(a) why May WTI #Crude traded negative last night?

(b) what's retail piling longs on Oil ETFs

(c) The way forward.

So the oil extracted from the fields need to be stored up. But there is a limit to storage.

Now, WTI Crude (CL) is a deliverable contract which means you need to take delivery if holding a position on expiry (which is today, 21 April at NYMEX in US)

Delivery point is Cushing, Oklahoma

FYI, May contract had ONLY 5% Open interest across contracts as far as Dec 2021.

Traders holding May CL contract who had long positions was looking at exit, was not able to sell, no storage positions available.

So had to sell at any price. Even if the price is negative.

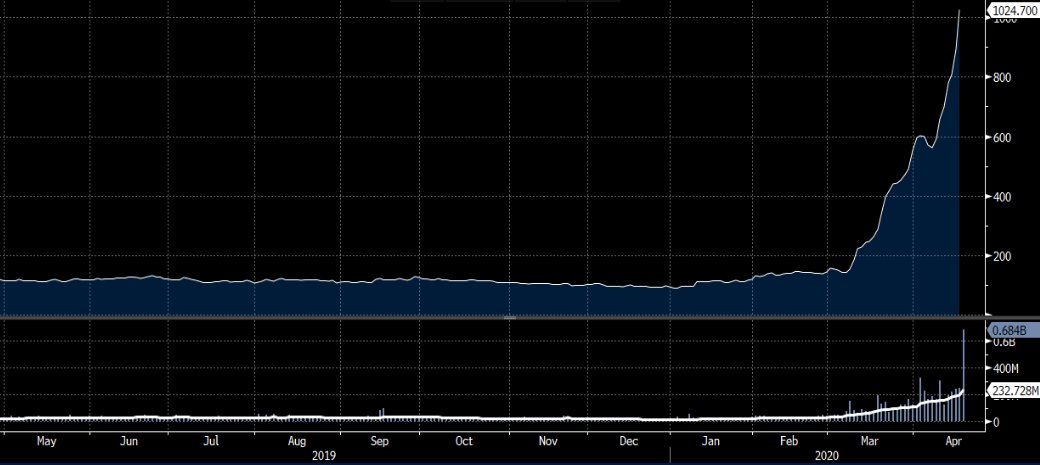

Blame it on virus lockdown, but retail volumes are skyrocketing as trading desks are working scantly, retail full on.

But they weren't buying May oil. They were buying June, which is trading at $21.12 (because expiry today and rollovers not happening)

June is trading ~$22 and Dec 2020 at ~35$

The reality is negative rollovers in such ETFs kill trading.

That's where the catch is : Who is really expecting to have to pay ~$22 per barrel to buy it in a month.

What ultimately matters is what one will pay for oil on the ground and this implosion is revealing that no one wants it.

One fund in Singapore already declared bankruptcy yesterday.

CME is likely to increase margins and that's like to cause another short squeeze.

"Something has to be done about the bloodbath"

Well, last year NG went negative at many delivery points in US. Before that, nobody could comprehend it.

Bond yields also went negative few years ago and was treated with same disdain.

If you have it and don't want it, it's a big problem to get rid of it.

End of thread.