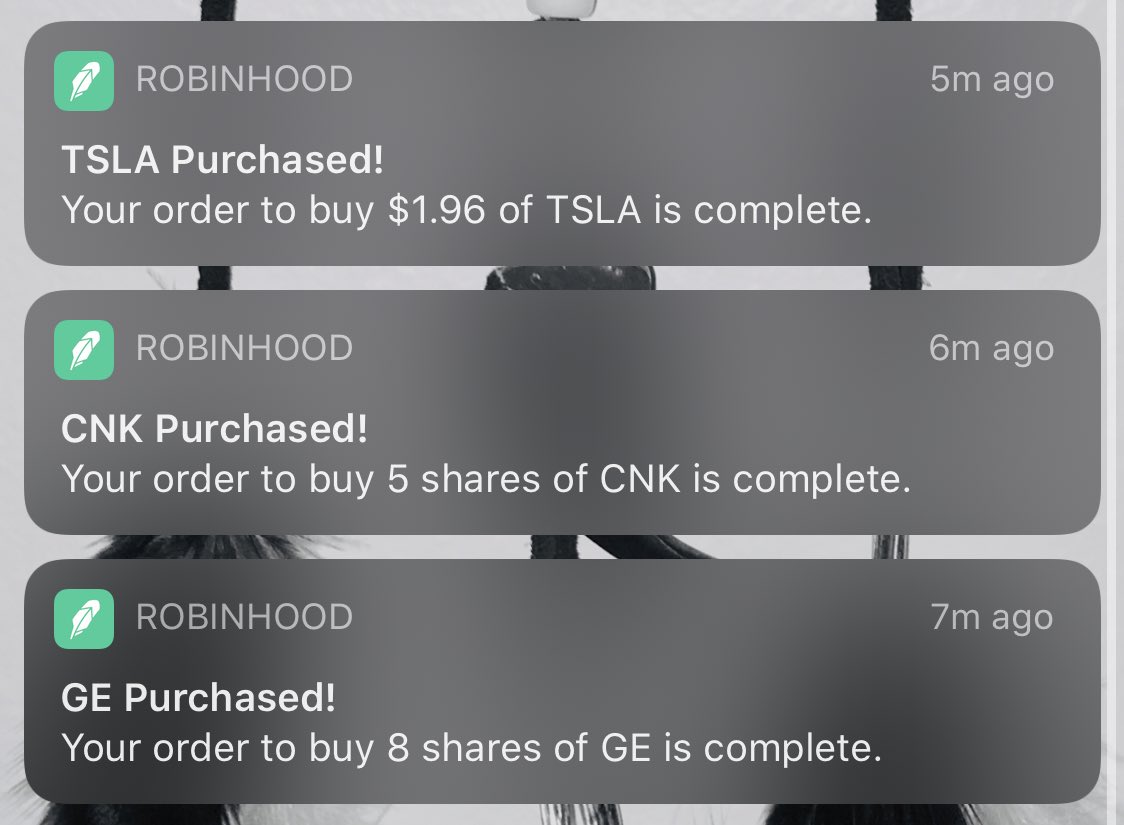

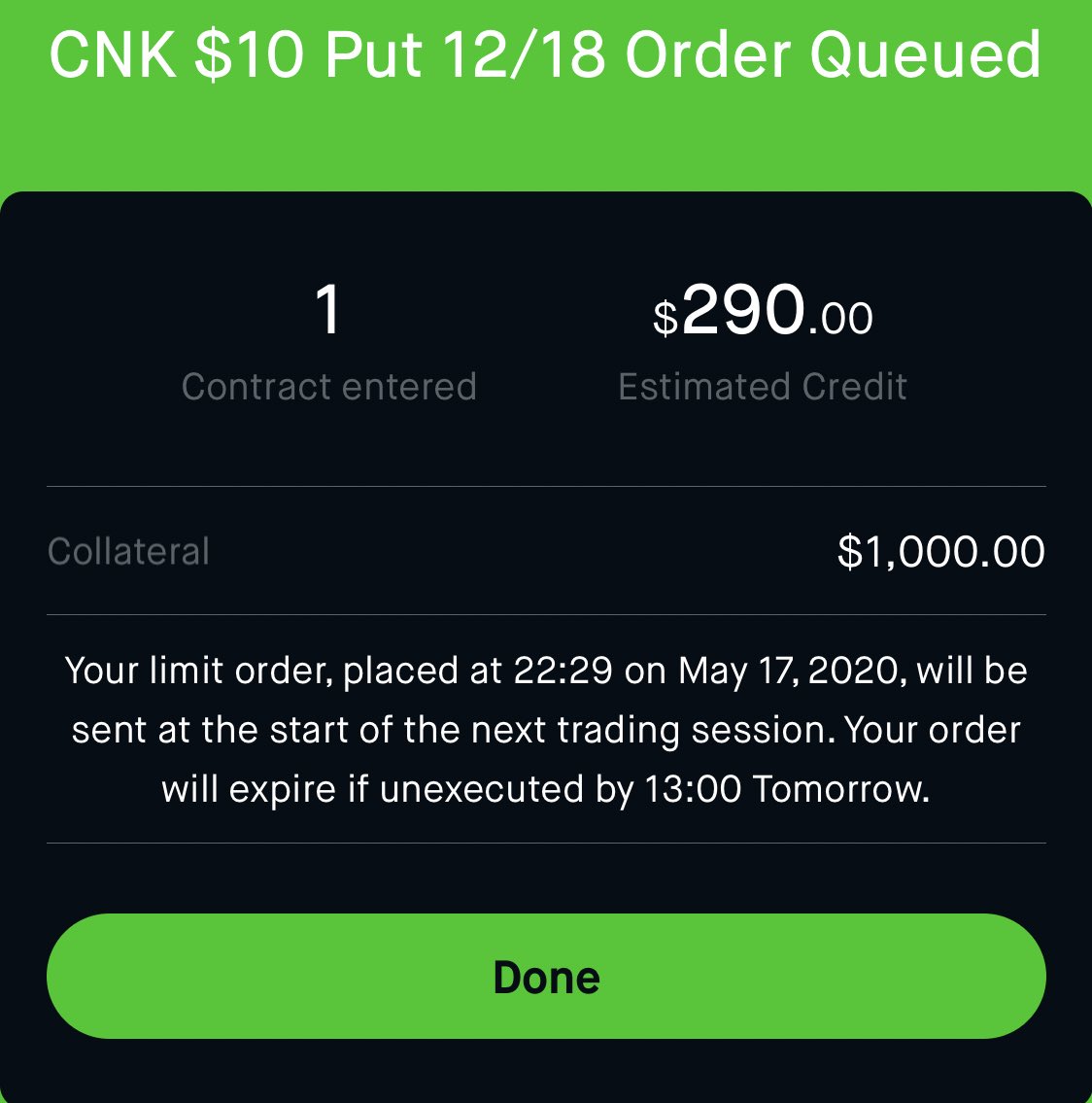

