1/ Buffett: "Most people come to our meeting to hear Charlie. At 96 he is in fine shape. It didn't seem like a good idea to have him come to this meeting. Charlie is in fine shape and he will be back next year." Charlie is now doing video streaming meetings.

"We own 100% of the stock of many businesses [that should be though of as additional equity holdings]."

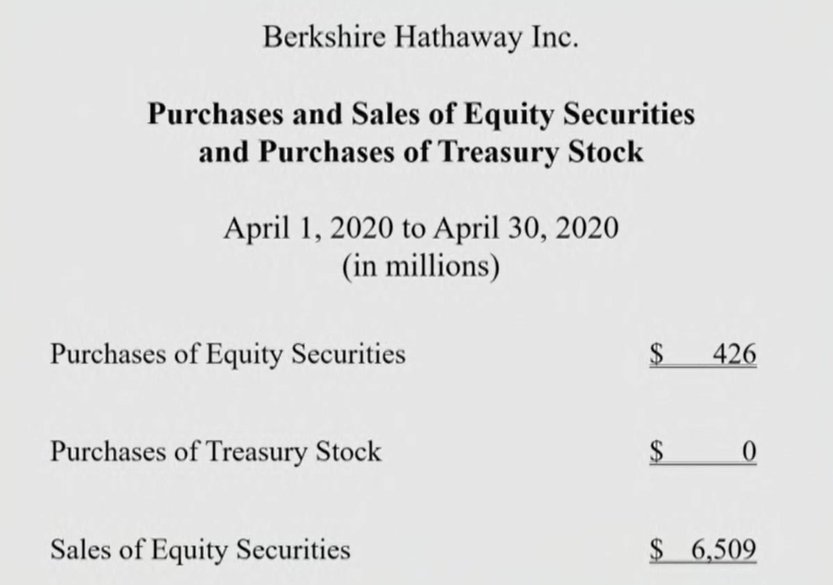

First question was about which airline positions were sold and how. "There are certain industries that are really hurt by a forced shutdown.... We have sold the entire positions [in the big airlines Berkshire owned."

Greg Abel: "I have nothing to add."

Abel: "Very few of our portfolio business have required cash."

Abel: "We do have retailers who have shut their doors. We will re-employee people at businesses like See's."

Abel: "Precision Castparts' defense business remains strong."

"If you come to us with unusual insurance coverage needs we will consider writing it."

Buffett: "To my knowledge, no Berkshire companies have received loans offered by the US government. That includes Oriental Trading and Nebraska Furniture Mart."

"You don't make a lot of money advising clients/running index funds. You make the most money selling active investment advice. I haven't changed how I provide for my wife in my will."

Strong shout out by Buffett to Ajit Jain as an amazing master of insurance underwriting.

IMPORTANT: It is fantastic to have Becky asking these questions. So much wasted time at the meeting has been eliminated. Less boring

Buffett windmill dunks on the question from Kass with his answer. It is just another way to distribute capital. "People can be stupid with dividends too."

Buffett: "Share buybacks will continue to be a political football."

How to spot the problems of people doing stupid things isn't always easy."

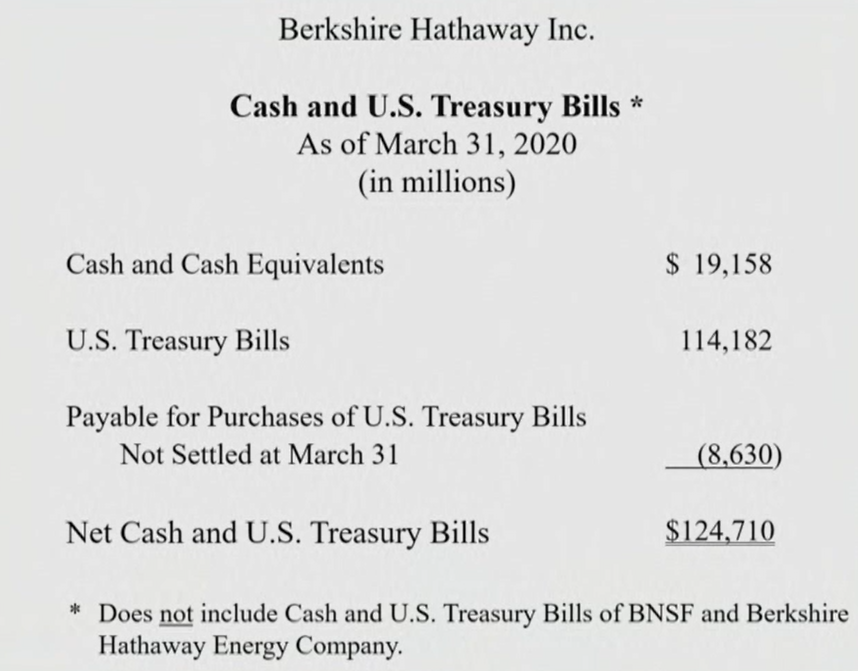

Buffett mentions the "option value of money."

To close: "Never bet against America!"

Wrap!