Why am i bullish on @synthetix_io exchange

With an emphasis of their upcoming implementation of futures

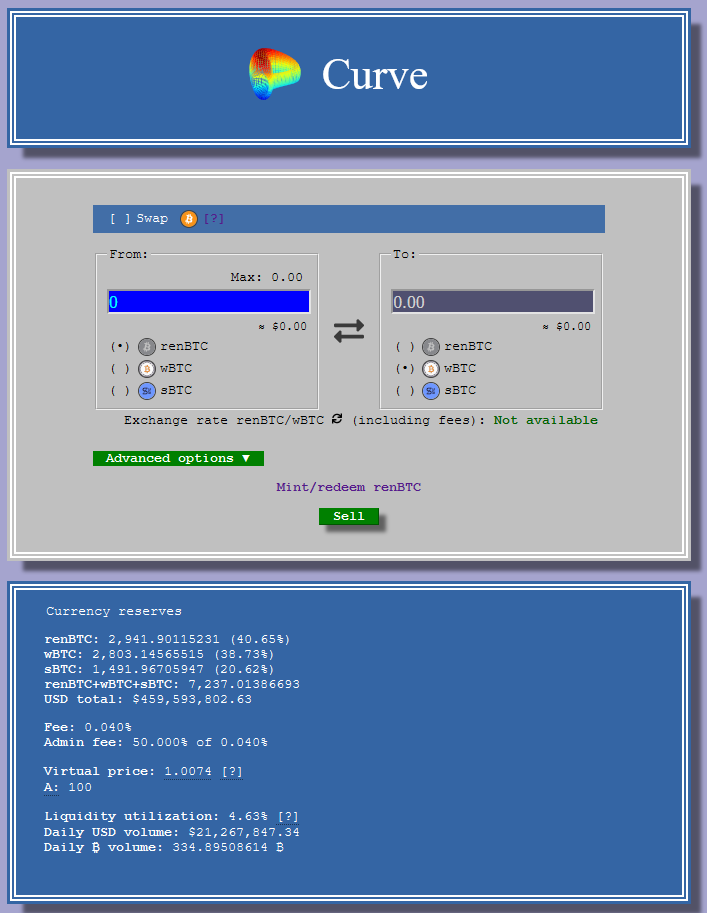

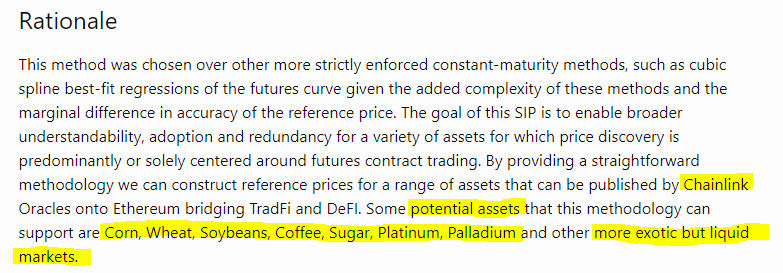

Synthetix started with a collateralized debt pool to create synthetic assets that track price feeds of real world assets via Chainlink oracles

https://twitter.com/Gasman404/status/1263484479630237696

So far, they have created synthetic tokens for many fiat currencies, gold, silver, btc & the index of the London & Japanese stock exchanges

As a trader, you can convert any synthetic asset to another at the prevailing spot price, with 0% slippage

As a trader, you can convert any synthetic asset to another at the prevailing spot price, with 0% slippage

https://twitter.com/synthetix_io/status/1267263288984797184

This is possible as the holders of the synthetic assets are essential trading against the debt pool created by minters

Their job is to hedge the debt created by traders & for their service they receive a share of the fee revenue from the exchange

Their job is to hedge the debt created by traders & for their service they receive a share of the fee revenue from the exchange

With Decentralized Futures coming soon

Traders will be able to take up to, and likely over 100x leverage

The advantage of trading against a debt pool is that orders & stops will execute at the intended price

Traders will be able to take up to, and likely over 100x leverage

The advantage of trading against a debt pool is that orders & stops will execute at the intended price

https://twitter.com/Arthur_0x/status/1237273876226138113

This solves the huge pain point of slippage & low liquidity on futures

They can be confident in the risk they have calculated & size accordingly

This also opens the door to leveraged trading of alt/btc pairs, which has been hard to achieve in the past due to thin order books

They can be confident in the risk they have calculated & size accordingly

This also opens the door to leveraged trading of alt/btc pairs, which has been hard to achieve in the past due to thin order books

Think of the debt pool created by minters as the house at a casino

If traders win, minters have to pay back more debt to unlock their collateral

But as a minter, I can sit comfy knowing that ~90% of traders lose overtime & the high leverage offered will only amplify this trend

If traders win, minters have to pay back more debt to unlock their collateral

But as a minter, I can sit comfy knowing that ~90% of traders lose overtime & the high leverage offered will only amplify this trend

For a MC of just 215M, you can own a share in the house of what could be the largest global online venues for traders of all types

The unique system of trading against the debt pool gives a clear reason for traders to migrate from CEX's

The unique system of trading against the debt pool gives a clear reason for traders to migrate from CEX's

With the ability for anyone with an Ethereum wallet to access the exchange, regardless of the security laws or Geo-blocking in their region, i can truly see Synthetix dominating the market for decentralized futures over the next few years

Security wise, all synthetic assets in the system are covered by ~750% of collateral. This will move lower overtime.

The liquidation method being added ensures solvency & incentivizes minters to stay overcollateralized

The liquidation method being added ensures solvency & incentivizes minters to stay overcollateralized

https://twitter.com/DegenSpartan/status/1268169722006130688

I have high confidence in the team to execute the plan & remain censorship resistant overtime

Along with the recent IPFS hosting that was deployed, they have a plan on transitioning to a system of decentralized governance overtime

Truly unstoppable ⚔️

blog.synthetix.io/transition-to-…

Along with the recent IPFS hosting that was deployed, they have a plan on transitioning to a system of decentralized governance overtime

Truly unstoppable ⚔️

blog.synthetix.io/transition-to-…

Lastly - While Synthetix is a DEX, it will not be sacrificing decentralization for better UX/speed as the exchange will be operational on ETH's Layer 2 via @optimismPBC

Having tested the demo, i can confirm it is as fast as any CEX i have ever used 🌈

medium.com/ethereum-optim…

Having tested the demo, i can confirm it is as fast as any CEX i have ever used 🌈

medium.com/ethereum-optim…

• • •

Missing some Tweet in this thread? You can try to

force a refresh