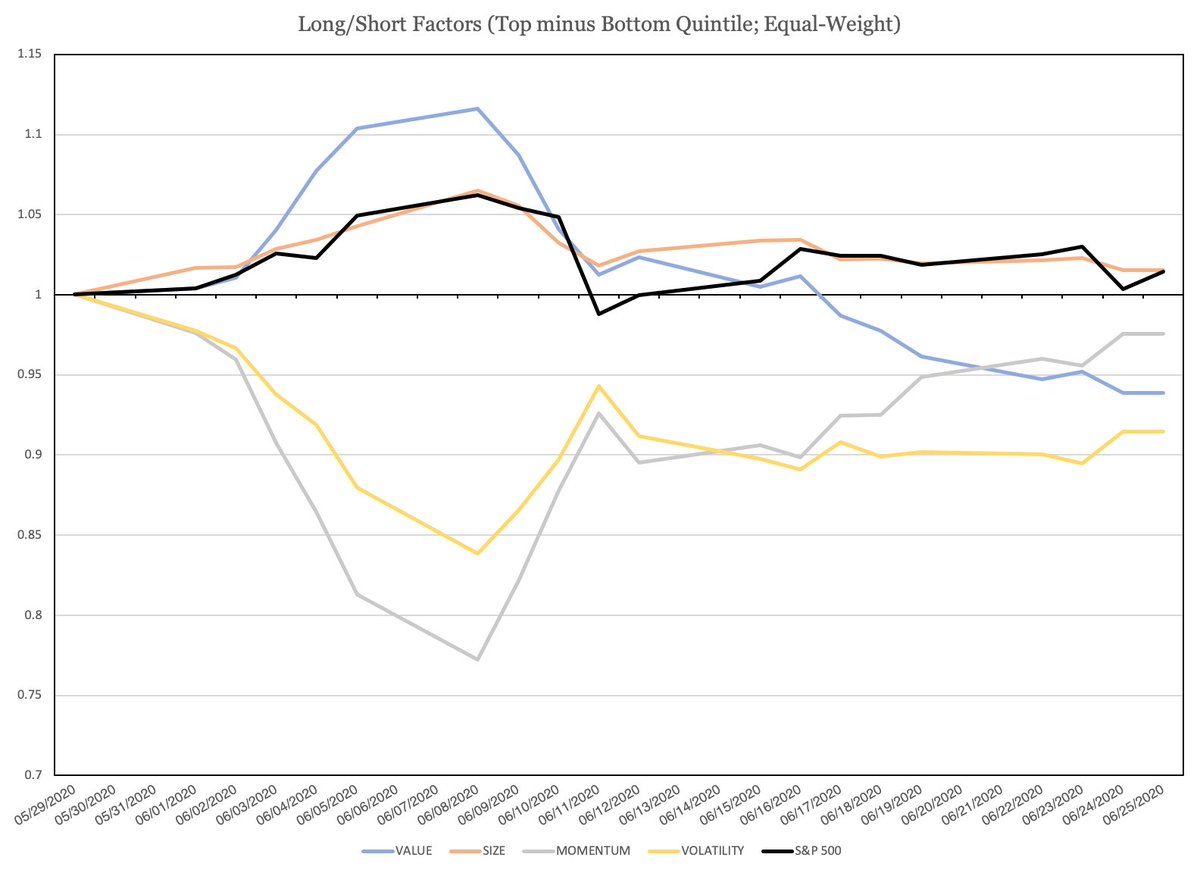

Is that healthy? No comment. I will say that it’s not unusual to see a momentum crash in a market recovery.

e.g. you trade value and your buddies trade momentum and low volatility. You get a margin call and need to de-lever. The more overlap in holdings you have, the more you impact their returns.

I have zero explanation for the early June ramp other than an “unwind” of a factor convergence that occurred due to the overwhelming influence of a “COVID-19” factor that gripped markets in March.

FIN.