𝐊𝐧𝐨𝐰 𝐘𝐨𝐮𝐫 𝐆𝐋𝐂𝐬

With the extension of MCO, we know a lot of you have more time at home. Why not spend some time getting to know your GLCs? After all, GLCs make up a huge portion of the economy, and honestly, your lives too.

#GLCmy #GLCreforms

This is a thread.

With the extension of MCO, we know a lot of you have more time at home. Why not spend some time getting to know your GLCs? After all, GLCs make up a huge portion of the economy, and honestly, your lives too.

#GLCmy #GLCreforms

This is a thread.

Q: What are government-linked companies (GLCs)?

A: GLCs are companies that have a primary commercial objective and in which the Malaysian Government has a direct controlling stake.

Some of the GLCs include:

A: GLCs are companies that have a primary commercial objective and in which the Malaysian Government has a direct controlling stake.

Some of the GLCs include:

1. Malaysia Airlines Berhad (MAB)

A GLC wholly-owned by Khazanah Nasional, which is owned by the Ministry of Finance Incorporated (MOF Inc.). Up till 2014, the airline was known as Malaysia Airlines (MAS) before a restructuring exercise that changed the name to MAB.

A GLC wholly-owned by Khazanah Nasional, which is owned by the Ministry of Finance Incorporated (MOF Inc.). Up till 2014, the airline was known as Malaysia Airlines (MAS) before a restructuring exercise that changed the name to MAB.

