Stock Market Insights | Company Analysis | Value Investing | Trading Psychology | Behavioral Finance

4 subscribers

How to get URL link on X (Twitter) App

⭐️ #LIC THE GIANT (contd.)

⭐️ #LIC THE GIANT (contd.)

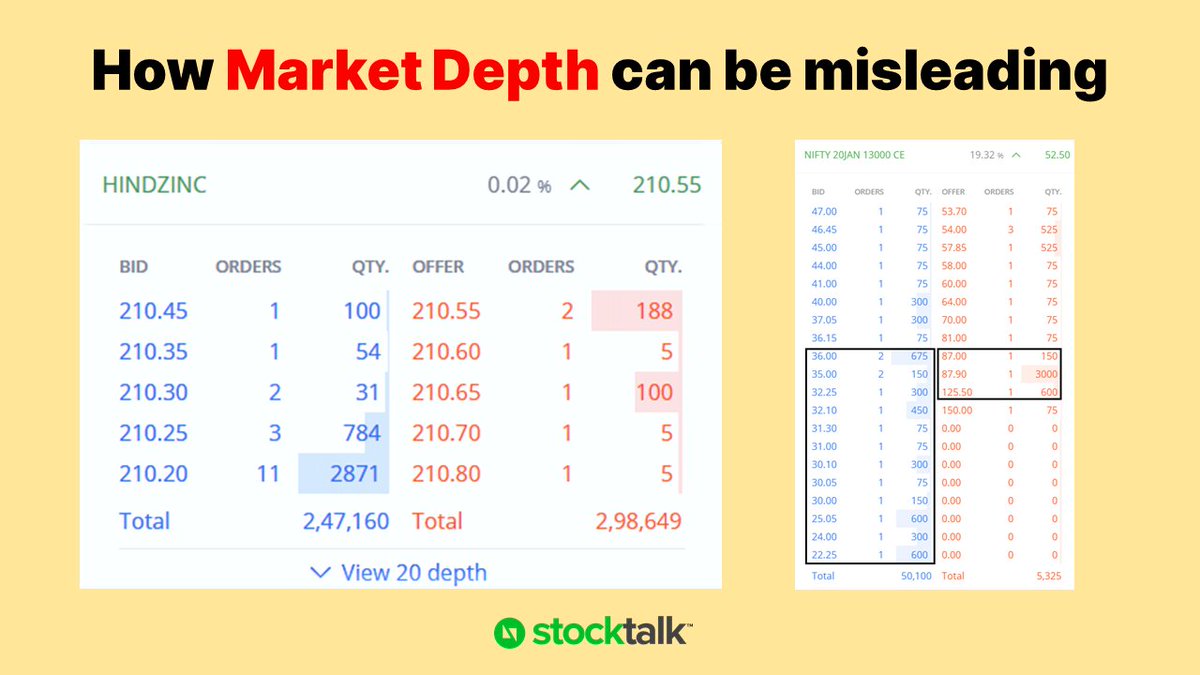

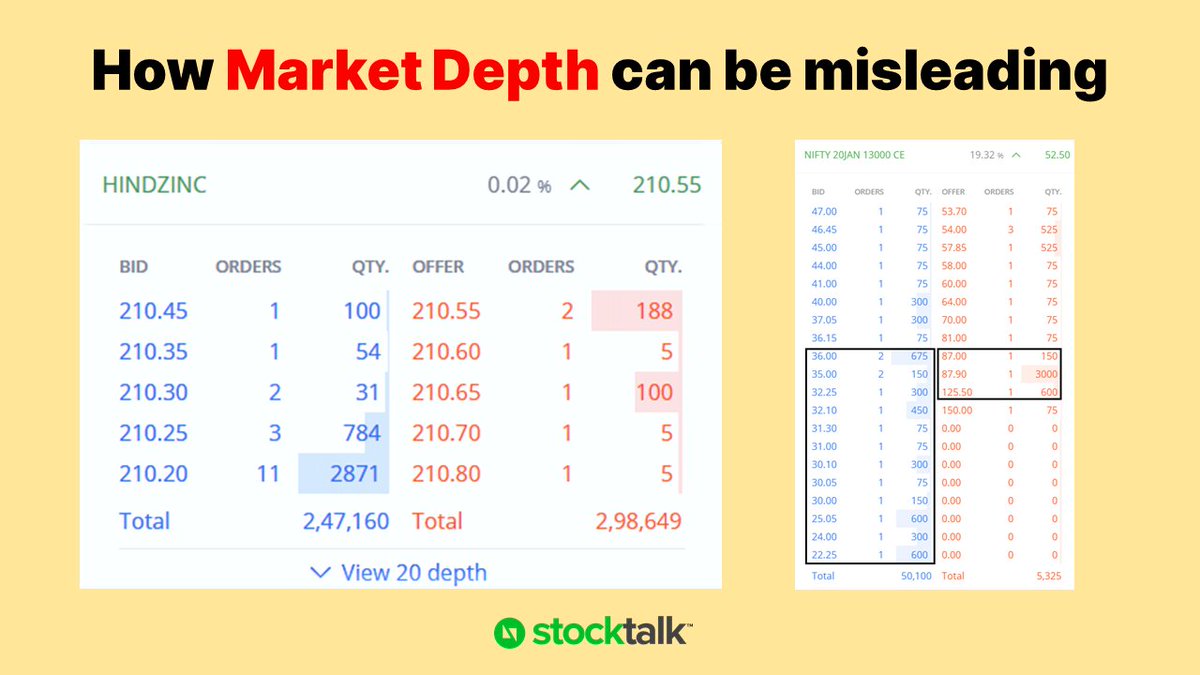

Here's how most traders read the market depth:

Here's how most traders read the market depth:

