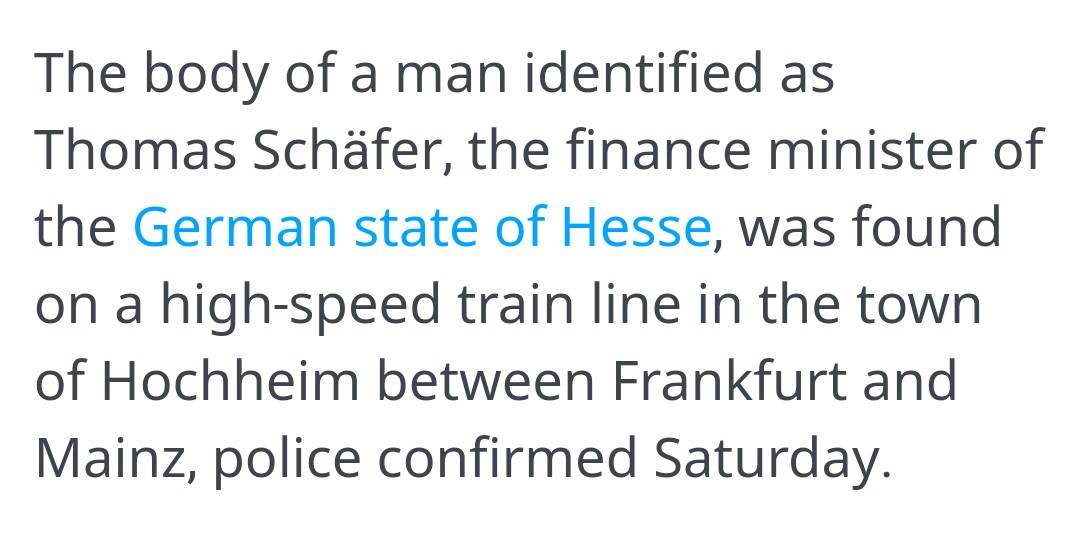

- Schäfer was a member of Chancellor Angela Merkel's center-right Christian Democrats (CDU)

