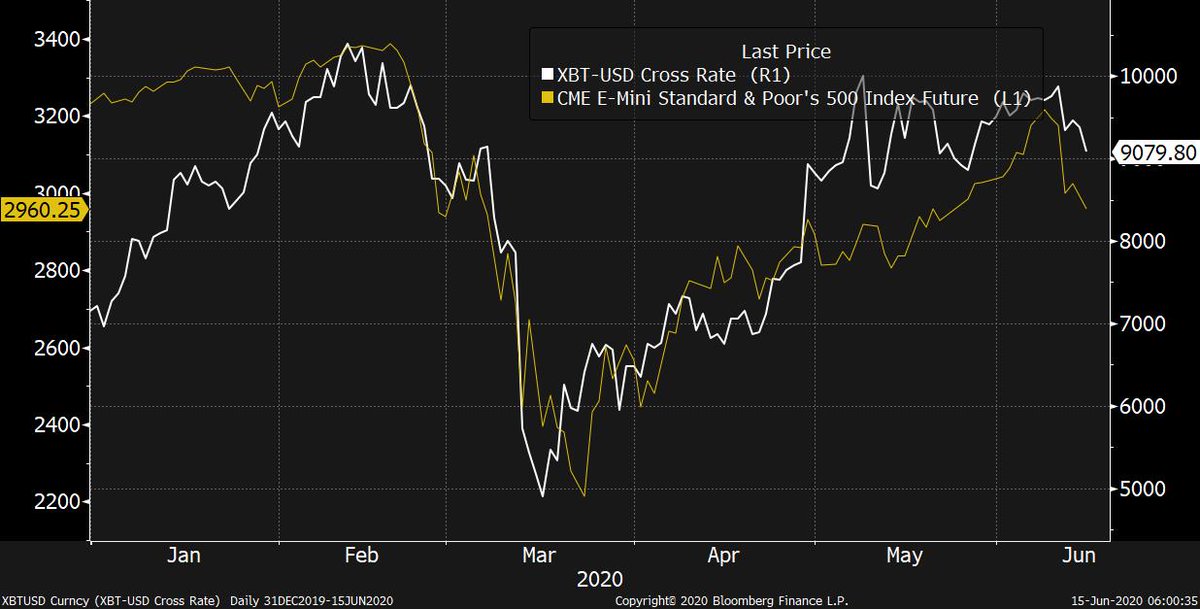

There's been a lot of Galaxy Brain takes about why stocks have rallied so hard. But in today's @markets newsletter, I argued that it's all pretty straightforward bloomberg.com/news/newslette…

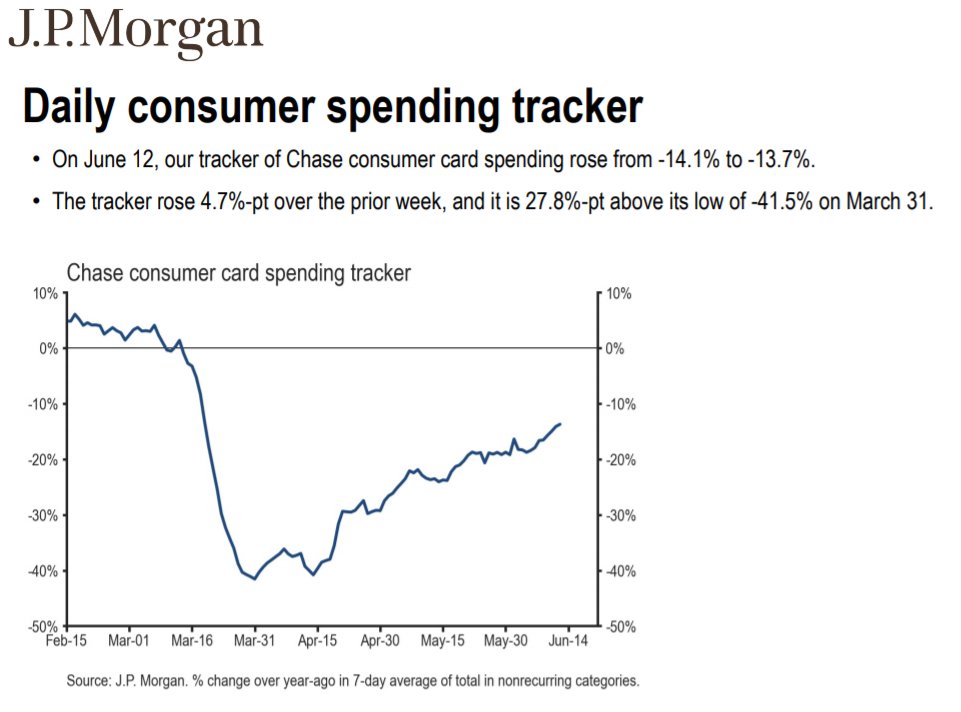

-Significant improvement in the real economy

+

-Sooner than expected

+

-Extreme investor pessimism

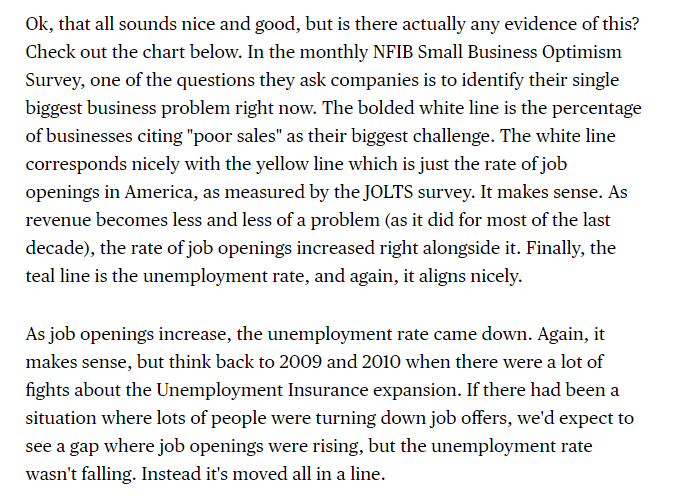

And you get a vicious market rally that hasn't hardly given anyone a chance to catch up or get in.