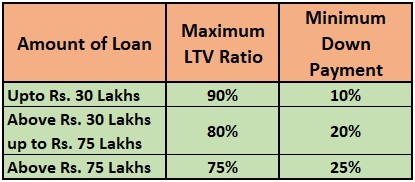

If you are a home buyer and plan to take a housing loan to finance your purchase, or if you are planning to invest in a housing finance company, this will add more to your knowledge base.

Why is this ratio important for Banks/NBFC's? Well, It defines the risk that bank takes.

If the buyer is ready to make a huge down payment and thereby improve the LTV ratio for the bank, The bank may charge him lower interest rate as the perceived risk for the bank is lower.

1) Higher LTV Ratio is risky for the banks, They may higher interest in such scenario.

2) Lower LTV Ratio is good for the banks, If this happens in your case, feel free to bargain for low interest rate on your home loan.

by @RJGyanchandani

#homeloan #nbfc #banks