In today's @Markets newsletter, I wrote about all the ways that 2020 has undermined a bunch of popular Bitcoin narratives.

bloomberg.com/news/newslette…

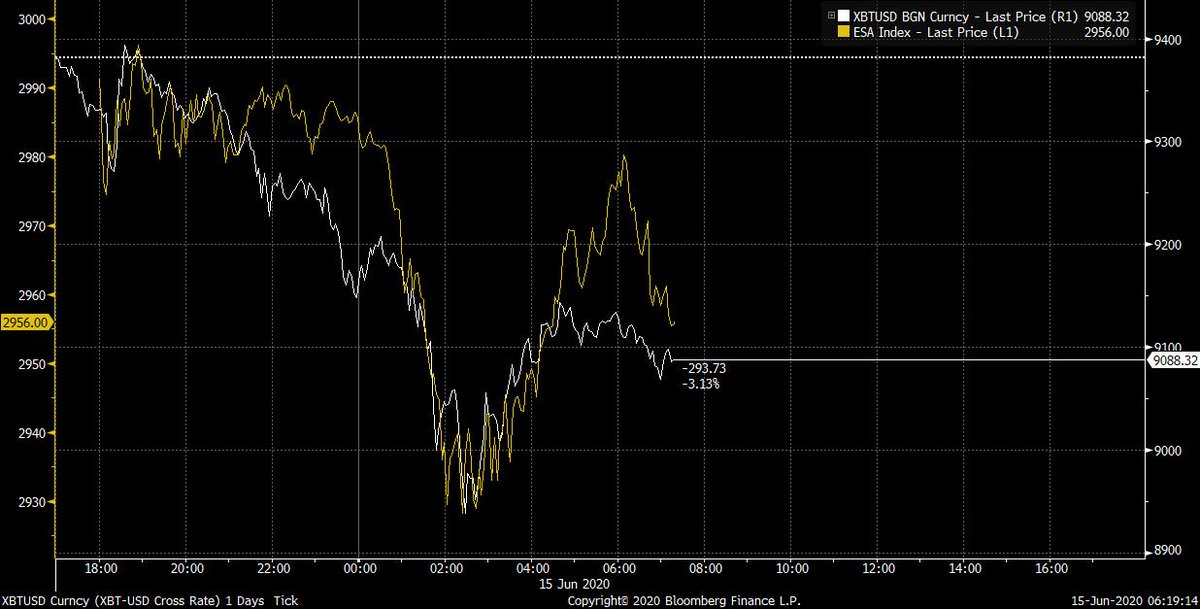

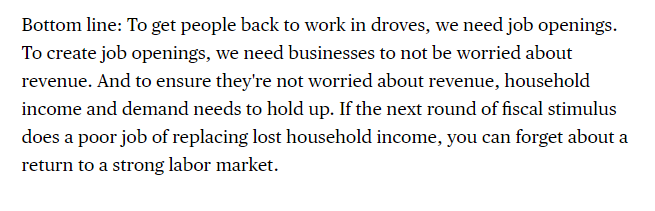

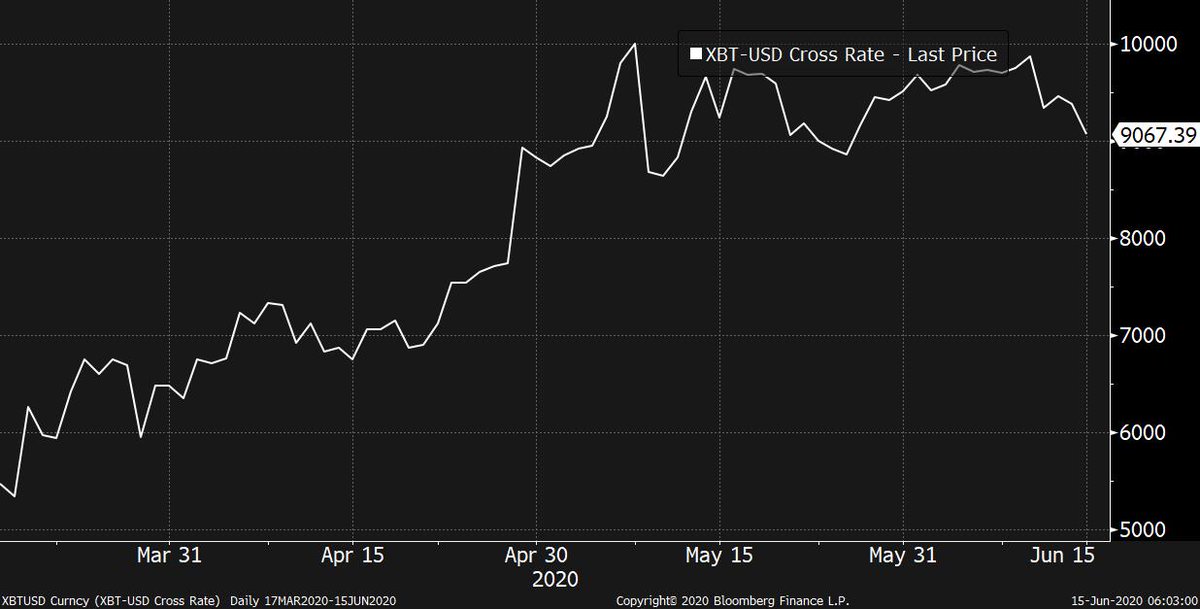

Despite all the volatility and turmoil and hype, Bitcoin has not broken its general trend of going lower, and making lower highs.

