Trend, value, quality, carry, volatility. Tentmaker (eating vol-targeted Sharpe to fund Christian work). See the pinned tweet for compound return generators.

46 subscribers

How to get URL link on X (Twitter) App

https://x.com/ReformedTrader/status/1411033851288117248

2/ "A small group of undervalued professional players & executives, many of whom had been rejected as unfit for the big leagues, turned themselves into one of the most successful franchises.

2/ "A small group of undervalued professional players & executives, many of whom had been rejected as unfit for the big leagues, turned themselves into one of the most successful franchises.

2/ Asset classes have fat tails, and most have negative skewness.

2/ Asset classes have fat tails, and most have negative skewness.https://x.com/ReformedTrader/status/1770226110003019878

https://x.com/ReformedTrader/status/1781094347636977799

https://x.com/ReformedTrader/status/1779735365986984145

2/ #1. Fiction: Factors are Data-Mined with No Good Economic Story

2/ #1. Fiction: Factors are Data-Mined with No Good Economic Storyhttps://twitter.com/ReformedTrader/status/1371235486988001281

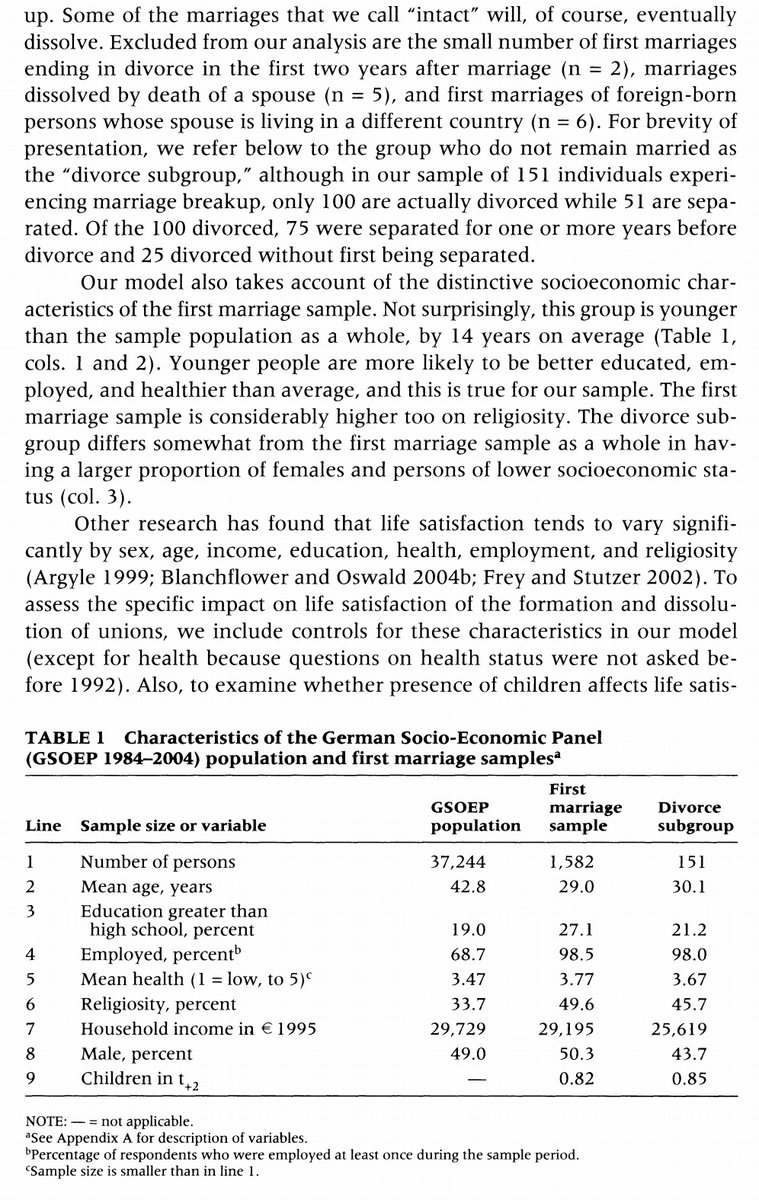

2/ "The model's four terms describe different life stages for an individual who marries during the sample period. The intercept reflects the average life satisfaction of individuals in the baseline period [all noncohabiting years that are at least one year before marriage]."