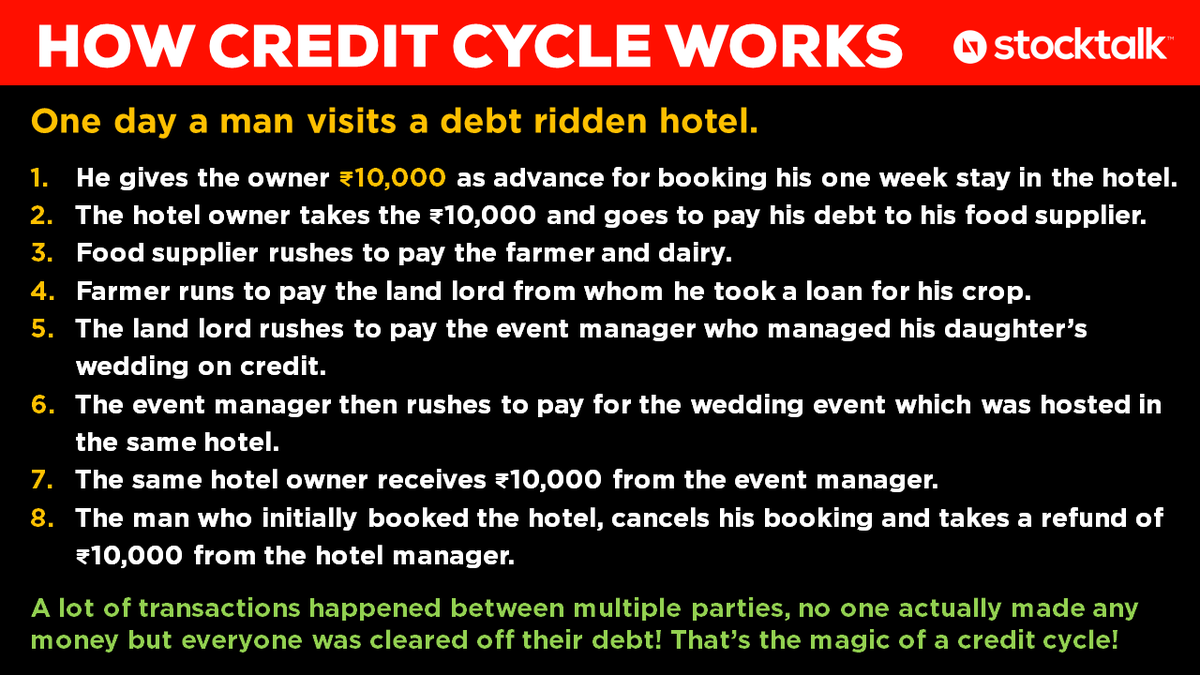

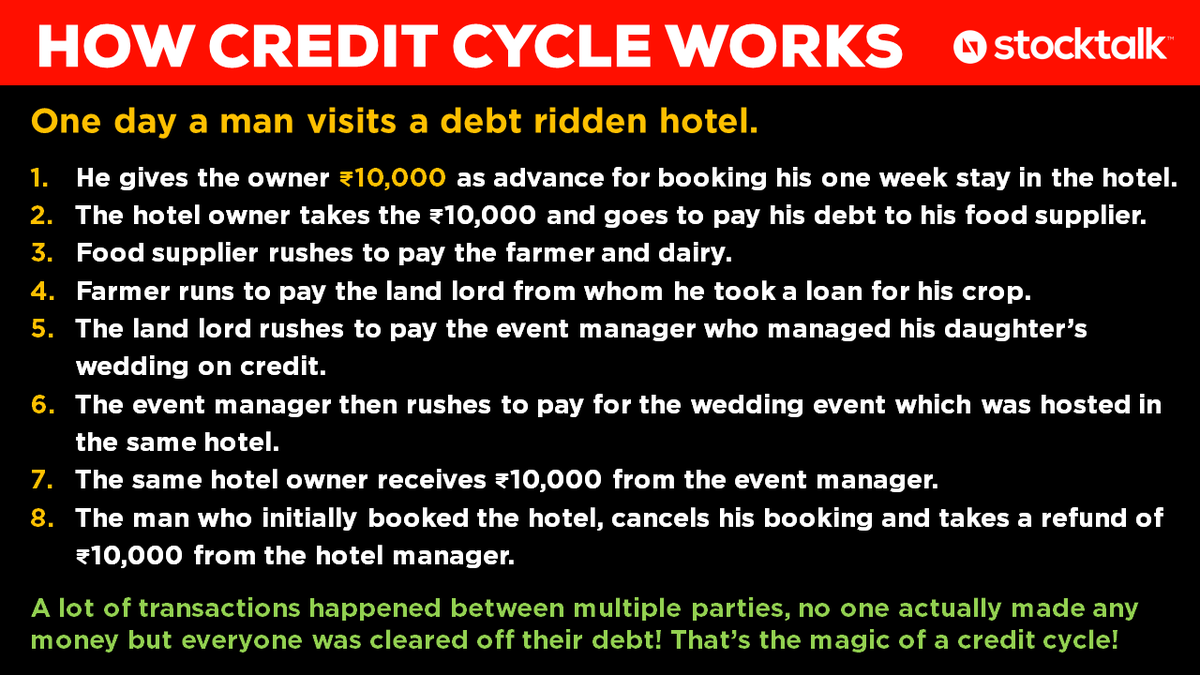

3⃣ Food supplier rushes to pay the farmer and dairy.

3⃣ Food supplier rushes to pay the farmer and dairy.

https://twitter.com/stocktalk_in/status/1300435218537410561But that T+2 days cycle leaves a possibility of you transferring those shares to someone on Tuesday i.e. before the shares are debited from your demat on Wednesday.