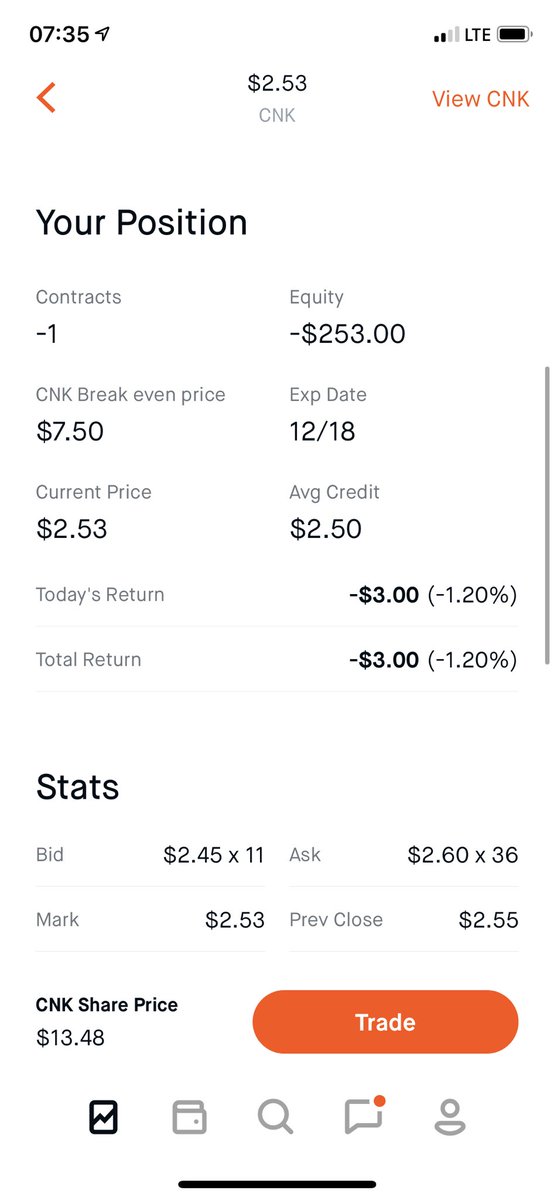

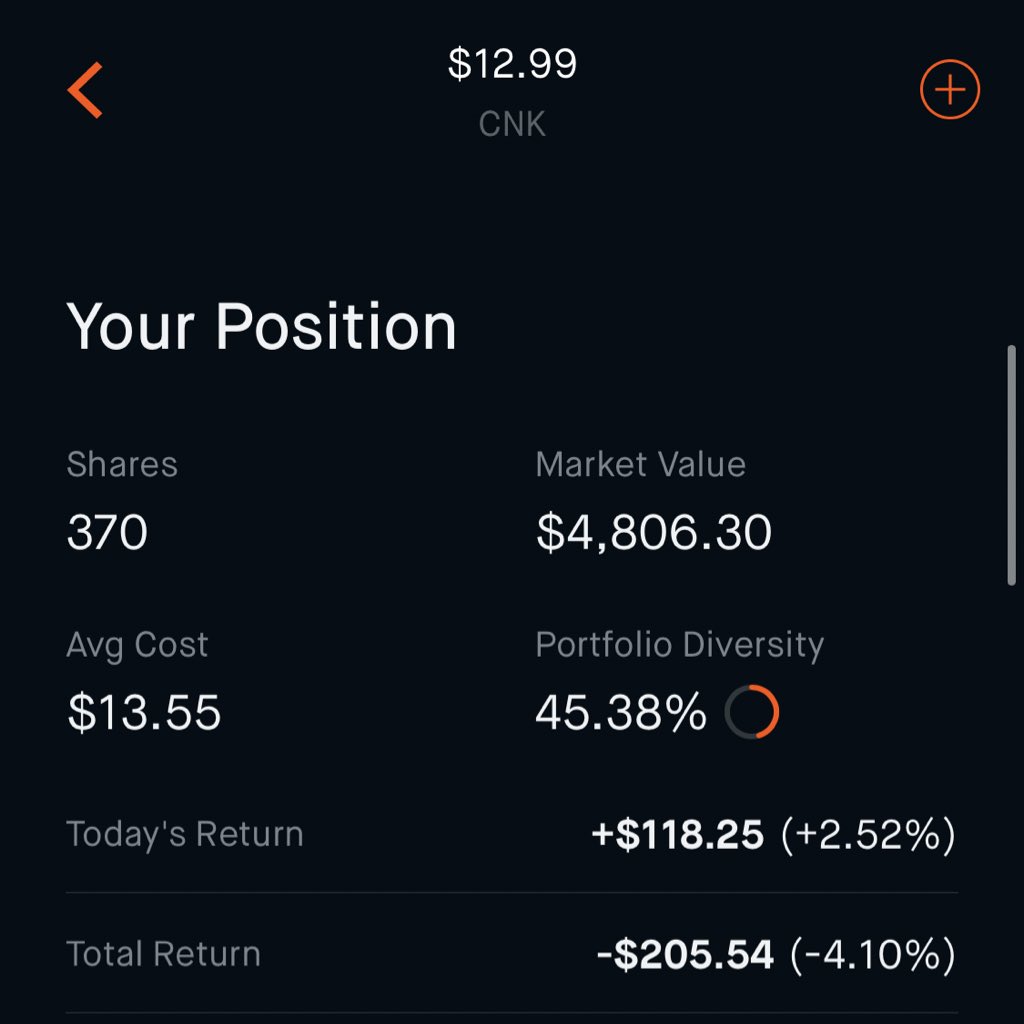

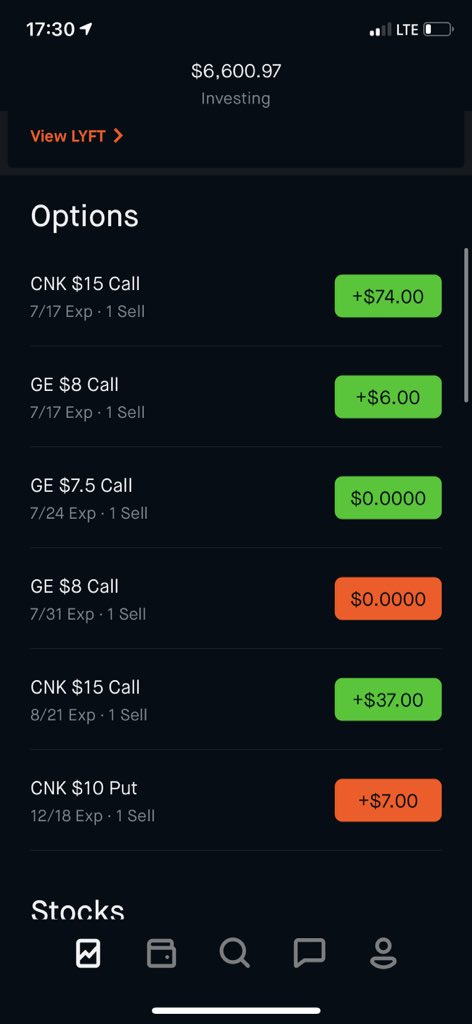