2/ "The model's four terms describe different life stages for an individual who marries during the sample period. The intercept reflects the average life satisfaction of individuals in the baseline period [all noncohabiting years that are at least one year before marriage]."

2/ "The valuation gap between cheap and expensive stocks remains extremely wide. This signals the potential for attractive returns going forward."

2/ "The valuation gap between cheap and expensive stocks remains extremely wide. This signals the potential for attractive returns going forward."

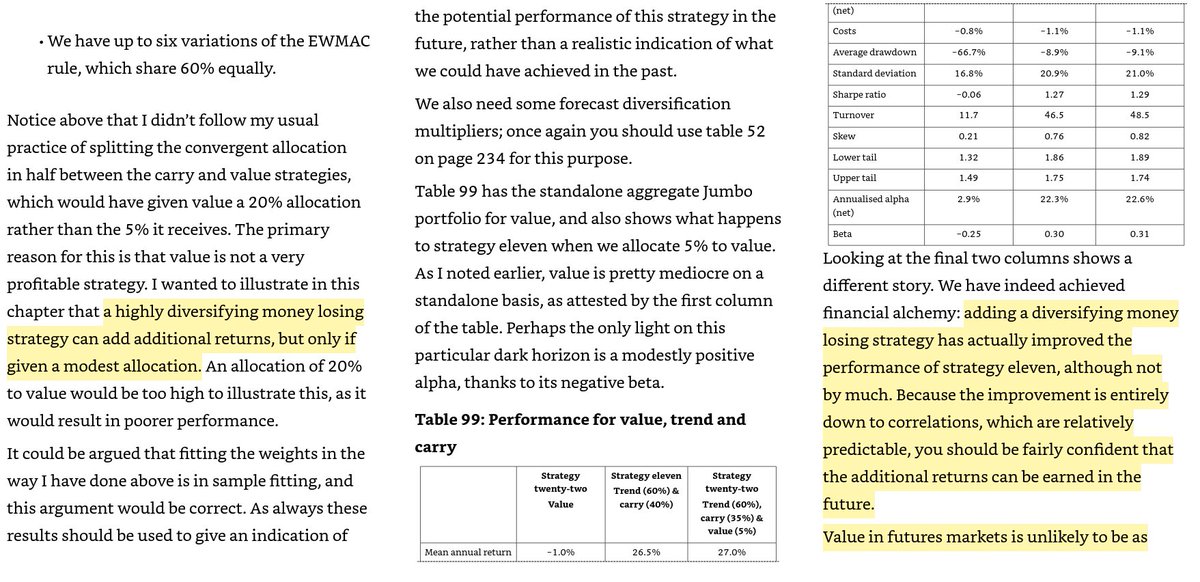

2/ Part 1: Basic directional strategies

2/ Part 1: Basic directional strategies

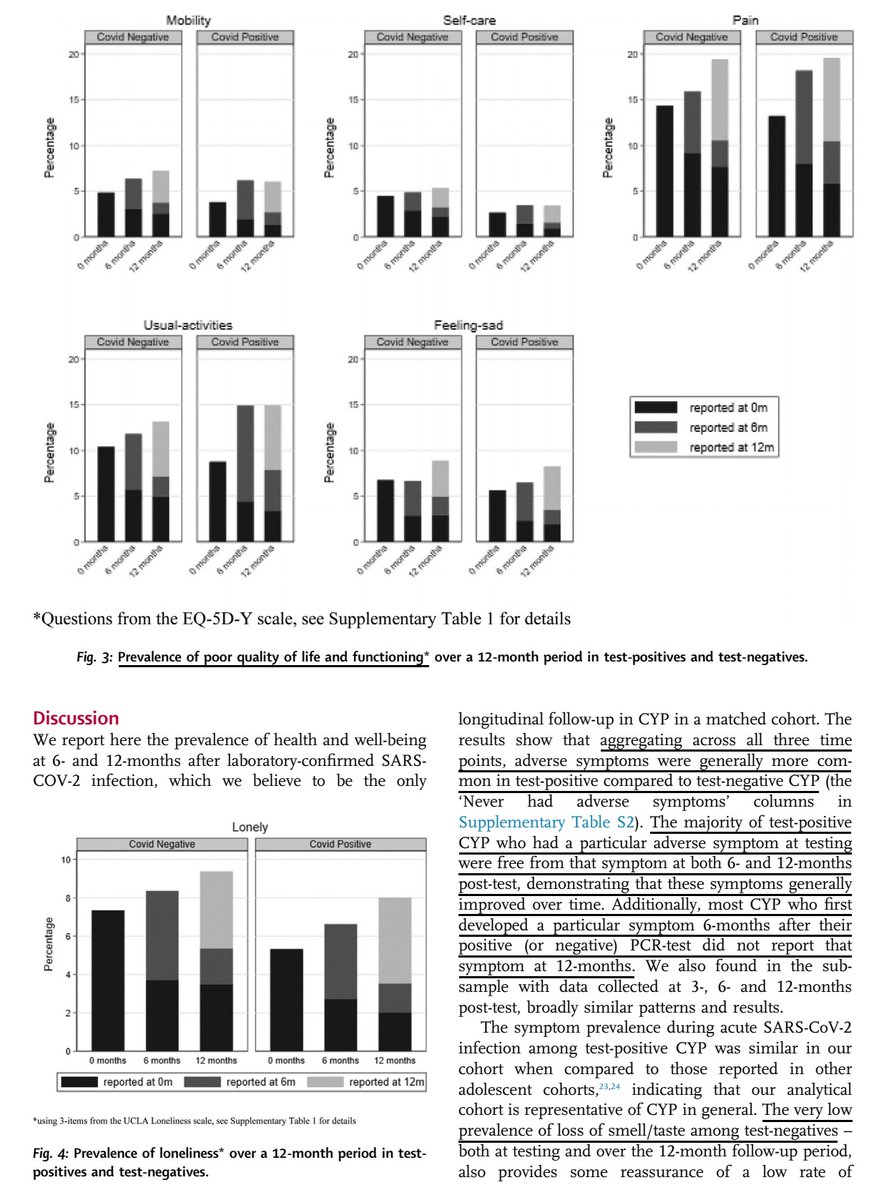

2/ "The broadly similar pattern of adverse health and well-being reported as new-onset at 6- and 12 months among test-positives and test-negatives highlights the non-specific nature of these symptoms and suggests that multiple aetiologies may be responsible."

2/ "The broadly similar pattern of adverse health and well-being reported as new-onset at 6- and 12 months among test-positives and test-negatives highlights the non-specific nature of these symptoms and suggests that multiple aetiologies may be responsible."

2/ Do you hedge out market beta in order to make the portfolio more risk balanced?

2/ Do you hedge out market beta in order to make the portfolio more risk balanced?