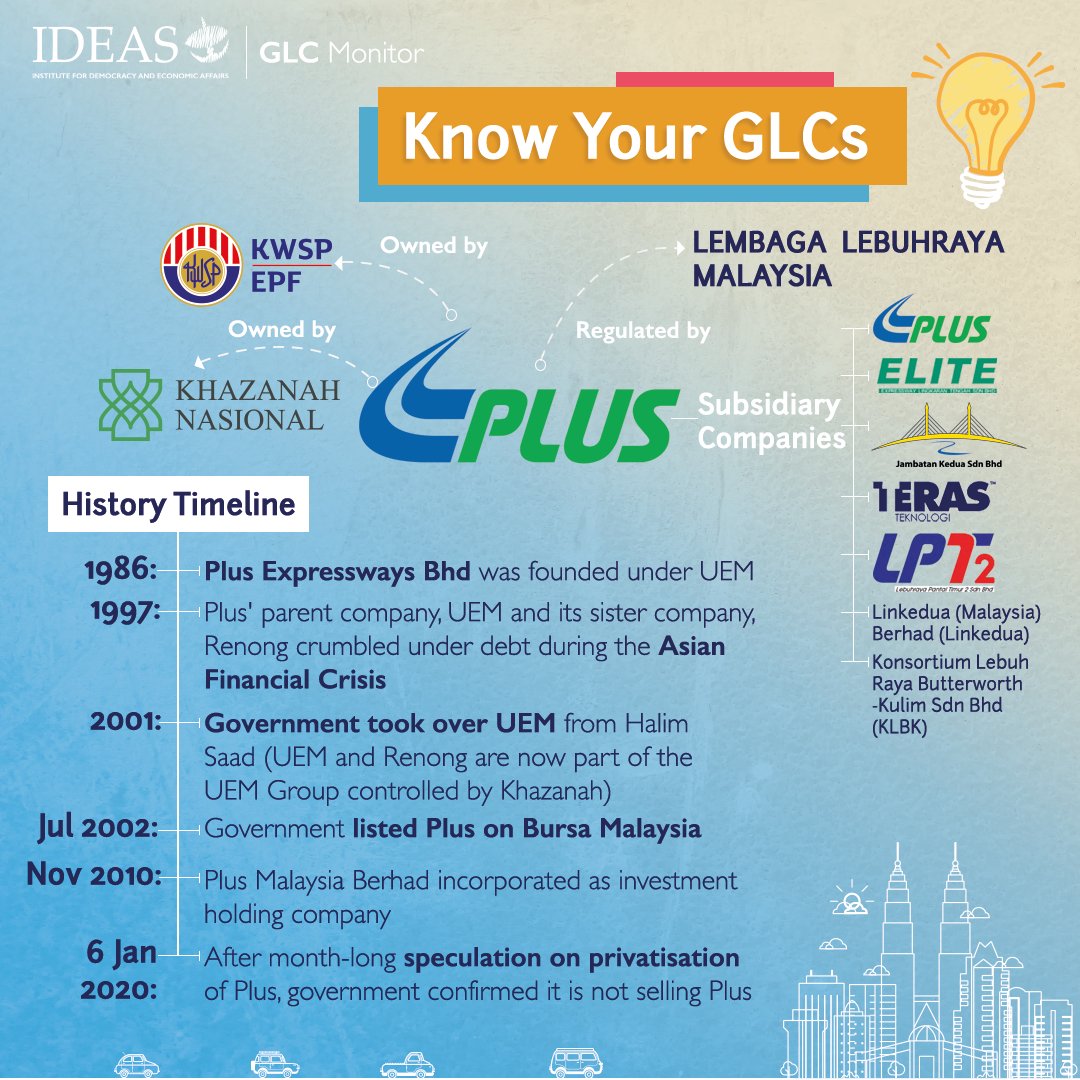

2. PLUS Malaysia Berhad

A GLC co-owned by Khazanah (51%) & EPF (49%). PLUS was founded as a private company in 1986. The government then took over after the Asian Financial Crisis. Early this year, a proposal to privatise PLUS was rejected. Thus, PLUS remains government-owned.

A GLC co-owned by Khazanah (51%) & EPF (49%). PLUS was founded as a private company in 1986. The government then took over after the Asian Financial Crisis. Early this year, a proposal to privatise PLUS was rejected. Thus, PLUS remains government-owned.

Earlier this year, IDEAS released a press statement endorsing the government's decision not to sell PLUS: ideas.org.my/ideas-endorses….

3. Axiata Group Berhad

Incorporated as an operations arm of Telekom Malaysia before becoming a company of its own in 2018. We define Axiata as a GLC too because GLICs (KWSP, Khazanah and PNB) own almost 80% of the company!

Incorporated as an operations arm of Telekom Malaysia before becoming a company of its own in 2018. We define Axiata as a GLC too because GLICs (KWSP, Khazanah and PNB) own almost 80% of the company!

How is Celcom related to Axiata? Celcom is a subsidiary of Axiata which controlled 20% market share of mobile cellular subscriptions in 2018.

But more interestingly, the GLICs also own substantial shares in competitor firms. Eg: Maxis (23.5%) and DiGi (26.3%).

But more interestingly, the GLICs also own substantial shares in competitor firms. Eg: Maxis (23.5%) and DiGi (26.3%).

Last year, the proposed merger between Axiata and Telenor (owner of DiGi) was called off. The reason was not made known officially, but optimization of human resource could be a potential explanation.

In our latest GLC Monitor Report released early this week, we explored ownership concentration in the Telecommunications industry where GLICs have substantial ownership in the companies from the same industry. You can view the report here: bit.ly/GLICfootprint.

What does ownership concentration mean to market competitiveness? Would we address this problem if GLICs were to increase investment abroad?

4. Tenaga Nasional Berhad (TNB)

You can see from the timeline how TNB transformed from a state owned enterprise, to a private company wholly-owned by the govt to what it is now, a public listed company on Bursa Malaysia. The govt is a majority shareholder via different GLICs.

You can see from the timeline how TNB transformed from a state owned enterprise, to a private company wholly-owned by the govt to what it is now, a public listed company on Bursa Malaysia. The govt is a majority shareholder via different GLICs.

TNB is very important in Malaysia’s developing economy as it is the sole electricity utility company in Peninsular Malaysia. It is also the only provider of electricity in Sabah as Sabah Electricity is owned by TNB.

Recently Datuk Seri Mohamad Hasan, UMNO Deputy President was touted to be appointed as TNB chairman, although he rejected the appointment. IDEAS has expressed concern over the recent developments regarding the appointments of politicians to head GLCs.

ideas.org.my/ideas-during-t…

ideas.org.my/ideas-during-t…

5. Telekom Malaysia Berhad (TM)

Did you know that TM was the first Malaysian state-owned enterprise to be privatised? In 1987, the privatisation of Jabatan Telekom Malaysia (JTM) means that it is transferred from public to private ownership and control.

Did you know that TM was the first Malaysian state-owned enterprise to be privatised? In 1987, the privatisation of Jabatan Telekom Malaysia (JTM) means that it is transferred from public to private ownership and control.

In 1990, 25% of the company was placed on the Kuala Lumpur Stock Exchange. Despite being privatised, TM is a GLC as the government owns more than 68% shares via various GLICs.

