How to get URL link on X (Twitter) App

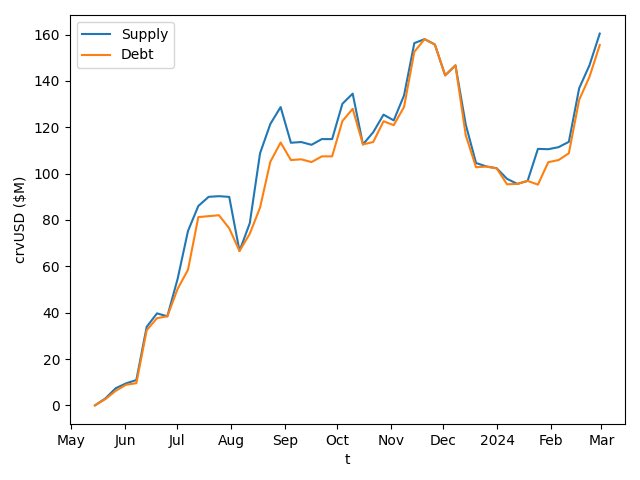

1 - crvUSD growth trend is up only

1 - crvUSD growth trend is up onlyhttps://x.com/curvefinance/status/1763000153659850916?s=46

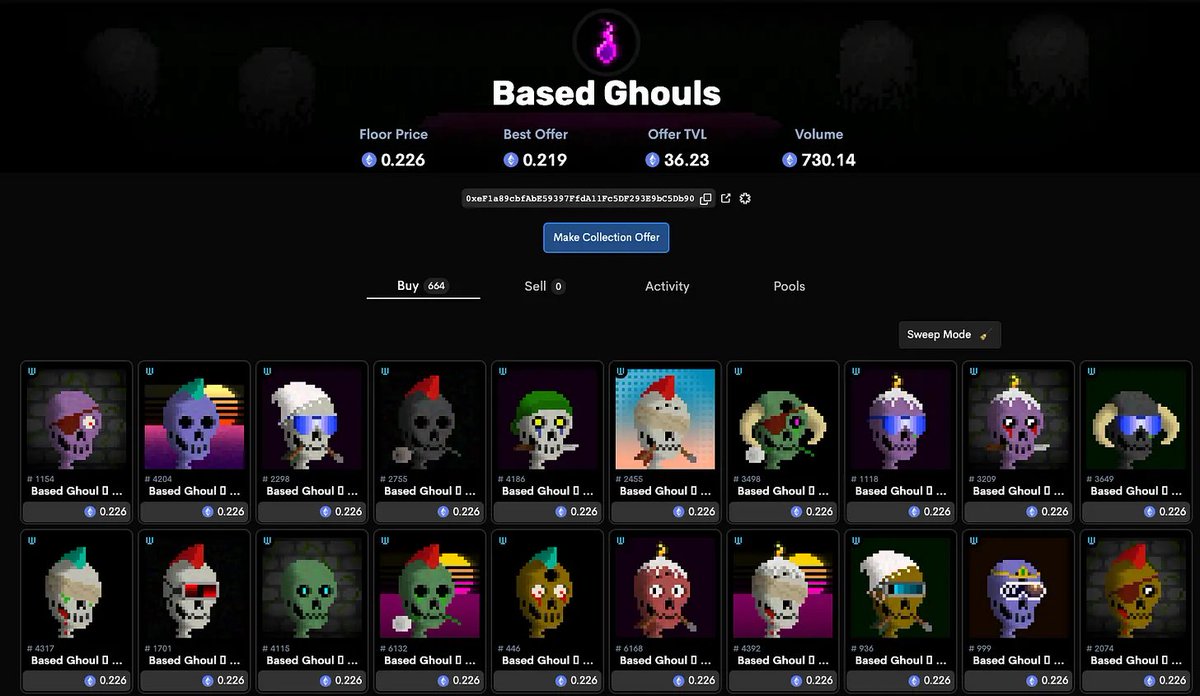

1/ $SUDO - @sudoswap - $93 mc

1/ $SUDO - @sudoswap - $93 mc

Drops thread on their new tool SweepMax

Drops thread on their new tool SweepMaxhttps://twitter.com/dropsnft/status/1588597976674766848?s=20&t=uWFbdRhkDE8IT5-83ueikA

Primer - The idea to use synths to power cross pool swaps originated late last year as a white swan event

Primer - The idea to use synths to power cross pool swaps originated late last year as a white swan eventhttps://twitter.com/pythianism/status/1289228340721672196

1/ As of last month all price feeds are now provided & secured by Chainlink

1/ As of last month all price feeds are now provided & secured by Chainlink

https://twitter.com/hasufl/status/129468150858275226432min-40min

https://twitter.com/Gasman404/status/1263484479630237696So far, they have created synthetic tokens for many fiat currencies, gold, silver, btc & the index of the London & Japanese stock exchanges

https://twitter.com/synthetix_io/status/1267263288984797184