12+Years in markets| Stocks | Stocks discussed are not a reco. | Politics | Proud Indian

7 subscribers

How to get URL link on X (Twitter) App

markets of India, primarily in Bengal, Bihar, Jharkhand, Assam etc.

markets of India, primarily in Bengal, Bihar, Jharkhand, Assam etc.

They are currently into three segments

They are currently into three segments

https://twitter.com/aditya942000/status/1631653217288466435-Moving towards 100% in-house mfg.

🌋These lining are designed to withstand very high temperatures (>1,200°C) without effecting the molten metal inside.

🌋These lining are designed to withstand very high temperatures (>1,200°C) without effecting the molten metal inside.

Firstly lets have a look on how the co evolved over a period of time.👇

Firstly lets have a look on how the co evolved over a period of time.👇

Have been launching new and Innovative products.

Have been launching new and Innovative products.

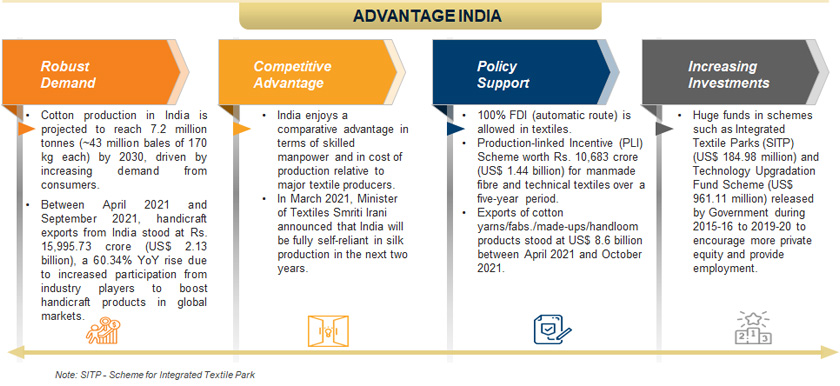

-Ban on imports from China's Xinjiang region

-Ban on imports from China's Xinjiang region

👉So, Oberoi Realty is already a reputed brand name in MMR market.

👉So, Oberoi Realty is already a reputed brand name in MMR market.

👉They enjoy around 30%+ Ebitda margins in IMIL segment (earlier they were 20%+)

👉They enjoy around 30%+ Ebitda margins in IMIL segment (earlier they were 20%+)

📲Route Mobile Ltd (RM) provides cloud-communication platform as a service (CPaaS) to enterprises, over-the-top (OTT) players & mobile network operators (MNOs).

📲Route Mobile Ltd (RM) provides cloud-communication platform as a service (CPaaS) to enterprises, over-the-top (OTT) players & mobile network operators (MNOs).

https://twitter.com/Nigel__DSouza/status/1348477745567682560?s=20

👉Online sales contribute 20%+ of total Rev.

👉Online sales contribute 20%+ of total Rev.

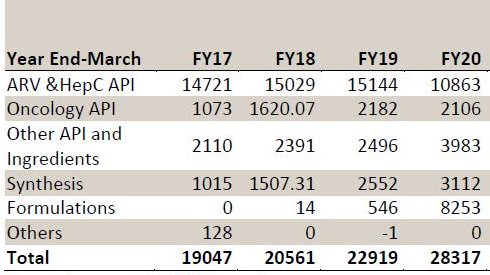

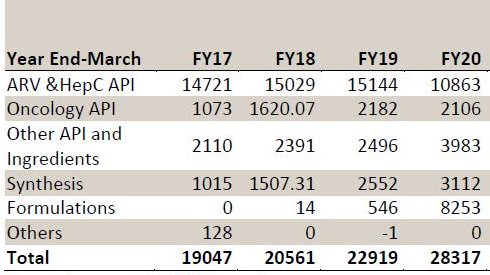

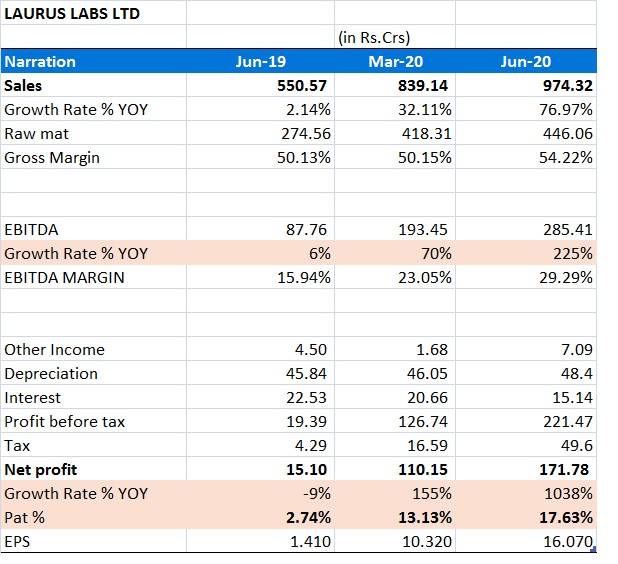

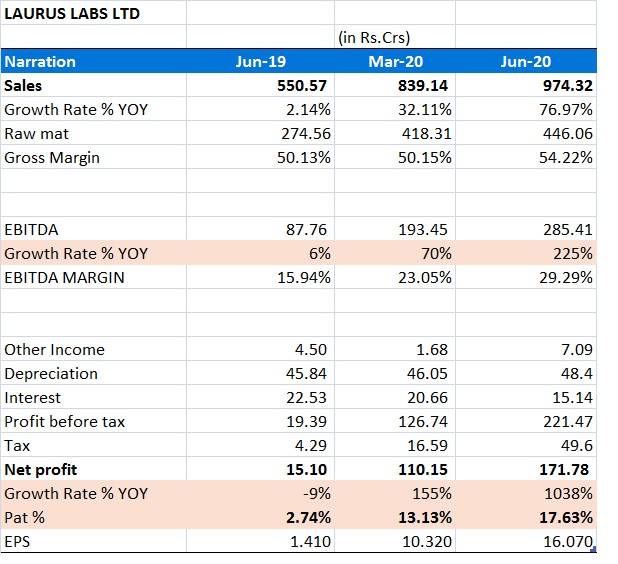

Co. has successfully derisked its business from mainly an ARV API co. to diff segments.

Co. has successfully derisked its business from mainly an ARV API co. to diff segments.