1/ There has been acute fuel shortages in ZW for period up to 2008 & from 2016 to date.

What are the public policies in operation that have either caused the shortages or have not ended them?

Its a citizen contribution to the conversations on a matter of public interest: FUEL SHORTAGE.

"Petroleum" word was first used in 1556 by the German mineralogist Georg Bauer (Georgius Agricola).

eolss.net/Sample-Chapter…

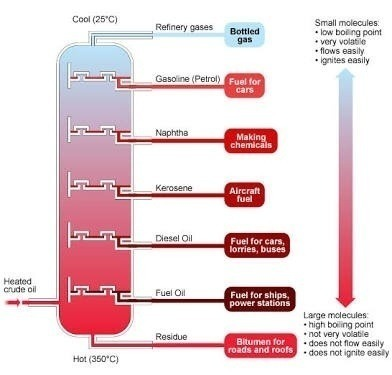

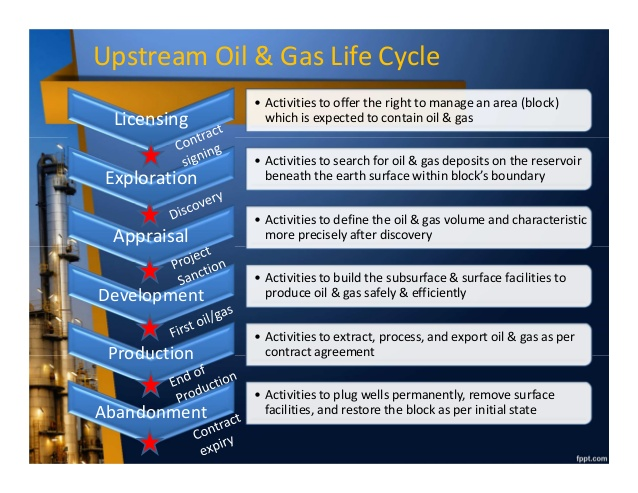

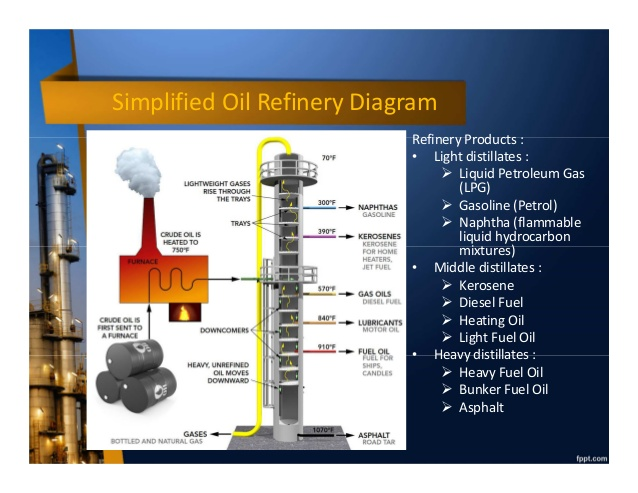

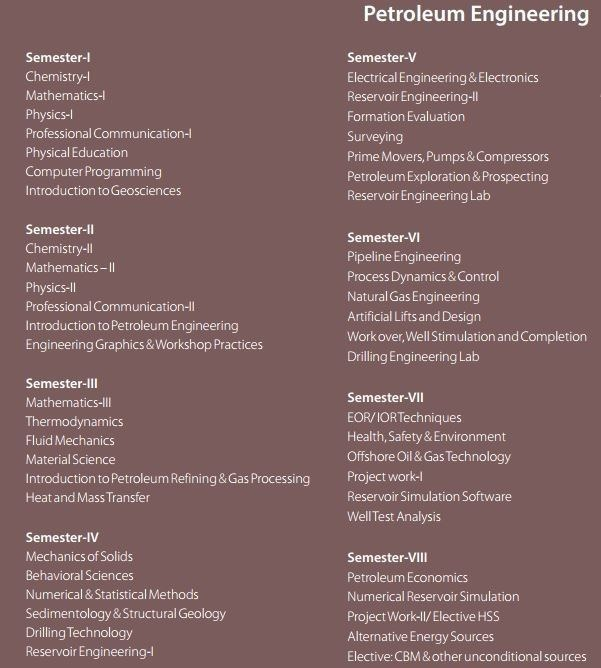

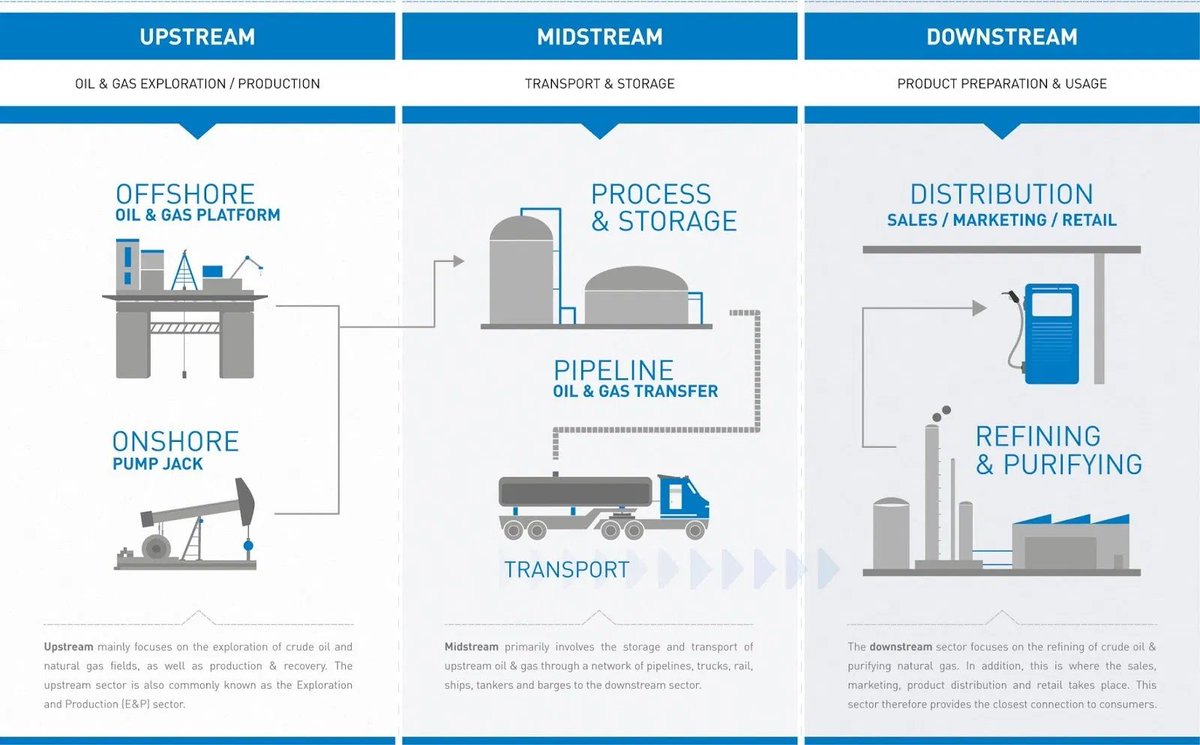

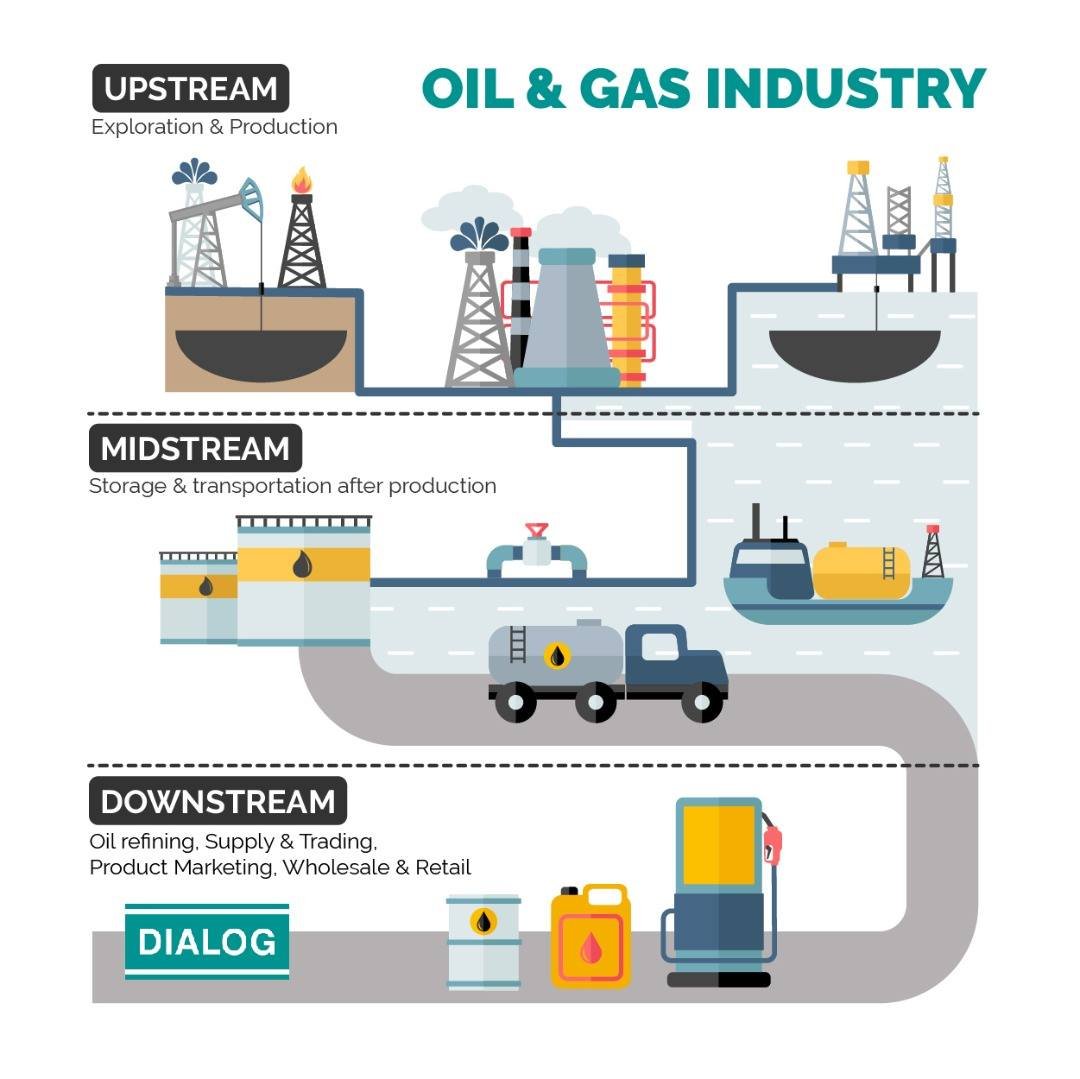

i. petroleum engineering: exploration by petroleum geologists, extraction by drilling & reservoir engineers, refining by petroleum production engineers,

ii. transporting,&

iii. marketing of petroleum products.

