Long thread

#investing

1/n

~India's fourth recession since independence

~ First since liberalisation and perhaps worst to date is here.

~ Indian economy shrinking 5% in fiscal 2021

~ 1st quarter will suffer a staggering 25% cont.

~ About 10% of GDP in real terms could be permanently lost.

~ Non- Agri growth contract to 6%.

~ Agri growth can be near to its trend line(Assuming normal monsoon)

~ For the 1st time in recession we will see Non- Agri de-growth.

~ Non agri economy such education,travel and tourism among others could continue to see big hit in quarters to come

~ These sectors are large employers, so job losses and income losses will get extended.

~ 8 states which contributes over half of India's GDP show's that their "Red zones" contribute 42% to the state GDP

~ Orange zone contributes ~46%

~ Green zone contributes ~12% only

~New telcom subscriber base decline to 35%

~ April will be the worst performing Month

~Economic package without enough muscle

~ Estimated the fiscal cost of package is 1.2% of GDP

~ Crude oil prices are expected to average 30$ per barrel in 2021.

Risks :

1. A further markdown in global growth if there is uneven health recovery and premature austerity in the face of a large rise in public debt.

2. A second wave in cases adding to the uncertainty.

3. A setback to became of monsoon failure or supply of disruption

~ Most Strict lockdown in India

~ S&P global estimates that 1 month of lockdown shaves 3.5% of annual GDP on average across asia- pasific.

~ Due to strict lockdown,impact on economic growth will correspondingly large

~ Mobility rate declining during may, highest in India

~ We believe a catchup to pre crisis trend level of GDP growth will not be possible in next three fiscal despite policy support

~ Assuming avg. Growth of about 7% between 2022 and 2024.

~ To catch-up world require Average GDP growth to surge to 11% over next three fiscal. Something that has never happened before.

~ Economic pacakge include short term measure and reforms to boost long term eco. Prospect would be much smaller at 1.2 % of GDP

~

~ About ⅔rd of fiscal cost was already accounted for in PMGKY announced in March

~ 65% of 11 lakh crore booster shot in Form of liquidity and credit support

~ About 11% of total allocation is for strength Agriculture and Allied related infra.

~ Moreover many reforms have announced that entail no fiscal stimulus.

Thrust seems more on raising the 'Trend' than Cycle.

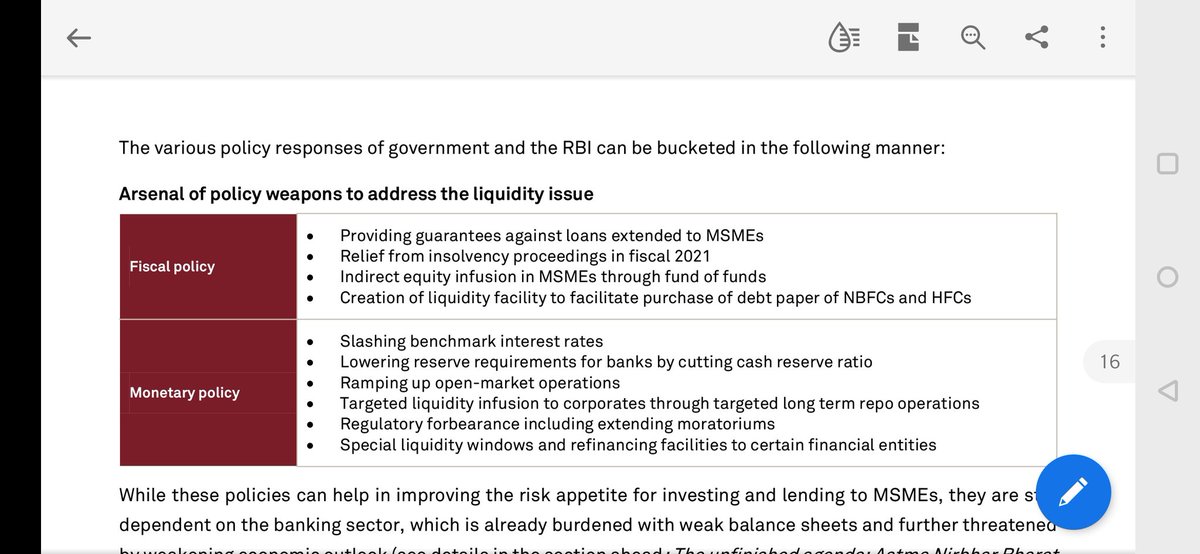

~ Measure announced by government are oriented towards reducing financial stress.

~ MSME have seen then most severe crunch in cash flows.

~ Poor ,Mainly in Informal sector have been hit by job and Income loss.

~ Short term relief to corporate under IBC

~ Min. Threshold to initiate Insolvency proceeding was raised.

~ Fresh insolvency proceeding was suspended upto one year.

~ Borrowing limit of states were also eased for fiscal 2021.

1. Analysis of 13k MSME over 5 years indicates that working capital cycle of MSME can stretch by 15 to 20% during downturn compare to normal year, requirement could shoot through roof.

2. Financial condition remains tight wit equity market seeing large losses...

Globally bond market burdened,excess supply to top it all banks are scared to lend.

3. If company continue to face crunch, there would be bankruptcies.

4. Economy needs liquidity backstop with support from both fiscal and monetary policies

Research :

1. Out of 633.88 lakhs MSME, 630.52 Lakh MSMEs with limited access to formal credit.

2. Successful of loan guarantee itself will depend on willingness of bank to lend and premised on certain conditions that may cover only handful of MSMEs.

3. Banks remains saddled with high NPA, so they could continue to stay away from risky lending.

4. CRISIL Report expect.

~ Bank credit to decelerate further

~ Asset quality slippages to increase

~ Bad loan recoveries to decline

5. Implementation could take time

6. Disallowing global tender of value upto 200 crore for government procurement, are welcome step But this ll pay off mid to long term

7. Support to key business that employee a large workforce such automobile and more prone relatively (restuarant, entertainment and travel)

8. MSMEs that engage in producing auto components have almost 100% B2B linkage with automobile business, they will continue to suffer because of demand disruption.

Others are Construction,Textile, Printing, packaging.

9. Benifit could have been expanded to cover at least all Jandhan account holders