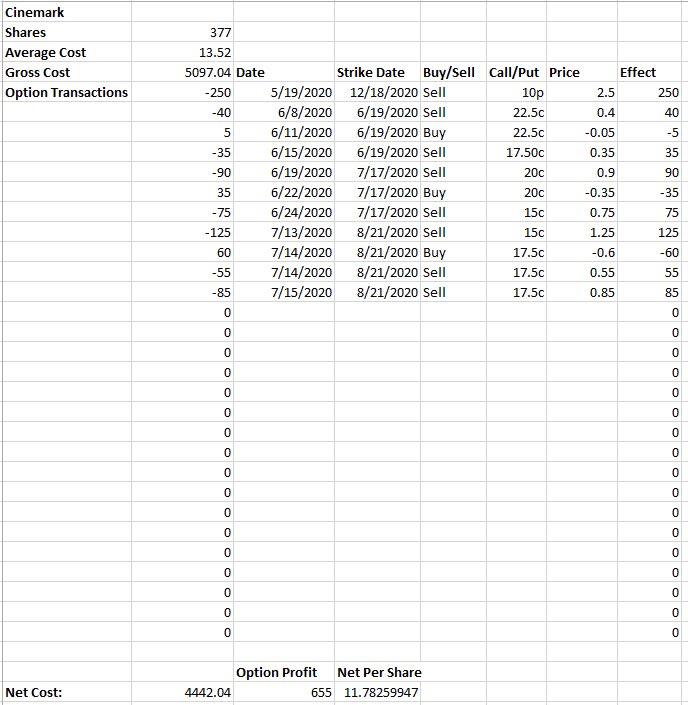

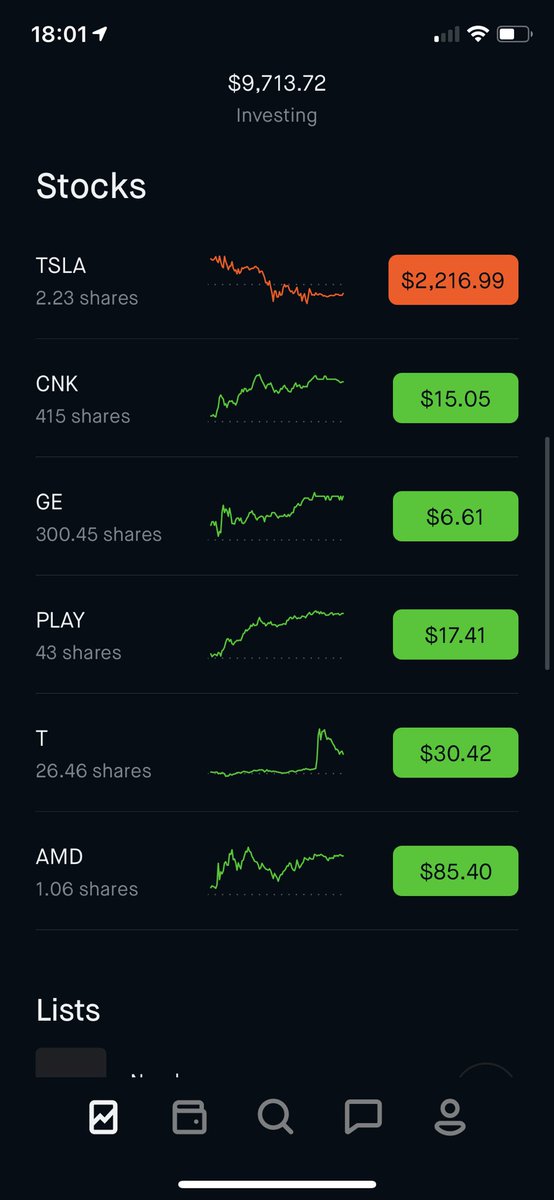

