We flattened it.

We even made it to nose dive, dig a hole, and then bury itself.

Never going to come back.

I am talking about economy.

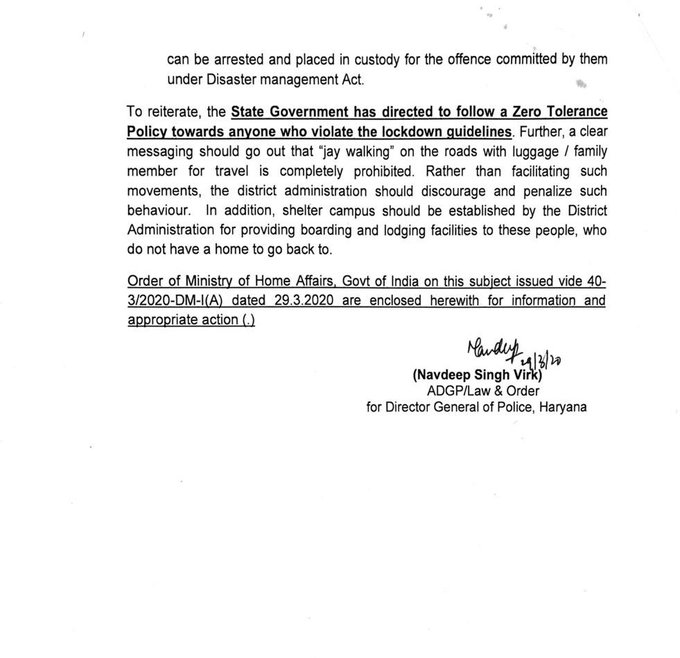

Covid? That has now spread to every part!

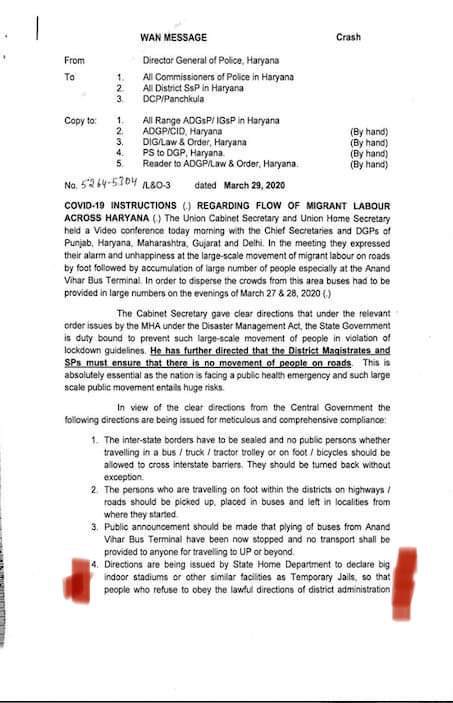

Post lockdown migrant worker travel was a masterstroke 1/n

And no. It is not hindsight either @narendramodi. Had briefed you back then. Warned you multiple times 2/n

Well, we have had that briefing also dear PM @narendramodi. You are really losing your memory now. I urge you to pay more attention please. 3/n

We need to help it find a way back to the surface.

Before we come to that, why don't you go through all our previous briefings once and come back? 4/n

Else, a couple of major IT players announcing layoffs & the scene will go really dark dear PM @narendramodi. Really really dark. 9/n

Because only those who are assured of a steady income will spend now. And only when they spend our demand would grow for non-essential items. But the salaries and pensions are in danger too!