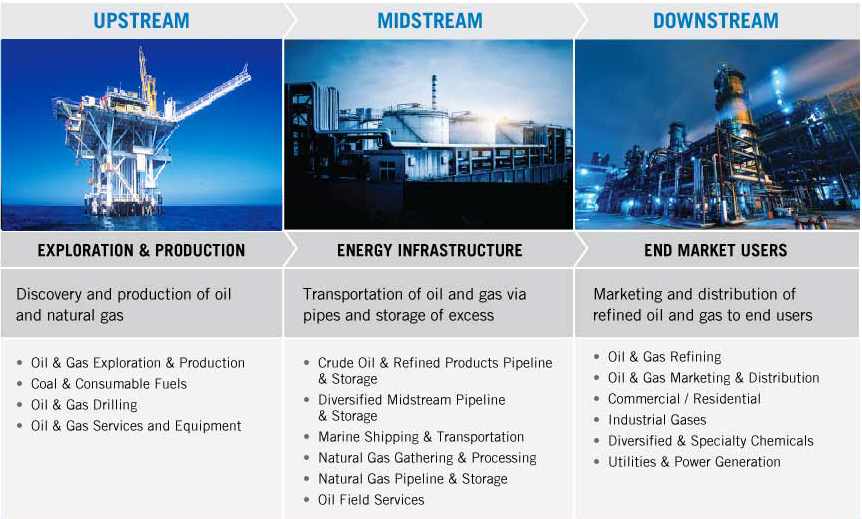

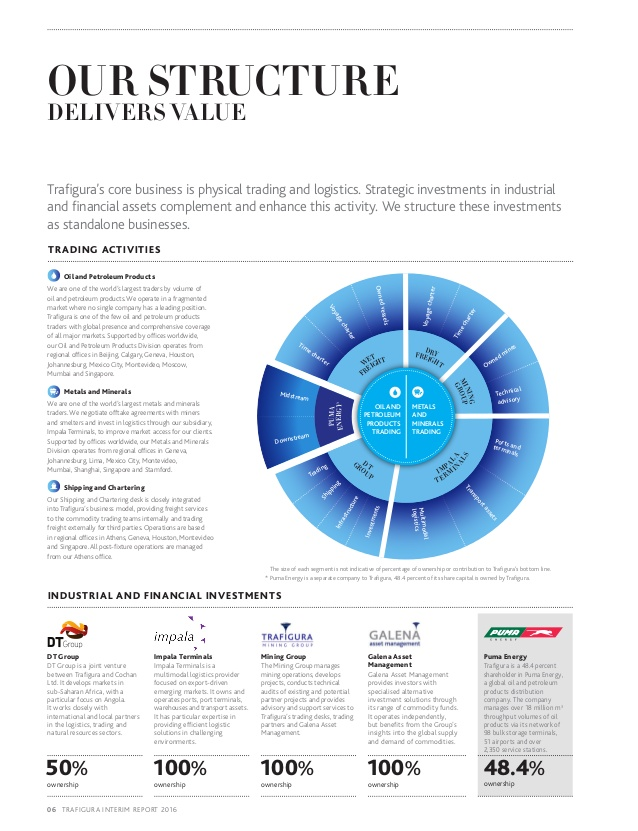

i. #Upstream,

ii. #Midstream &

iii. #Downstream

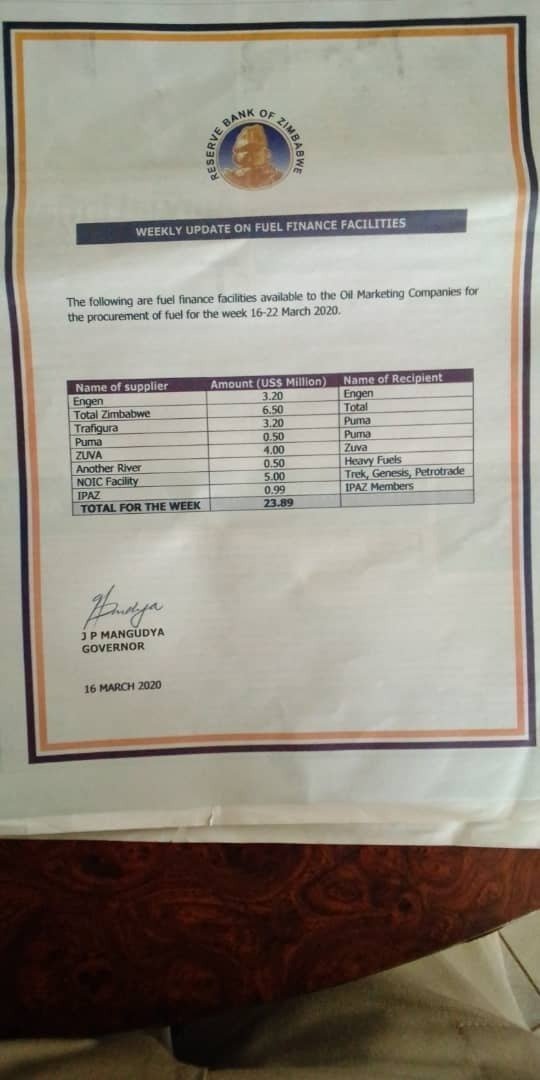

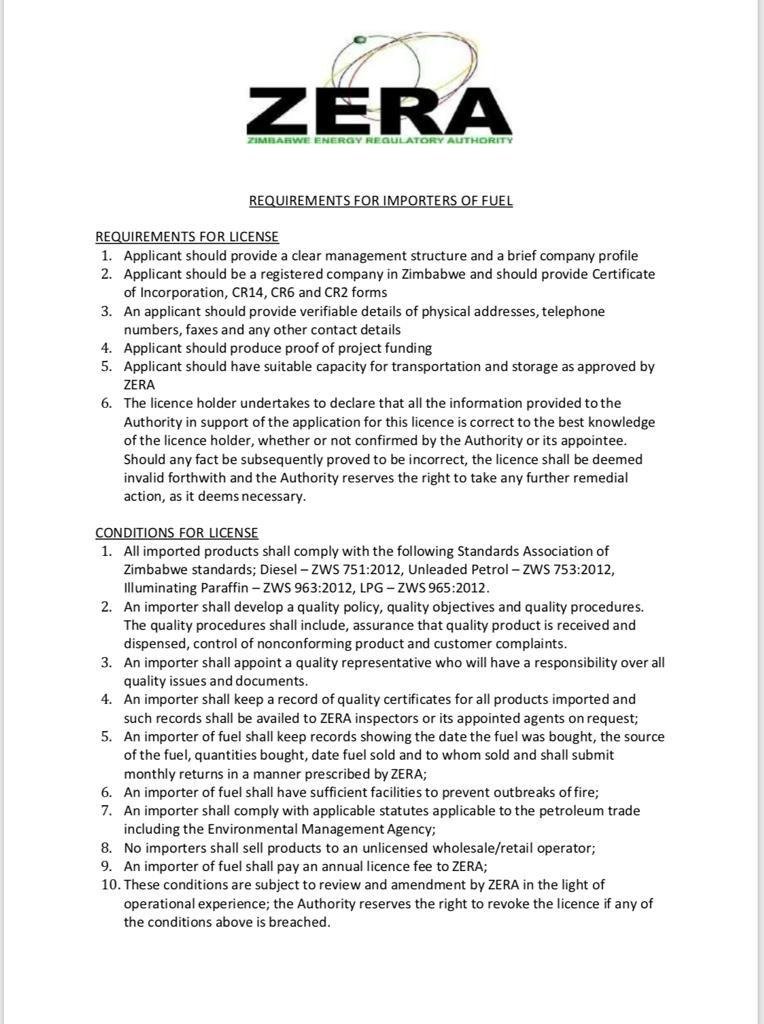

a) for procurement to buy from importers, &

