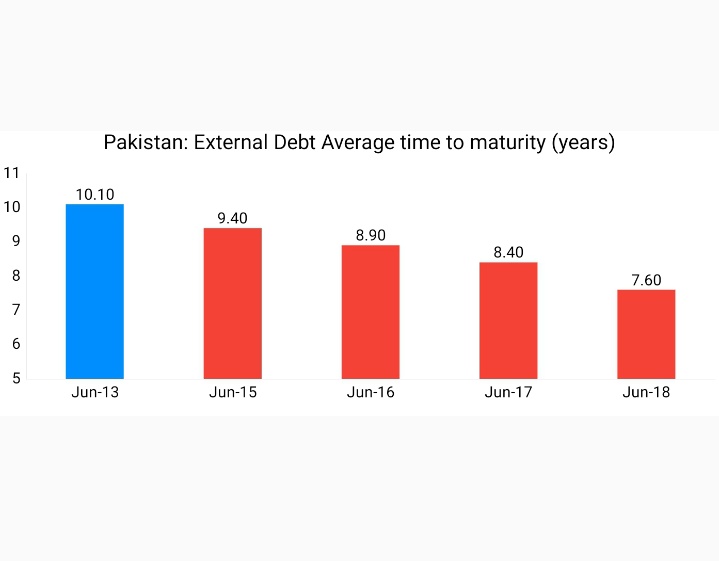

Source:

finance.gov.pk/dpco/RiskRepor…

30/N

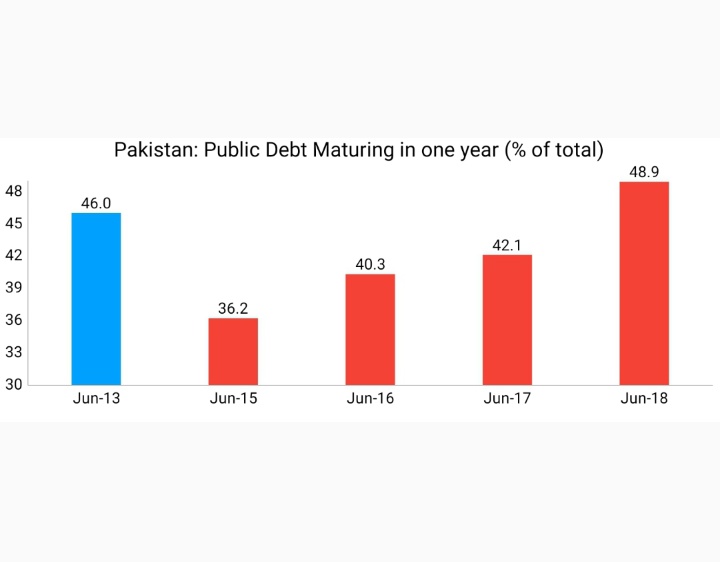

Source:

finance.gov.pk/dpco/RiskRepor…

31/N

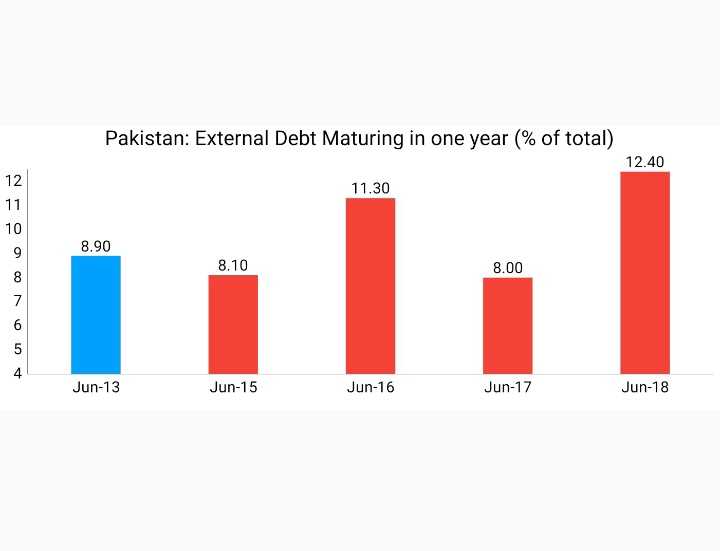

Source:

finance.gov.pk/dpco/RiskRepor…

32/N

Source:

finance.gov.pk/dpco/RiskRepor…

33/N

Source:

finance.gov.pk/dpco/RiskRepor…

34/N

Source:

finance.gov.pk/dpco/RiskRepor…

35/N

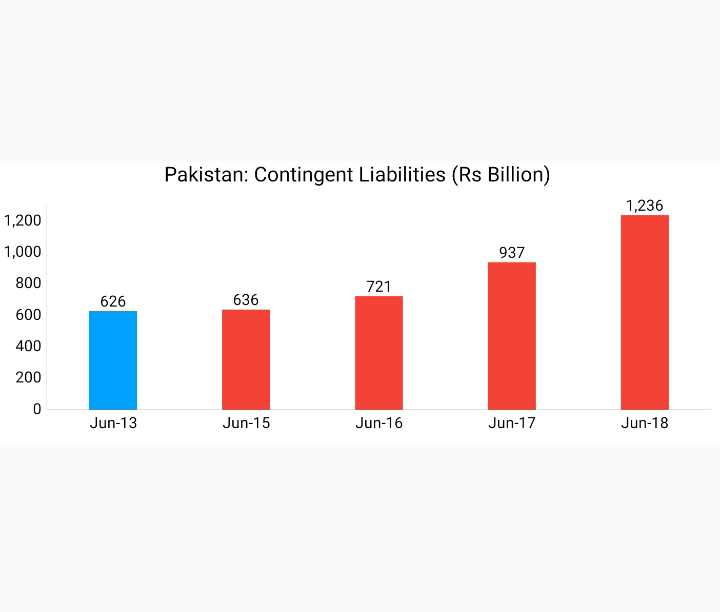

when event actually happens

It relates to govt guarantees on behalf of PSEs

CLs surged from Rs625.9bn in Jun'13 to Rs1236.2 in Jun'18 - up 97.5%

Source:

finance.gov.pk/dpco/RiskRepor…

36/N

Source:

finance.gov.pk/publications/D…

finance.gov.pk/publications/D…

37/N

Source:

finance.gov.pk/publications/D…

38/N

Source:

finance.gov.pk/publications/D…

finance.gov.pk/publications/D…

39/N

Source:

finance.gov.pk/publications/D…

finance.gov.pk/publications/D…

40/N

Source:

finance.gov.pk/publications/D…

41/N

In absolute terms, it increased from Rs15,873bn in FY13 to Rs28,253 in FY18 - an increase of 78%

Source:

finance.gov.pk/publications/D…

42/N