dw.com/en/german-stat…

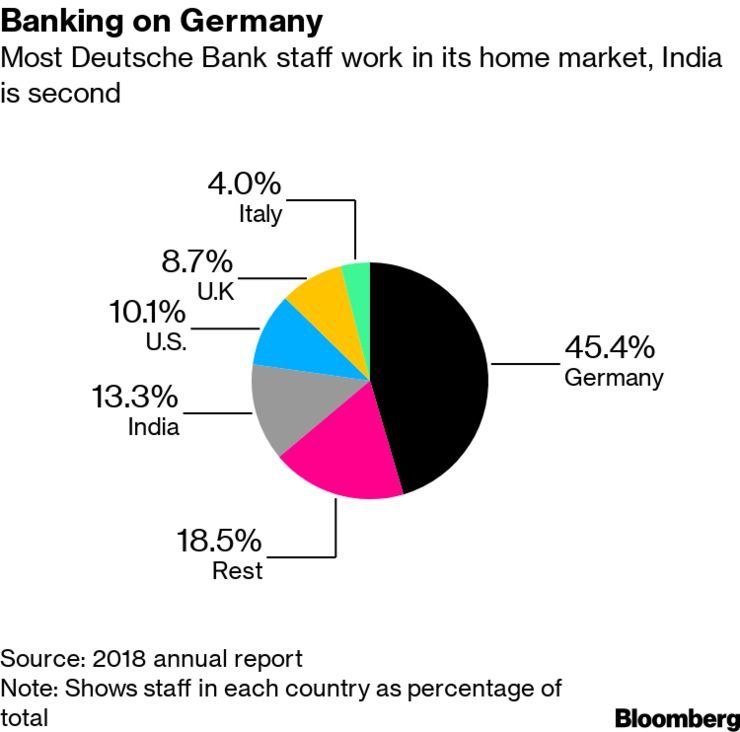

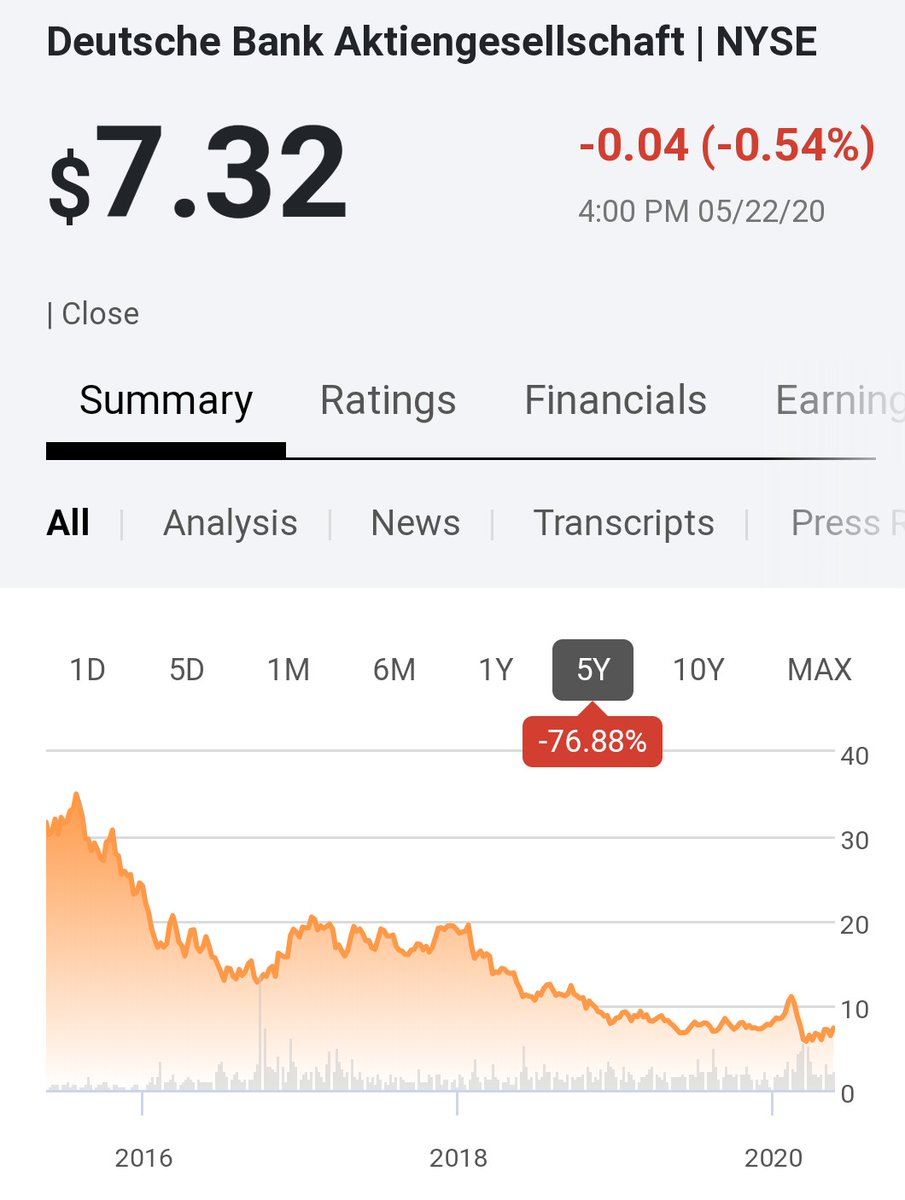

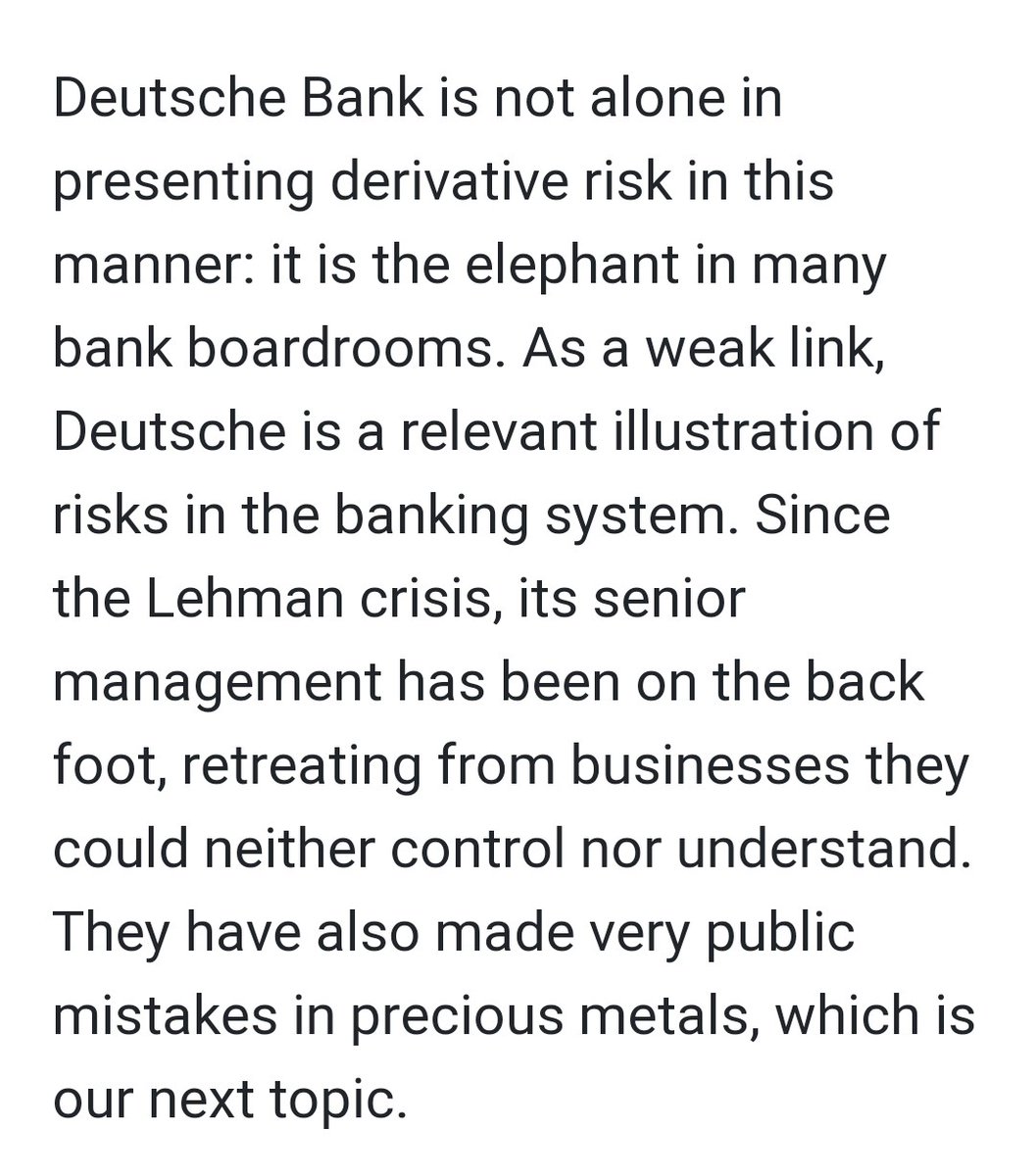

- Following the failure of merger talks between Deutsche Bank and Commerzbank in April, both banks have pursued savage restructuring plans at the expense of their workforces

