A specialty chemical co. into mfg of AROMA CHEMICALS, NUTRACEUTICALS & OLEOCHEMICALS.

-Its parent co. Fairfax Holding owned by Billionaire Investor PREM WATSA.

- Fairchem came into exitence in after FAIRFAX INDIA HOLDINGS acquired 45% stake in Adi Finechem in 2015.

- ADI n PRIVI r stil managed by the same promoters n they still hold stake in Co.

- Although Fairchem is 1 entity but there are two business running under it

-But mgt later realized that both these businesses r different in nature in order for them to grow they should be separated.

Since there are two businesses running under one umbrella its imp to understand both of these.

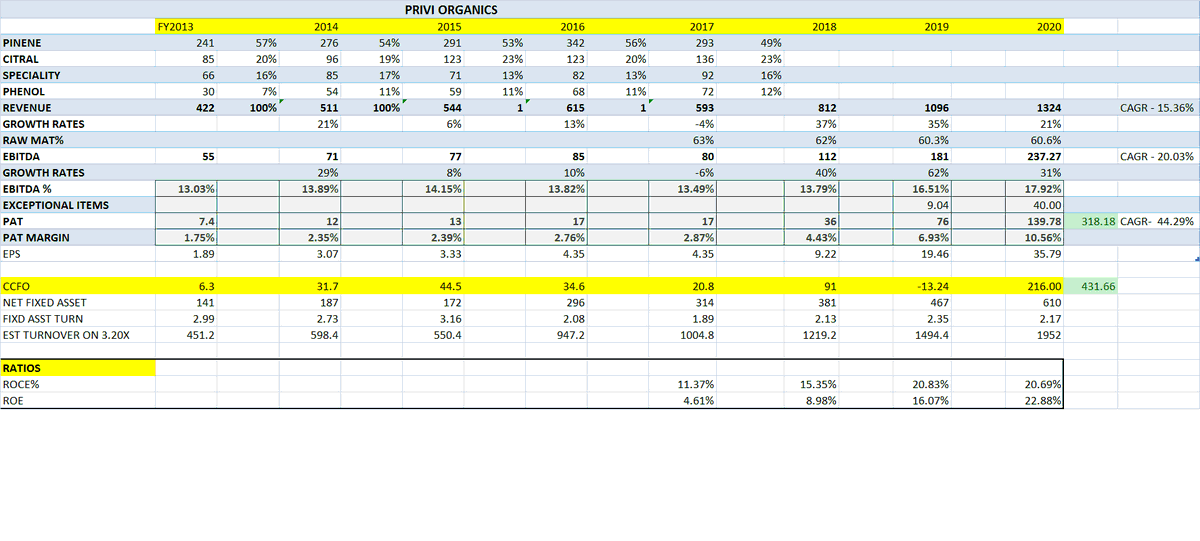

PRIVI ORGANICS - Its in Mfg of Aroma chemicals using waste products from Pulp n Paper Mills.

These are used in day to day items like soaps,perfumes,hair oil etc.

-Aroma Chemicals is the Fastest Growing Segment Within F&F industry, current market size is over $5bn (37500cr)

-Privi's major products are from PINENE BASED wch r derived from pine trees.

-Petrochem & Pine based Aroma Chemicals Constitute ~70% Of Global Aroma Chemicals Market

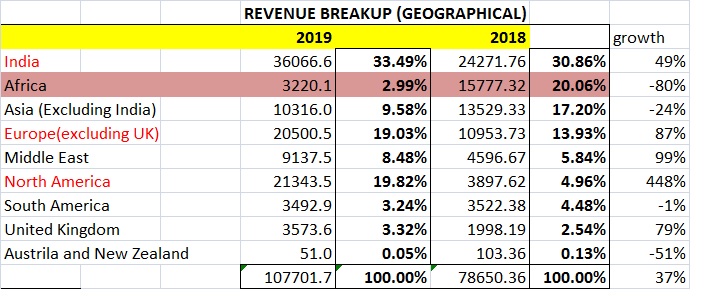

-Clients:Givaudan, Firmenich, IFF, Takasago, P&G,

Henkel

-Growth in Middle Class consumption in

Emerging Economies to be key

market driver

-Low chinese competition.