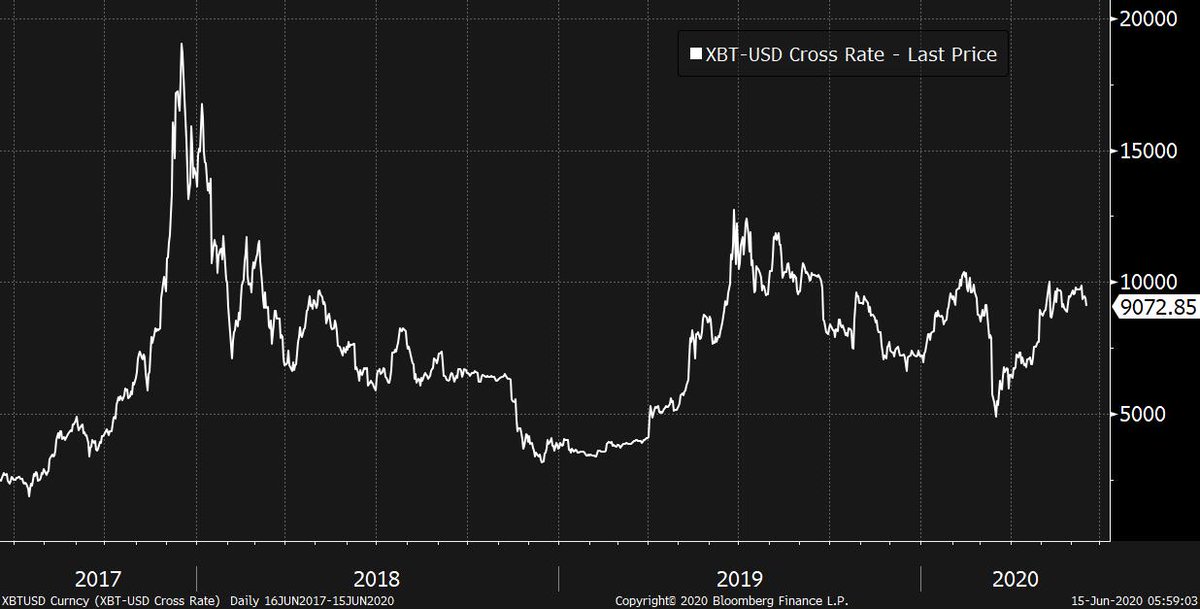

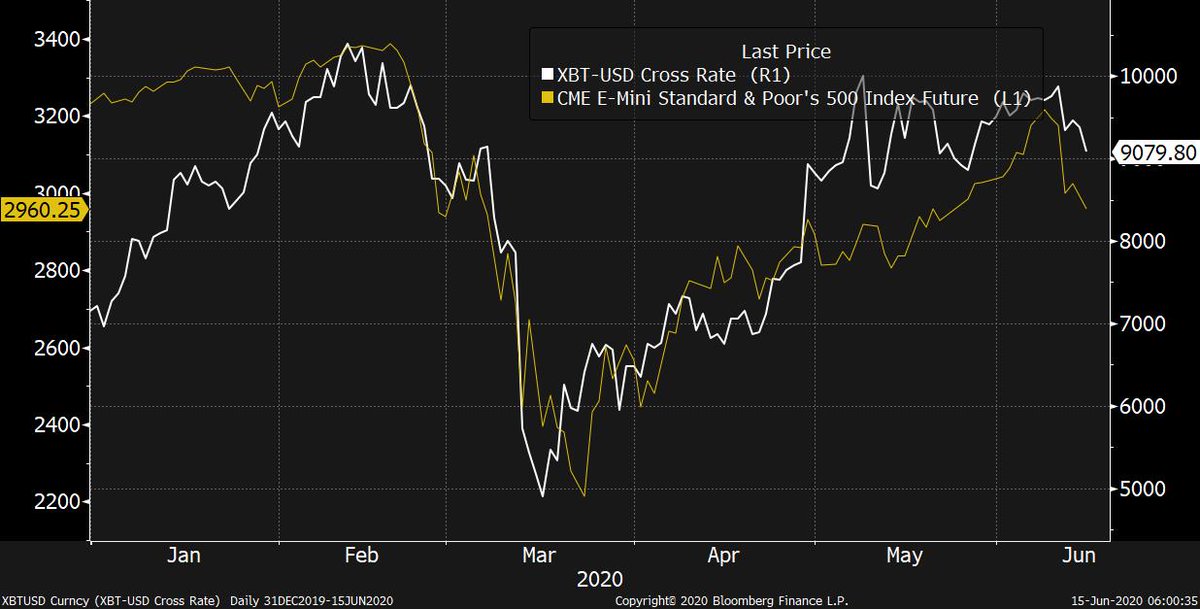

Despite being pitched as a portfolio diversifier (by many people who wear blazers and sit on industry panels) it's basically just moved in line with the stock market this year. No diversification. Just more beat.

