david-salazar.github.io/2020/04/17/fat…

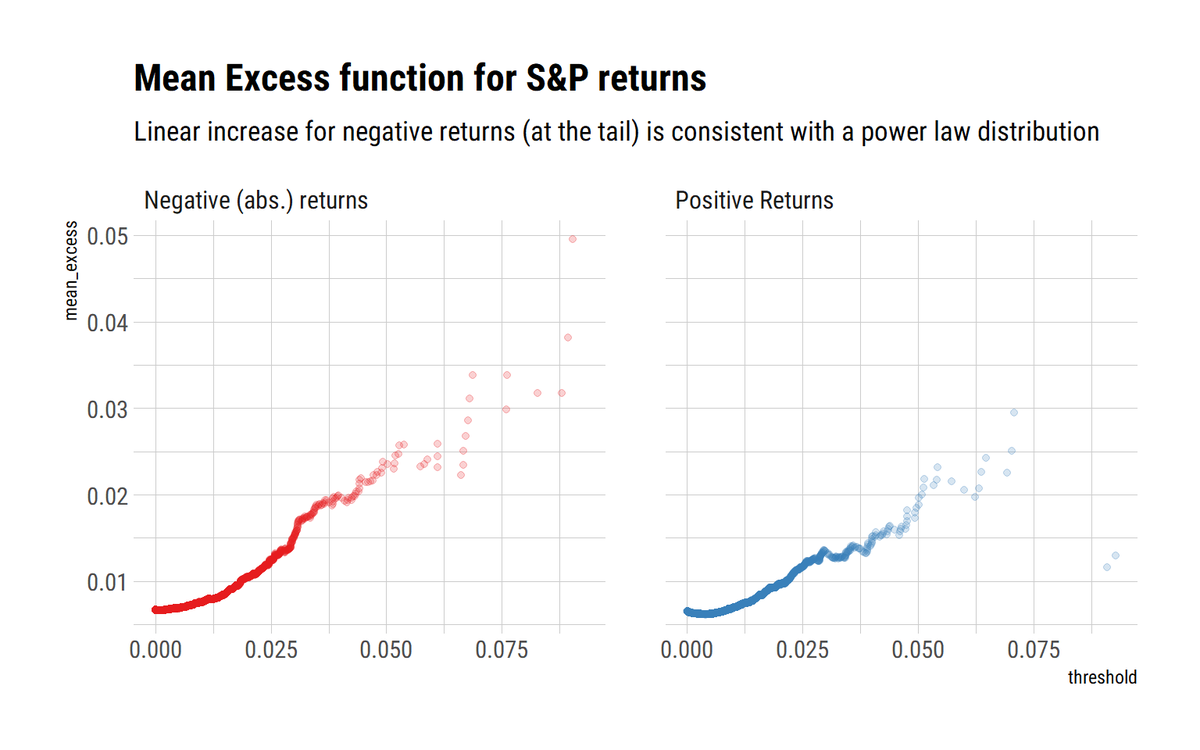

david-salazar.github.io/2020/05/09/wha…

david-salazar.github.io/2020/05/13/sta…

david-salazar.github.io/2020/05/19/und…

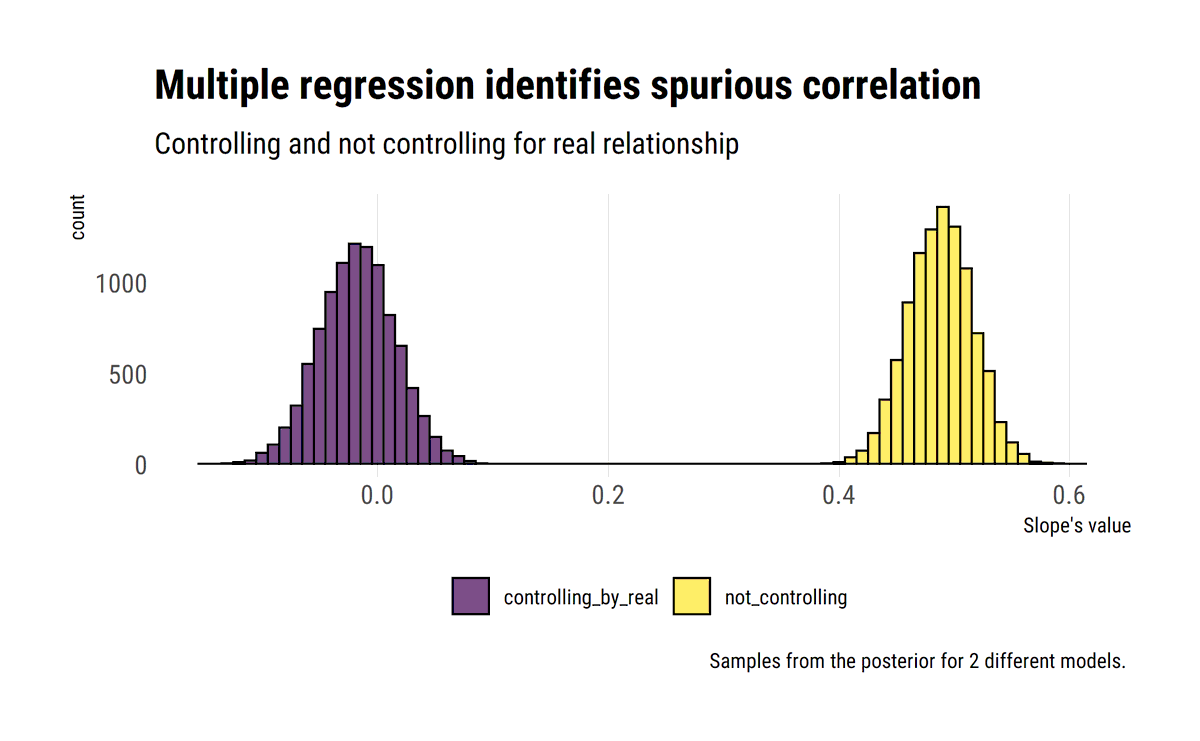

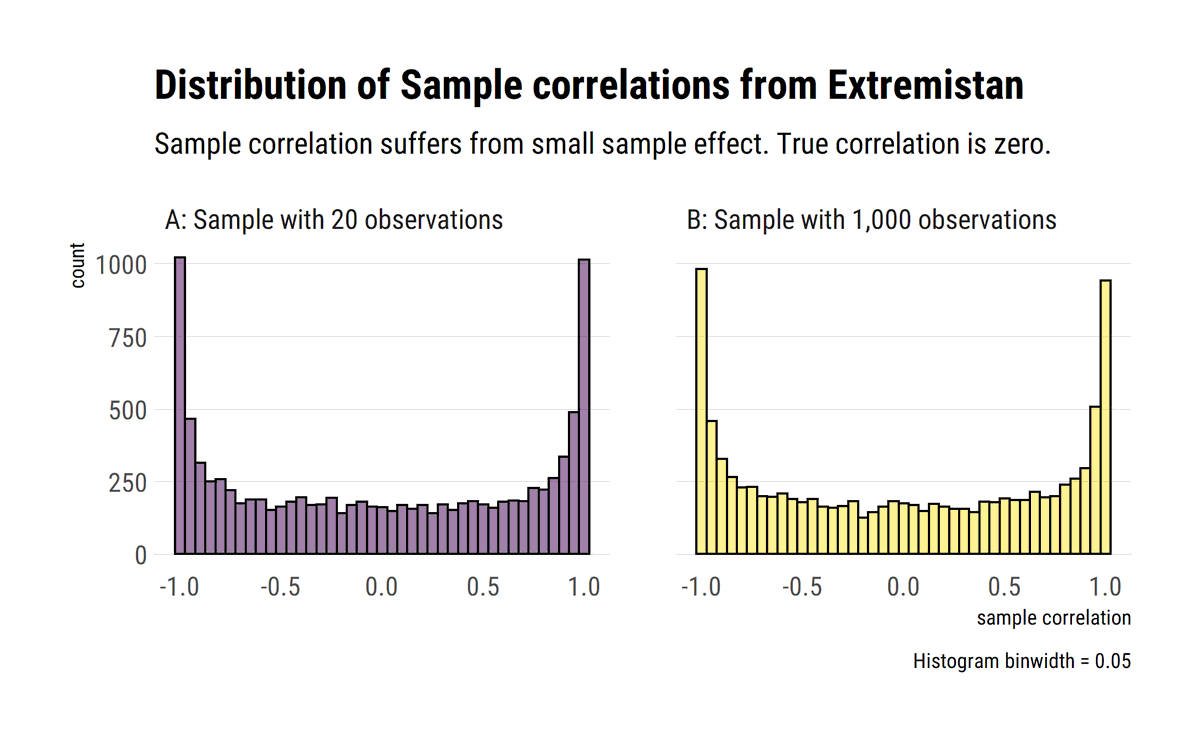

Blogpost: david-salazar.github.io/2020/05/22/cor…

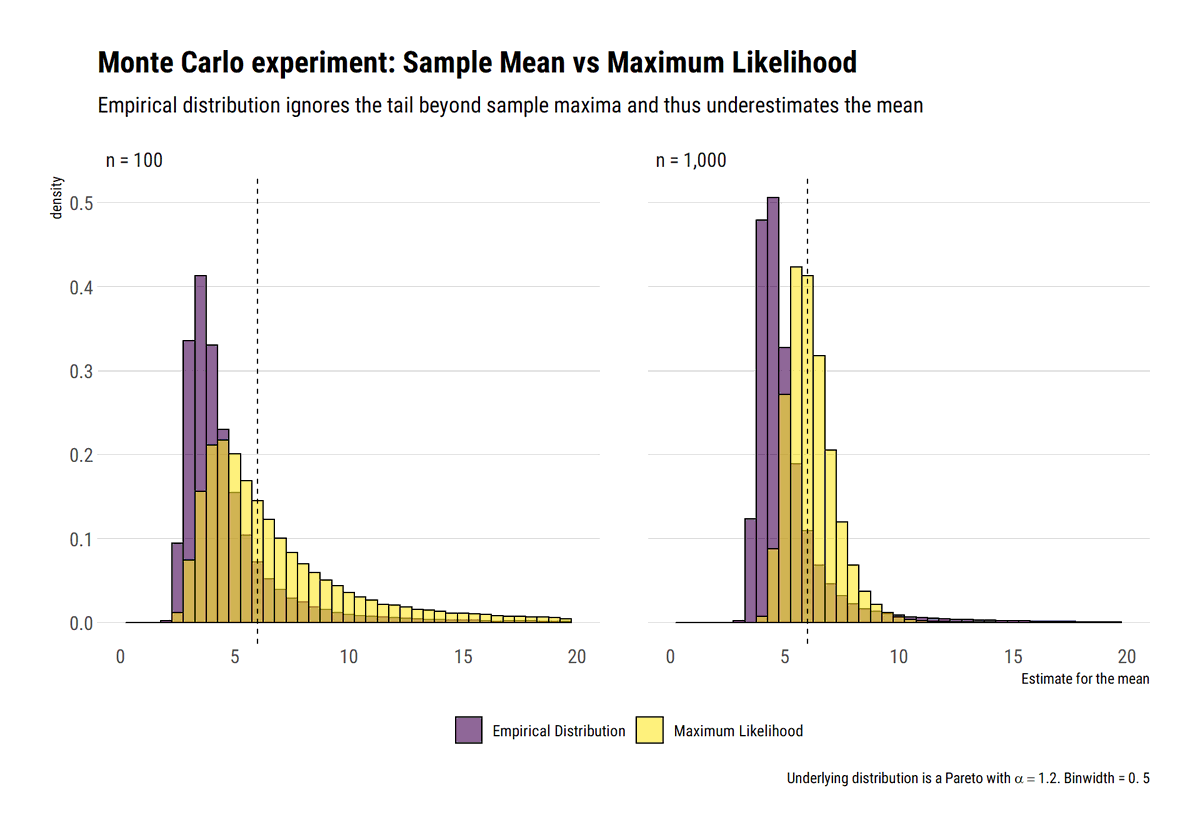

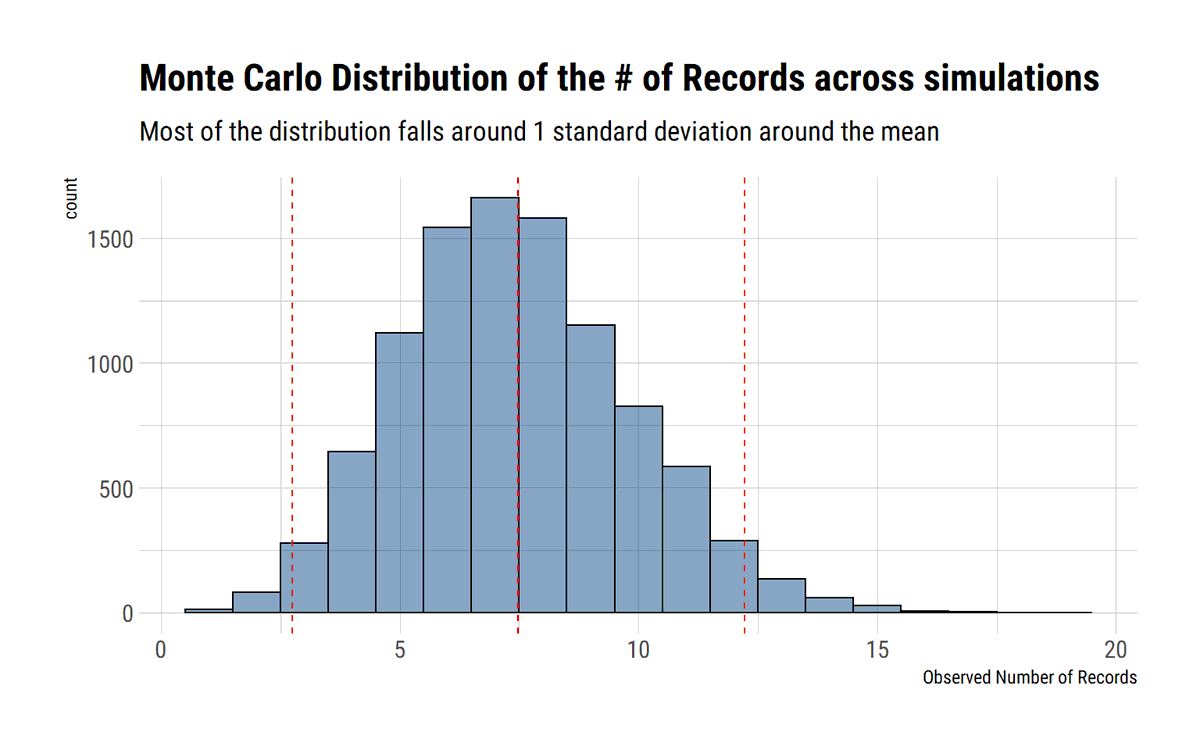

Monte-Carlo experiment:

