Data Analytics Lead, Fulbright scholar & Mantock's Guide Director. I run a Financial Blog, i'm a mom of boys, I love solving problems and relaxing at the gym!

How to get URL link on X (Twitter) App

https://twitter.com/MsGillyJ/status/1160154974237679617?s=19

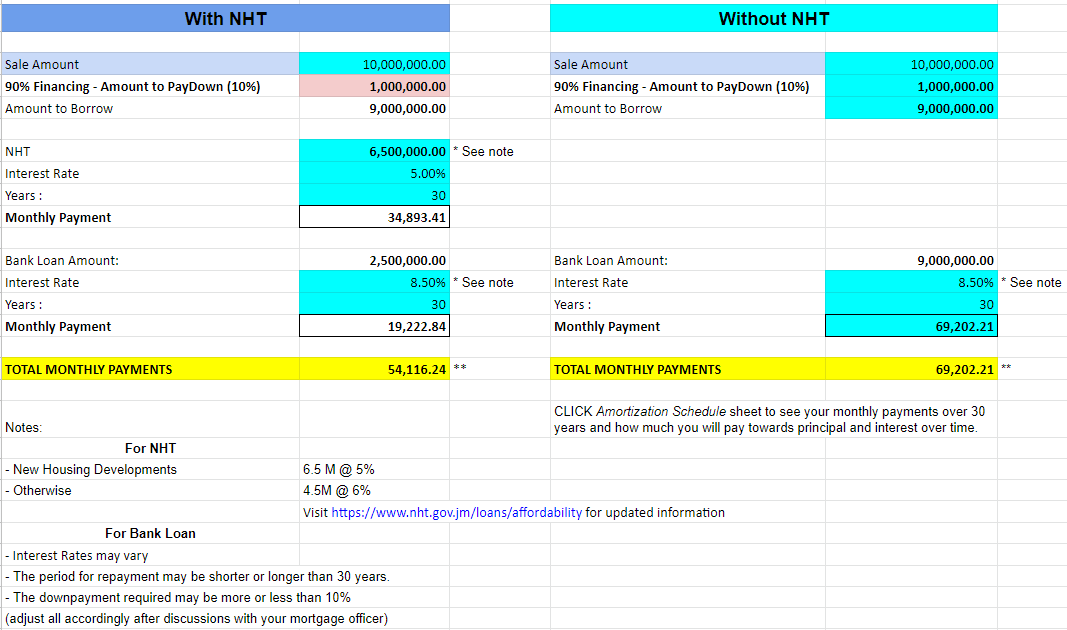

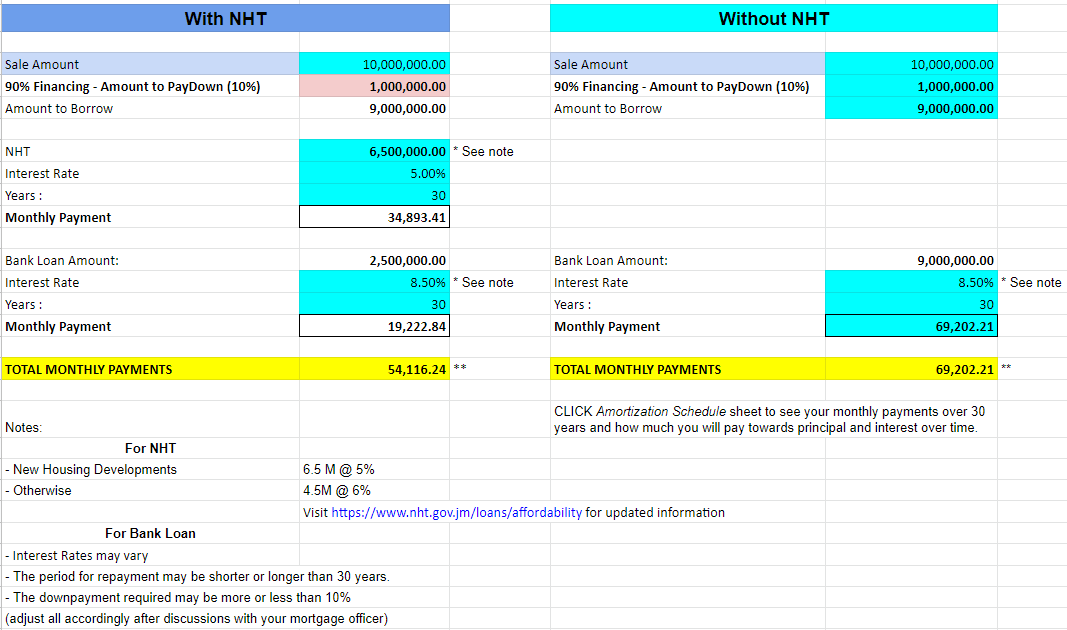

2.. Five years ago I simultaneously bought my own home and was selling my parents home on their behalf. Buying a home can seem complicated and in my search there has been no central place to explain the process in JA so here is somewhere for you to start.

2.. Five years ago I simultaneously bought my own home and was selling my parents home on their behalf. Buying a home can seem complicated and in my search there has been no central place to explain the process in JA so here is somewhere for you to start.