Copped 10 $CNK @ Market ($13.55)

Copped 1 $DRI @ Market ($63.35)

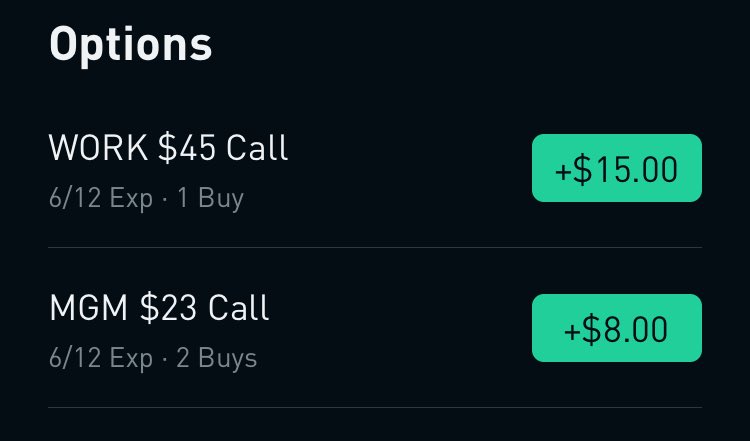

Still got my eye on $DIS (I want it below $100 waiting for earnings) and $BA I’d love near $110 ...

