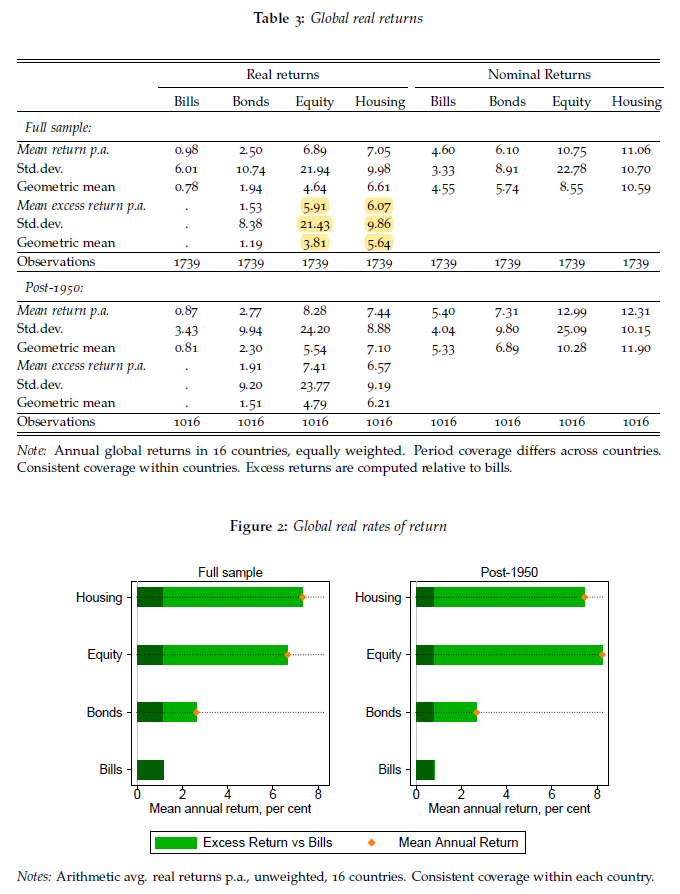

"Our new, comprehensive data set includes total returns for equity, housing, bonds, and bills in 16 advanced economies from 1870-2015, revealing new insights and puzzles."

papers.ssrn.com/sol3/papers.cf…

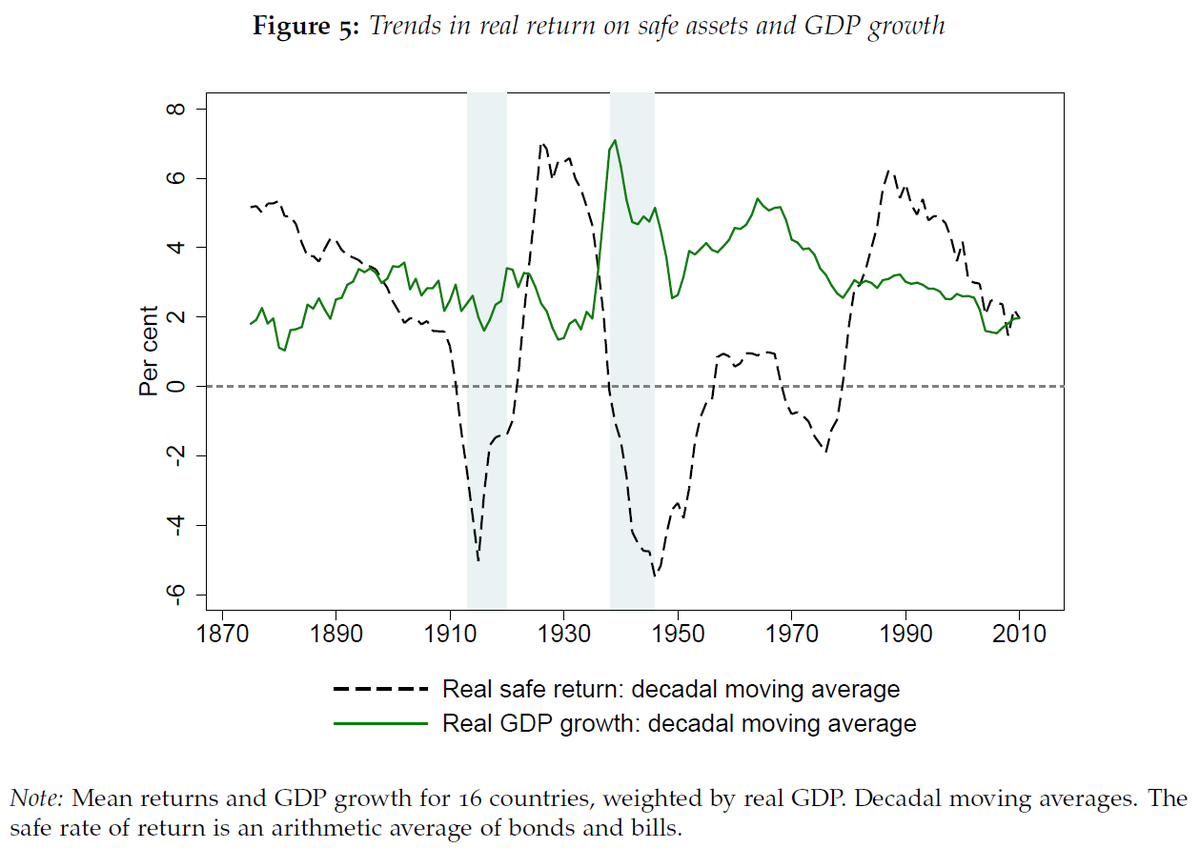

"Safe assets offered little protection during high-inflation eras and during two world wars, both periods of low consumption growth."

"This finding speaks to the recent literature on the mispricing of risk around financial crises."

For example: