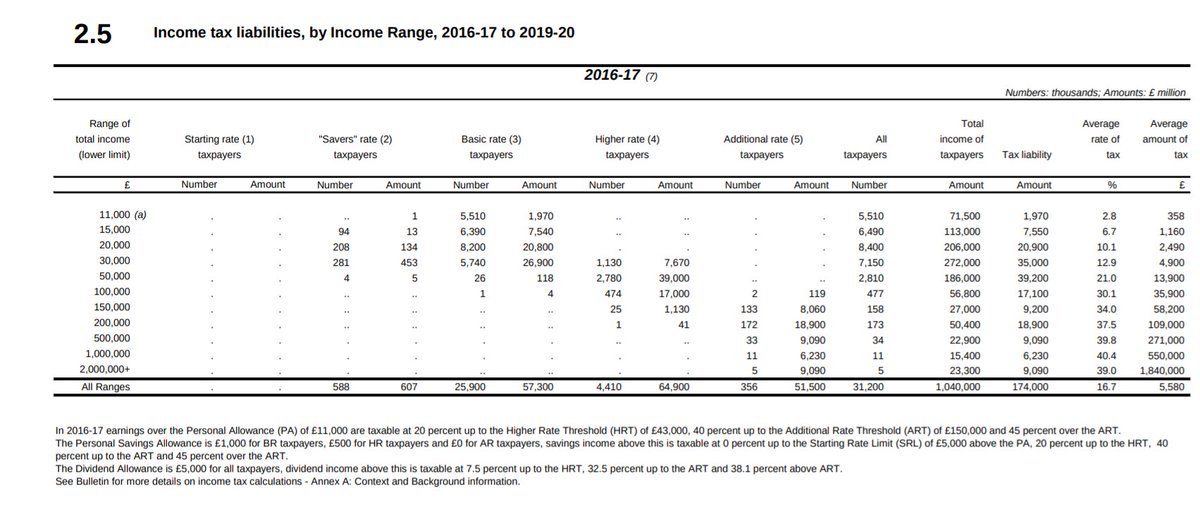

- The chart and paper seeks to misinform you about the rich and taxes (they should desist)

- The authors' underlying concern about elements of the UK tax system is legitimate

FT write up:

ft.com/content/09f373…

Paper:

warwick.ac.uk/fac/soc/econom…

2/

assets.publishing.service.gov.uk/government/upl…

5/

If you sell BP shares and buy Unilever, realising a taxable capital gain, is that the same as annual earnings?

If you sell a business after 40 years, is it still?

8/

- should it be measured/taxed on turnover or when it accrues, for example?

9/