A lot of talks about profits--all the time goes around social media, very few talk about ugly side of trading mistakes... Its a lovely evening today, in a relax mode let's talk, post your losses, mistakes. let's discuss some failures of year 2020.

#kacharts

#learnfrommistakes.

#kacharts

#learnfrommistakes.

In few mins I will post my all big losses of 2020 so far and learnings.

Did this few days back in group #kacharts, thought to share with you all.

Did this few days back in group #kacharts, thought to share with you all.

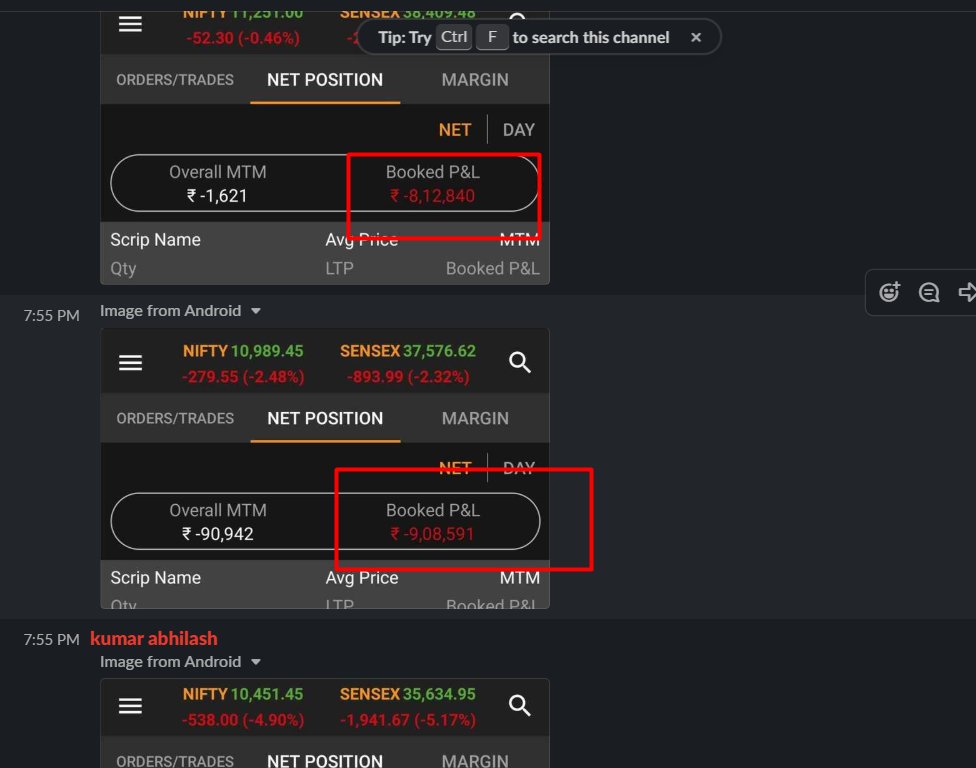

Twice as its 2 ac of almost same cap being managed by algo trading.. All buying and selling price same.

This was 30th july - highest single day intra loss.

1.4cr

Lost in option selling - was aggressive shorts in puts.

Interesting part is - loss was covered in next 2 days

This was 30th july - highest single day intra loss.

1.4cr

Lost in option selling - was aggressive shorts in puts.

Interesting part is - loss was covered in next 2 days

In just one stock - #caplinpoint.

Lesson learnt - do what u have done most and u r confident about.

I m more confident in buy and hold as long as trend continues.

Option selling is just not my cup of tea atleast as of now.

Lesson learnt - do what u have done most and u r confident about.

I m more confident in buy and hold as long as trend continues.

Option selling is just not my cup of tea atleast as of now.

Few more loss making days whose ss i keep as souvenir which reminds me my mistakes. And then there r many more whose ss i forgot to take.

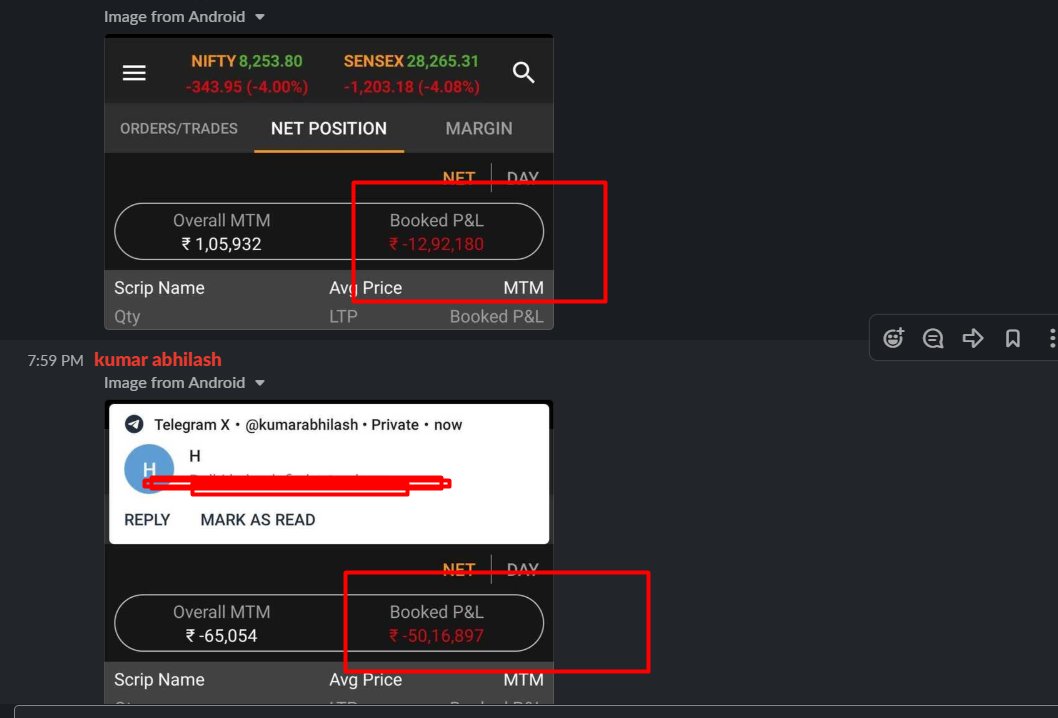

One more ss added.

Net loss 50 lakh plus.

Main dent was given by bank nifty long and other few stocks where i didnt took any sl.

Future trades must be taken with sl.

Non stop profit from few days made me overconfident 😑😑😑😑

Market ne pel diya

Luckily came out at 2pm else.

Net loss 50 lakh plus.

Main dent was given by bank nifty long and other few stocks where i didnt took any sl.

Future trades must be taken with sl.

Non stop profit from few days made me overconfident 😑😑😑😑

Market ne pel diya

Luckily came out at 2pm else.

• • •

Missing some Tweet in this thread? You can try to

force a refresh