Even with salary cuts, salary delays everywhere, it is more important than ever to hold on to your Insurance covers.

Please ensure you or your closed ones in the family do not lapse term life or health insurance in these times.

Thread - 1/n

#coronavirus #COVID19outbreak

Please ensure you or your closed ones in the family do not lapse term life or health insurance in these times.

Thread - 1/n

#coronavirus #COVID19outbreak

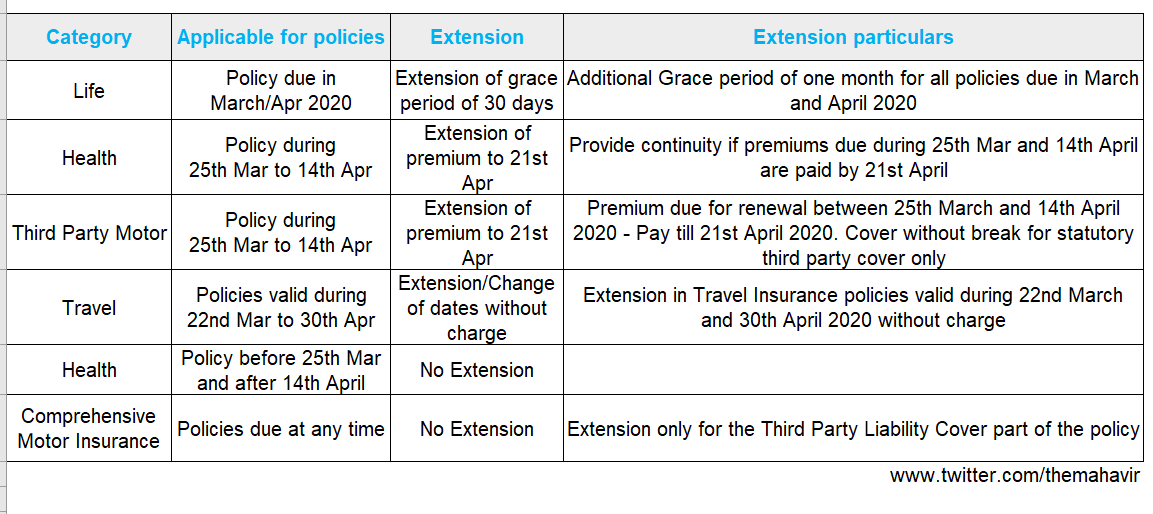

First, Govt./IRDAI has rolled out extensions that you should be aware of. Listing them down for each type of insurance.

2/n

2/n

Life Insurance extension.

Additional grace period of 30 days in case your policy was due for renewal in March and April.

Total grace period depends on the premium frequency of your policy:

Monthly premium mode: 45 days

Annual and all other modes: 60 days.

3/n

Additional grace period of 30 days in case your policy was due for renewal in March and April.

Total grace period depends on the premium frequency of your policy:

Monthly premium mode: 45 days

Annual and all other modes: 60 days.

3/n

Health Insurance extension:

Only if your policy is due between 25th Mar to 14th Apr you can pay the premium due by 21st Apr and get cover without any break - this means if there is an unfortunate claim on a health insurance policy due during the lockdown, it will get paid.

4/n

Only if your policy is due between 25th Mar to 14th Apr you can pay the premium due by 21st Apr and get cover without any break - this means if there is an unfortunate claim on a health insurance policy due during the lockdown, it will get paid.

4/n

I am clueless, but Health Insurance ideally should have ideally be given equal extensions to life insurance.

Hopefully, we will see additional extensions in a few days. I will update this thread in that case.

Hopefully, we will see additional extensions in a few days. I will update this thread in that case.

Car Insurance extension:

If your policy is due between 25th Mar to 14th Apr - you can pay the premium due by 21st Apr and your third-party cover will continue without break. There is no relief for the own damage cover in your motor policy.

5/n

If your policy is due between 25th Mar to 14th Apr - you can pay the premium due by 21st Apr and your third-party cover will continue without break. There is no relief for the own damage cover in your motor policy.

5/n

Here's a summary of all the extensions given by IRDAI/Govt. for insurance in the last few weeks.

6/n

6/n

With or without extensions, it is important to keep your term and health insurance covers afloat. Here's what you can do. If any industry expert is reading this, please add to these suggestions.

You can convert your term life insurance policy to monthly/quarterly frequency at the time of renewal and reduce the burden of paying a large premium at one go.

7/n

7/n

For Health Insurance, many insurers and aggregators have EMI facilities for making premium payments. You can also pay renewal premiums by any credit card and convert the due to EMIs by calling your bank’s call center.

8/n

8/n

Reduce your sum insured (applicable for only health insurance) only when there is no other way around. Don't touch your health insurance coverage if you have crossed 40 years. In fact, try to upgrade it if possible.

9/n

9/n

Most importantly, do not lapse your parents' health insurance for sure! 🙏

It would be very difficult to get a health insurance cover for them later.

10/n

It would be very difficult to get a health insurance cover for them later.

10/n

I am hopeful that the industry will work with the regulator and come together with more extensions, other innovative ways to ensure covers that provide long term financial protection are intact.

Will keep updating this thread. Cheers!

11/n

Will keep updating this thread. Cheers!

11/n

Update:

If your policy is due between 25th Mar and 3rd May, you can now renew by 15th May and cover without any break.

If your policy is due between 25th Mar and 3rd May, you can now renew by 15th May and cover without any break.

Update:

If your policy is due between 25th Mar and 3rd May, you can now renew by 15th May and get cover for third party insurance without any break.

If your policy is due between 25th Mar and 3rd May, you can now renew by 15th May and get cover for third party insurance without any break.

• • •

Missing some Tweet in this thread? You can try to

force a refresh