Rebuilding people's trust in insurance with @BeshakIN | Discover the right plans/experts like never before

Follow me to get your health & life insurance right

2 subscribers

How to get URL link on X (Twitter) App

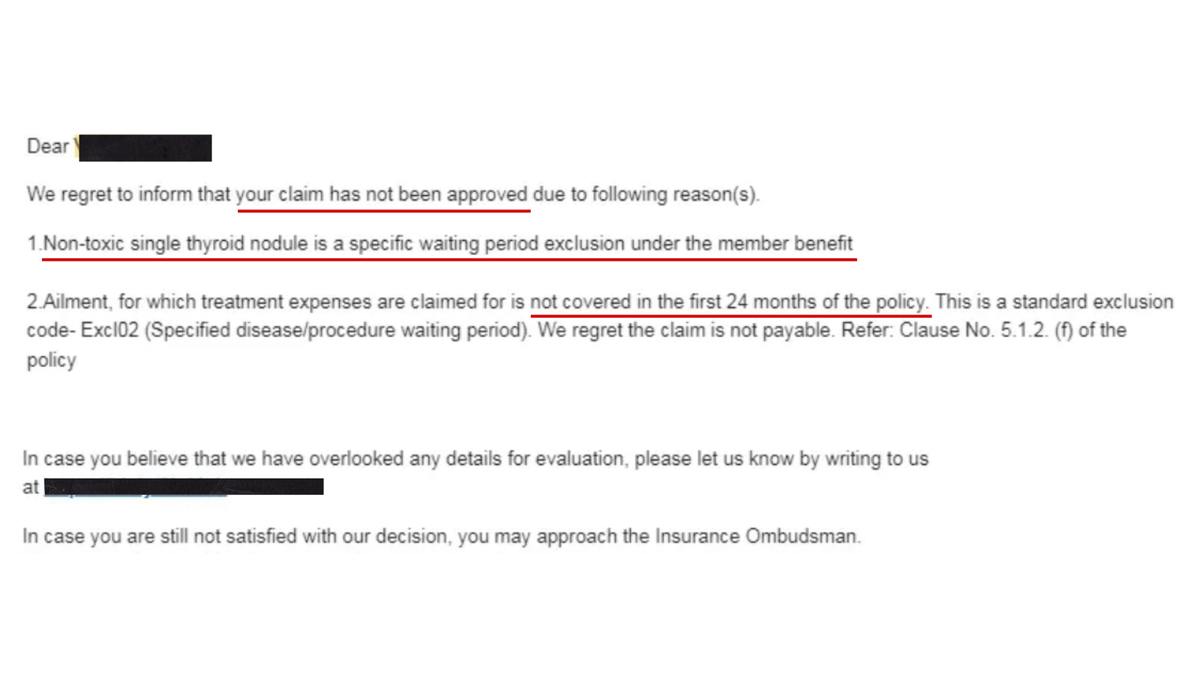

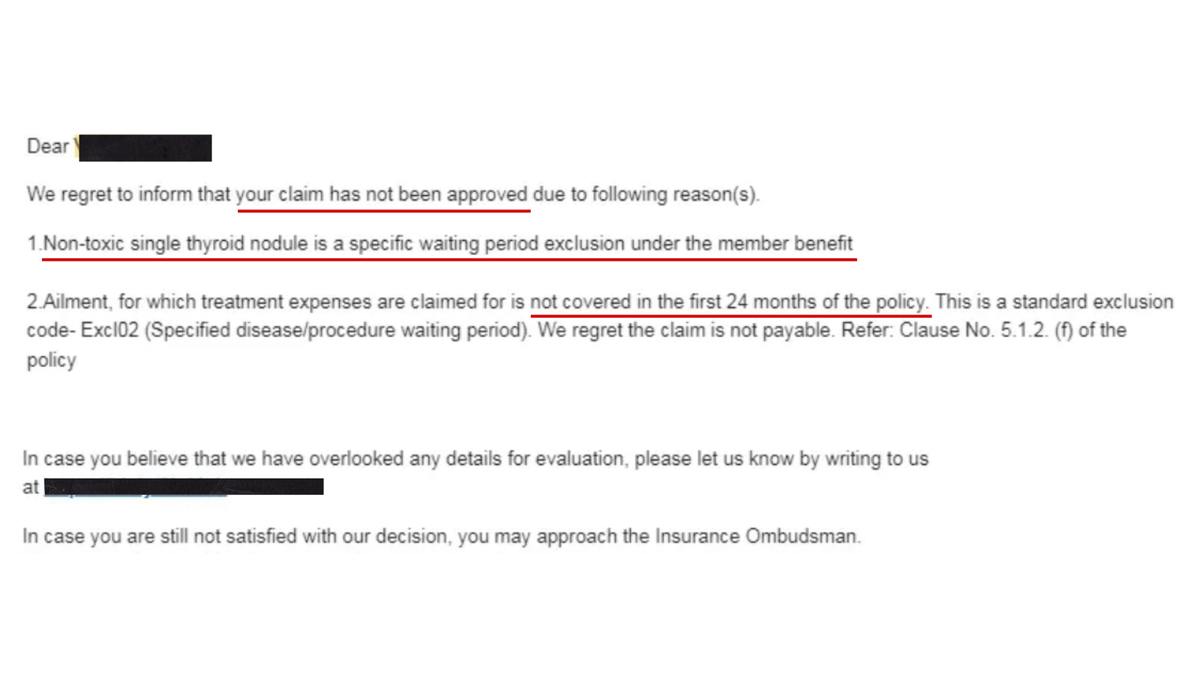

This person was diagnosed with thyroid cancer - called "malignant neoplasm of the thyroid gland"

This person was diagnosed with thyroid cancer - called "malignant neoplasm of the thyroid gland"

A customer was hospitalized for angioplasty, and the insurer first approvied a cashless treatment of 70K.

A customer was hospitalized for angioplasty, and the insurer first approvied a cashless treatment of 70K.

First, let's understand why this happens.

First, let's understand why this happens.

1st things 1st: Health insurance premiums aren’t fixed.

1st things 1st: Health insurance premiums aren’t fixed.

INCLUSIVENESS:

INCLUSIVENESS:

EARLIER: Health Insurance regulations had a minimum maximum-entry-age limit of 65 years.

EARLIER: Health Insurance regulations had a minimum maximum-entry-age limit of 65 years.

