New foreign-sector Treasury holding data out today; for the month of April (comes with a lag).

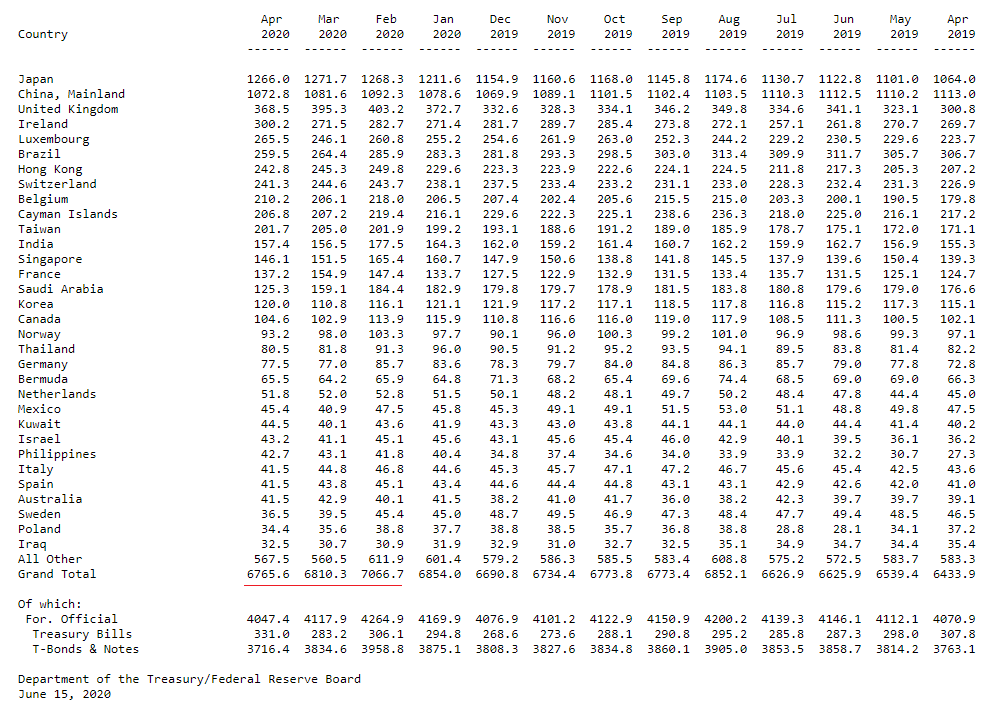

From Feb-end through April-end, the foreign sector sold over $300 billion in U.S. Treasuries.

From Feb-end through April-end, the foreign sector sold over $300 billion in U.S. Treasuries.

https://twitter.com/LynAldenContact/status/1254104595699322881

This likely bottomed in April, based on Fed Treasury custody data which comes out weekly (less complete data set, but much shorter lag).

When swap lines ramped up to provide USD liquidity, the foreign sector stopped selling Treasuries, and has since been buying some.

When swap lines ramped up to provide USD liquidity, the foreign sector stopped selling Treasuries, and has since been buying some.

The Treasury issued like $3 trillion in net Treasuries YTD, with very little purchased by the foreign sector. The majority of the issuance went onto the Fed's balance sheet.

The Fed accumulated more Treasuries in March and April than the foreign sector has in six years.

The Fed accumulated more Treasuries in March and April than the foreign sector has in six years.

• • •

Missing some Tweet in this thread? You can try to

force a refresh