https://twitter.com/ReformedTrader/status/1621351442304081922Short-Term Idiosyncratic Momentum in Cross-Sectional Stock Returns: Empirical Evidence

https://twitter.com/ReformedTrader/status/1409259987965075459

https://twitter.com/ReformedTrader/status/1468464495689285634

https://twitter.com/ReformedTrader/status/1611951830564761601Zooming in on Distress Risk: Bankruptcy vs. Other Failures

https://twitter.com/ReformedTrader/status/1598393784727113728Effects of the LIBOR Scandal on Volatility and Liquidity in LIBOR Futures Markets

https://twitter.com/ReformedTrader/status/1608274189856968708

2/ "Study 1 shows that less hedonic adaptation is reported in response to activity changes than to circumstantial changes."

2/ "Study 1 shows that less hedonic adaptation is reported in response to activity changes than to circumstantial changes."

2/ "After controlling for age, gender, and population size, greater neighborhood socioeconomic status (SES) predicted greater desires for material consumption, more impulsive buying, and fewer savings behaviors, while individual SES showed the reverse pattern."

2/ "After controlling for age, gender, and population size, greater neighborhood socioeconomic status (SES) predicted greater desires for material consumption, more impulsive buying, and fewer savings behaviors, while individual SES showed the reverse pattern."

