Dr. Fred Moll was working at Guidant at that time. He proposed to commercialize the tech.

Guidant said it was too futuristic.

Intuitive Surgical was born in 1995.

Guthart joined ISRG in 1996.

Remember Dr. Moll. He'll reappear in this thread later.

Guthart became CEO of ISRG in 2010.

This still sounds a bit futuristic, right?

"Any sufficiently advanced technology is indistinguishable from magic"

"The public has no idea of the extent of difference between top surgeons and bad ones. Robots are good at going where they are supposed to, remembering where they are and stopping when required.”

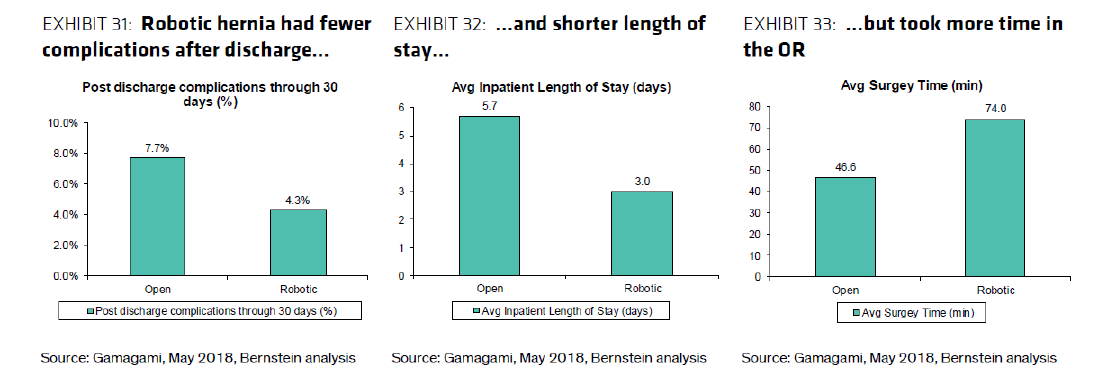

Why do robots take longer time in Operating Room (OR)?

There is fair bit of learning curve involved for surgeons to perform these surgeries. As utilization increases, OR time decreases.

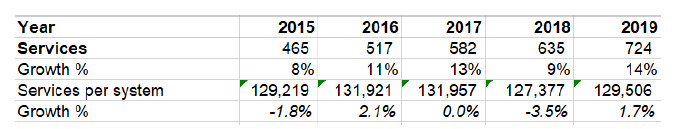

Systems revenue comes from selling (primarily directly, but some are also sold through distributors) Da Vinci Systems to hospitals. Current global installment base ~5.6K. Shipment growing at >20% in last 3 yrs. ASP (in $ mn) is also generally increasing.

~40% of the shipment is basically customers upgrading/trading existing Da Vincis.

Since Da Vinci systems are huge capex for hospitals...

There are ~6.2K hospitals in the US and ~3.5K Da Vincis. But hospitals with 5+ systems increased 4x in last 3 yrs, so penetration is lot lower than it seems

You bet they would. So how defensible is the moat?

I see 6 layers of defense. Let's peel one by one.

Not easy to replicate this.

Avg tenure of Engineering team is >10 yrs. People seem to like it there.

“Move fast and break things” can work in a tech pure-play, but healthcare is a highly regulated and slow-paced industry. Not easy to unseat incumbent.

Like I hinted, competition is coming, and it's coming from the behemoths $MDT and $JNJ who are 2.0x and 6.5x mcap respectively compared to $ISRG.

GS in its recent initiation said "MDT’s robots will be inferior in technology, but more cost effective compared to ISRG".

JNJ is more threatening in the long-run. Why?

He later launched another robotic MIS company named Auris Health which was acquired by $JNJ last year.

This makes me uncomfortable.

Verb’s plan is to build a digital surgery platform that combines robotic, advanced visualization, instrumentation, data analytics, and connectivity.

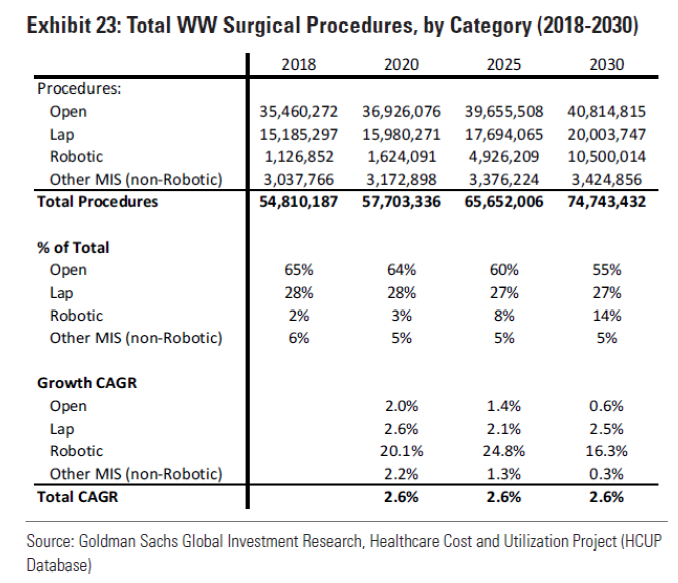

I don't think this is winner-take-all market. It doesn't have to be. $ISRG had 20 year open field, and yet it penetrated only ~2% worldwide surgery market.

All three can co-exist.

The market is too big for these behemoths to eat from each other.

But I might lose for something else...

It, of course, may not which can certainly derail upside.

If $MDT and/or $JNJ competes with price, that's bad news for $ISRG longs.

Recalls/negative reports or lawsuits can make things bumpy.

Duration of Covid-19 and stress on healthcare system can also be a factor in the near-term.

The stock isn't cheap. I don't think it's close to be fairly valued than undervalued.

But great companies usually surprise you.

As always, bears are welcome in DMs/comments. Bulls can also point out why I should be MORE bullish.

Phew! The tweet storm ends!

Happy weekend, everyone!

I think it's close to be fairly valued than undervalued