Recently, TM launched its "Digital Economy Special Programme" in support of the government's PRIHATIN stimulus package to drive digitalization, with extra focus on the rural economy. Without TM, private actors might underinvest in rural areas.

This is an example of how GLCs can address market failure. But must the government hold a golden share in order for GLCs to serve the nation effectively?

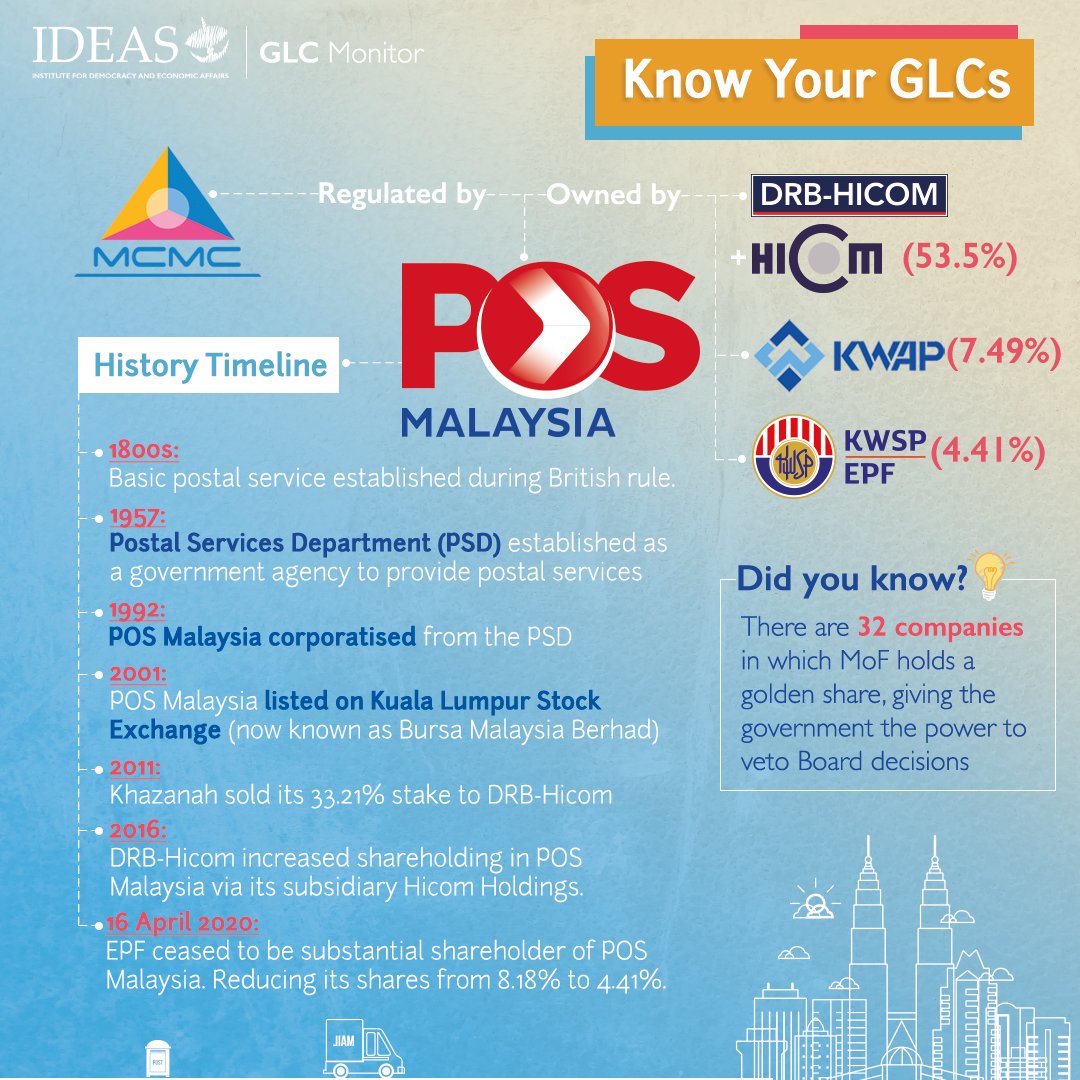

6. POS Malaysia Berhad

Although POS Malaysia was privatised in 2001, the government holds a golden share that entitles MoF (Inc.) to certain special rights. According to MoF website, there are 32 companies in which MoF holds a golden share.