b) for wholesaling to sell to retailers (own or franchisee service stations).

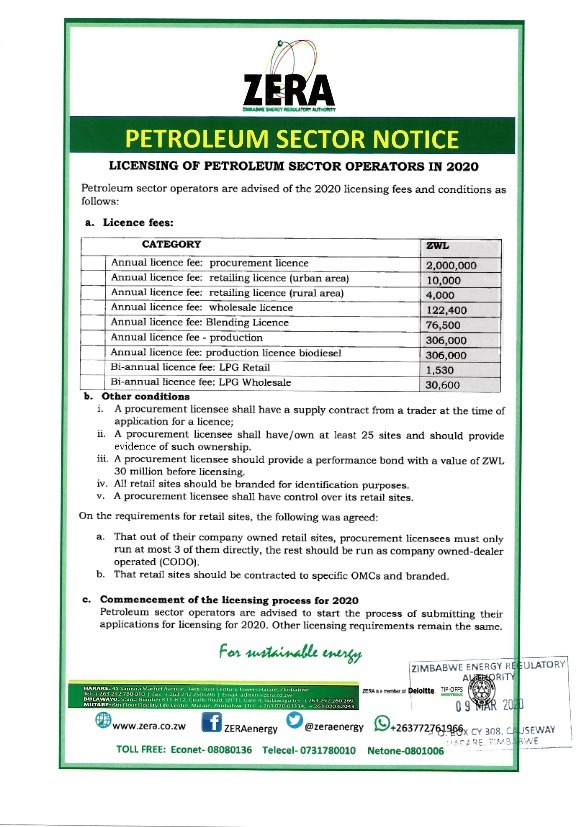

There are 5 categories of petroleum licensees:

i. Production

ii. Blending

iii. Wholesale

iv. Procurement

v. Retailing (Urban&Rural)

