Founder @fintrekk | SEBI registered Research Analyst | Loves Scuttlebutt | Voracious reader | GARP & SS Investing

#AKGweekendreadings #AKGweeklycharts

7 subscribers

How to get URL link on X (Twitter) App

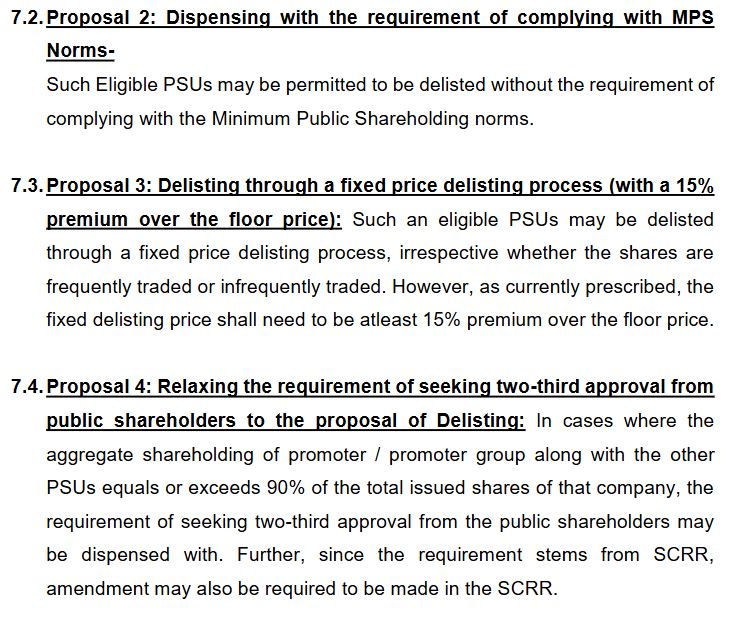

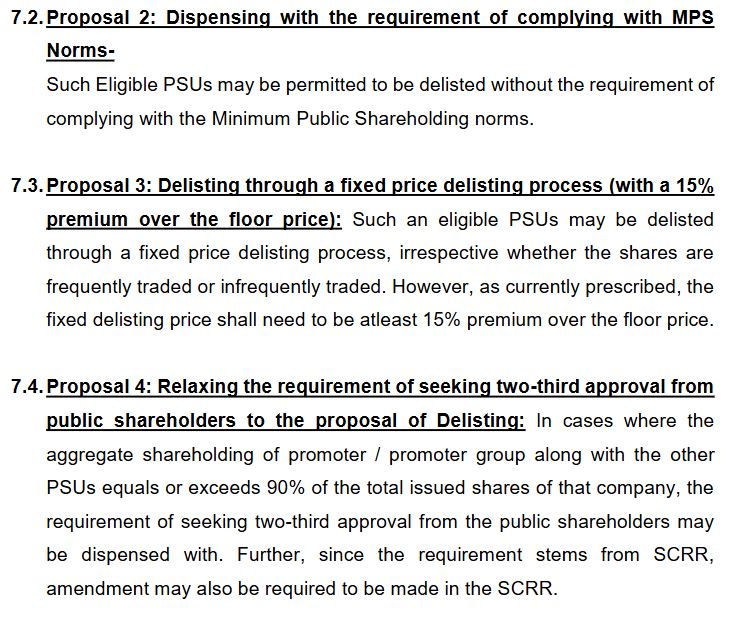

It has been proposed to delist them with a 15% premium to the floor price (60 days VWAMP or highest price paid by PACs in 26w/52w volume weighted average price)

It has been proposed to delist them with a 15% premium to the floor price (60 days VWAMP or highest price paid by PACs in 26w/52w volume weighted average price)

https://twitter.com/apri_sharma/status/1499625963088642051(1) The 2yr PG in "relevant stream" clause is filled with roadblocks (Earlier it was only PG). Forcing RIAs to do a PG degree that too of 2 yrs is bizzare. Many professional certifications like CS were removed from the equivalent PG category overnight.

https://twitter.com/TrungTPhan/status/1474064372079075330?s=20

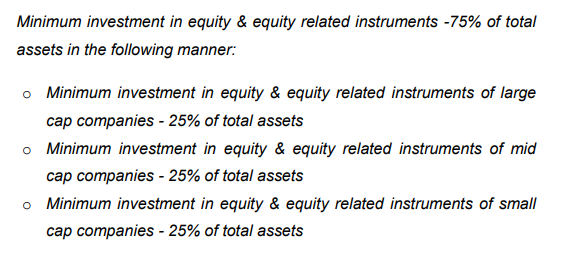

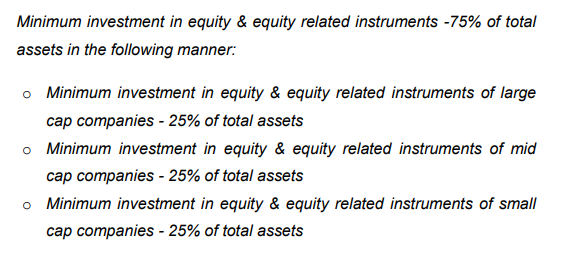

(2/n) Which funds are impacted by this?

(2/n) Which funds are impacted by this?https://twitter.com/SquawkCNBC/status/1303665278262353920"I have no clue where the market is gonna go in the near term. I don't know whether it's going to go up 10%; I don't know whether it's going to go down 10%," Druckenmiller said. "But I would say the next three-to-five years are going to be very, very challenging"

https://twitter.com/amitgupta0310/status/1287389997759205376(1) The minimum margin requirement for BUYING stocks from the client can be 20% of the trade value instead of (earlier decided) full 100% VAR+ELM

https://twitter.com/amitgupta0310/status/1276914785091612673The increase in COVID-19 cases globally, especially in the US, mean that the Fed is likely to ease more which will suit gold upside even further