Founder of Lyn Alden Investment Strategy. Blended finance and engineering background. Author of Broken Money. GP @egodeathcapital. BoD at Bakkt and @Swan.

242 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/LynAldenContact/status/1933333089947922707

Published in 1997, The Fourth Turning spoke of 80-100 year cycles of history, with each fourth one being a "crisis" period.

Published in 1997, The Fourth Turning spoke of 80-100 year cycles of history, with each fourth one being a "crisis" period.

Then, when I tried to search on Twitter for that certain platform that apparently can't be named, the search results would replace it with "newsletter" in my search of the network, which was kind of Orwellian:

Then, when I tried to search on Twitter for that certain platform that apparently can't be named, the search results would replace it with "newsletter" in my search of the network, which was kind of Orwellian:

Now, quantifying the actual federal workforce is actually nontrivial.

Now, quantifying the actual federal workforce is actually nontrivial.

Some people assume that the end of inflation means prices go down, but instead it just means the rate of change of prices decreases to the target rate.

Some people assume that the end of inflation means prices go down, but instead it just means the rate of change of prices decreases to the target rate.

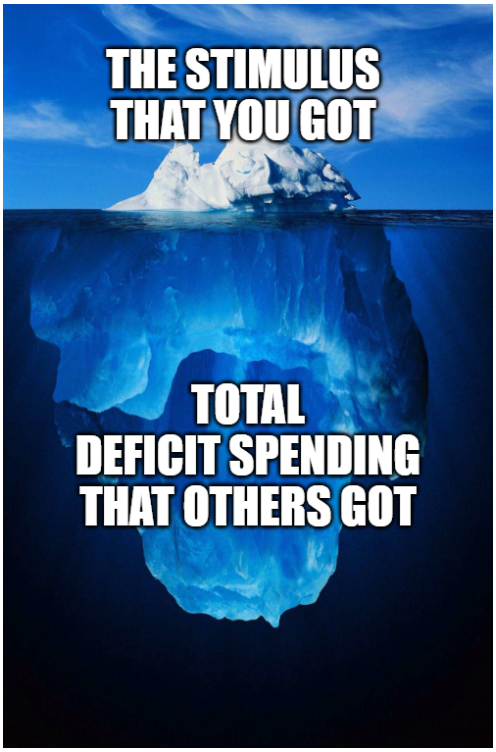

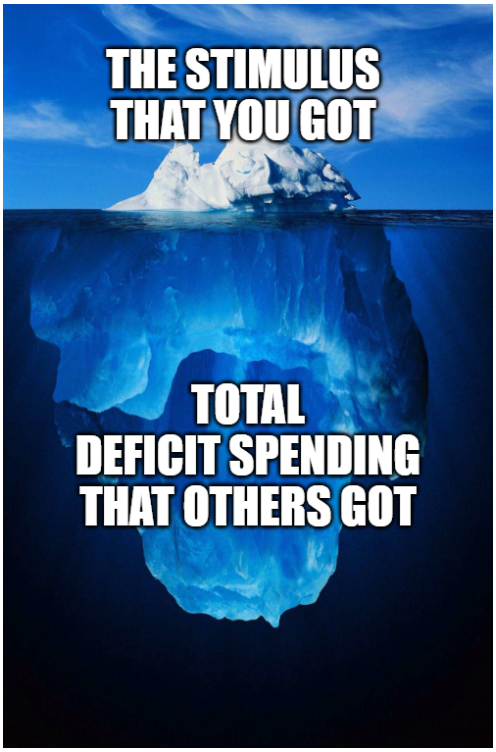

Some households received hundreds of thousands or even millions in stimulus.

Some households received hundreds of thousands or even millions in stimulus.

The Golden Monarch economically defeated all opposition and reigned supreme for thousands of years. Now ancient and wise, and having seen the entirety of history, he contemplates his diminishing role in the modern world and wonders if he could have done anything differently.

The Golden Monarch economically defeated all opposition and reigned supreme for thousands of years. Now ancient and wise, and having seen the entirety of history, he contemplates his diminishing role in the modern world and wonders if he could have done anything differently.

Unfortunately it goes both ways; sovereign debt crises tend to lead to war, and war tends to lead to sovereign debt crises.

Unfortunately it goes both ways; sovereign debt crises tend to lead to war, and war tends to lead to sovereign debt crises.

Egypt needed an IMF loan to keep their dollar-denominated debt in working order. And one of the conditions from the IMF was to devalue the currency, to try to improve import/export balance.

Egypt needed an IMF loan to keep their dollar-denominated debt in working order. And one of the conditions from the IMF was to devalue the currency, to try to improve import/export balance.

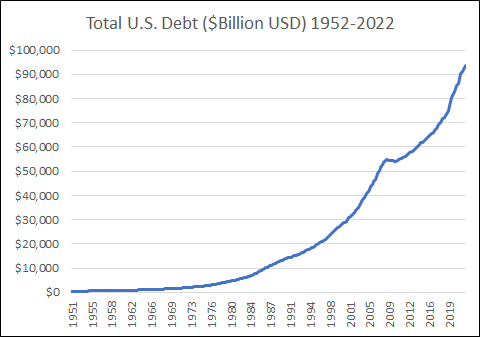

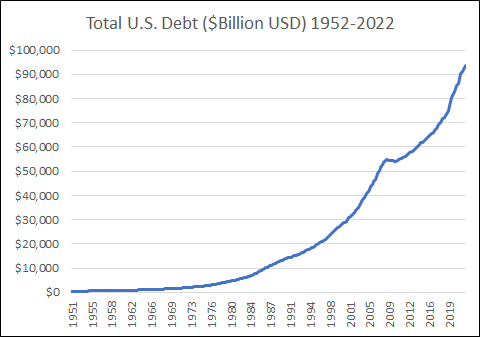

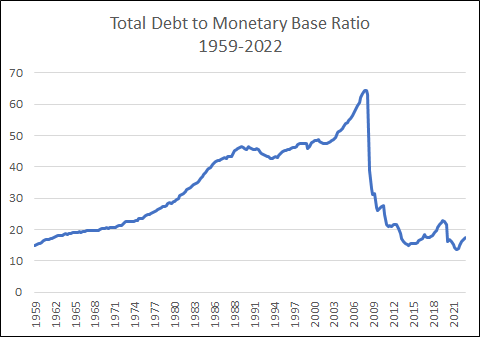

A debt is a claim for dollars. Going into the 2008/2009 crisis, there were $53 trillion claims for dollars and less than $900 billion ($0.9 trillion) in actual base dollars. It was a 63x ratio.

A debt is a claim for dollars. Going into the 2008/2009 crisis, there were $53 trillion claims for dollars and less than $900 billion ($0.9 trillion) in actual base dollars. It was a 63x ratio.

This chart shows year-over-year loan creation and fiscal deficits for the 1960s/1970s in absolute dollar terms (billion USD) compared to the prior year. Loan creation was a bigger source of money creation than deficits, and drove inflation.

This chart shows year-over-year loan creation and fiscal deficits for the 1960s/1970s in absolute dollar terms (billion USD) compared to the prior year. Loan creation was a bigger source of money creation than deficits, and drove inflation.