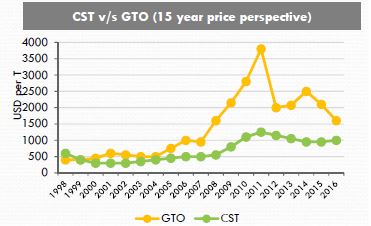

either to use GTO(GUM TURPENTINE OIL) OR CST(CRUDE SULPHATE TURPENTINE)

-Majority of players use GTO bcz its widely available(China is Major supplier) but the risk is its prices r highly volatile therefore effecting margins

-It has got 3plants - 2 in Mahad,Maharashtra , 1 in Ankleshwar Gujarat.

-Total capacity about 31000 MTPA vs 22000 MTPA IN 2017

Fixed assets in Mar '20 - 746cr vs 583cr (inc. CWIP)

-PEAK ASSET TURNOVER : 3-3.25X

-Capex plan of Rs100cr p.a. ( Before COVID-19 )

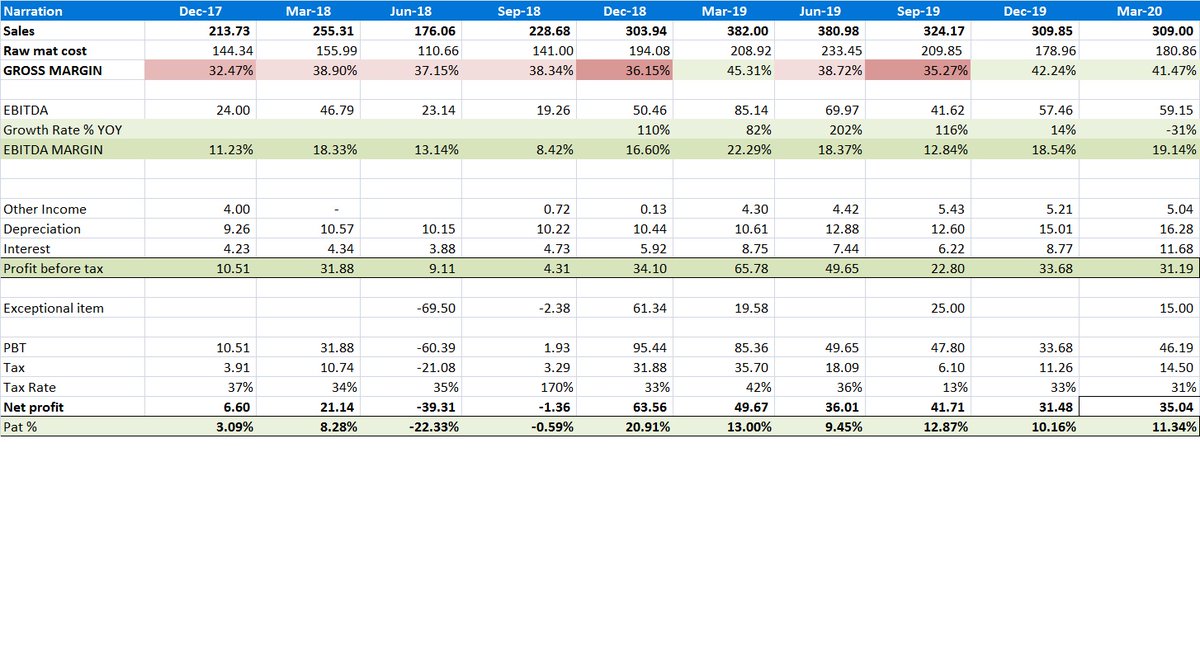

Since Consolidated No's contains data of both entities PRIVI N ADI it would be difficult to bifurcate between two.

Standalone is purely ADI finechem.

Have been able to bifurcate the two businesses.

Kindly let me know in case of any error in data.

RISKS:

- Demand wl be impacted as it caters to Fragrance Comp. majorly used in perfumes, soaps etc.

-As co. ws expanding aggressively -ve Op. Leverage wl come into play in case of lower utilization.

Would be grateful if anyone can share more negatives about the Co.

Disclosure: Invested