zera.co.zw/electricity3/

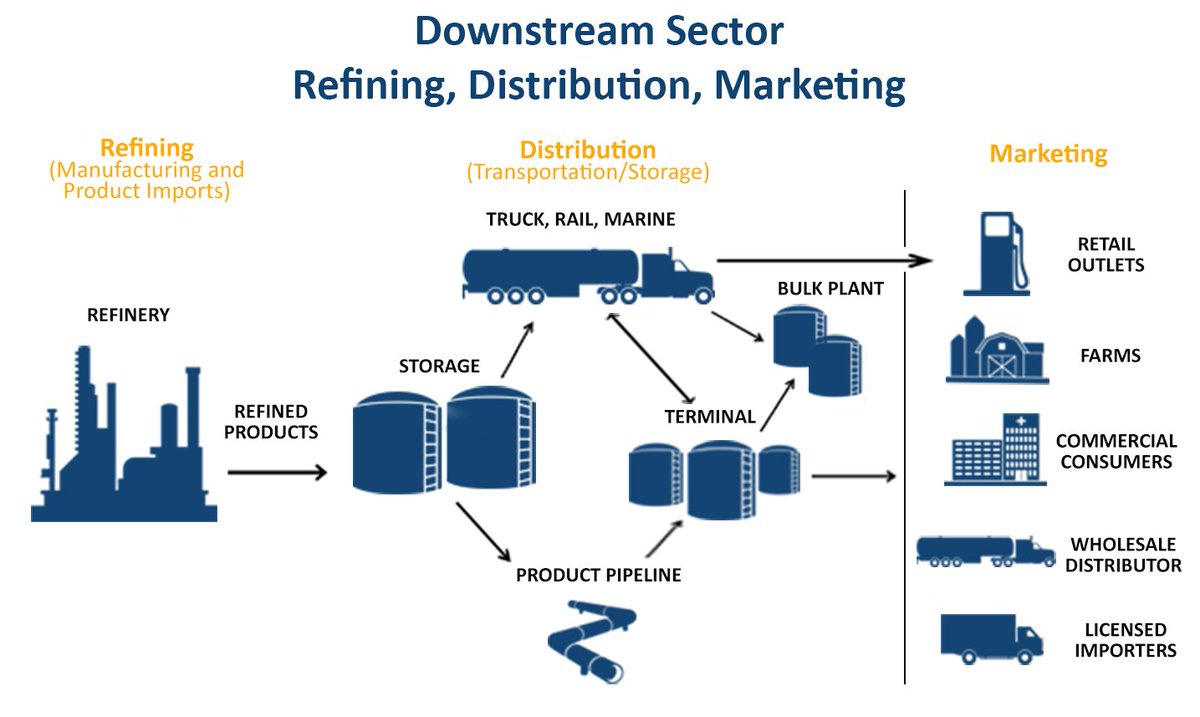

i. The value chain is as follows:

a. Producer >>

b. Importer (international petroleum companies) >>

c. Wholesaler (#PetroleumMarketingCompanies) >>

d. Retailer (own or franchisee service stations))

All the PMCs have their own & franchised retail outlets.

iii. #Wholesalers or importers buy the products directly from #PetroleumProducers.