wsws.org/en/articles/20…

bloomberg.com/news/articles/…

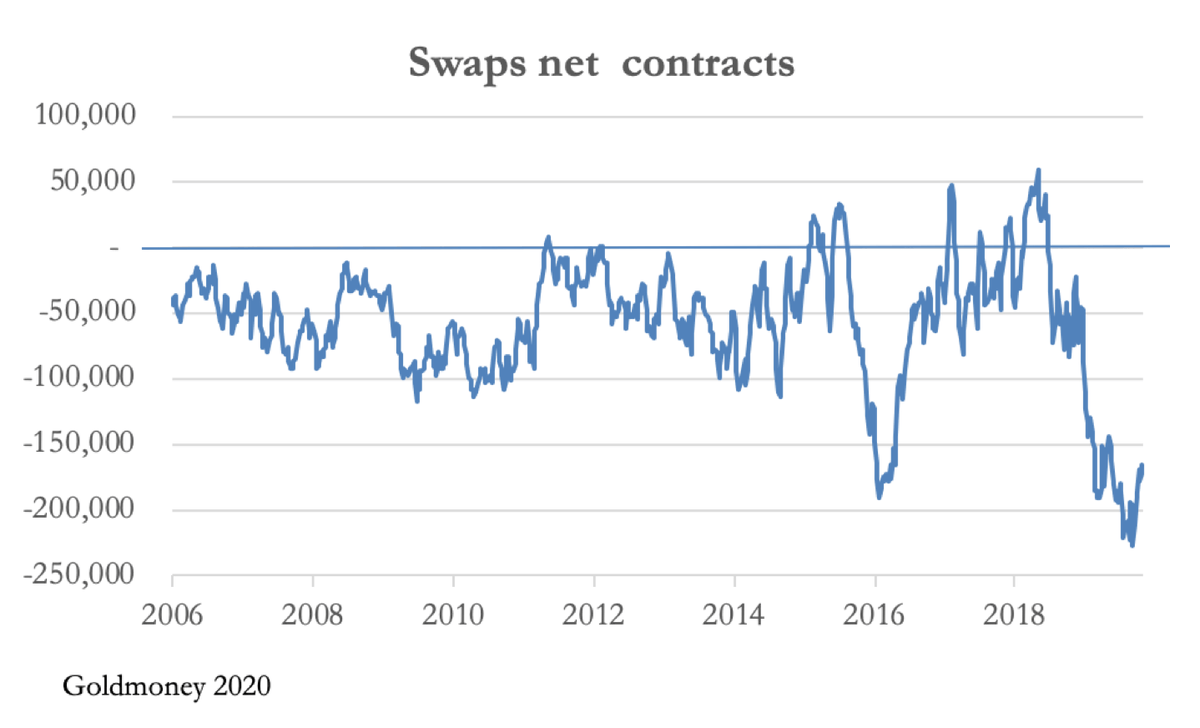

- According to the Bank for International Settlements, in mid-June last year all global OTC contracts outstanding were still unimaginably large at $640 trillion,

seekingalpha.com/article/433874…

- The ESM is a fund with around € 410 billion.

Klaus Regling, director of EVM, has proposed that € 240 billion be freed up for action against the coronavirus.

- That is nearly thirty-five thousand times the €1.062bn netted difference in the balance sheet. seekingalpha.com/article/433874…

