I'm sure this is far from perfect, but this is how I've approached it.

1) You pay money to borrow, you get paid money to save

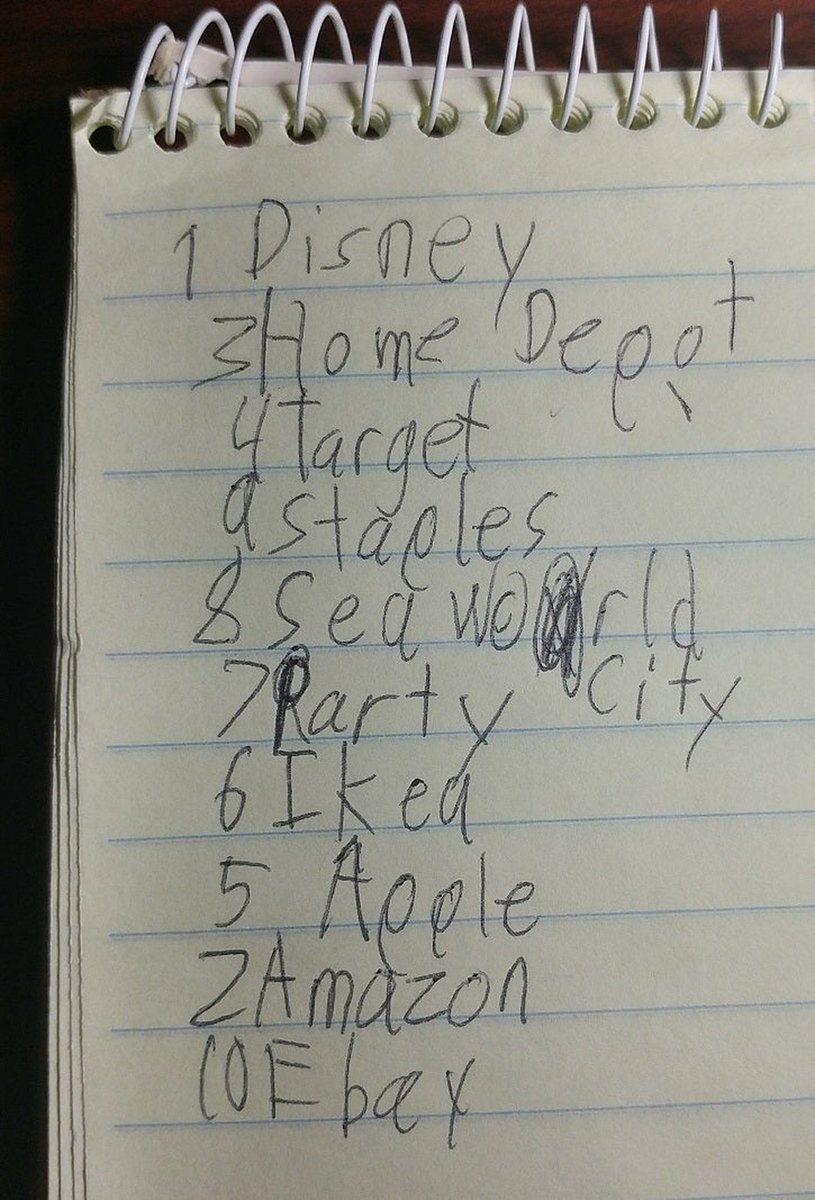

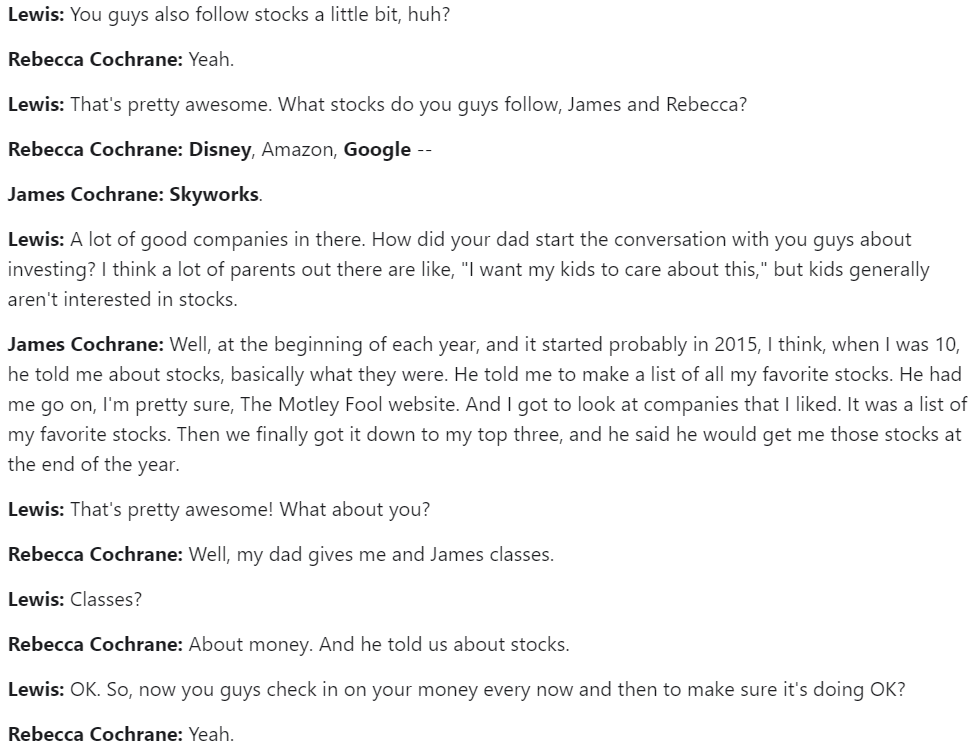

2) Stocks were small pieces of companies that you could own

I like using this account b/c 1) It's used for college savings; 2) It allows for self-directed investments.

savingforcollege.com/article/coverd…

Coverdells allow max contributions of $2K/yr. After that college savings are directed to 529 funds.

FL has no state income tax. Not sure how I would feel about forgoing state income tax benefit that 529s offer that Coverdells don't if I lived in different state

Talks are about an hour. Just once/yr, except for when they bring up the topic of money or investing during the year.

Talks cover basic personal finance and investing.

When child #3 reaches 10, she'll be brought into the talks as well.

@bwithbike has given excellent advice on this topic over the years. Can you chime in Brian?

Would also love to hear from @7AustinL @7investingSteve @TMFStoffel and any others with their experiences sharing with their kids.

I believe @saxena_puru might have some meaningful contributions for this conversation.