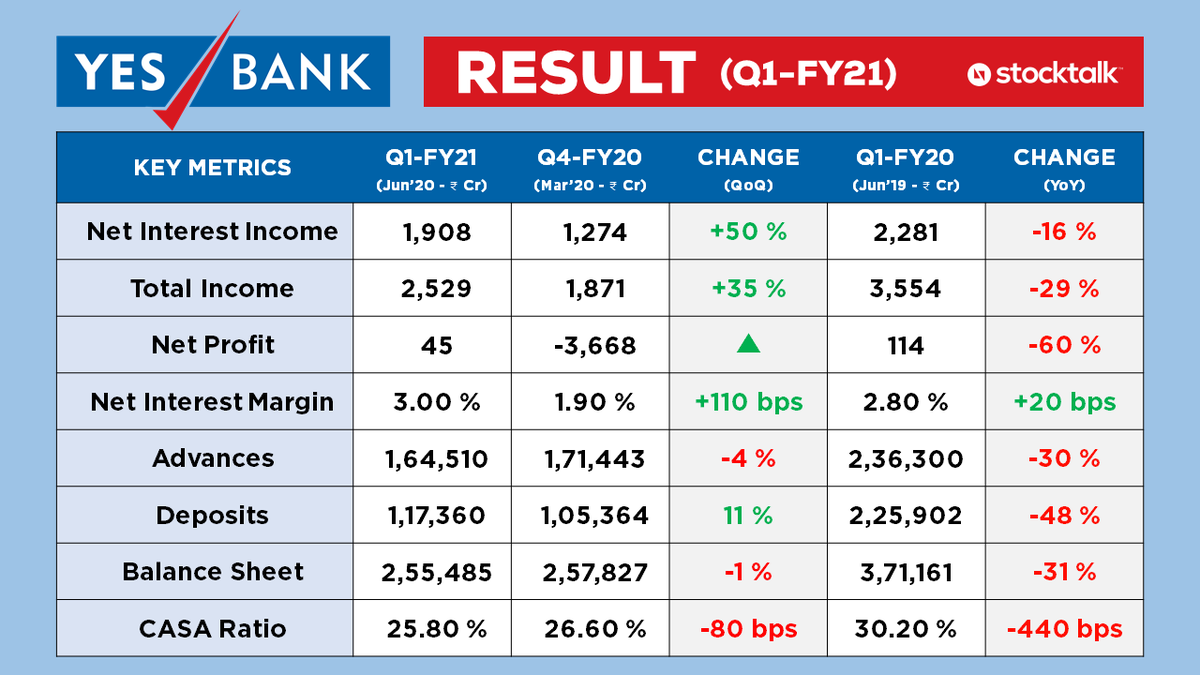

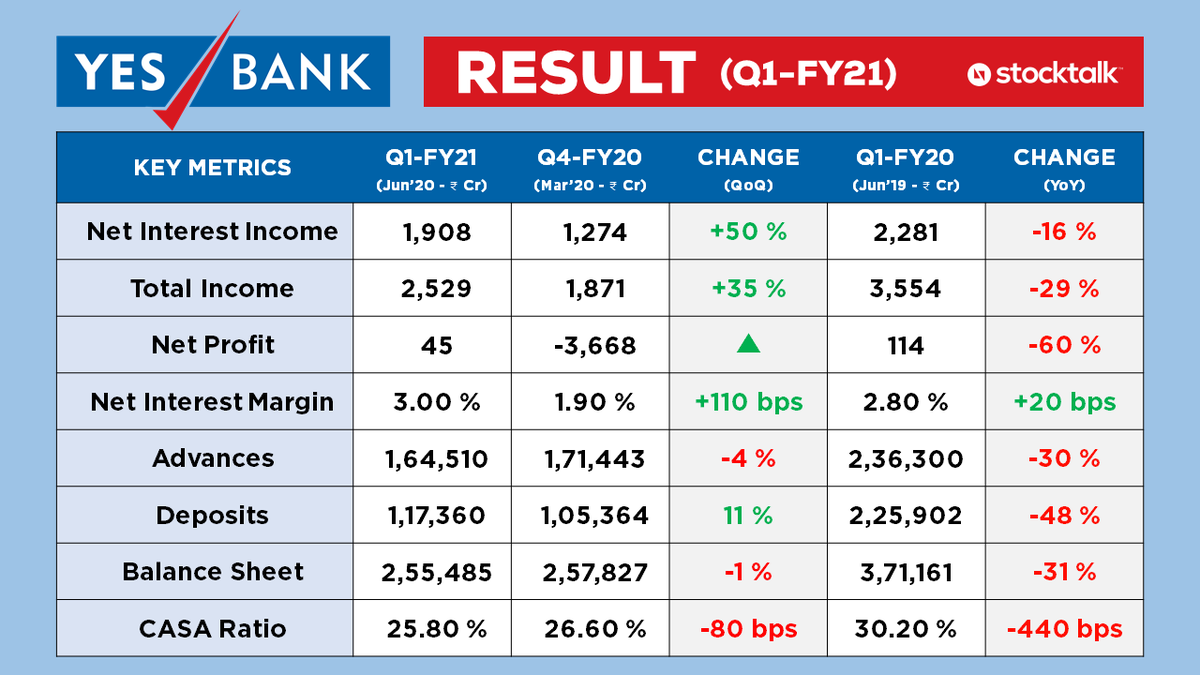

