CreditVidya has analyzed data footprints of 5,00,000 consumers across income segments to try and & understand what is going on.

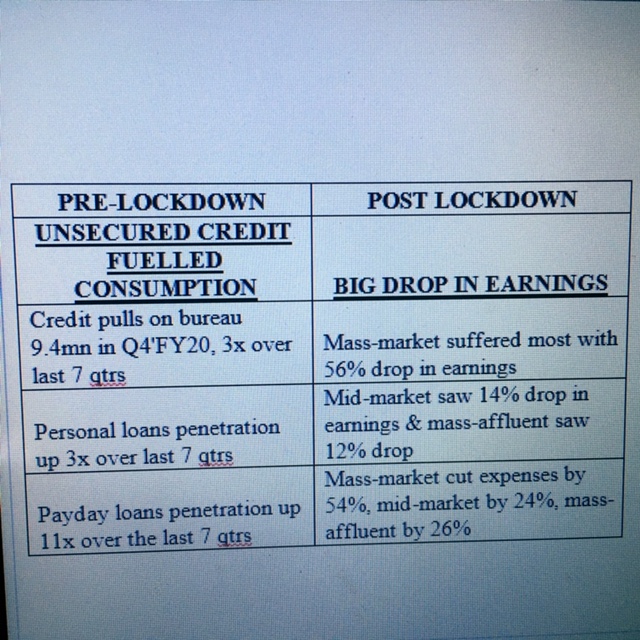

Data pre-Covid & post-Covid (post March)

Thread.. (1/5)

3 Sample Set

1. Affluent: Income > Rs.60,000; Savings Rs.23,000; Population 10%

2. Mid Market: Income > Rs.20-60,000; Savings Rs.11,000; Population 20%

3. Mass Market: Income > Rs.10-20,000; Savings Rs.4000; Population 70%

(2/5)

Key Findings

1. Consumers hoarding cash, severe distrust in economy

2. Likely to see a prolonged recession

3. Default risks likely to rise 3x

(3/5)

In Case of Income Loss

- Mass-market segment has 1 month of liquidity to cover their monthly loan repayment

- Mid-market has 1.5 months

- Mass-affluent has 2 months of liquidity cover

(5/5)