#TweetStorm - 1) The Curious Case of #GlenmarkPharma and #Favipiravir. The The number of articles on Favipiravir and Glenmark Pharma have shot through the roof. We will look at it from a price,volumes and search perspective.

Stock price shot up 40% in the day and closed 27% on 22nd June 2020. Added almost a 3000-4000 cr market cap coz of this move.

Stock price fell 6.7% on 23rd June 2020.From a low of 160-200 in March the stock has moved up to 500+ but is still down from peaks of 1250.

Stock price fell 6.7% on 23rd June 2020.From a low of 160-200 in March the stock has moved up to 500+ but is still down from peaks of 1250.

The total number of shares of the #GlenmarkPharma are 28.2cr shares. 1.55 cr delivery volumes on 22nd June 2020 means almost 5.5-6% of the company shares in delivery volumes. Add another 2-2.5% today.

Almost 11-13% of Free Float got delivered on 22nd June 2020 !! Pic @stockedge

Almost 11-13% of Free Float got delivered on 22nd June 2020 !! Pic @stockedge

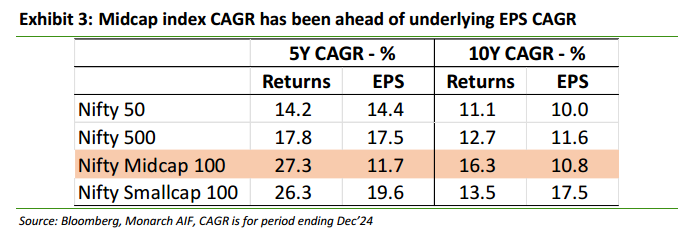

Even though the company is categorized as a Midcap and SEBI Classification hardly any Mutual Fund owns it apart from HDFC Mutual Fund as of May 2020 – Source – . Also over the years Mutual Fund holding has remained almost low at 2-4% of equity even in Pharma Bull Run.

FPIs own around 28.51% of the shareholding down from a peak of 36% in 2015. For

Only one known investor – Ashish Dhawan is seen in the shareholding in last 2 quarters with a 1-1.25% stake.

For a 10000-15000 crore market cap company its unusual that almost no Mutual Fund owns it.

Only one known investor – Ashish Dhawan is seen in the shareholding in last 2 quarters with a 1-1.25% stake.

For a 10000-15000 crore market cap company its unusual that almost no Mutual Fund owns it.

It would be interesting to see almost 700-1000 cr value of Glenmark traded was bought by whom.

The shareholding at the end of the quarter will tell us if Mutual Funds or FIIs bought or it was all Retail !!

The shareholding at the end of the quarter will tell us if Mutual Funds or FIIs bought or it was all Retail !!

The Revenue estimates for Favipiravir drug for Glenmark is not more than a 100 cr or a few 100 crs at max. This led to a 3000-4000 cr market cap gain.

The Search Trends for #Glenmark & #Favipiravir have gone through the roof in India and the World. Google Trends for last 5 mths

The Search Trends for #Glenmark & #Favipiravir have gone through the roof in India and the World. Google Trends for last 5 mths

• • •

Missing some Tweet in this thread? You can try to

force a refresh