A thread on loan refinancing

#financetwitterJa

2/

1. Principal (how much you borrow)

2. Interest (what rate is your lender charging you)

3. Tenure (how long will you have to repay)

4. Frequency of payment (monthly, quarterly, annually etc.)

3/

- Decrease in Principal – borrow less =pay less

- Decrease in interest Rate – lower financing cost = pay less

- Increase in Tenure – longer loan period = pay less monthly

- Increase in pmt frequency – monthly pmt vs annual

4/

5/

psoj.org/wp-content/upl…

@thePSOJ

6/

7/

There may be different nuanced meanings at each financial institution so ensure you ask what it entails.

8/

9/

This is rare but if your lender does this then your loan would just extend for the time that the loan was deferred.

10/

While interest is accruing, it means even though you are not making a payment, interest is still being charged on your outstanding principal balance.

11/

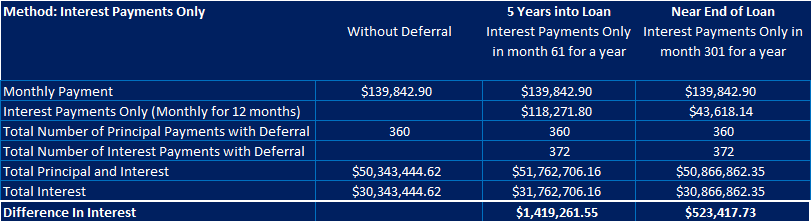

For our example of a $20M, 30-year loan, in year 5 interest-only pmts would be $124k (in comparison to the payment before of $139k, which is not much of a big difference), but in year 25, the pmt would only be $43k.

In this scenario, the interest that you had not paid during the deferral period would accumulate & at the end of the loan, you would pay it in full as a one time pmt. /14

15/

16/

Visit my loan calculators to see how doing either would impact your payments docs.google.com/spreadsheets/d…