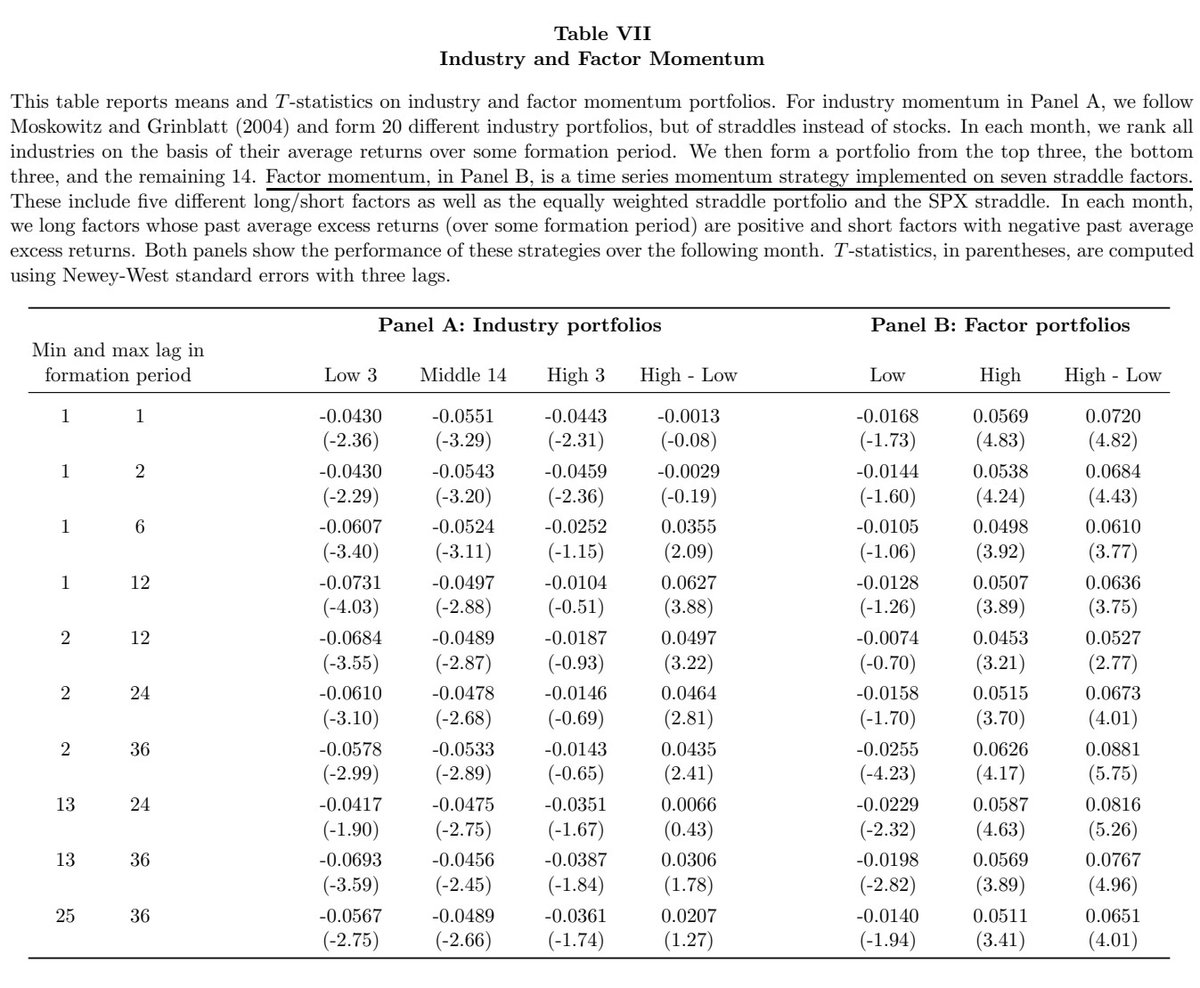

2/ " This phenomenon is robust to including out-of-the-money options or delta-hedging the returns.

2/ " This phenomenon is robust to including out-of-the-money options or delta-hedging the returns.

2/ "This result is robust to the length of the formation period and is apparent in a wide variety of subsamples.

2/ "This result is robust to the length of the formation period and is apparent in a wide variety of subsamples.

2/ "Holding and continuously rolling one-month at-the-money S&P 500 put options is costly but is the most reliable of the candidate hedge strategies considered."

2/ "Holding and continuously rolling one-month at-the-money S&P 500 put options is costly but is the most reliable of the candidate hedge strategies considered."