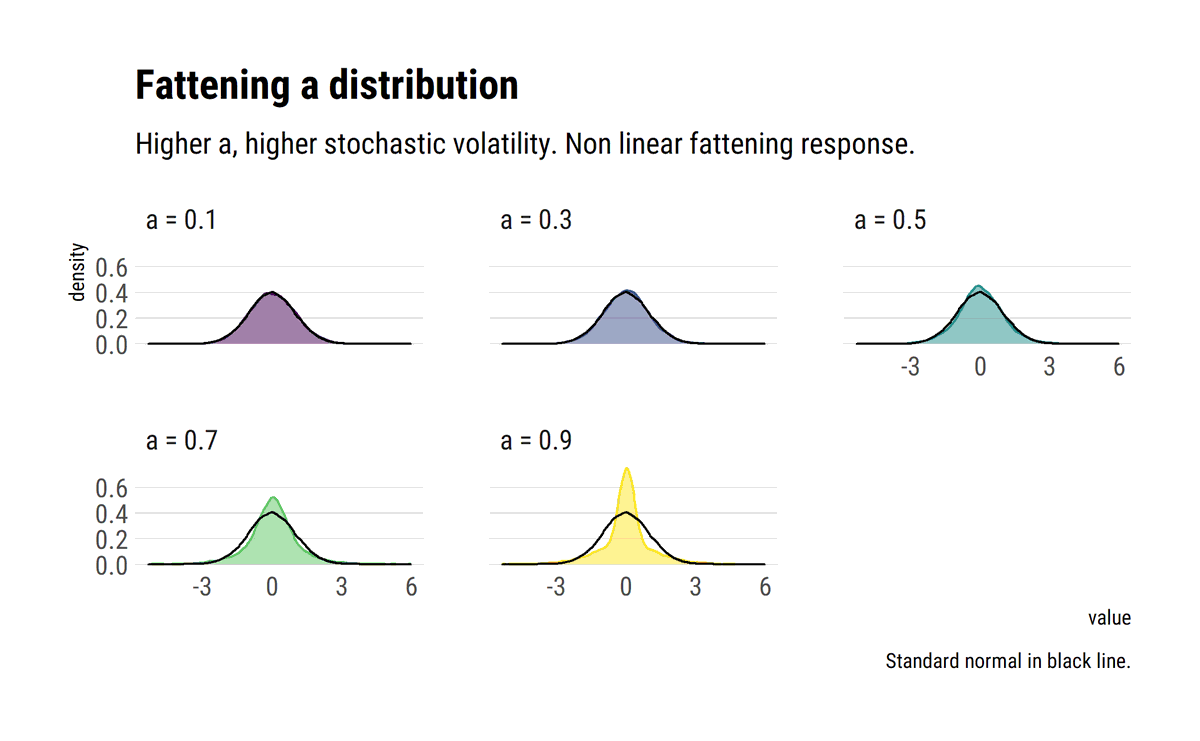

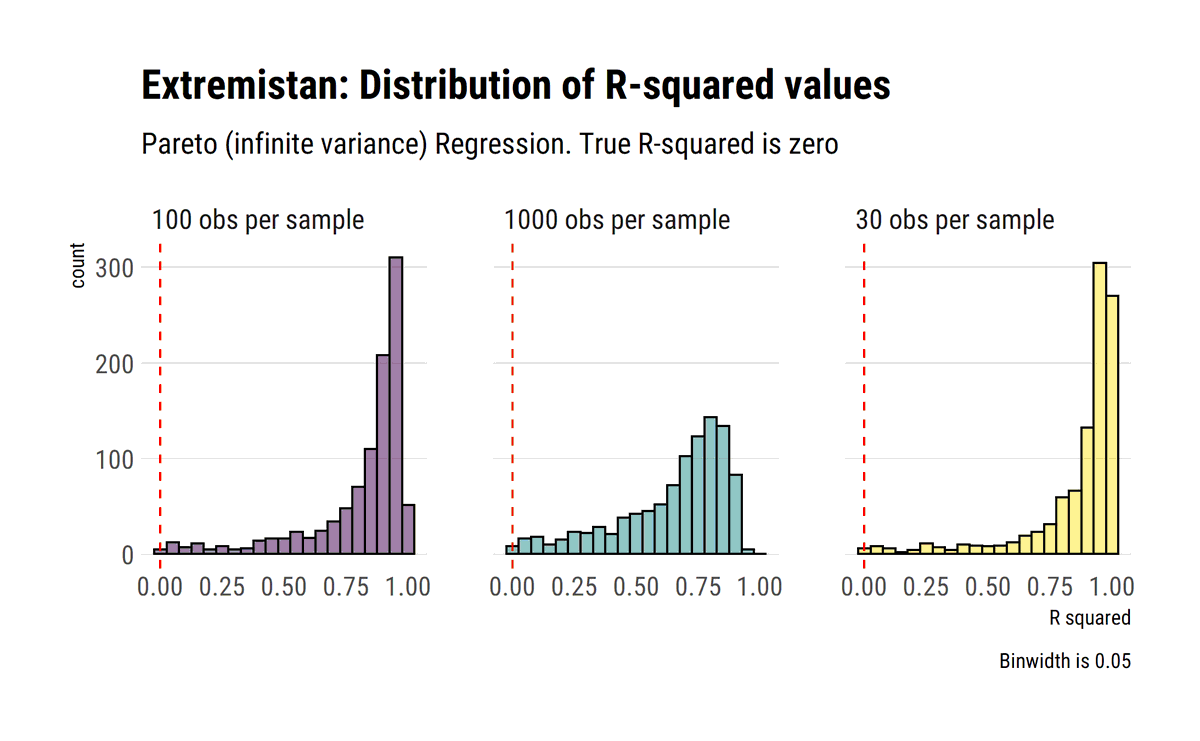

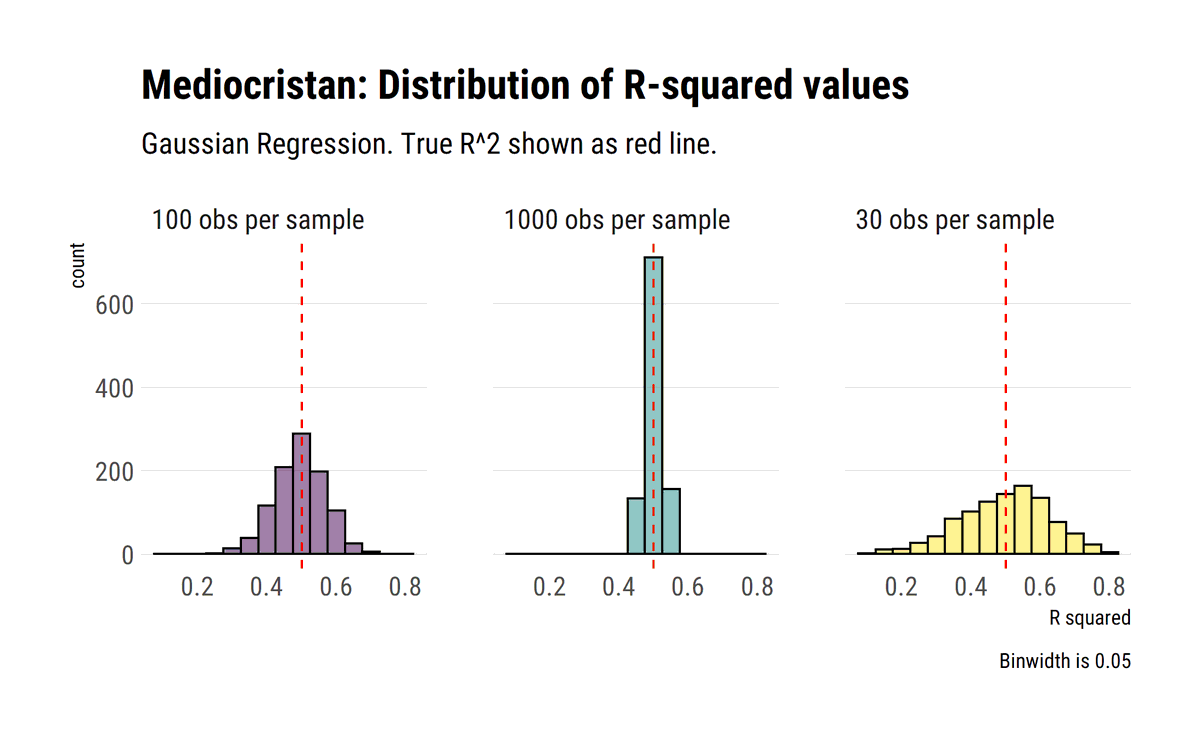

david-salazar.github.io/2020/05/26/r-s…

Blogpost with Monte-Carlo experiments:

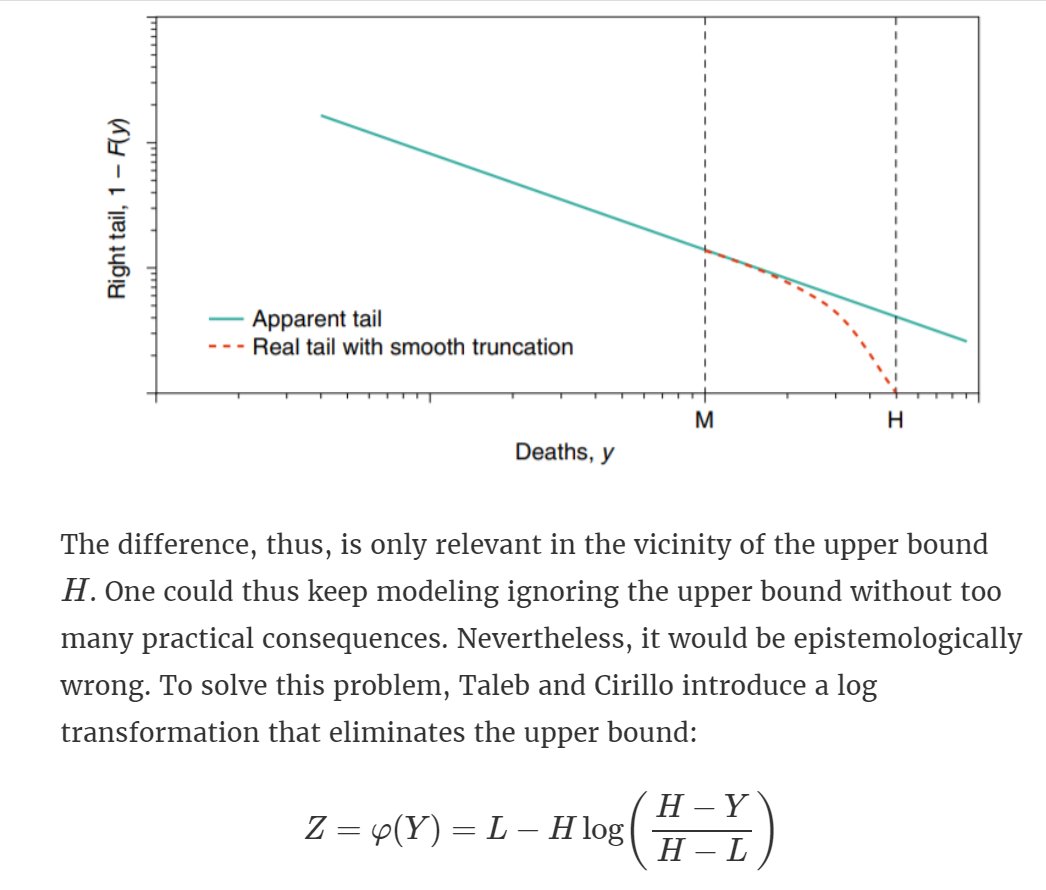

david-salazar.github.io/2020/05/30/cen…

Blogpost:

