Shilpa Medicare Ltd

MCAP 4200 Cr , CMP 518 Good long term bet but buy at decline ( right now valuations are high )

1-Company is in API and Formulation business for domestic and international market .

MCAP 4200 Cr , CMP 518 Good long term bet but buy at decline ( right now valuations are high )

1-Company is in API and Formulation business for domestic and international market .

2- Total 6 manufacturing unit 2 API unit in Raichur , 1 API UNIT in Austria , 2 formulation unit in Jadcherla and Hyderabad and one unit for Biologicals in Hubli

3- R&D two unit one in Dharwad for biologicals and one in Bengaluru

4-API - both oncology and non oncology manufacturing. 5-formulations- oncology and adjuvant therapy - both oral solids and injectables , and non oncology injectable line started In Mar 20

4-API - both oncology and non oncology manufacturing. 5-formulations- oncology and adjuvant therapy - both oral solids and injectables , and non oncology injectable line started In Mar 20

6- Company is entering in Biologicals .

Biologicals-A biologic drug (biologics) is a product that is produced from living organisms or contain components of living organisms.

Biologicals-A biologic drug (biologics) is a product that is produced from living organisms or contain components of living organisms.

Biologic drugs include a wide variety of products derived by using biotechnology, like Lantus insulin and Botox injection You must have heard about Tocilizumab ( for corona treatment) which is also a biologic drug

Biologics are used to prevent, treat or cure a variety of diseases including cancer, chronic kidney disease, diabetes, cystic fibrosis, and autoimmune disorders.

Understand the Difference between Biologicals and Biosimilars

Biologic drugs are large, complex proteins made from living cells through highly complex manufacturing processes.

Biologic drugs are large, complex proteins made from living cells through highly complex manufacturing processes.

Unlike generic drugs, which are copies of chemical drugs, a biosimilar is a copy of a biologic medicine that is similar, but not identical, to the original medicine. It enters the market subsequent to a previously authorized version whose patent has expired

and is approved only after showing that it is “highly similar” to an approved biological product, known as a reference product, in terms of safety, purity, and potency, and in some cases efficacy, with allowable minor differences.

Their plant of Biologics will start very soon ( phase 1 ) Company is having 6 biosimilars and one new Biological in pipeline for autoimmune disorder and oncology and market size of all 6 biosimilars are around 43 billion dollars and revenue should be expected by Fy 21-22 onwards

7- Oral dissolving films and transdermal products- production will start in few months. Recently, fast oral dissolving films are gaining interest as an alternative of fast dissolving tablets.

The films are designed to dissolve upon contact with a wet surface, such as the tongue, within a few seconds, meaning the consumer can take the product without need for additional liquid. This convenience provides both a marketing advantage and increased patient compliance.

As the drug is directly absorbed into systemic circulation, degradation in gastrointestinal tract and first pass effect can be avoided. These points make this formulation most popular and acceptable among pediatric and geriatric patients and patients with fear of choking

Transdermal patch -is a medicated adhesive patch that is placed on the skin to deliver a specific dose of medication through the skin and into the bloodstream

main objective of transdermal drug delivery system is to deliver drugs into systemic circulation through skin at predetermined rate without major systemic side effects Transdermal patch unit will start in Dabaspet Bengaluru

8- Patent status

API. 200 filed 34 granted

formulation 83 filed 8 granted

Oral dissolving films 46 filed 2 granted

Biologic 6 filed 2 granted

API. 200 filed 34 granted

formulation 83 filed 8 granted

Oral dissolving films 46 filed 2 granted

Biologic 6 filed 2 granted

9- Formulation products USFDA and EU filing - 38 approved and 23 pending. 10-company exited JV OF CRAMS business , and ex CRAMS revenue CAGR 13.66%( because of low growth they exited)

11- Recently Launched first branded Generic version of Anti cancer Lenvatinib price which is over 50% lower than the existing brand available in India. 12Fy20 - recently enhance capacity of Tranexamic acid by 100% -Used to control Bleeding l

13- Recently acquire FTF Pharma Pvt. Ltd, which is involved in the research and development of generic, super generic and value-added generic drugs.