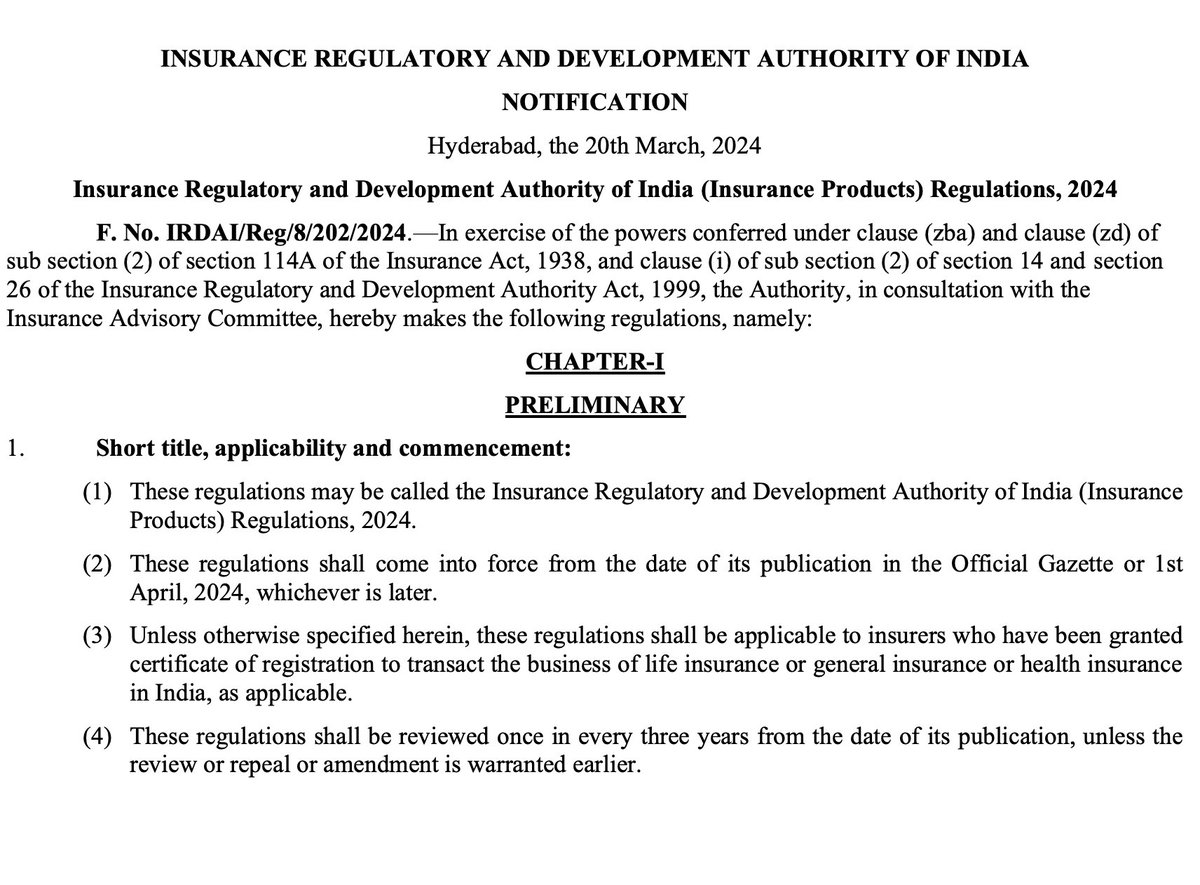

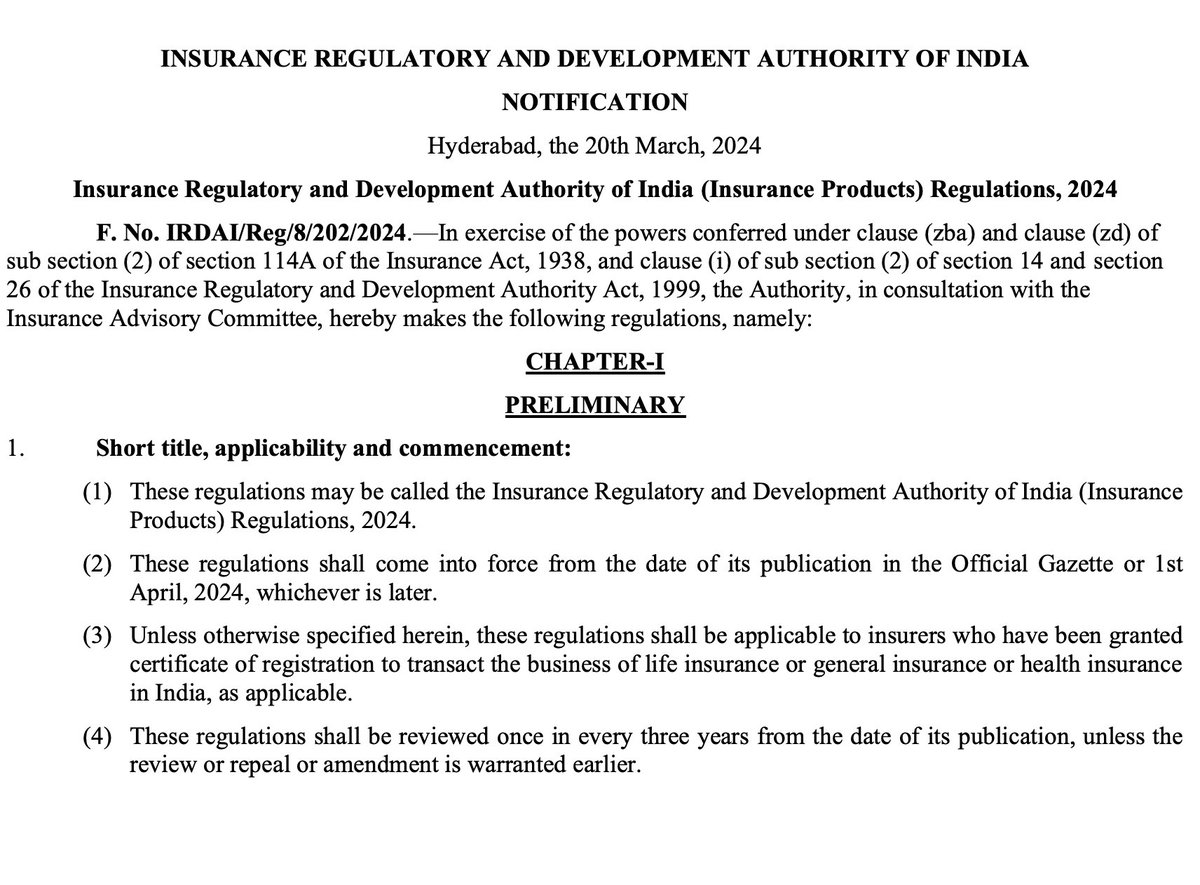

Change in definition of Pre-existing disease.

Change in definition of Pre-existing disease.

Let's start with the basics: Health Insurance is an "indemnity" cover

Let's start with the basics: Health Insurance is an "indemnity" cover

That's precisely the reason why @BeshakIN we recommend people should never solely depend on employer insurance.

That's precisely the reason why @BeshakIN we recommend people should never solely depend on employer insurance.