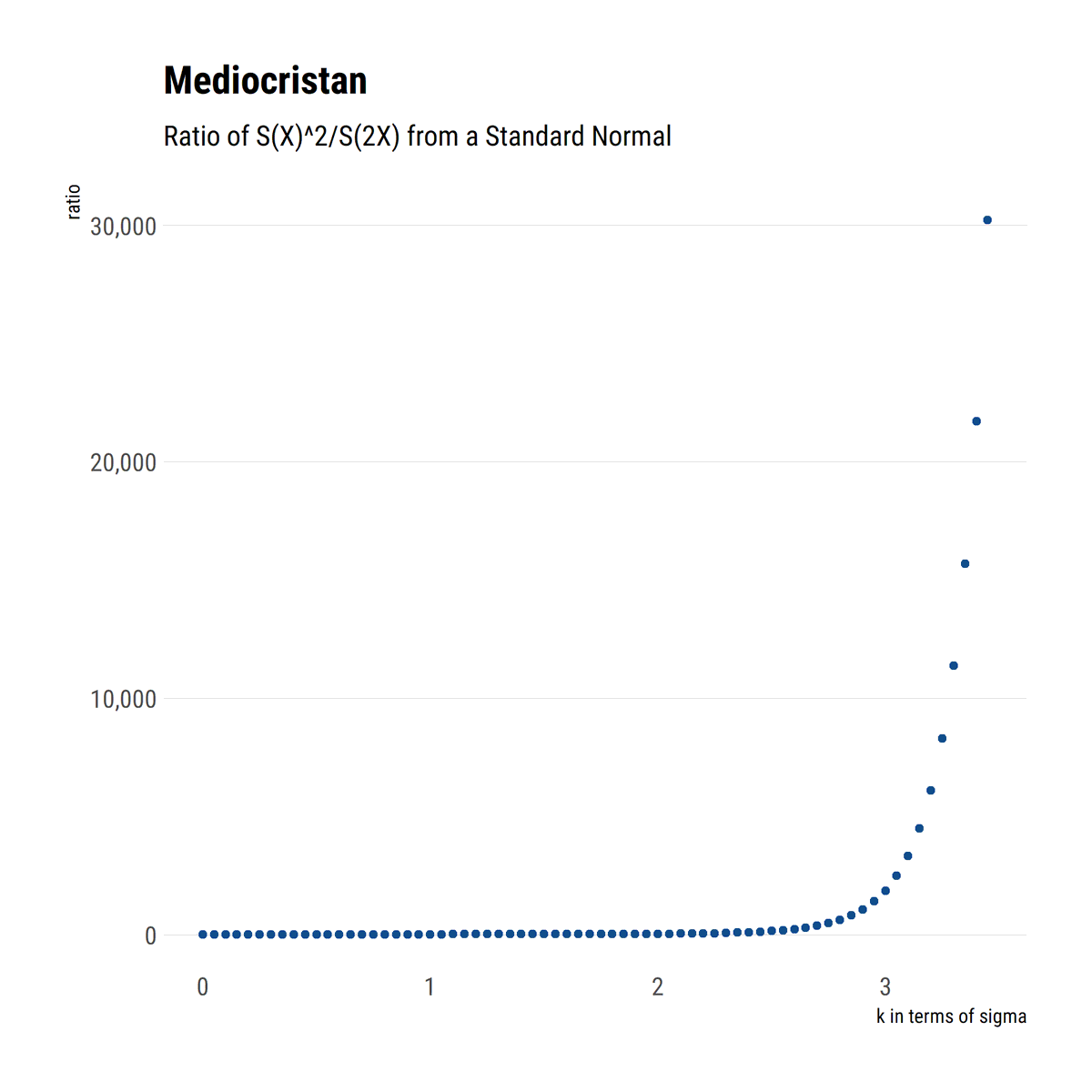

david-salazar.github.io/2020/06/02/lln…

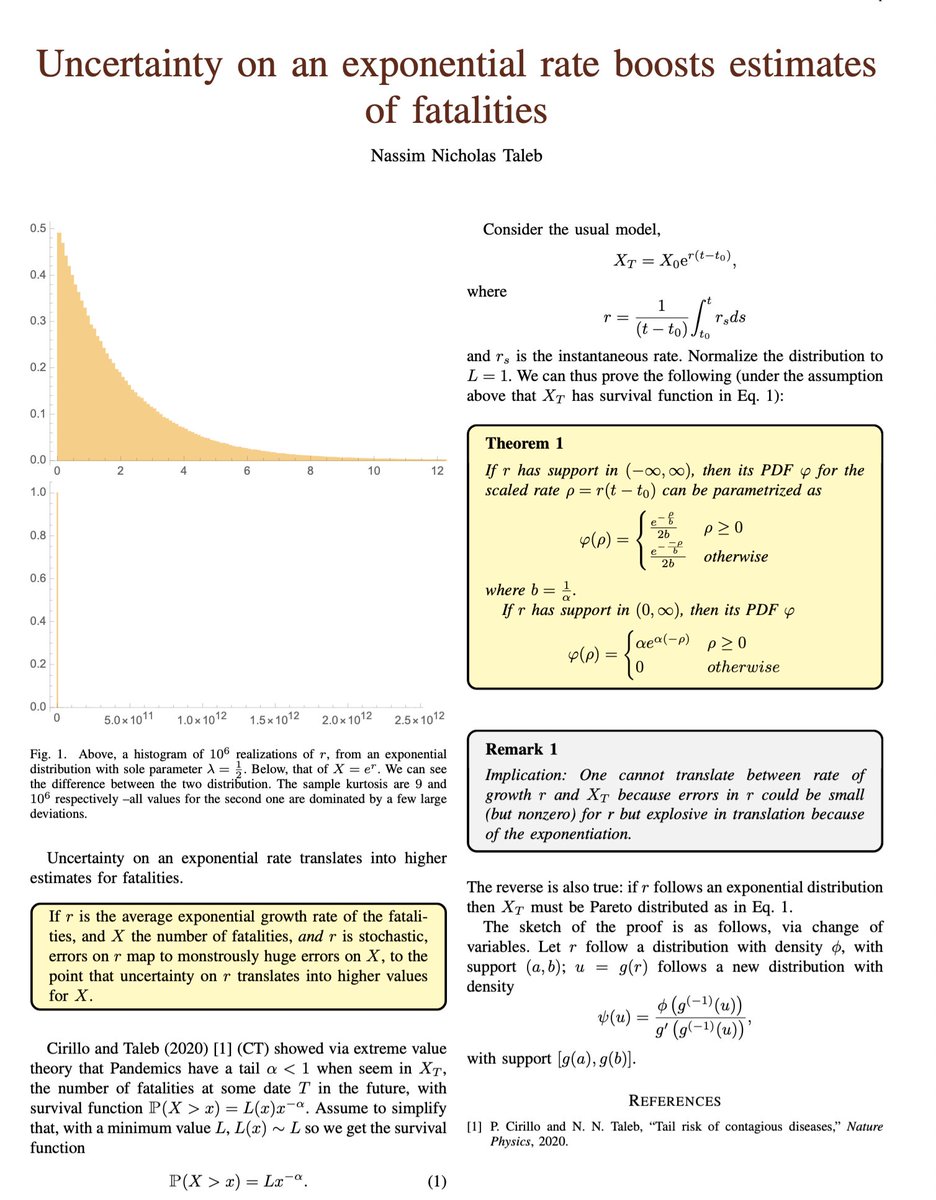

arxiv.org/ftp/arxiv/pape…

Blogpost:

