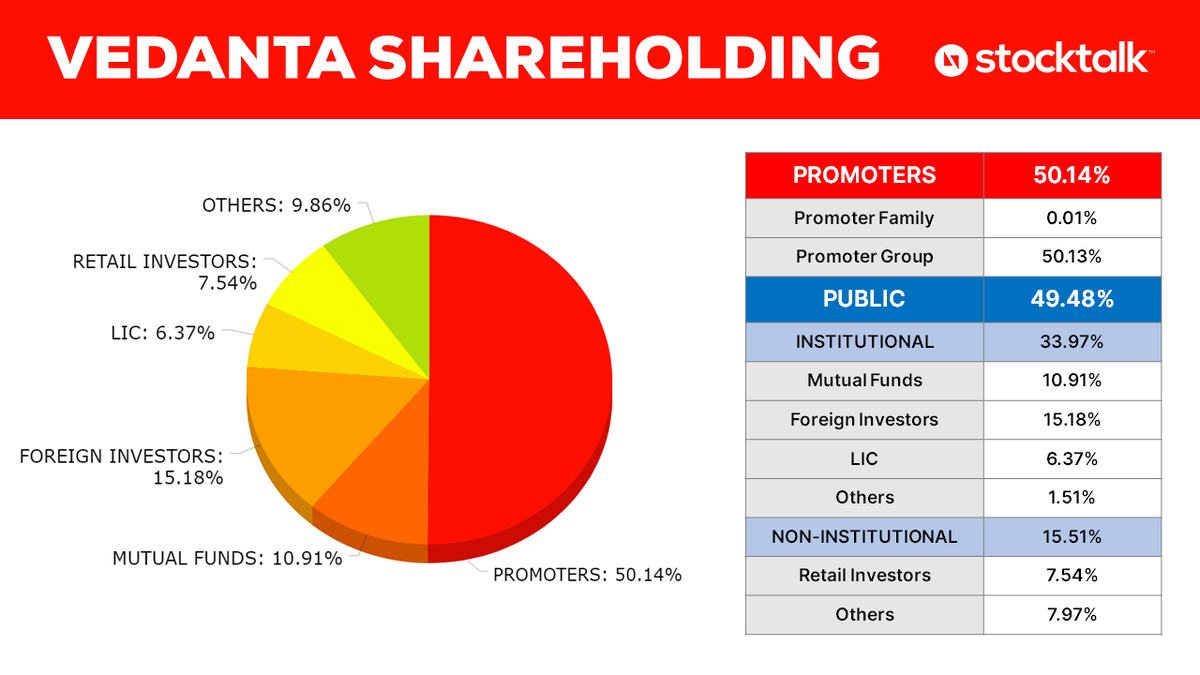

SHAREHOLDING:

🔶 PROMOTERS: 50.14%

🔷 PUBLIC: 49.48%

- Mutual Funds: 11%

- Foreign Investors: 15%

- LIC: 6.5%

- Retail Investors: 7.5%

- Others: 10%

✅ 34% is held by institutional investors.

✅ Institutions will resist de-listing price.

(1/n) 👇

PROCESS:

🔶 Company makes a public announcement of proposal of de-listing (done).

🔶 Company seeks the following approvals:

- Approval from board of directors (via board meeting)

- Approval from shareholders (via special resolution)

(2/n) 👇

🔶 SPECIAL RESOLUTION:

For the de-listing to be approved, the voting results should be in the minimum ratio of 2:1 (for : against) of public shareholders.

🔶 Vedanta Public Shareholders: 49.48%

- Institutions: 34%

- Retail: 7.5%

- Others: 9%

(3/n) 👇

🔶 So as per the condition, for the de-listing to be approved, at least ~33% of the public shareholder should vote IN FAVOUR of the de-listing.

🔶 This will then fulfil the condition of 2:1 (33% : 16%)

(4/n) 👇

🔶 After getting both the approvals (board + shareholders), the company then makes an application to the stock exchanges for the de-listing.

🔶 It also appoints a merchant banker to conduct due-diligence of its books and derive an offer price.

(5/n) 👇

🔶 OFFER PRICE:

The offer price is derived upon by the method of book building.

The offer price shall be in reference to the book value of the stock.

🔶 FLOOR PRICE:

Floor price shall the average of 26 weeks trading price on stock exchanges.

(6/n) 👇

🔶 SHAREHOLDER RIGHTS:

After the offer price is declared, the shareholders will have the right to reject it.

The company will then have to make a counter-offer which shall not be less than the book value as certified by the merchant banker.

(7/n) 👇

🔶 FAILED DE-LISTING:

Neither the promoters nor the shareholders will have any obligations to accept the offers or counter-offers.

If the counter-offer stands rejected by any party then the de-listing procedure is considered as failed.

(8/n)