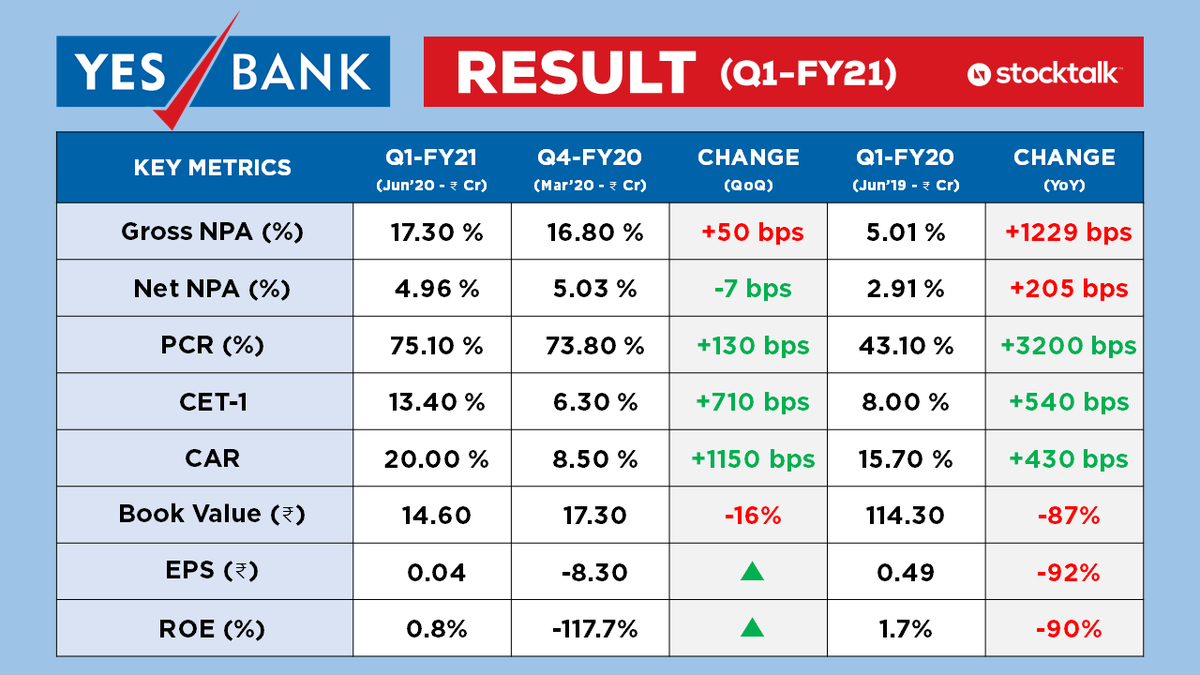

⚡️ #YESBANK RESULTS DECLARED!

⚡️ #YESBANK RESULTS DECLARED!