14- Picked 40% in Auxilla provides such services for the development of injectable solution and suspensions, lyophilised dosage forms, liposomal, microsphere and nano suspension dosage forms

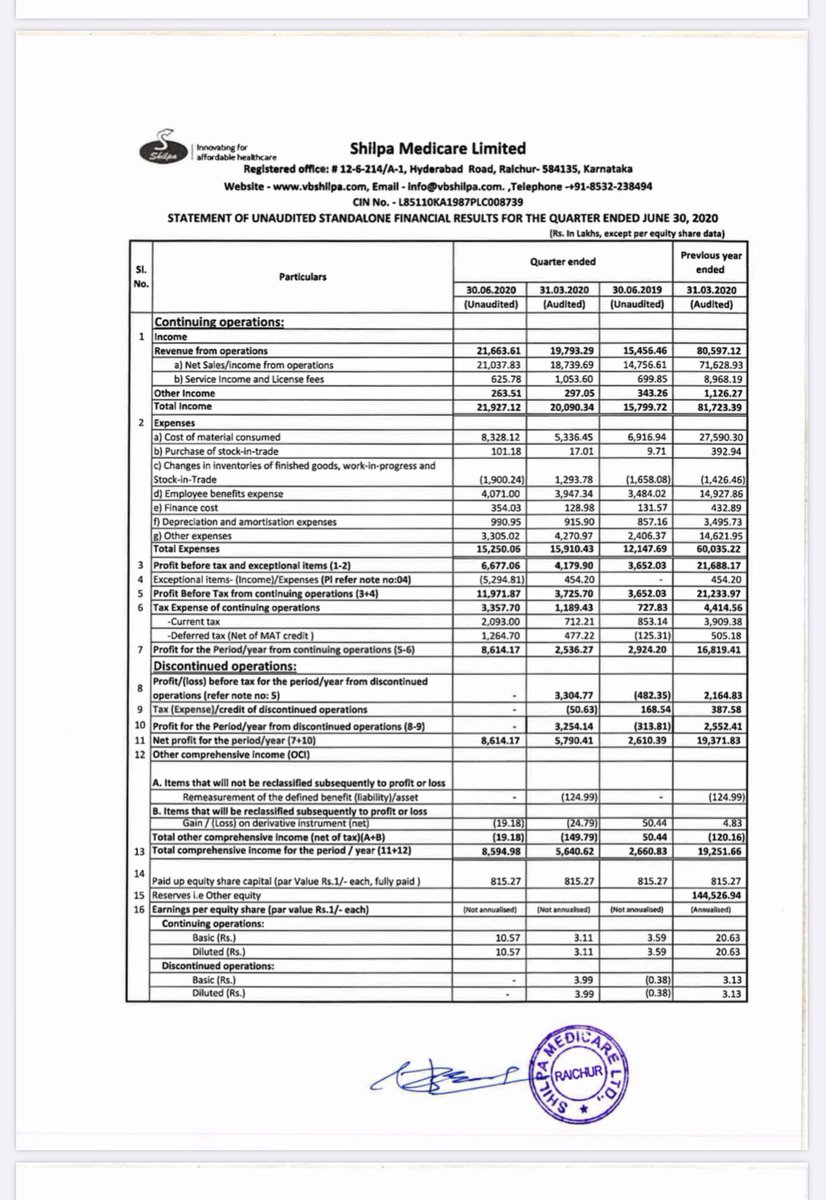

17- High receivable is a bad sign. Which is due to its entery in formulation business which generally entails relatively high receivables and inventory holding period as Compare to API segment. OPM from 19-21% in last few q debt 320 Cr

In My opinion it’s a long term growth story but we need to see their growth in biologics and transdermal and oral dissolving film segment. This is what I know please give your valuable opinion also .

@threadreaderapp unroll

@threadreaderapp unroll

Shilpa Medicare Limited today launches the Indian branded generic of Axitinib, an tyrosine kinase inhibitor drug with a brand name AXISHIL.

AXISHIL is used to treat patients suffering from Advanced Renal Cell Carcinoma (RCC).

This novel targeted therapy attacks cancer cells without damaging normal cells, thus causing fewer side effects.

This novel targeted therapy attacks cancer cells without damaging normal cells, thus causing fewer side effects.

There has been a significant improvement in survival ratcs in paticnts with advanced renal cancer duc to advent of this novel targeted therapy.

Currently the monthly therapy cost of innovator is approximately 1.66 Lacs and with the launch of AXISHIL, monthly cost of treatment will be reduced drastically to Rs. 14940/-.

@threader_app compile

#Shilpa Medicare - 2 interesting development

1- Launching green tea films- revolutionary technology

2- Formed new subsidiary ( According to AR ) for albumin manufacturing .

1- Launching green tea films- revolutionary technology

2- Formed new subsidiary ( According to AR ) for albumin manufacturing .

#Shilpa Medicare - oral dissolving film portfolio ( vitamin D3 and montelukast )

#Shilpa Medicare- Biologicals and Biosimilars- Read their comment -strengths in development of continuous bio processing that could disrupt current market pricing- Price war in biologics .

• • •

Missing some Tweet in this thread? You can try to

force a refresh