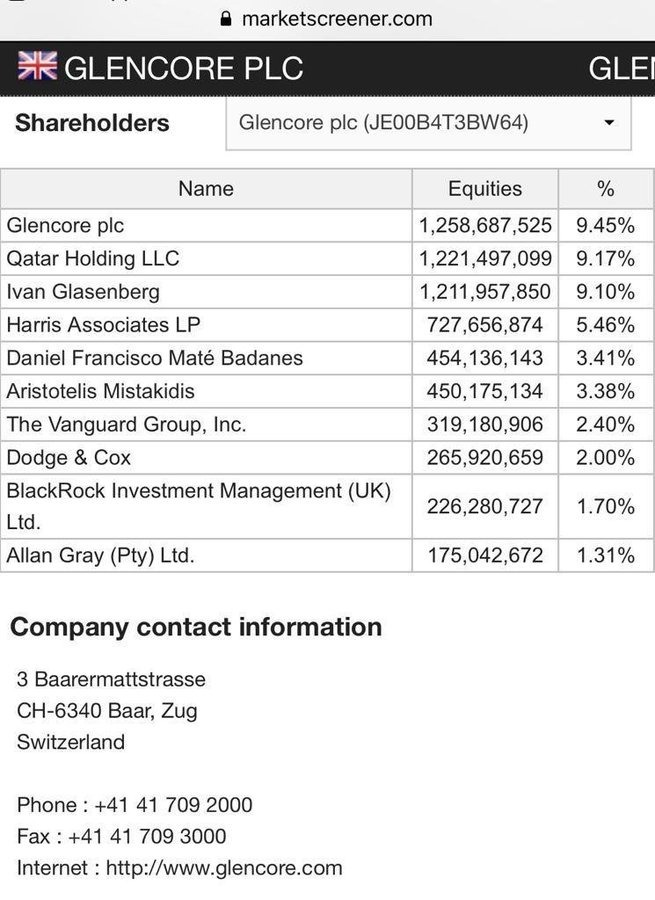

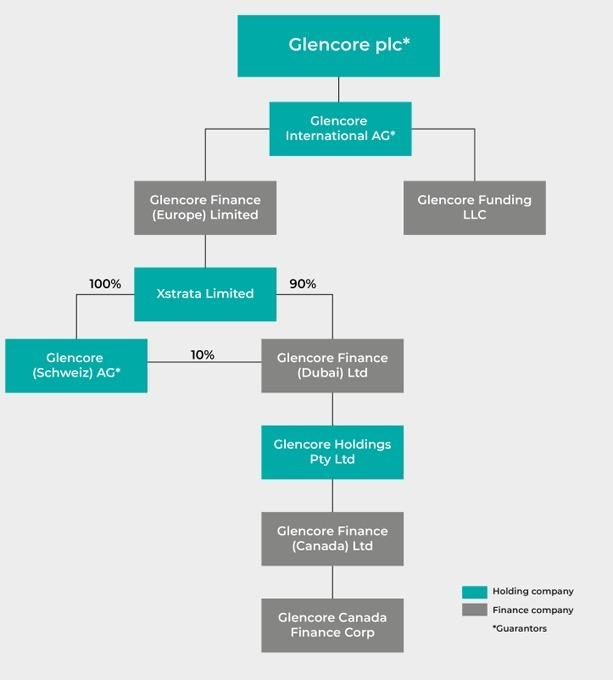

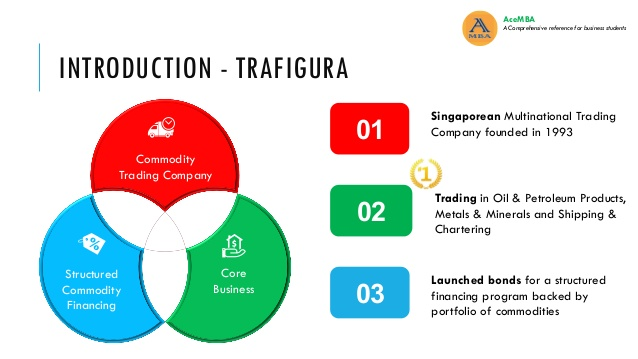

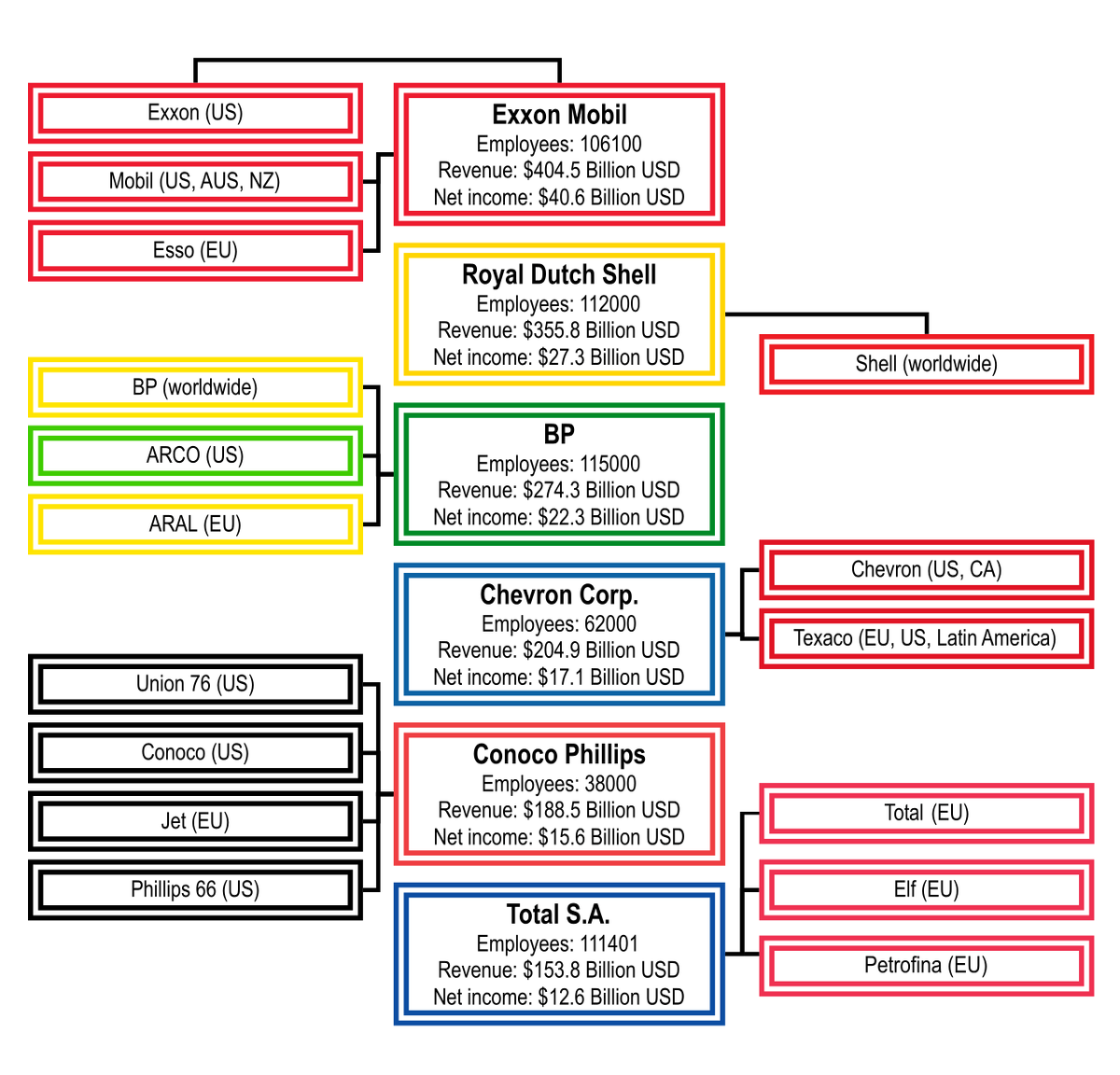

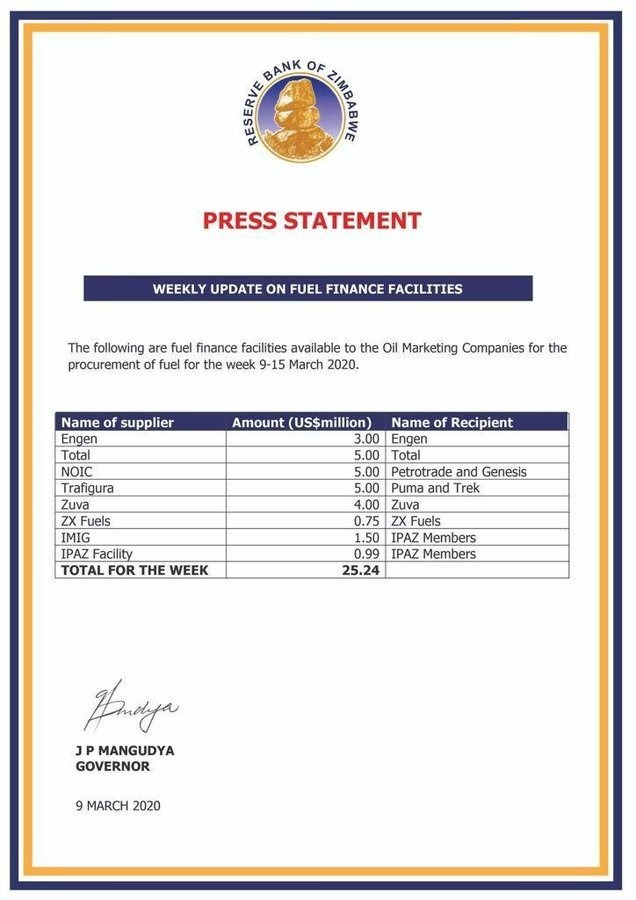

i. Glencore plc - Zuva

ii. Puma Energy - Trek/Puma/Genesis/Petrotrade/Ram

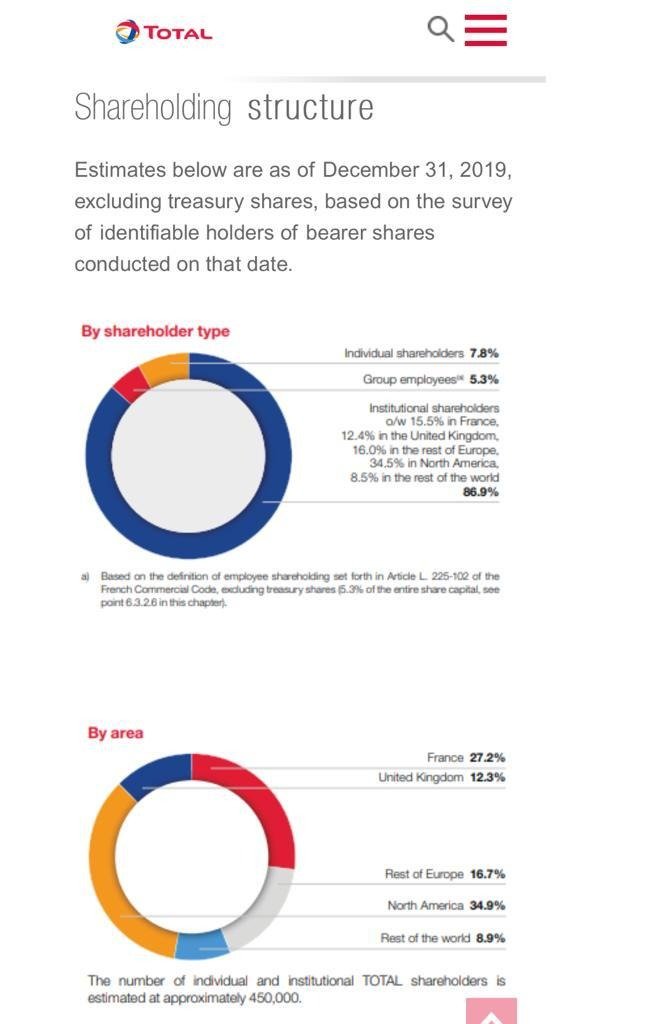

iii. Total -Total

iv. Vivon Energy - Engen

v. Unknown importer for various small players under Indigenous Petroleum Association of Zimbabwe (IPAZ)

a. Trafigura: 49%,

b. Sonangol Holdings, a subsidiary of Angola's state-owned oil company: 28%,

c. Cochan Holdings LLC: less than 5%,

d. Private shareholders: remaining minority shares.

ft.com/content/9ebb30…

africa-confidential.com/article/id/123…

pumaenergy.com/press-releases…

Vivon is a Shell licensee in Africa & its jointly owned by Dutch firm Vitol Africa BV & British-based private equity fund Helios Investment Partners. Shell was an initial shareholder at its formation.

shell.com/media/news-and…

Who constitutes the Indigenous Petroleum Association of Zimbabwe (IPAZ)?