Although POS Malaysia was privatised in 2001, the government holds a golden share that entitles MoF (Inc.) to certain special rights. According to MoF website, there are 32 companies in which MoF holds a golden share.

The largest shareholder of POS Malaysia, DRB-HICOM holds 53.5% shares directly and indirectly via its subsidiary, HICOM Holdings. Interestingly, DRB-HICOM is also a GLC as two GLICs (EPF and Lembaga Tabung Haji) have substantial shareholding in the company.

A golden share is actually just ONE share, but it gives the holder the power to overrule decisions made by other shareholders.

Golden share gives the government special rights to override Board decisions. Would regulation be a better option to govern the GLCs?

Golden share gives the government special rights to override Board decisions. Would regulation be a better option to govern the GLCs?

7. Petroliam Nasional Berhad (PETRONAS)

Did you know that PETRONAS is wholly owned by the government? Interestingly, PETRONAS is a provider and also a regulator in the upstream sector.

Did you know that PETRONAS is wholly owned by the government? Interestingly, PETRONAS is a provider and also a regulator in the upstream sector.

Concession agreement and Production Sharing Contract (PSC) are types of petroleum contracts agreement. In 1976, Malaysia replaced the concession agreement with the more equitable PSC system. PETRONAS pays an annual dividend as large as RM24 billion to the government.

It may raise its dividends this year to help the government fund the stimulus package. However, PETRONAS has been affected by the low oil prices and unprecedented market conditions, recording a 68% drop in net profits for the first quarter of 2020.

What is the cost of maintaining this dependency between GLCs and the government? You can find the discussion in our recording of IDEAS' webinar titled "The Role of Government Ecosystem in the New Normal".

[ERRATA] For the infographic on Axiata, Khazanah should be on top of the ownership structure, followed by PNB and KWSP. We apologise for the inaccurate information. The revised infographic is attached here.

8. CIMB Group Holdings Berhad

Did you know that CIMB is a GLC? More than half of its shares are owned by GLICs as stated in the infographic.

CIMB has subsidiaries providing a wide variety of financial services across all 10 ASEAN countries.

Did you know that CIMB is a GLC? More than half of its shares are owned by GLICs as stated in the infographic.

CIMB has subsidiaries providing a wide variety of financial services across all 10 ASEAN countries.

Banks might find it challenging to compete in foreign markets since the financial sector is deemed sensitive and local banks usually enjoy home advantage.

Do you agree that it is necessary for banks to be government-linked so that they can compete effectively abroad?

Do you agree that it is necessary for banks to be government-linked so that they can compete effectively abroad?

9. Malayan Banking Berhad (Maybank)

Did you know that there is an anchor bank in the investment portfolio of every GLICs (except for KWAP) as measured by equity ownership? For example, PNB has Maybank (42.4%), Khazanah has CIMB (26.8%), and EPF has RHB Bank (40.6%).

Did you know that there is an anchor bank in the investment portfolio of every GLICs (except for KWAP) as measured by equity ownership? For example, PNB has Maybank (42.4%), Khazanah has CIMB (26.8%), and EPF has RHB Bank (40.6%).

Does this reflect the need for GLICs to exert control over the banks they own? What does this mean for the efficient allocation of capital? You can find the full list of GLICs and their anchor banks in our latest GLC Monitor here: bit.ly/GLICfootprint.

10. Malaysia Airports Holdings Berhad (MAHB)

Did you know that MAHB was founded as a state-run airport before it was listed on the stock exchange?

Did you know that MAHB was founded as a state-run airport before it was listed on the stock exchange?

In 2004, the govt transferred GLC shares, including MAHB held by MoF Inc to Khazanah in an effort to improve their performance. Though Khazanah has divested in stakes in MAHB over the years, today it is still the largest shareholder & the govt still holds a golden share in MAHB.

We started this series of infographics during the extension of MCO. Throughout this period, we hope that you have learned more about GLCs.

Since this is the last post, we have decided to do something different. We saw some of the questions posed and we will address them in our next videos on GLCs. Do keep your questions coming!

Meanwhile, you can watch the 3 videos we have produced. Maybe you can find some of the answers there! 😉

youtube.com/playlist?list=…

youtube.com/playlist?list=…

• • •

Missing some Tweet in this thread? You can try to

force a refresh