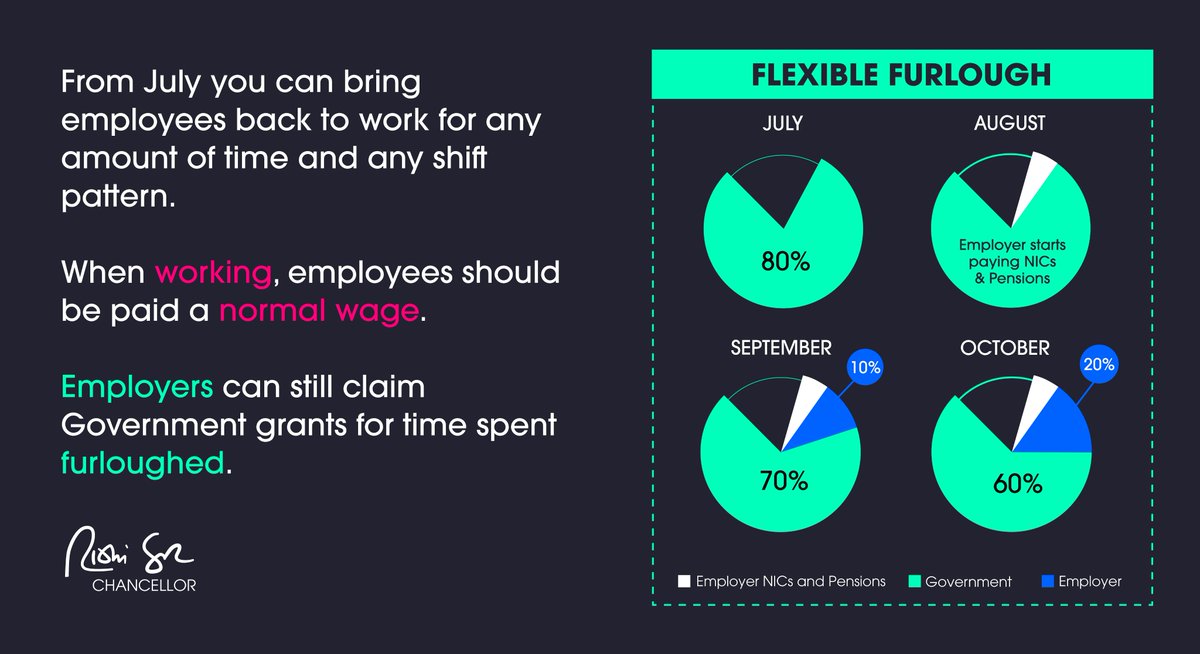

The government will pay 80% of furloughed people’s wages, up to a maximum of £2,500. At the same time, the Flexible Furlough will start in July, one month early.

Employers will only be asked to cover National Insurance and employer pension contributions which, for the average claim, accounts for just 5% of total employment costs.

Only then, in the final 2 months of the 8-month scheme, will we ask employers to contribute 10% towards people’s salaries with taxpayers paying the other 70%.

Then, after eight months of this extraordinary intervention of the government stepping in to help pay people’s wages, the scheme will close.

And I’ve decided to provide the maximum possible flexibility, with no central definition of part-time hours.

For instance, your employer could bring you back two days a week. They pay you for the two days and the furlough scheme covers the other three.

Employers wanting to place new employees on the scheme will need to do so by June 10th, to allow time to complete the minimum furlough period before then.