Are they PMCs or retailers?

Who is the importer of their fuel?

theindependent.co.zw/2020/02/07/why…

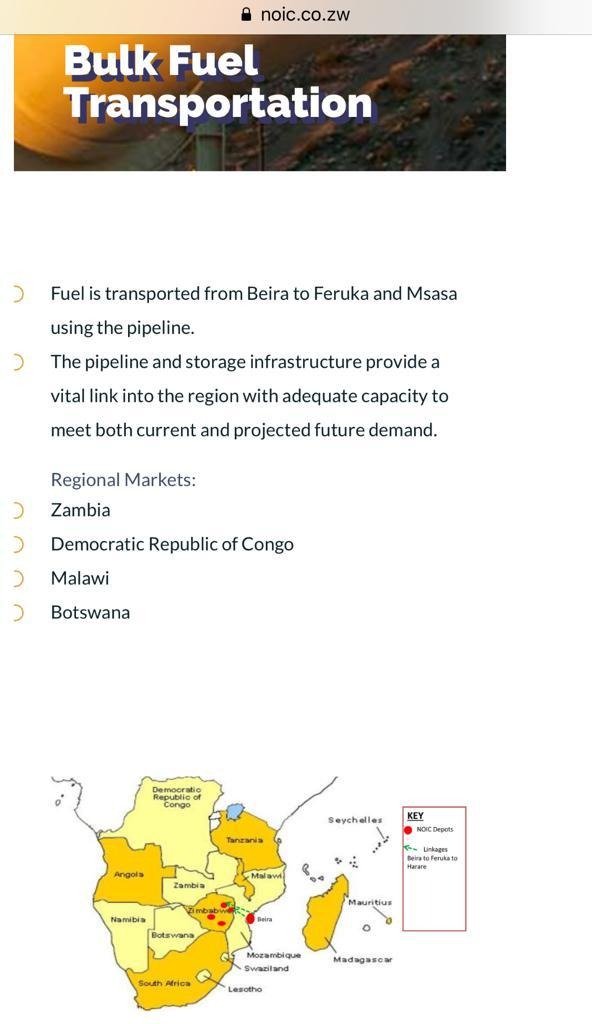

Out of NOCZIM came out: NOIC & its petroleum retailing subsidiaries: Petrotrade & later Genesis Energy.

@zeraenergy

zera.co.zw

1. Arab Foreign Bank (LAFB) &Tamoil (bothLibyan firms) US$44m

2. ZIMRA US$29,3m

3. Nordbanken US$24,6m

4. Dread Stock US$16,3m

5. BP South Africa US$12,7m

6. Buffer Stock $11,850m

7. CPMZ US$9,3m

8. Engen US$6,980m

9. Caltex (Chevron) US$2,6m

How much has been raised for the period 2003-2013 &from 2017 to date?

Imarii yaunganidzwa so far & since when?

In what form is the Strategic Reserve Fund?

How has it been used?

Have there been any audited financial statements of the fund?

i. End users of petroleum products in ZW are currently paying those licensed as retailers (service stations) in local currency (LX).

To be a PMC, one needs to have a minimum of 25 of own or franchisee service stations.

iv. The state/RBZ has two sources of foreign currency (FX):

a) that which is expropriated from exporters &

b) that which is buys from the market (interbank or parallel).

v. Its this FX that the RBZ allocates thru the fuel financing facility.

Based on an allocation system, the RBZ receives the LX from the importers & then pays them FX.

If it was determined by the market, the cost of money to import fuel in ZW would be the parallel rate bcoz that’s where one can only get FX.

Therefore, to keep the fuel cheap, the state determines the fuel price by financing the fuel importation FX requirements.

This is why even during lockdown, there are still fuel shortages bcoz the RBZ doesnt have the FX to finance it.

There is also a likelihood that PMCs can sell to bulk end users like corporates at FX-based prices & starve the retailers.

i) fuel price is kept low & highly regulated by ZERA since PMCs are allocated artificially priced FX; &

ii) parallel market rates are constantly pushed upwards as the RBZ seeks FX to buy to allocate for fuel.

i. By allocating FX it doesnt have or produce. Any statist allocation system will cause serious shortages.

ii. If it is to stop the allocations, it means it has to stop the expropriation of FX earnings from exporters&gold miners.

iii. This will improve the supply of FX into the market from exporters.

iv. The RBZ monetary behaviour of starving the market of FX by the surrender policy & at the same time go into the same market to buy FX at the parallel rate will keep the exchange rate UNSTABLE.

v. Keeping the exchange rate stable makes it easier for the state to allow PMCs to buy FX from the market where one finds FX.

The fixed interbank rate of 25 would have been unthinkable in June 2018.

For the period 2009-2016, there were hardly fuel shortages.

@fortunechasi @zimlive

@ZimFact @newswireZW @kukurigoZW @NewsDayZimbabwe @HeraldZimbabwe @SundayMailZim @DailyNewsZim @WeArePindula @zeraenergy @official_MOEPD @ZimTreasury @MinOfInfoZW

Hard decisions need to be taken!