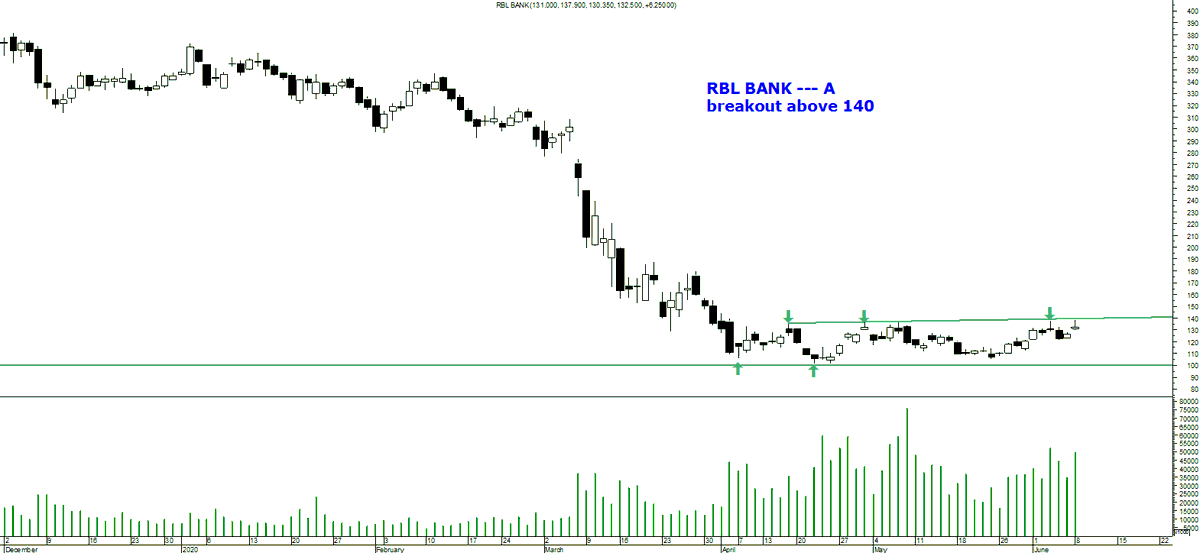

A lot of beaten down #Financials and #Banks seeing a breakout - #BandhanBank, #RblBank,#indiabullshousing... Can see upticks but one needs to be nimble footed to book out quick and a big rise or on the first turn.

Quick Charts - #RBLBank, #IndiabullsHousing,#BandhanBank, #IndusindBank... Need to be very alert and nimble.

If you in this trade. Time to take your stops closer and book some profits at least #rblbank,#ibulls

Only #Bandhanbank has lagged rest all big moves.

• • •

Missing some Tweet in this thread? You can try to

force a refresh