What majority of Indians do with their savings?

Small Savings: FD/RD, LIC & VPF

Big Savings: 2nd Flat, Land, Chit, Co-op Banks, Invest in Relative/Friend’s Business, stash cash in locker/home

1/n

Sometime greed pushes us to invest in Multi-Level Marketing. Most of the time, the investors are victim of the 'Fraud’, no or mere returns.

Asset Allocation refers to investing the savings in different legit asset classes:

Equity

Debt

Gold

Real Estate

Cash

Bitcoin

.@AnyBodyCanFly has mentioned in most of his tweets ~ Start Investment journey at very young age, continue till you achieve financial freedom. Discipline savings & investment does help to achieve financial independence early or late 40’s.

My assumption is before we start pushing our savings there, we should have the following in place:

1.Term Insurance (not Life Insurance)

2.Emergency Fund

3.May be own House (if you are strong enough to withstand Social Stigma, better to have a rented house)

What should be the allocation %, asset class definition, age etc? There r plenty of content available in public domain.

While its extremely imp to spread the risk by investing in different asset class to hedge your portfolio in the scenarios like ~ Recession, Pandemic,etc

Not to forget, the above crises gives you an opportunity to create a big “Wealth” in next 10-12 years.

Let me talk about one of the low penetrated asset class in India ~ “EQUITY”

What is Equity?

Investing in Equity is an opportunity to partner with successful businesses.

How the math works: If in a growing sector a best stock should give a conservative CAGR of 15-20%.

Let’s assume, you partner with this business by investing:

Lumpsum: 2.5 Lac

Add Monthly: 10,000

Add Inflation: 5%

Now, let’s see what will happen after 15 years @ 15% CAGR: Rs 1,08,94,936.46 (1 Crore & above)

(dividends not added)

and that’s the ~ Value of Compounding

@dmuthuk most of his tweets describe 'value of compounding' with great examples.

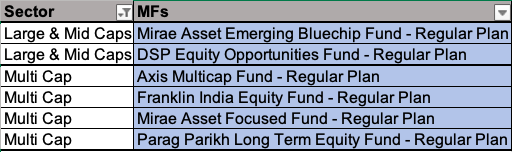

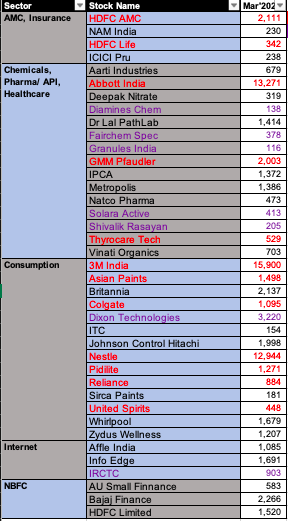

How I should invest in Equities? If an individual ready to put efforts during weekends, after office hours understand the economy, sectors, Capital Cycles & fundamentals invest directly in stocks or stay with Multicap Mutual Funds. The compounding math still remains the same.