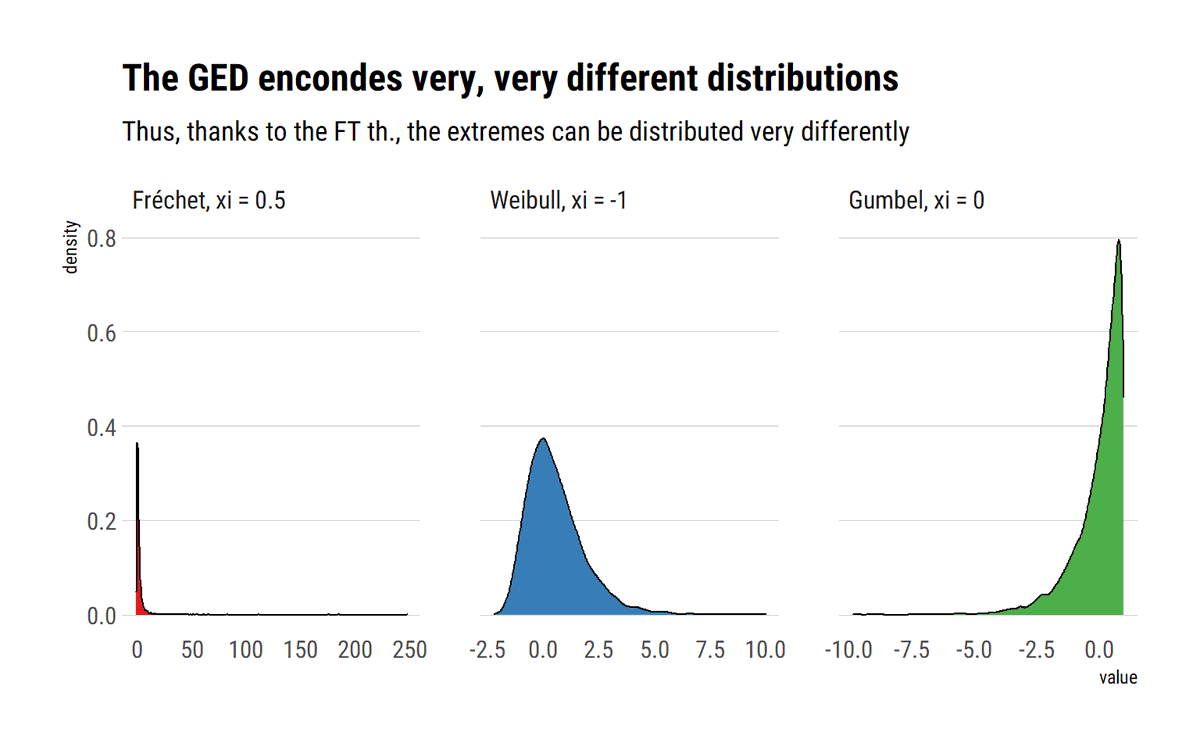

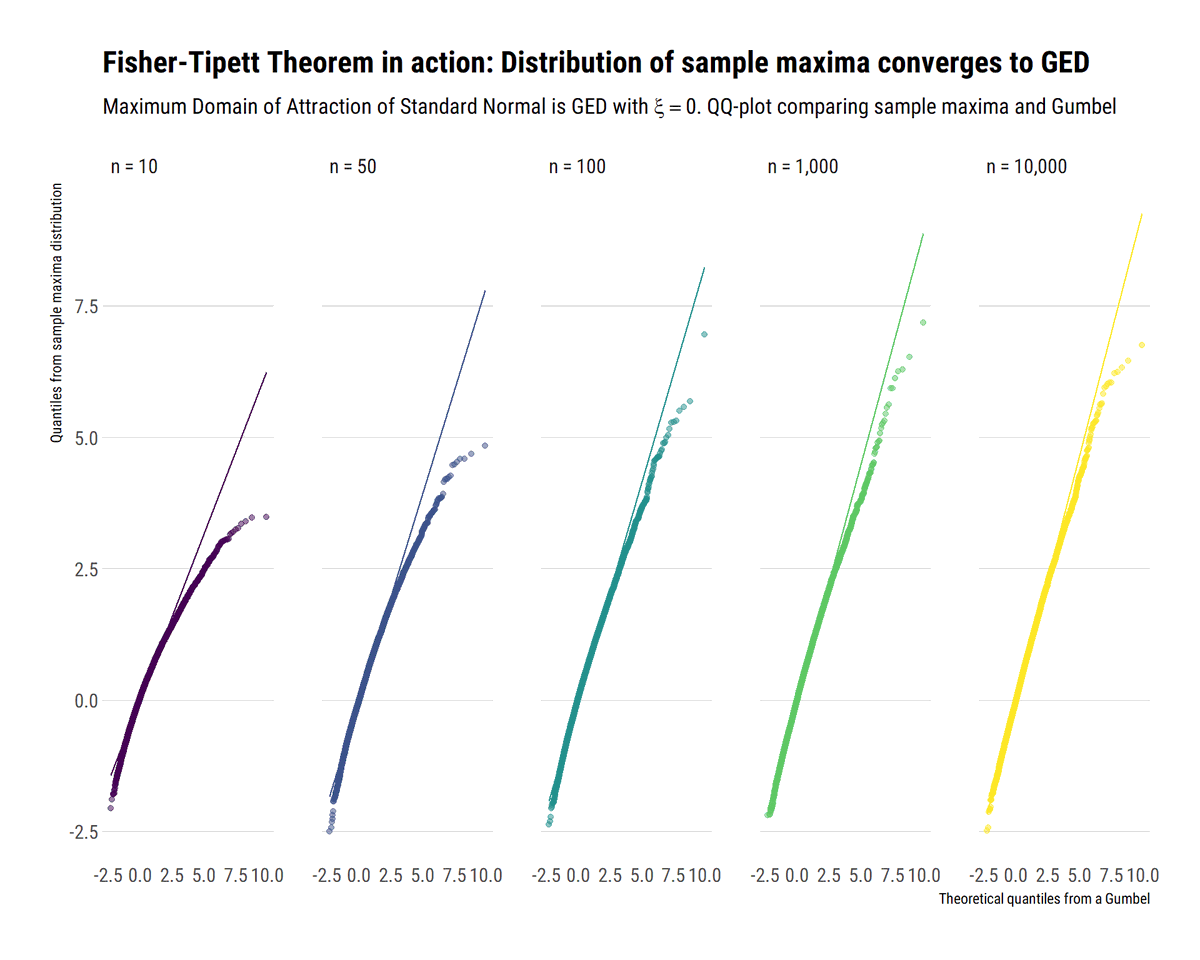

david-salazar.github.io/2020/06/10/fis…

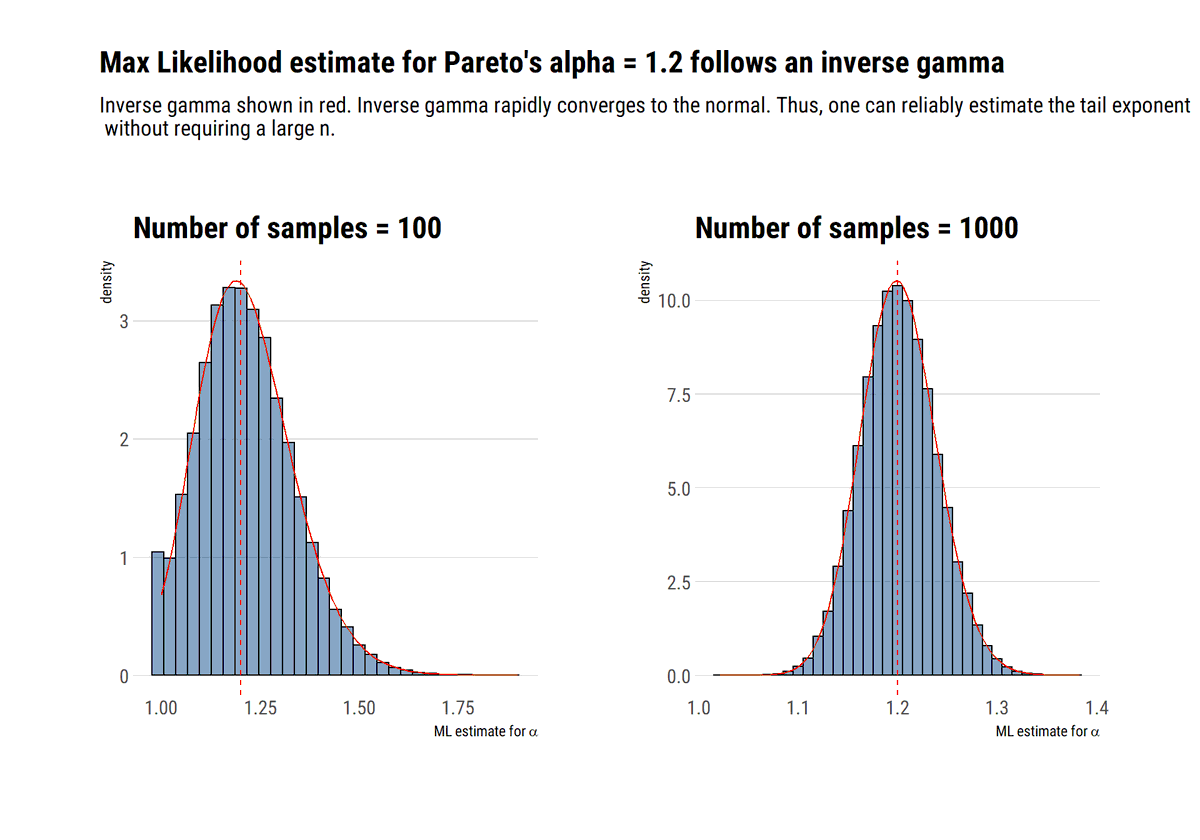

david-salazar.github.io/2020/06/11/how…

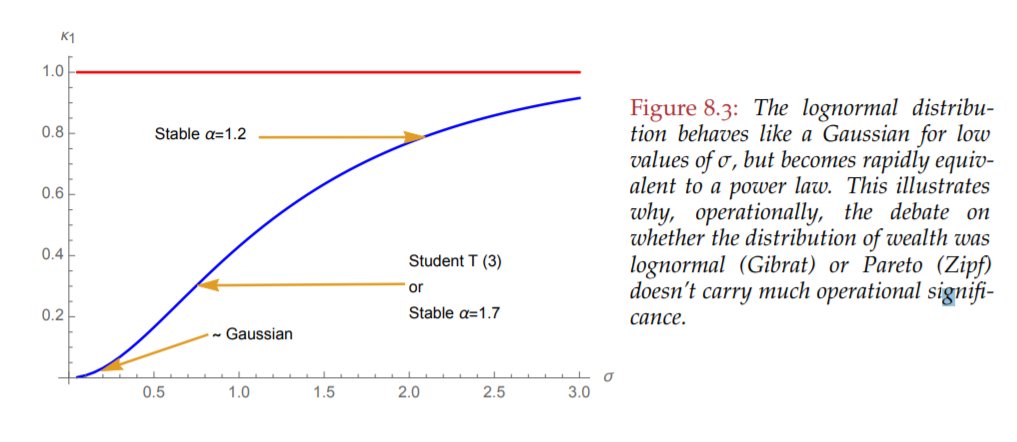

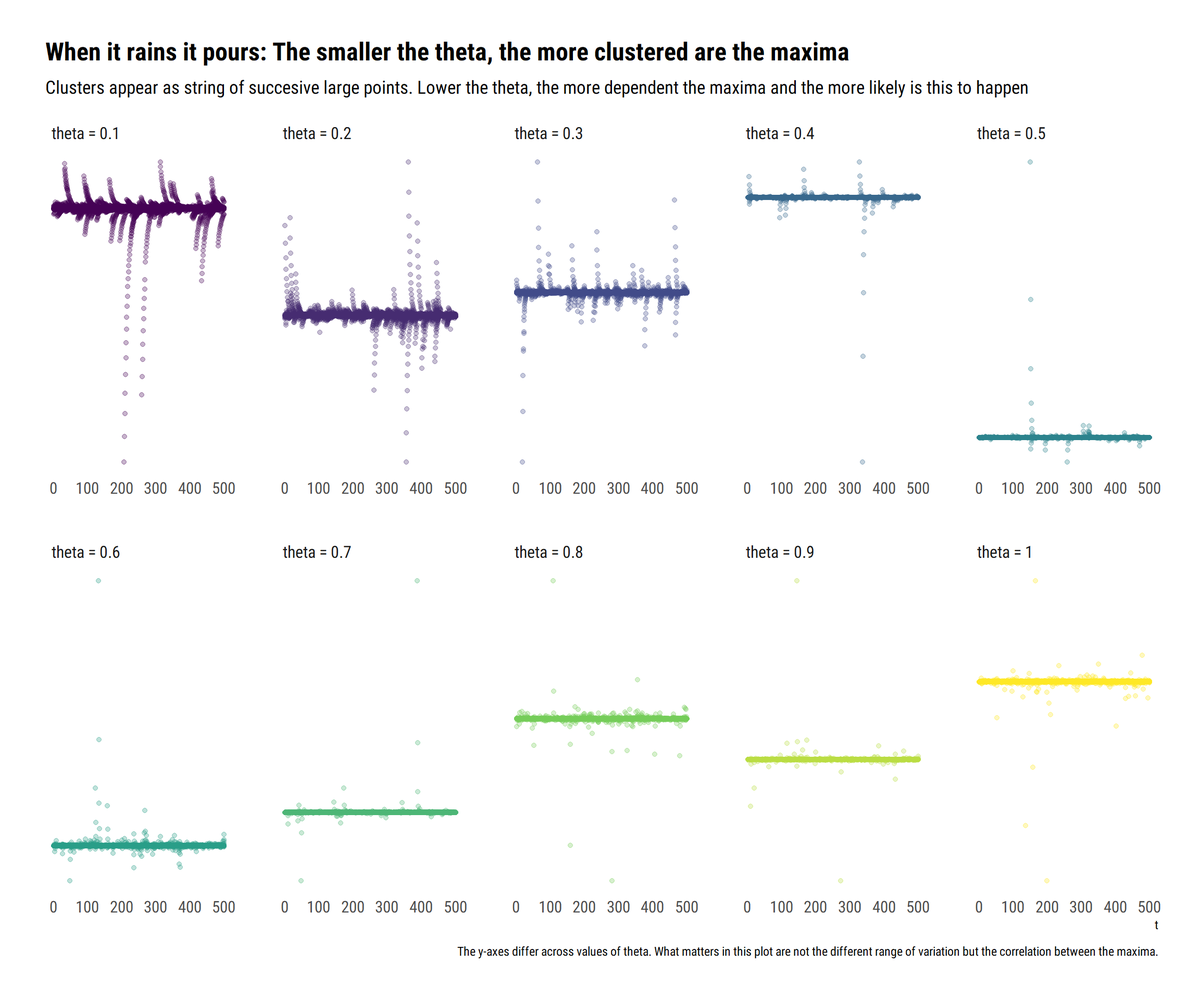

david-salazar.github.io/2020/06/14/whe…

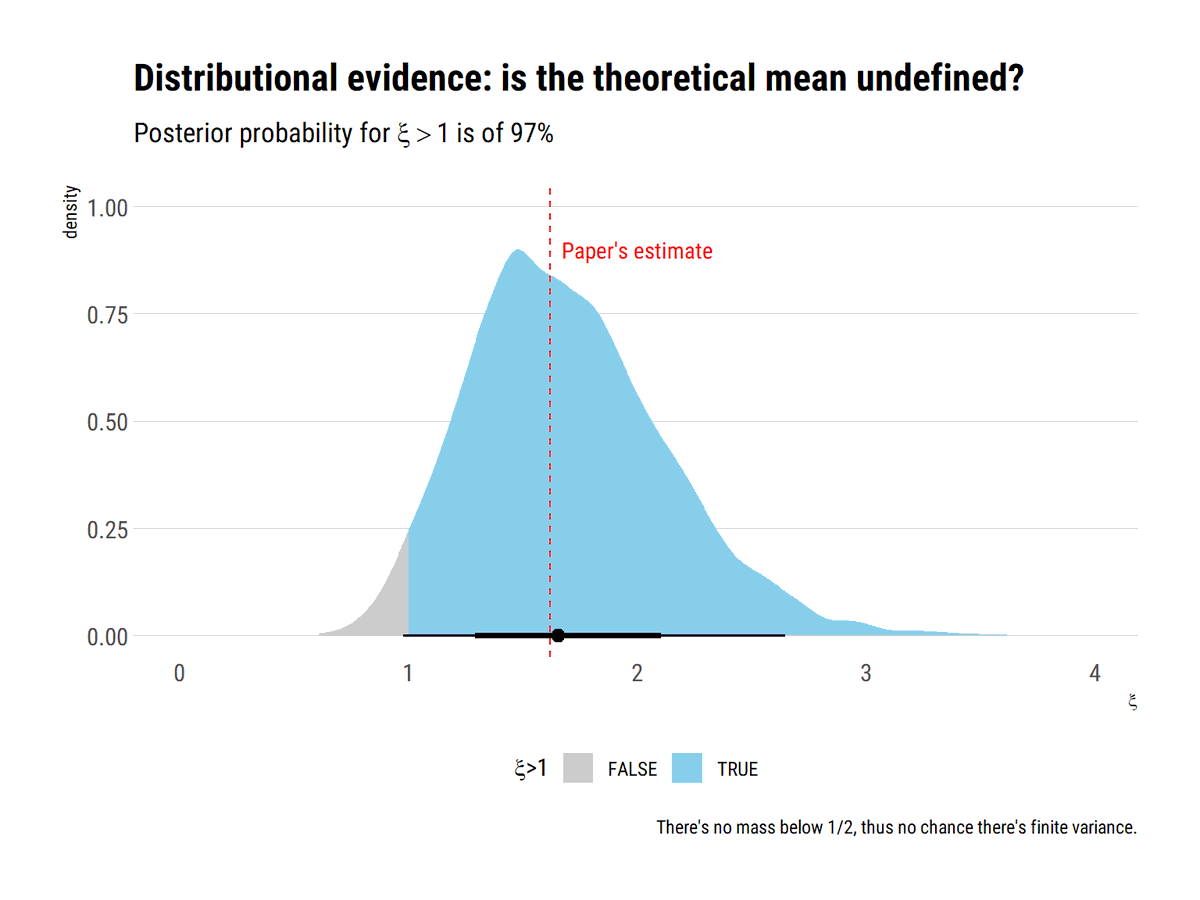

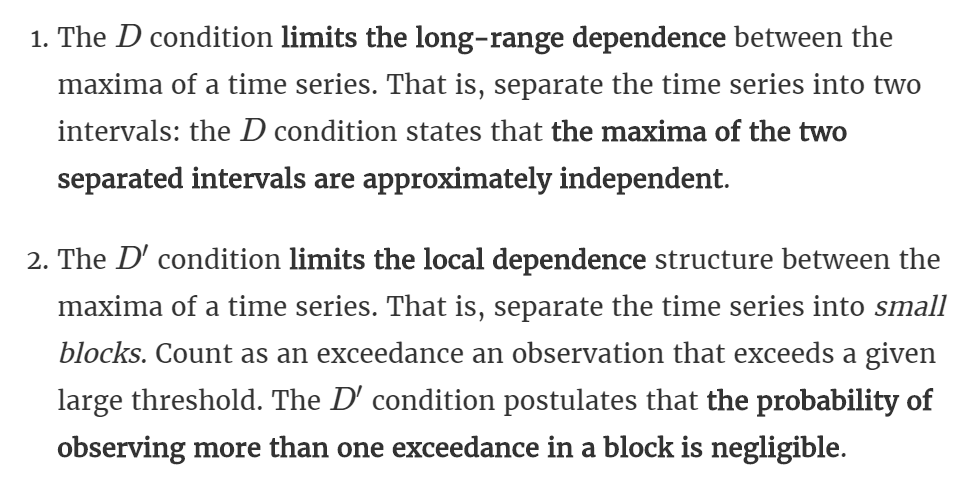

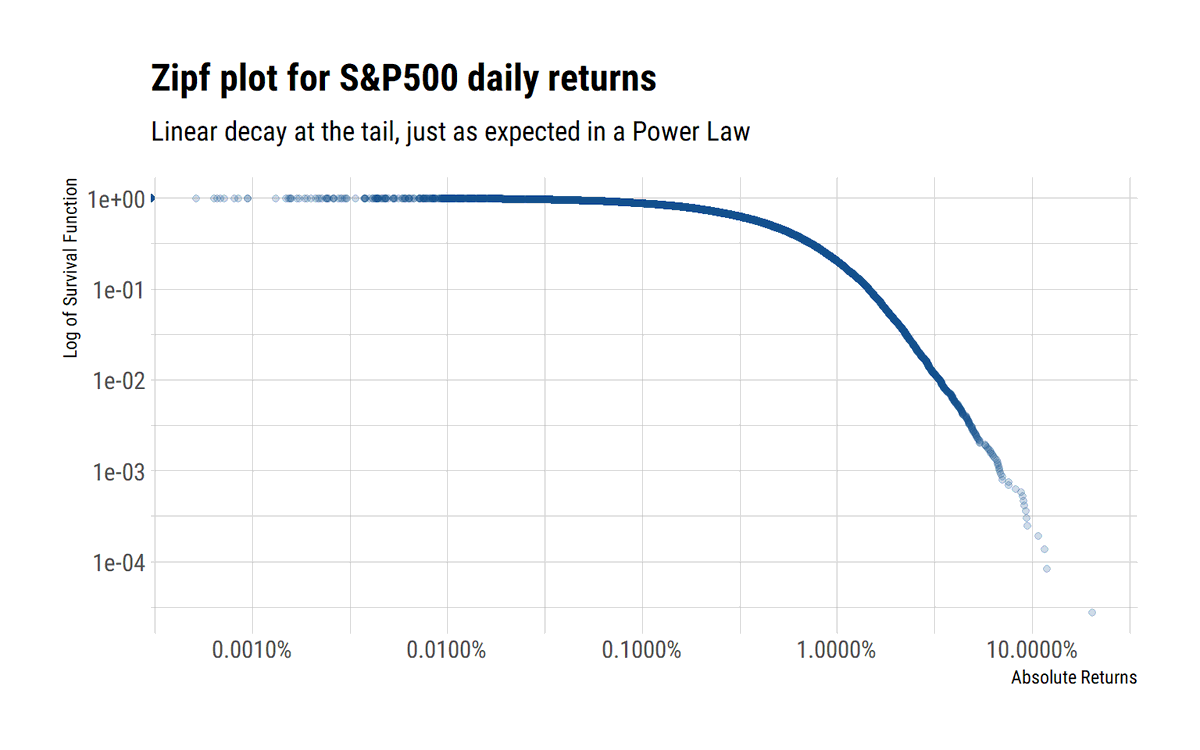

A single point rejects this possibility.