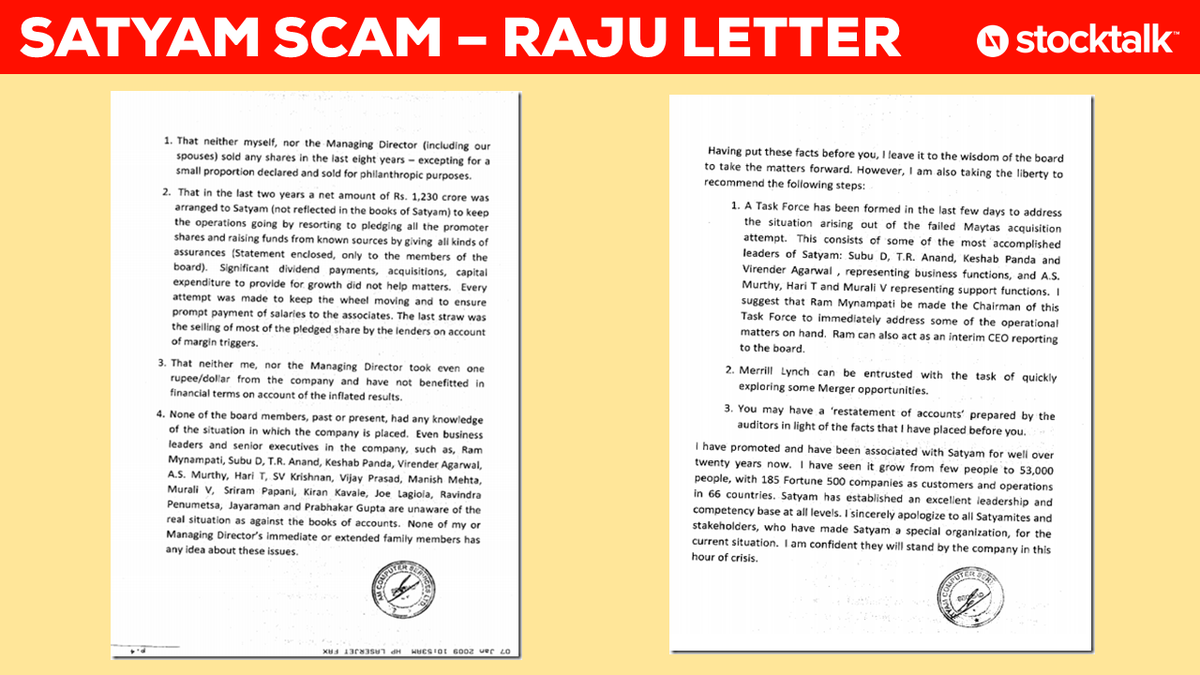

🔸 Satyam Computers was a company listed on Indian as well as US stock exchanges (ADRs).

🔸 Satyam Computers was a company listed on Indian as well as US stock exchanges (ADRs).