Bought 10 $T @ $30.59

And entering $DKNG @ $30.50

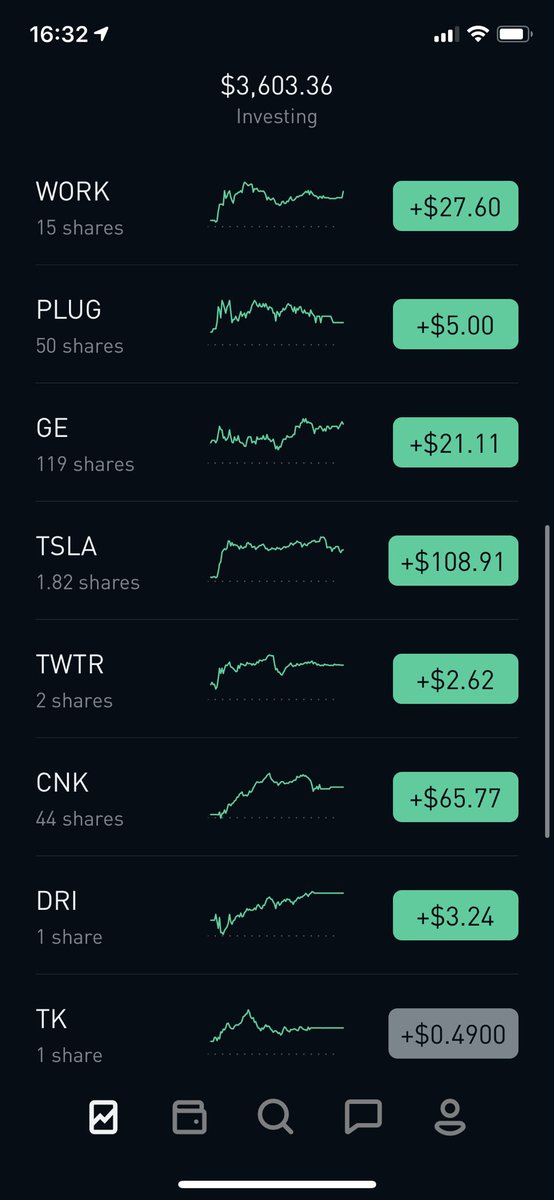

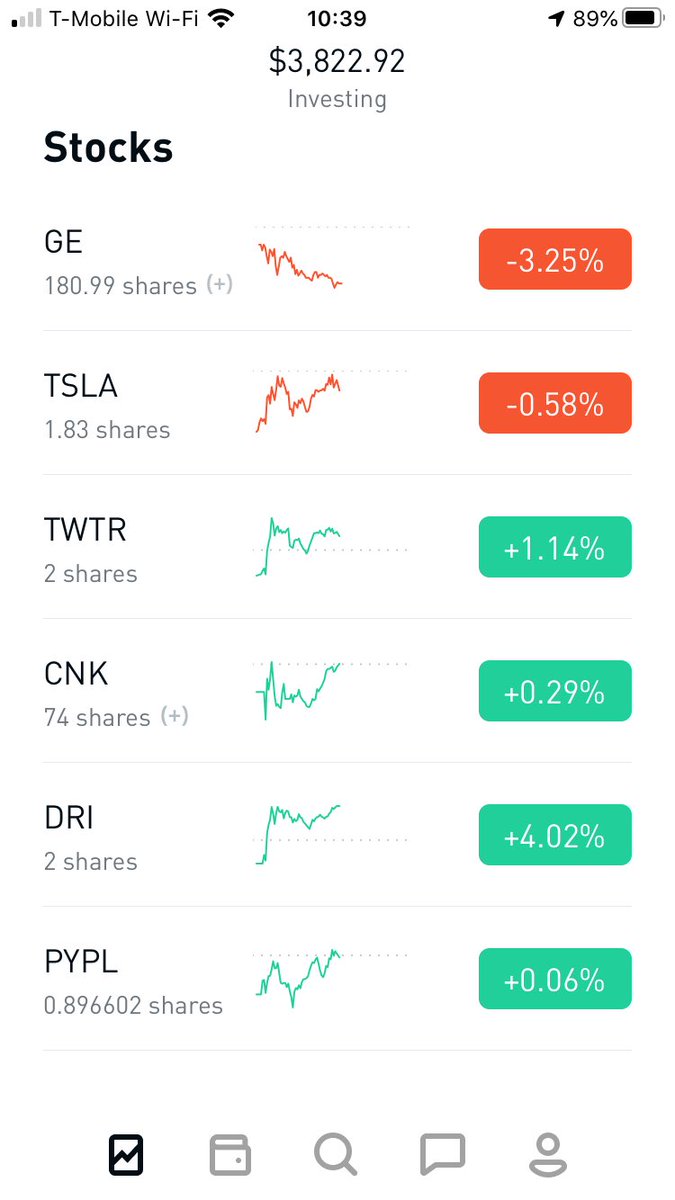