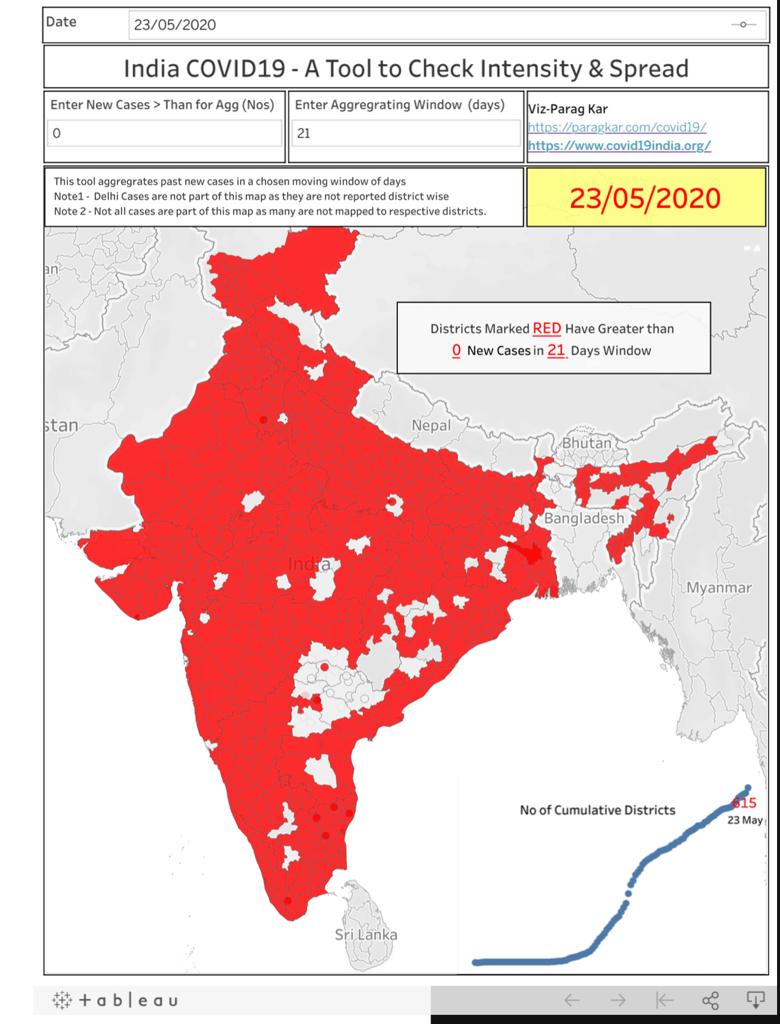

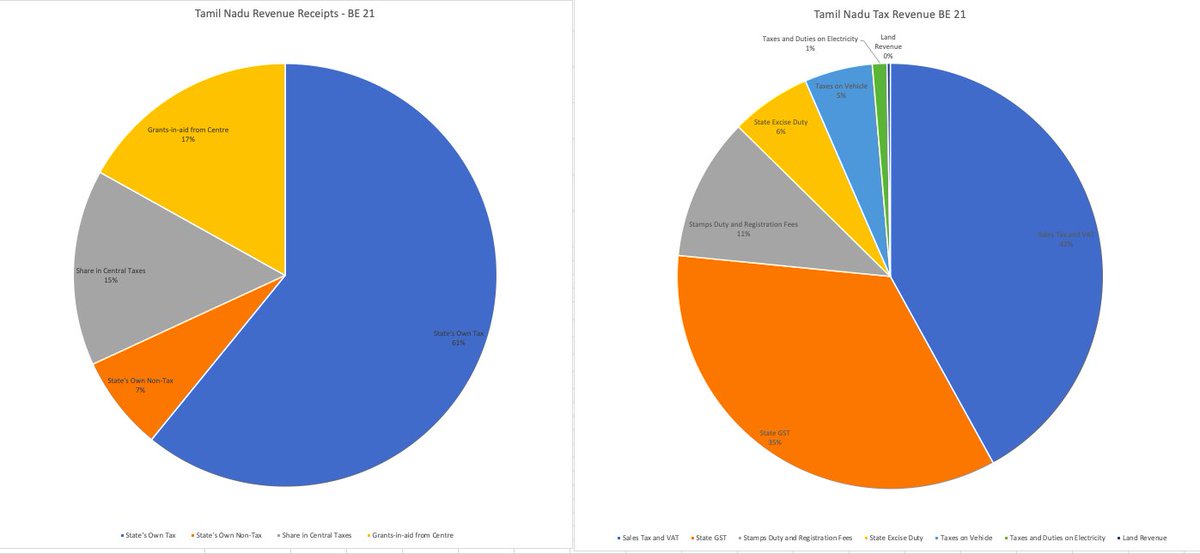

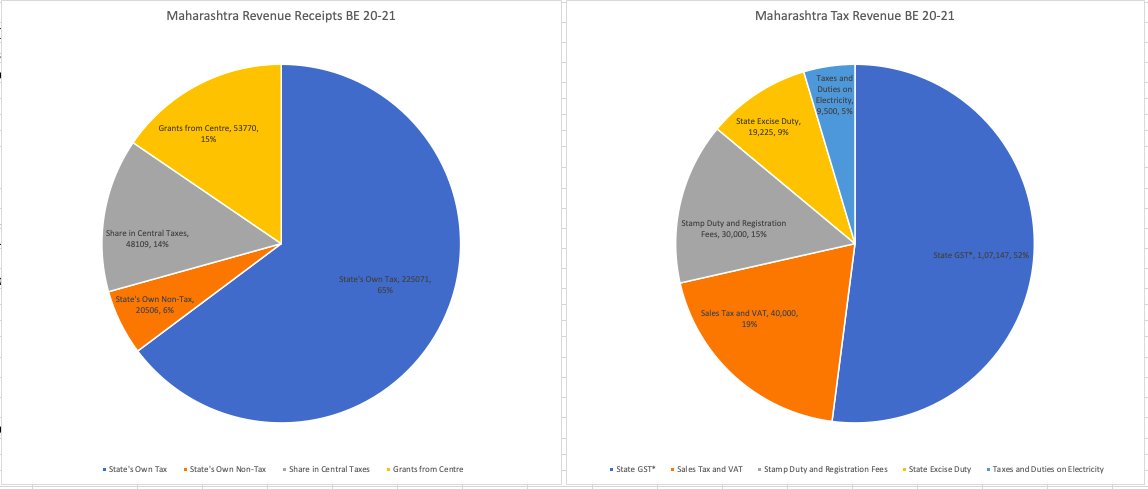

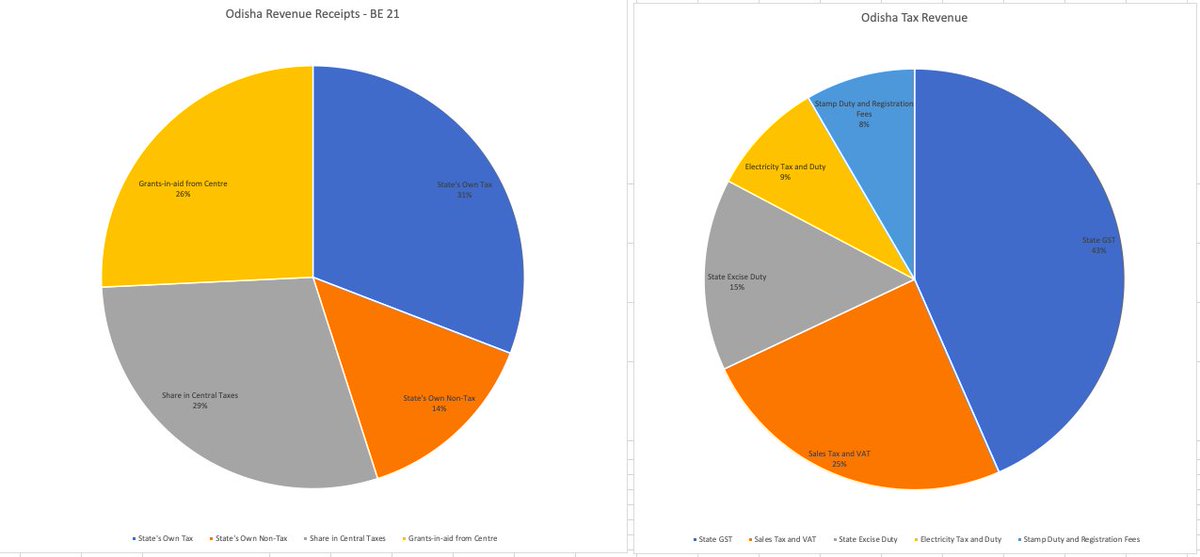

State's own revenue (tax & non-tax) makes up for 45-72% of total revenue receipts of the state. Out of which close to 50% is from State GST.

So now you see why states are eager to start liquor outlets. They earn their excise and a good % VAT from there. But I am digressing.

My concern is State GST. 13/n

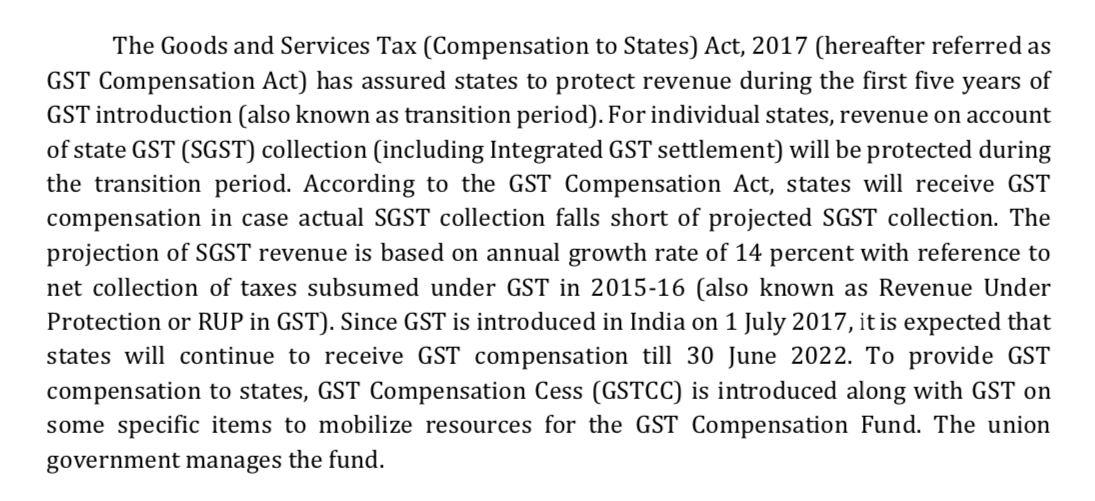

It is protected under GST compensation act. Yeah. You made that act.

Remember, you wanted to be great. India's second independence and all.

Hey, you really don't want me to remind it more dear PM @narendramodi.

Let's move on..

Also, since none of the higher GDP growth promises of GST came true, States were being increasingly dependent on centre for SGST target.

This paper here has some good insights dear PM @narendramodi. Well, at least pretend to read the abstract.

A blocking alliance in GST council is already possible. GST council would have become effectively defunct. mpra.ub.uni-muenchen.de/86355/1/MPRA_p…

Oh btw, we already have a State specific GST regime for Kerala after the 2018 floods.

Majority of its income is to now come from Centre.

But if you don't pay the compensation amount timely, then the salaries and pensions would stop.

And additional borrowing might also be difficult.

Either pay compensation amount at once.

Or, allow States to have own Covid Cess, like the Flood cess for Kerala.

This would also allow us a smoother transition to post 2022 frame-work. We can still retain many benefits of GSTN.

A federal polity cannot harmoniously co-exist with unitary economic framework. Not for long.

But we can find a way to retain the benefits while following principle of subsidiarity.

No briefing for a few days now dear PM @narendramodi. GN