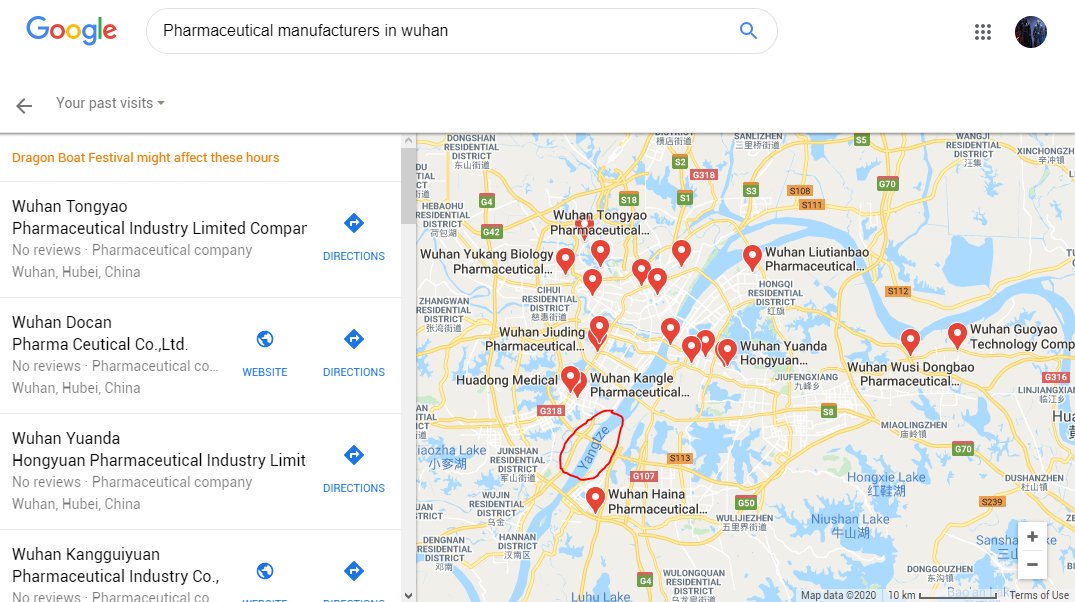

Some ask, "in what way can #3GD & Wuhan flooding affect us outside of China?" In MANY ways; 1 way is: 80-90%+ basic pharma drug material world uses (97% antibiotics US uses) comes from Wuhan China. Most of those factories sit next to Yangtze.

Flooded Wuhan = global drug shortage

Flooded Wuhan = global drug shortage

#ThreeGorgesDam #ChinaFloods

All the record floods so far are only appetizers.

The entree is coming in mid Summer. I can't imagine how will Wuhan & Shanghai look like when #3GD discharges water in full capacity.

All the record floods so far are only appetizers.

The entree is coming in mid Summer. I can't imagine how will Wuhan & Shanghai look like when #3GD discharges water in full capacity.

https://twitter.com/PavewayIV/status/1277354573376761858

Looks like this potential danger finally catches more people's attention

https://twitter.com/Jkylebass/status/1284130482003877889?s=19

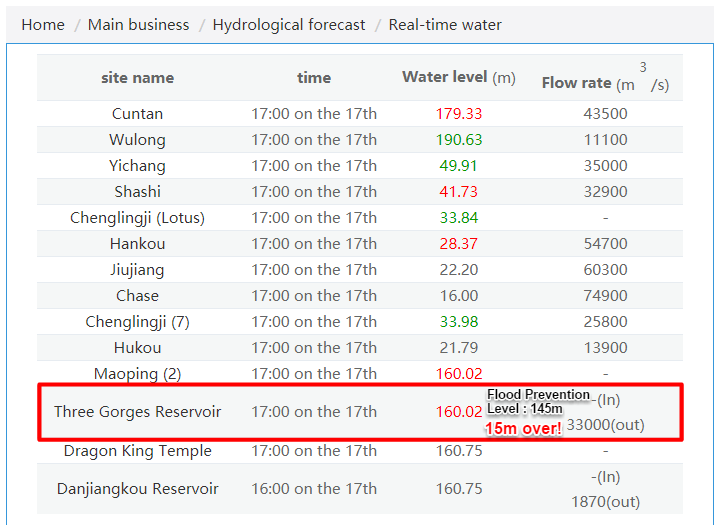

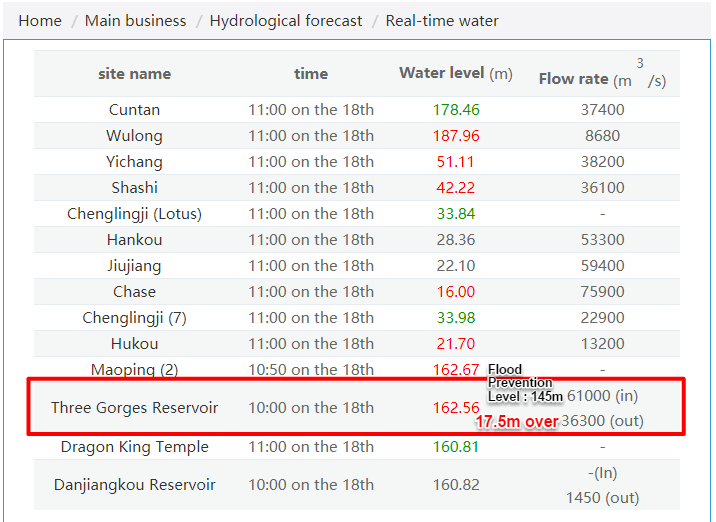

Water level rises fast at #3GD. Greater water discharge is coming in days/weeks ahead.

For those who is interested to see this data, the ONLY way to see them in English is to open this page in Chrome, right click on page, select "Translate to English"

cjh.com.cn/swyb_sssq.html

For those who is interested to see this data, the ONLY way to see them in English is to open this page in Chrome, right click on page, select "Translate to English"

cjh.com.cn/swyb_sssq.html

I think this is getting REAL !

@chigrl @Rosemary100 @Jkylebass

@EricSr10560351 @Braversa

@chigrl @Rosemary100 @Jkylebass

@EricSr10560351 @Braversa

https://twitter.com/BusinessTimes/status/1284392980560912386?s=19

Wow, water is rising very fast. Yesterday late afternoon was only at 160m, not even 24 hrs, it's at 162.5m! This speed can reach #3GD top in a week. #3GD has to greatly increase water discharge; and that means great flood for downstream.

https://twitter.com/skywalker_2k/status/1284268968732024832

• • •

Missing some Tweet in this thread? You can try to

force a refresh