bloomberg.com/news/articles/…

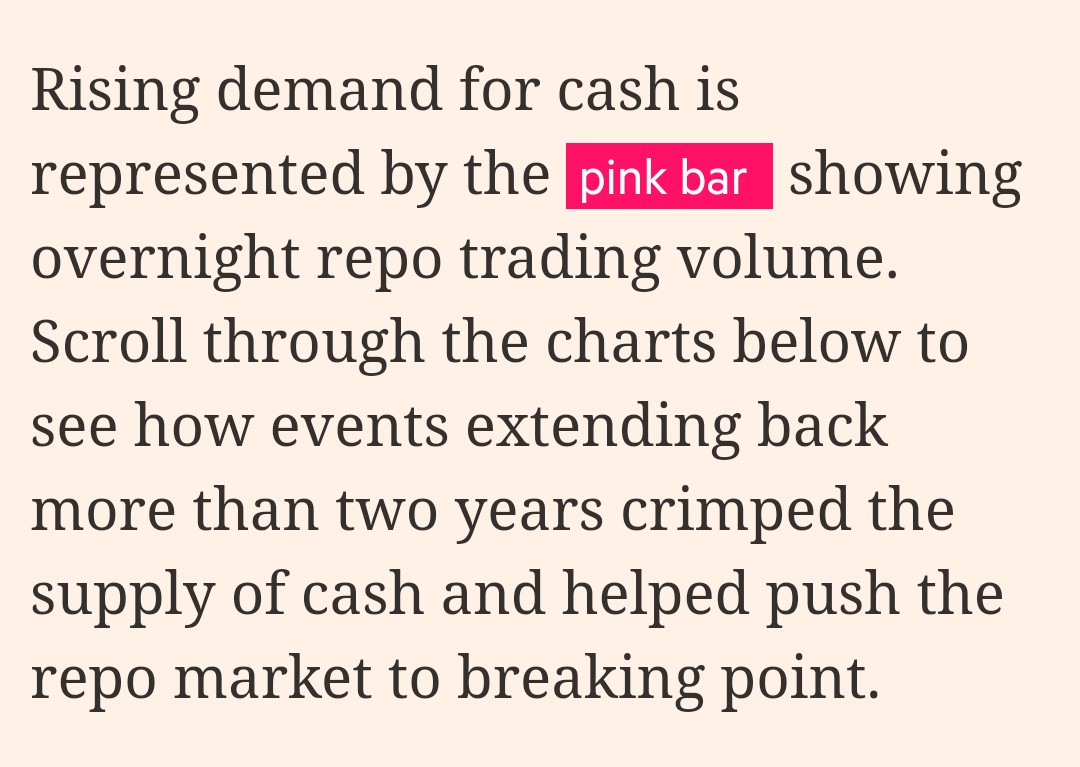

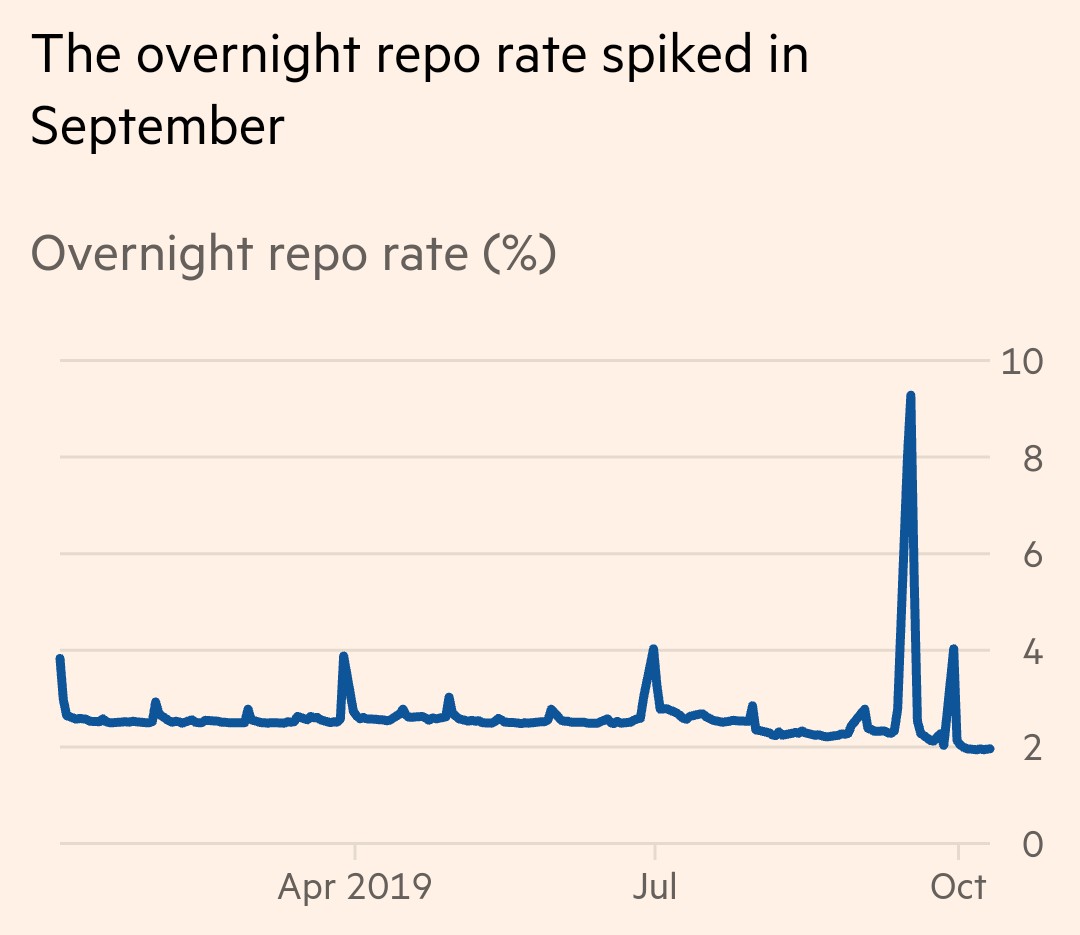

- When short-term borrowing costs spiked in September 2019, it marked the culmination of long-term stresses that the Federal Reserve is now working to tame

ig.ft.com/repo-rate/

- Between '07 and '19, the value of outstanding “leveraged loans,” syndicated loans extended to companies that credit agencies rate below investment-grade, rose from $554 billion to $1.2 trillion newyorker.com/business/curre…

- This will likely result in the contraction of the credit industry, with the most in-need borrowers potentially finding it more difficult to access credit. businessinsider.com/american-house…

For one thing, it brought back bad memories of the grim days in 2008 when the repo market froze up amid fears of cascading bankruptcies.

bloomberg.com/news/articles/…