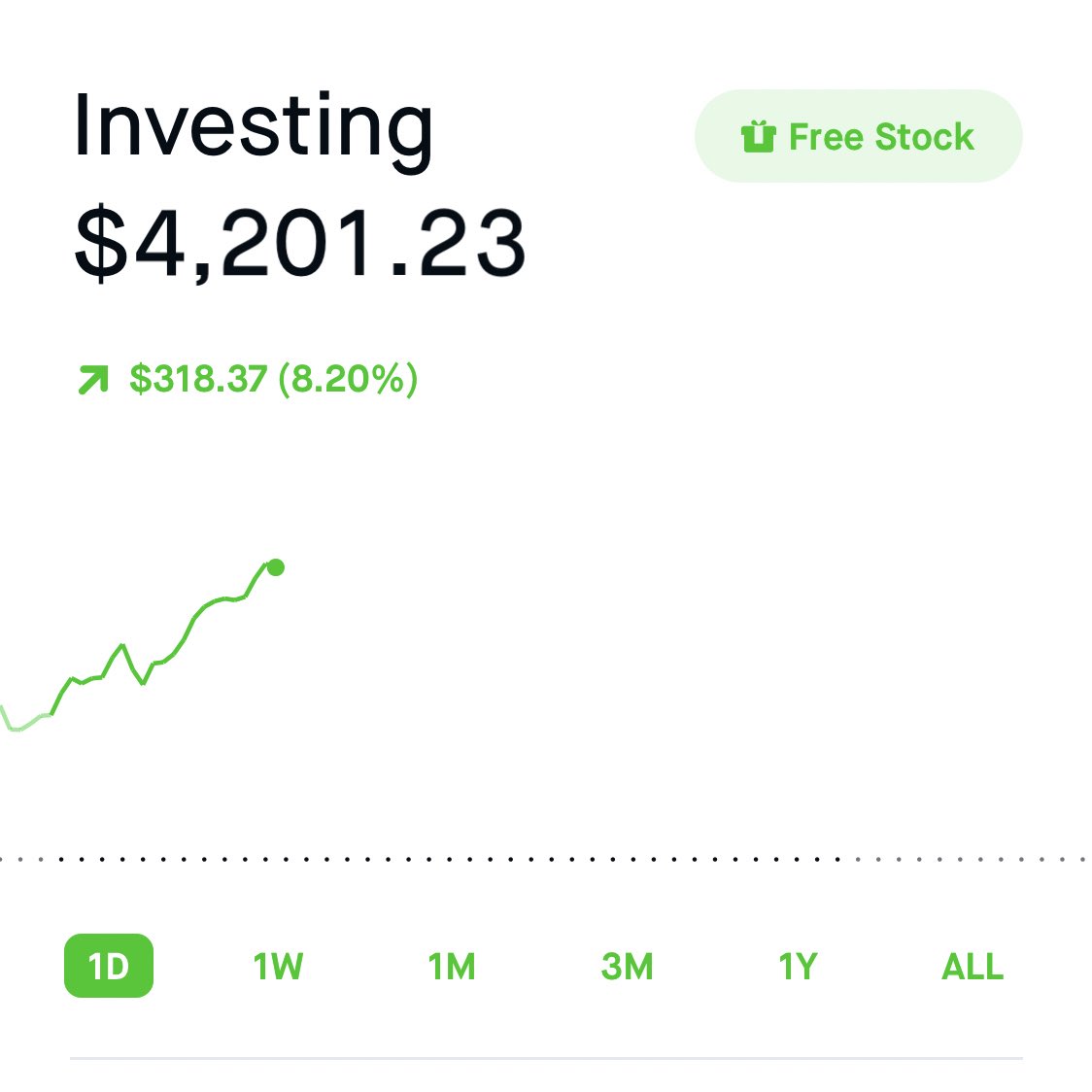

Cinemark is doing amazinnnggff todayyyy oh my lord up 10% and I got 100 of them thangs so let’s GOOOOOOOOOO