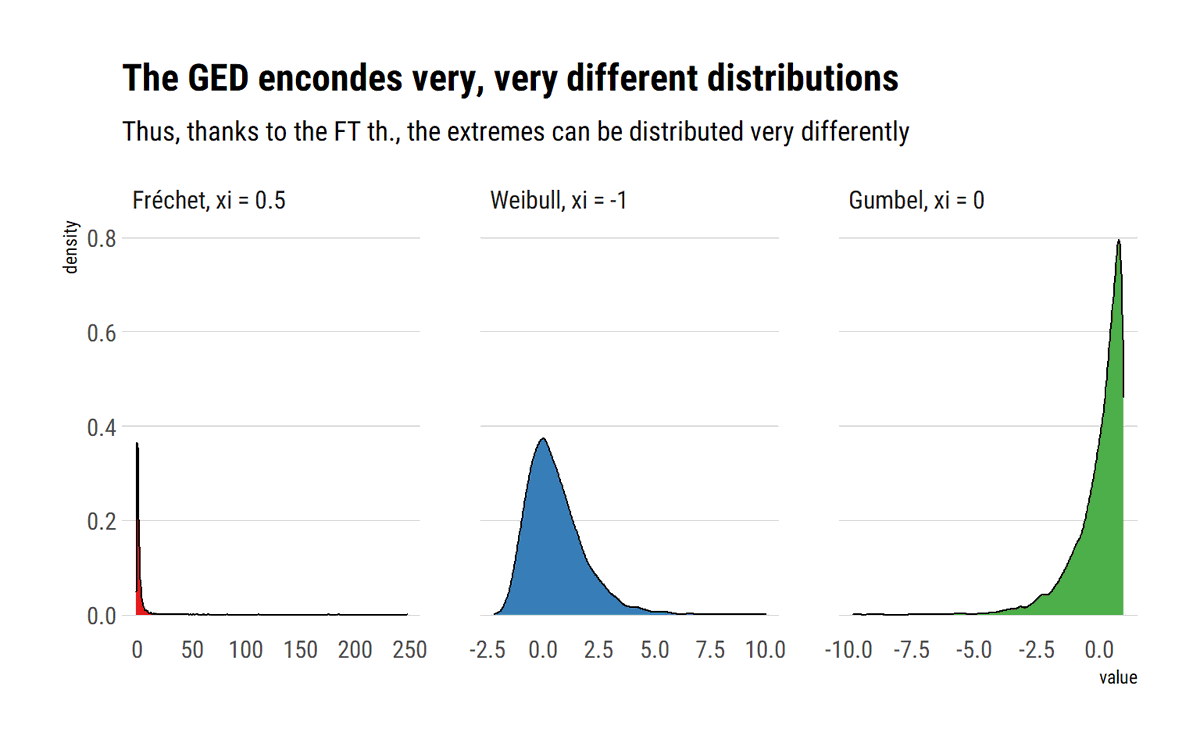

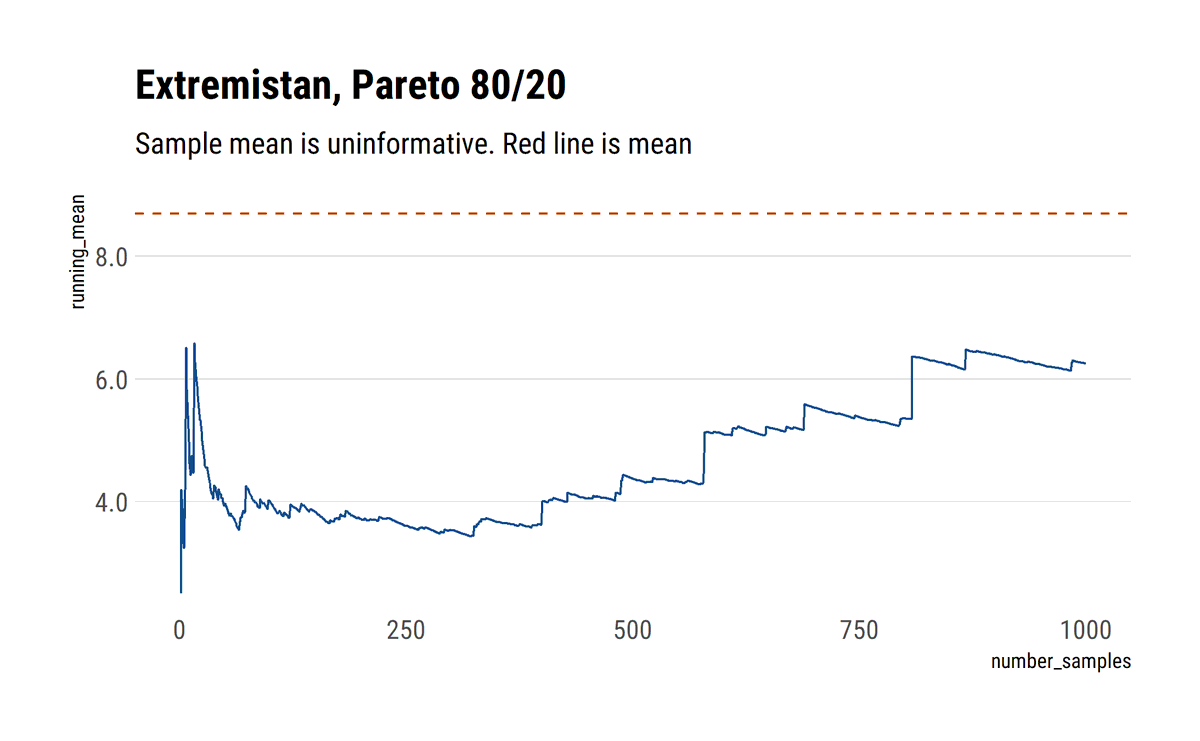

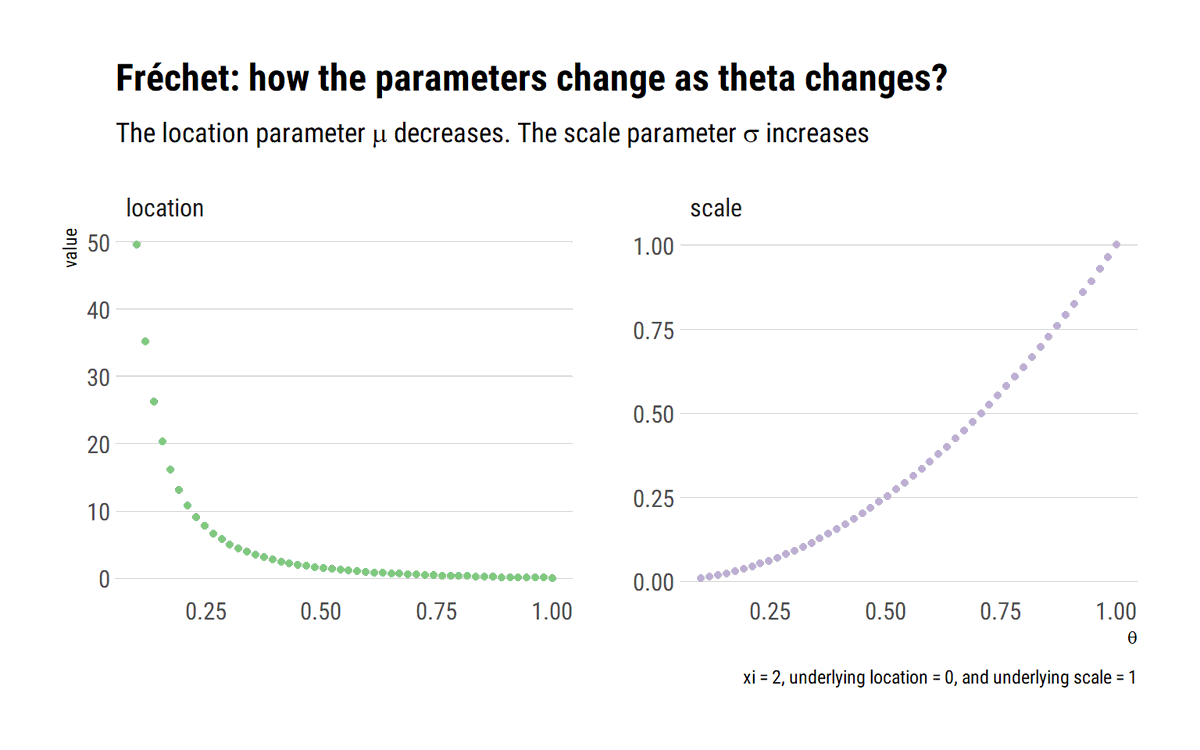

david-salazar.github.io/2020/06/17/ext…

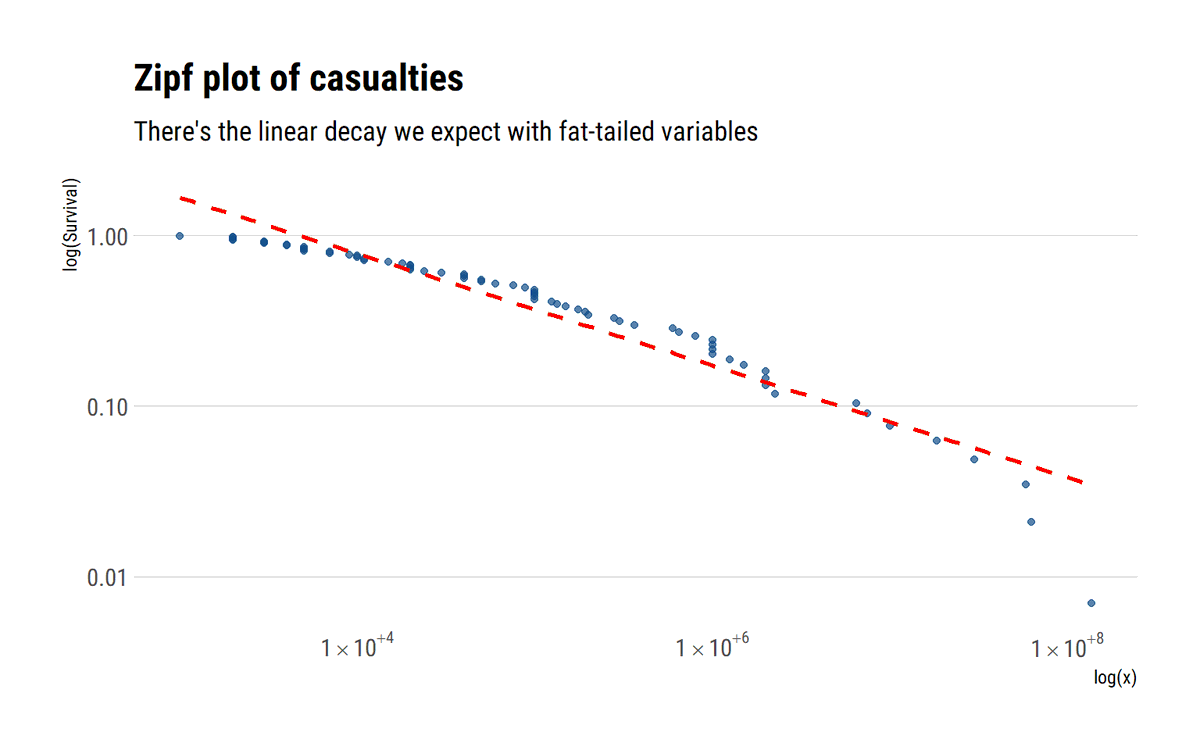

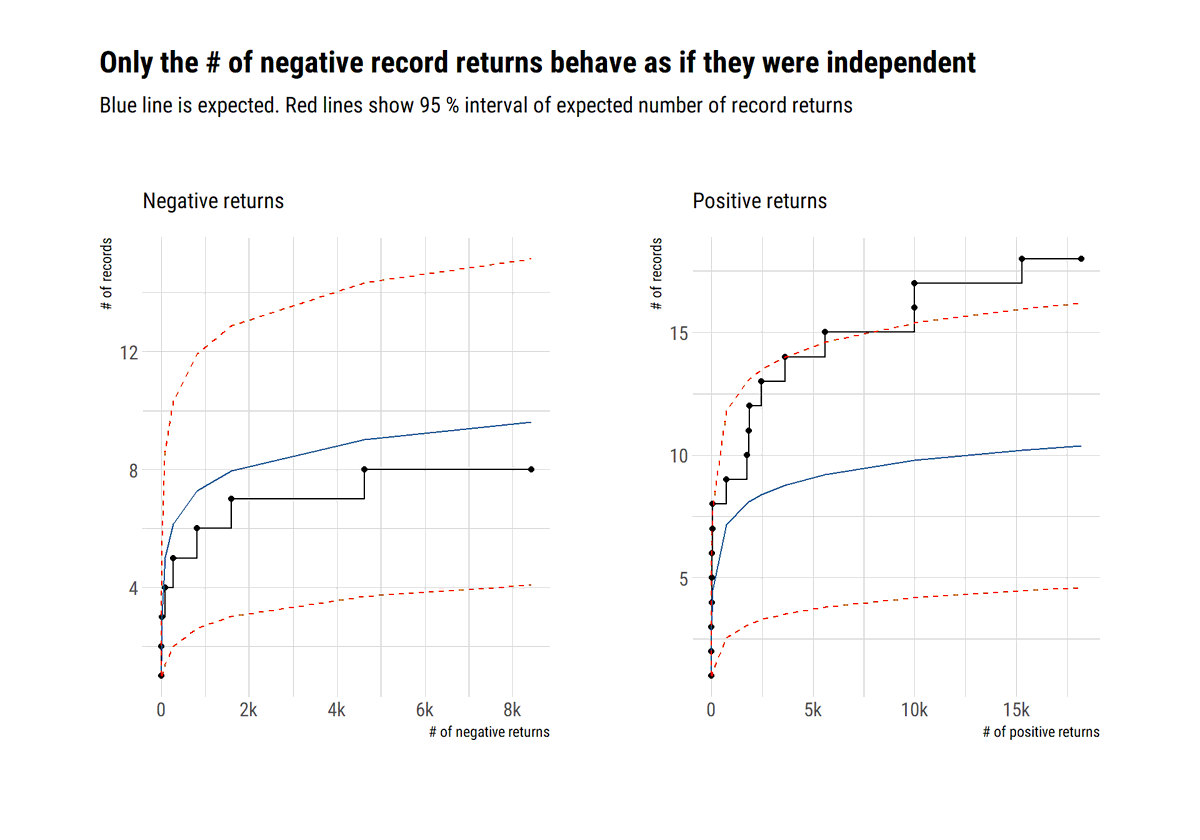

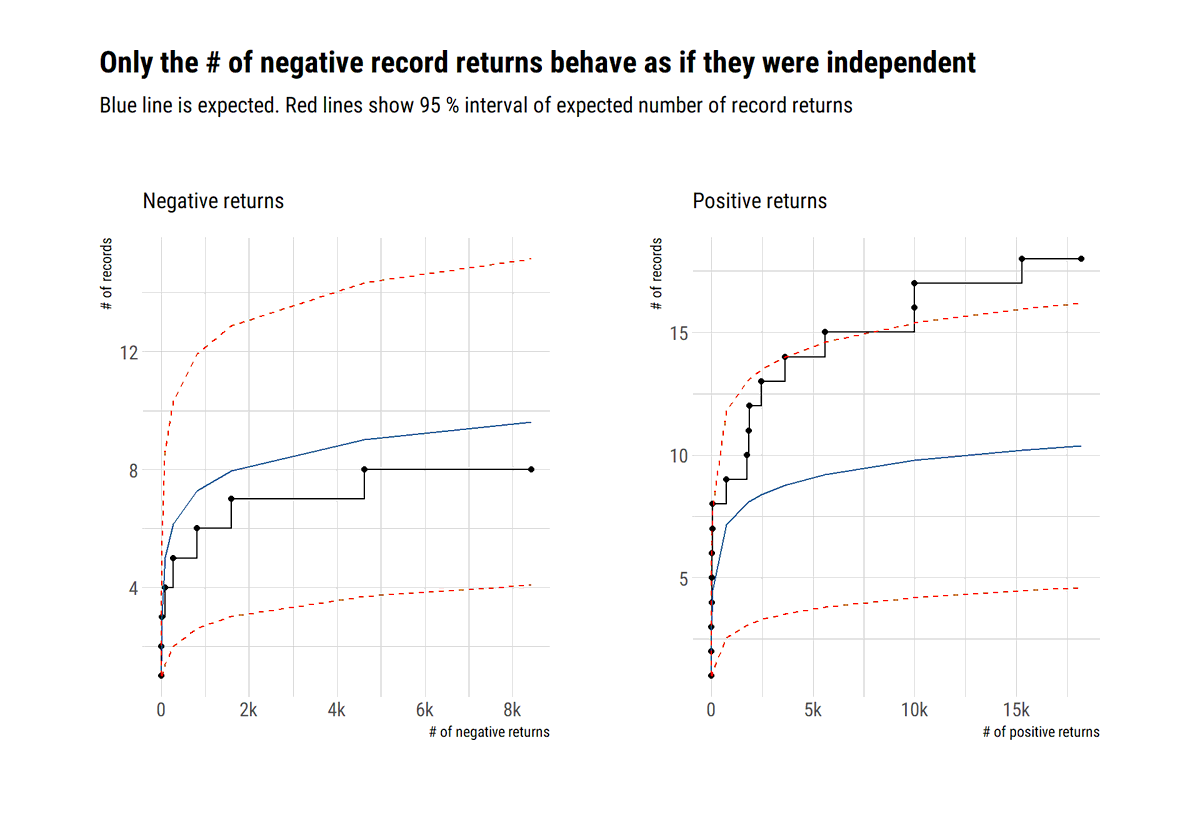

@nntaleb shows that SP500 negative returns can be considered independent

david-salazar.github.io/2020/06/24/pro…

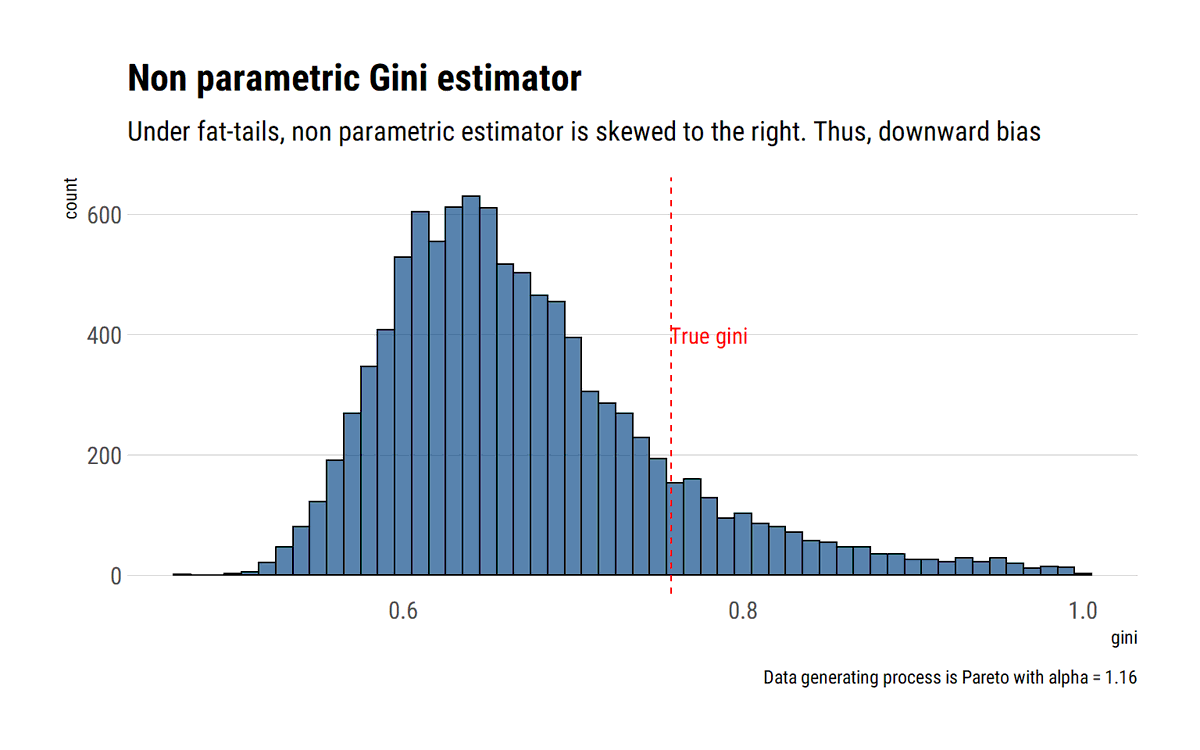

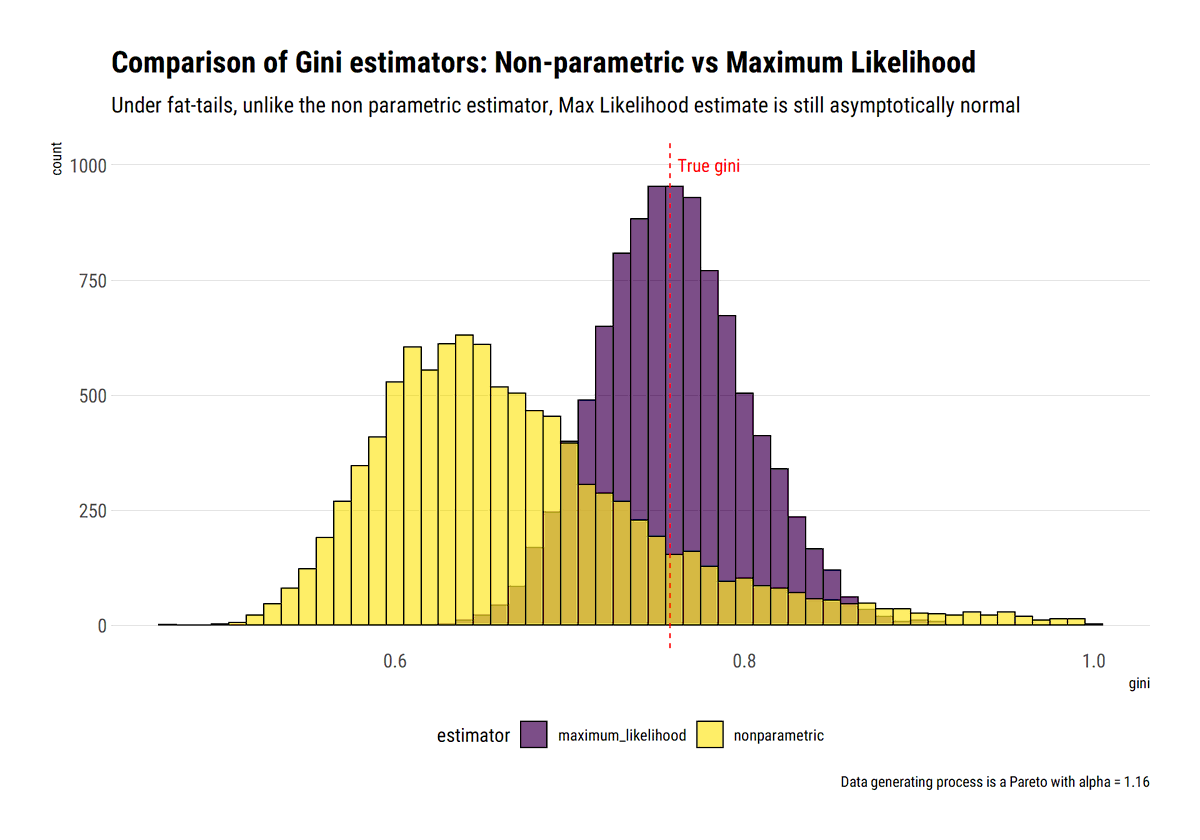

david-salazar.github.io/2020/06/26/gin…

david-salazar.github.io/2020/07/05/tai…