Despite the "digital gold" narrative, it basically just did the same thing as Ethereum during the crisis. It did not exhibit any special safe haven properties

Early May saw the much hyped "Halving" of the new supply that many proponents said would engender a price boom. But actually it's done nothing.

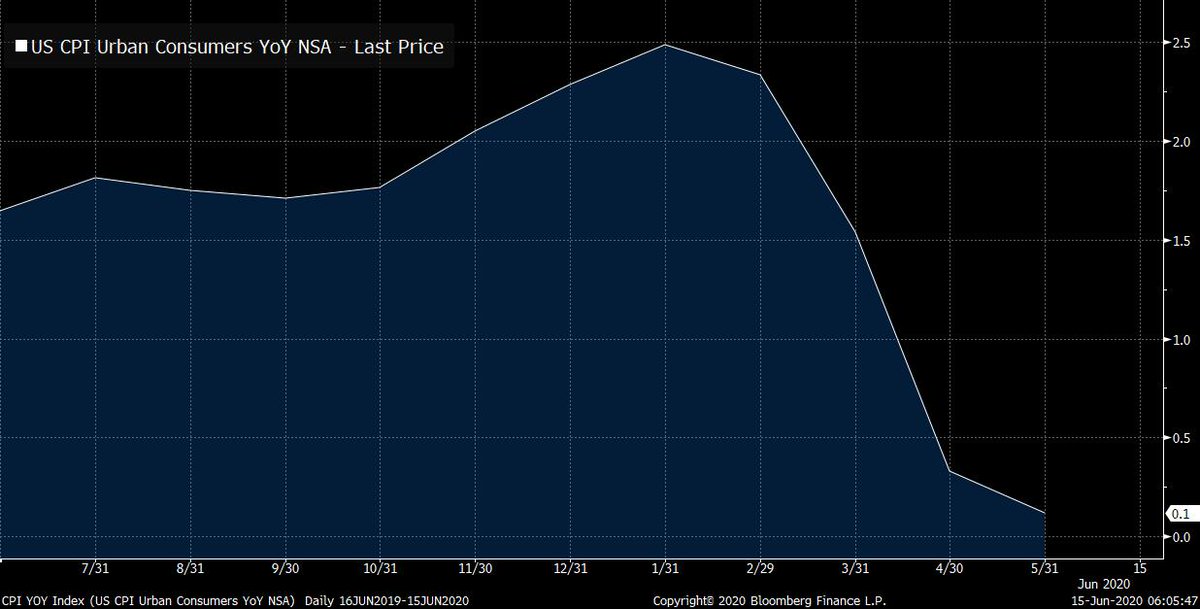

Despite popular narratives about "money printing" resulting in a surge in inflation. We've seen nothing of the sort. So the old misinformed Austrian tropes that suffuse the Bitcoin world are getting debunked before our eyes.

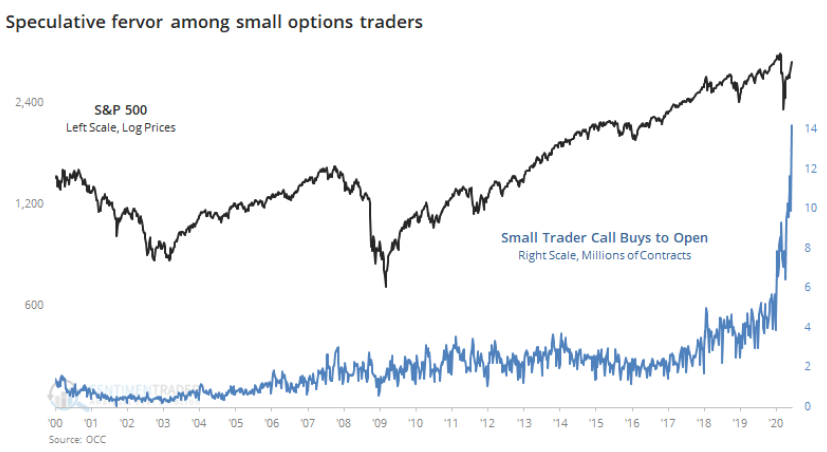

And finally -- perhaps most importantly -- The Robinhood phenomenon. A throng of people are discovering the stock market, and this has robbed Bitcoin of attention and the casino premium, since people can get their thrills elsewhere.

-- Bitcoins never claimed that the halving would make price go up

-- They never claimed Bitcoin would diversify your portfolio

-- They never claimed it would do well during turmoil