- At 15x (long term median PE), ‘fair value’ 2250.

- 14x = 2100.

- 13x = 1950.

Market doesn’t follow 1-yr forward PEs very closely (R2 < 10%) but a return to those levels would make some sense

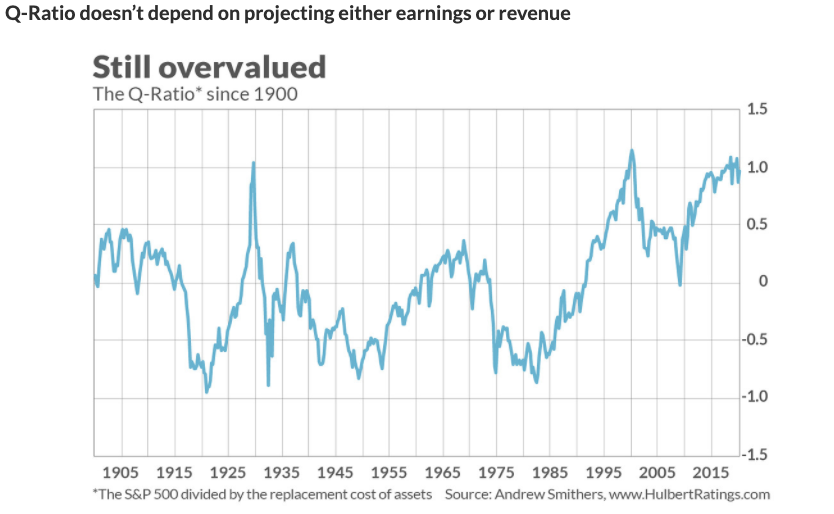

marketwatch.com/story/this-set…

Keep Current with ukarlewitz

This Thread may be Removed Anytime!

Twitter may remove this content at anytime, convert it as a PDF, save and print for later use!

1) Follow Thread Reader App on Twitter so you can easily mention us!

2) Go to a Twitter thread (series of Tweets by the same owner) and mention us with a keyword "unroll"

@threadreaderapp unroll

You can practice here first or read more on our help page!