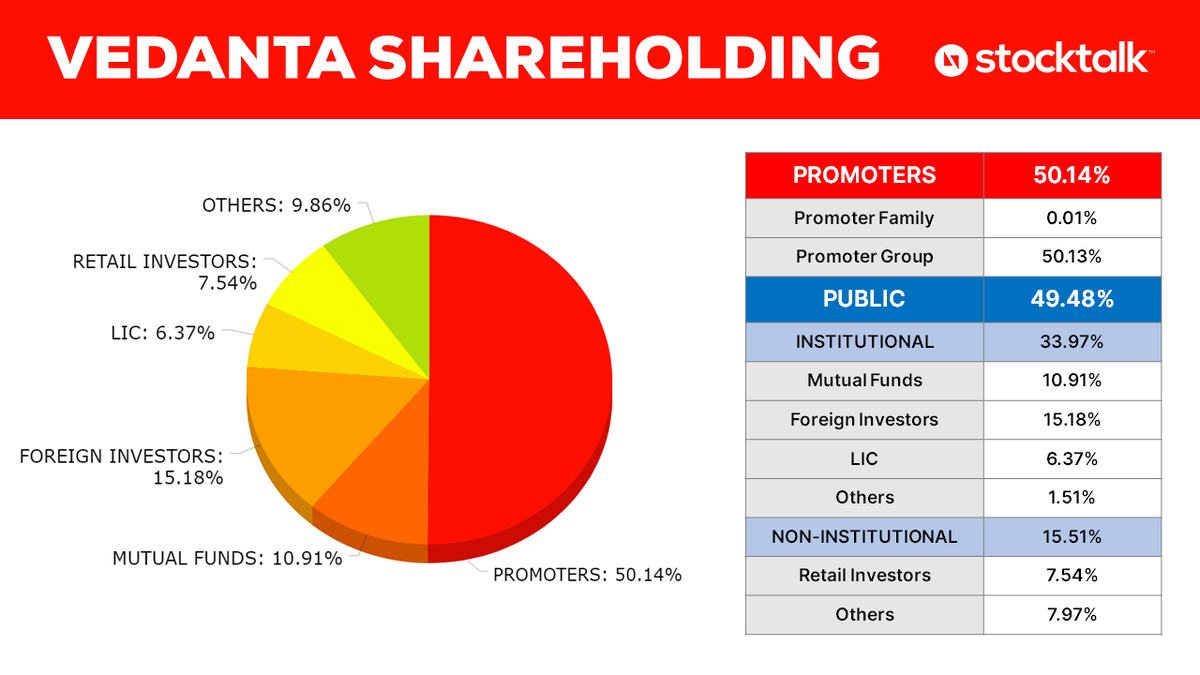

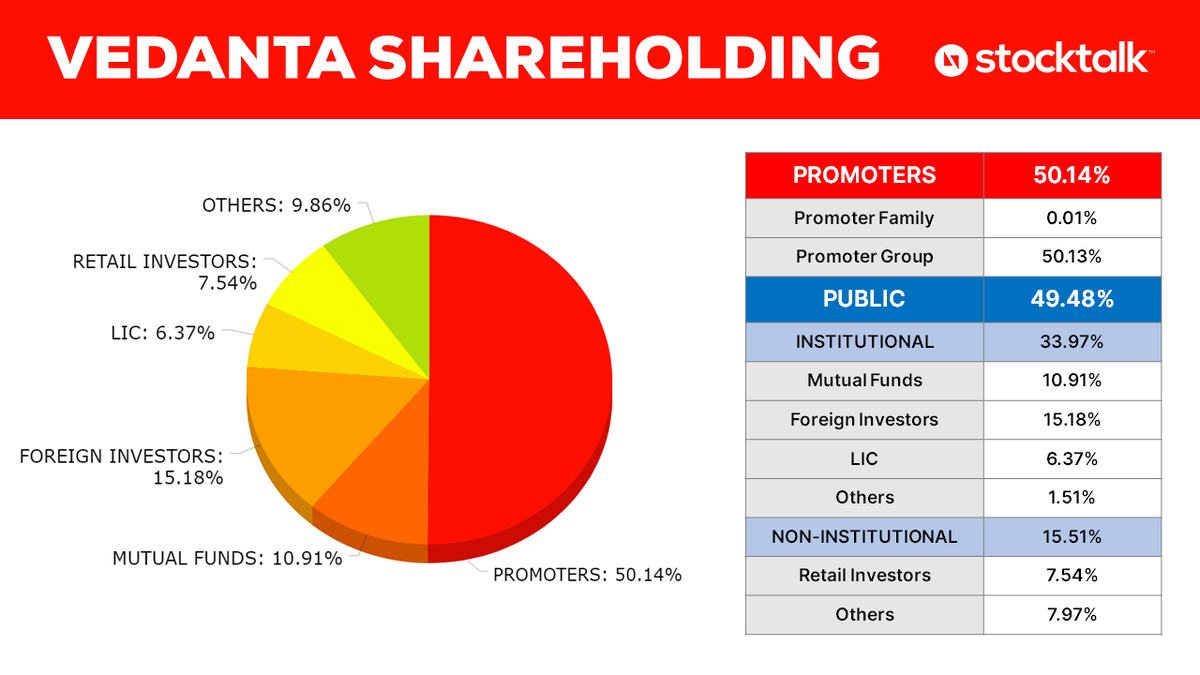

#VEDANTA DE-LISTING:

#VEDANTA DE-LISTING:

🔸Here's how most traders read the market depth:

🔸Here's how most traders read the market depth: