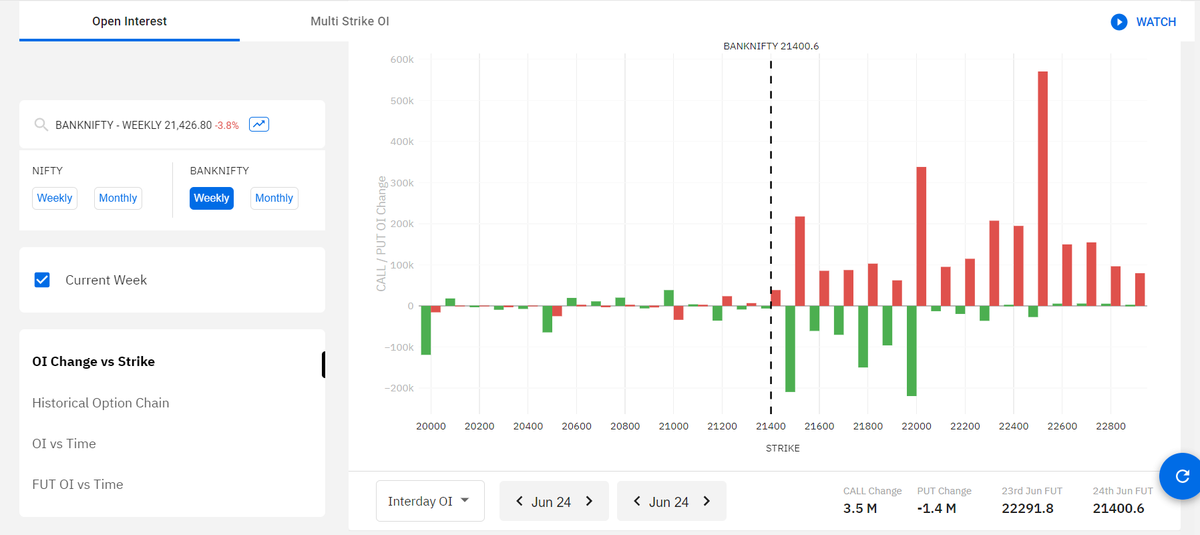

Here is Thread on Bank Nifty : -

Total last 13 years of data Captured -

Note - Bank Nifty Far OTM options are very illiquid during month starting , ensure proper liquidity before entering trade . only 500 points away strikes are liquid.

Banknifty is very volatile than nifty

Total last 13 years of data Captured -

Note - Bank Nifty Far OTM options are very illiquid during month starting , ensure proper liquidity before entering trade . only 500 points away strikes are liquid.

Banknifty is very volatile than nifty

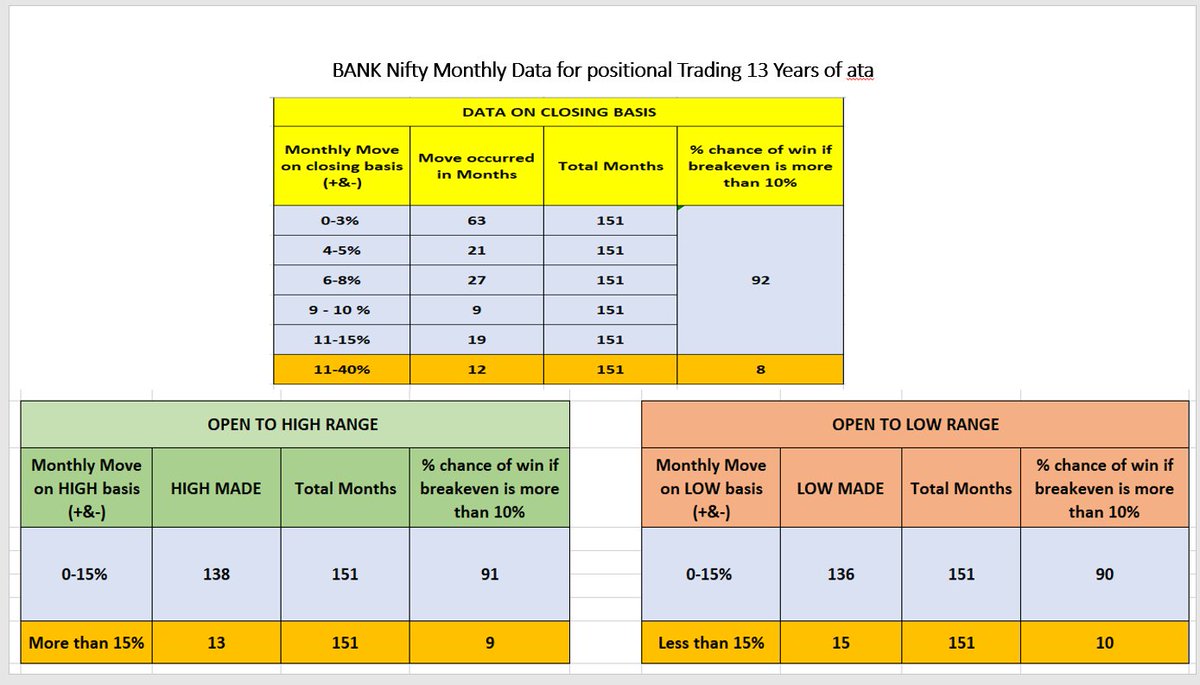

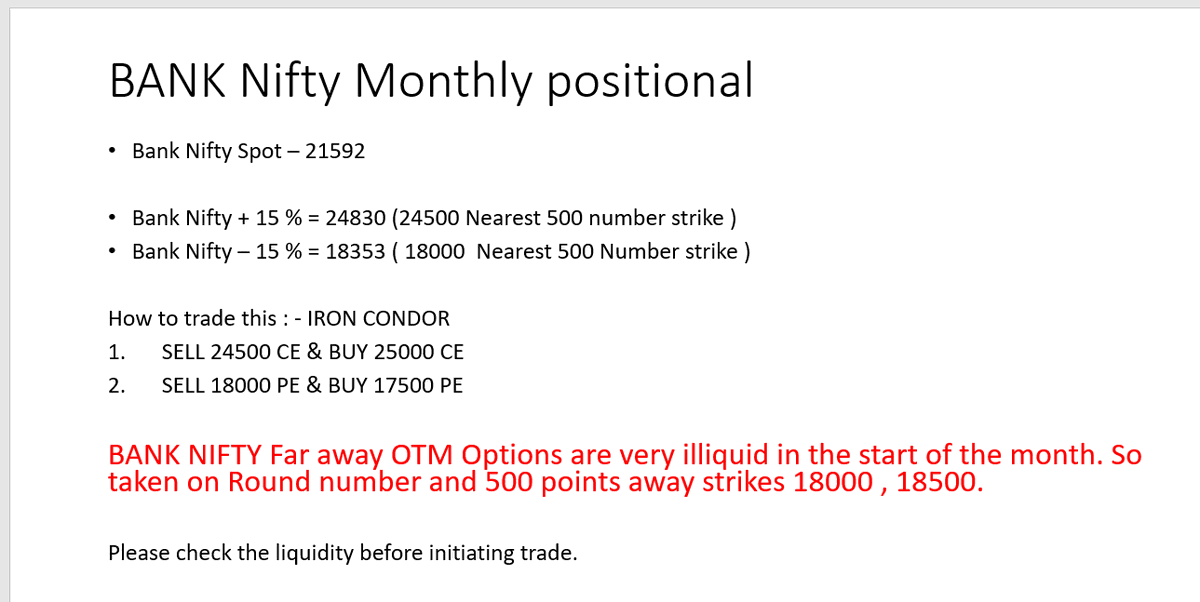

Starting with Bank Nifty Monthly data - see below pic - Data collected for past 151 month . focus on light blue area . As per data 90% of the time Nifty closed within +-15 % range from spot .

90% of the time it has not crossed 15% on higher side and also on lower side from spot

90% of the time it has not crossed 15% on higher side and also on lower side from spot

That Means if we sell options beyond 15% with hedge we can easily earn some profit every month .

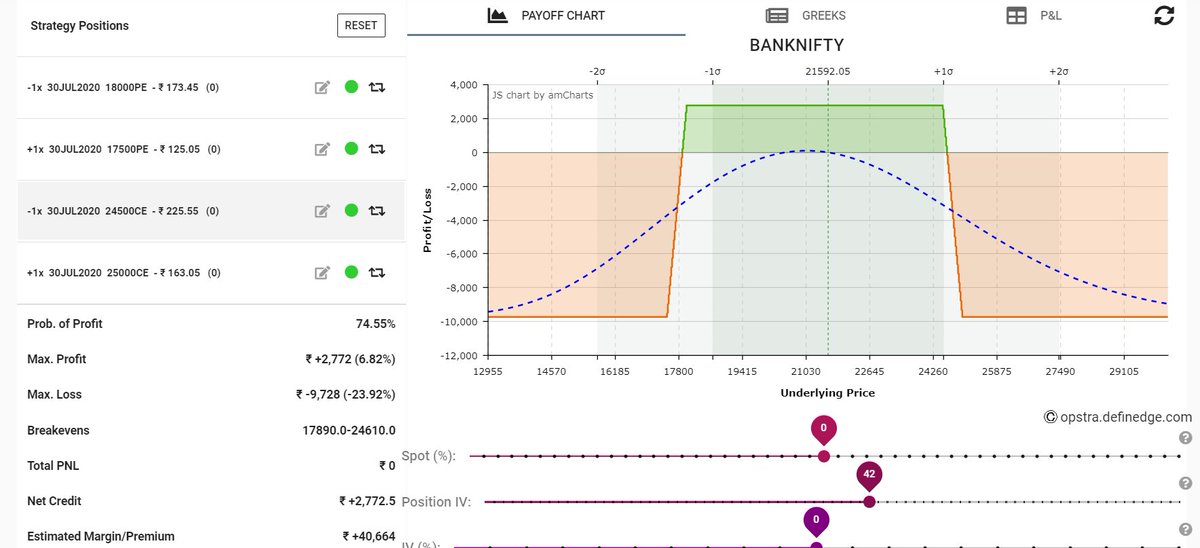

See below pic - for strategy

See below pic - for strategy

See in this strategy, we shorted options beyond 15 % . That means we will be accurate 90% of the time as per past data . also we initiated risk defined strategy , means our loss is also limited if strategy went wrong .

Now when to enter and when to exit : - Enter on first week of expiry month

Exit – if ur getting more than 2% returns on capital exit or exit/adjust if the break even point on either side is touched .

For monthly strategy this thread ends here .

Next is weekly data : -

Exit – if ur getting more than 2% returns on capital exit or exit/adjust if the break even point on either side is touched .

For monthly strategy this thread ends here .

Next is weekly data : -

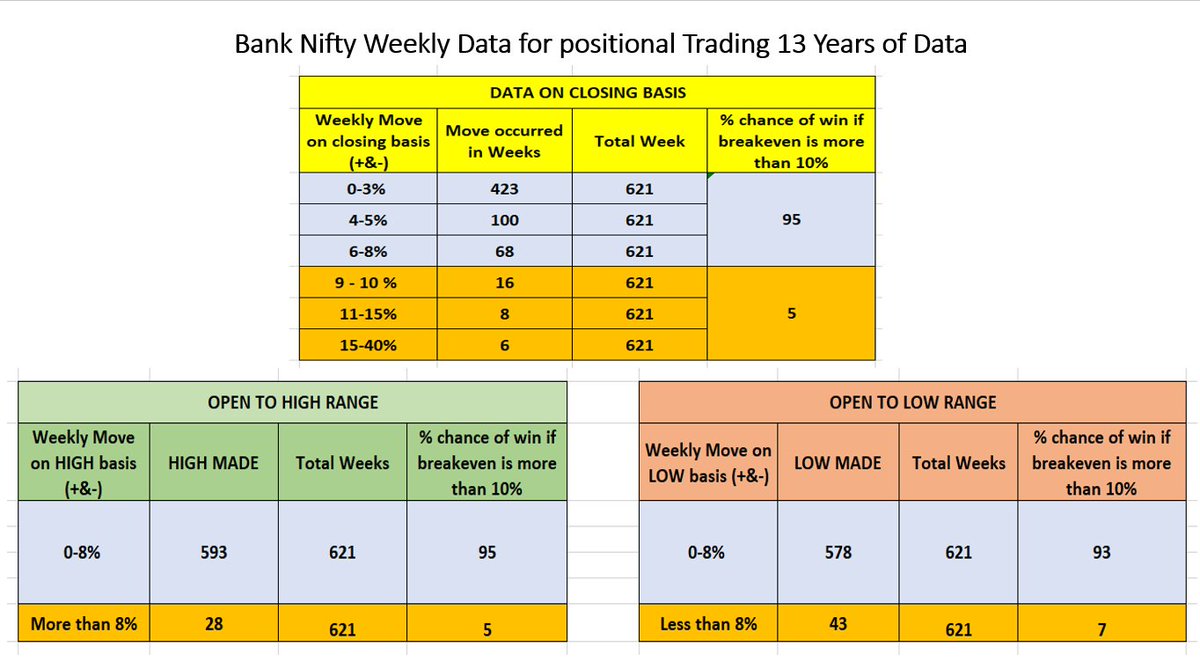

See below Pic . 621 Weeks data analysed. As per data 95% of the time BankNifty trades withing 8 % range on weekly time frame .

That means if we sell Banknifty weekly options beyond 8% range with hedge we can earn some profit every week .

That means if we sell Banknifty weekly options beyond 8% range with hedge we can earn some profit every week .

General observations: -

1. Weekly options are very volatile as compared to monthly .

2. If ur getting 1% return on your strategy just exit and relax 3. If ur getting Max 1-2 % loss on your strategy , just exit and relax .

1. Weekly options are very volatile as compared to monthly .

2. If ur getting 1% return on your strategy just exit and relax 3. If ur getting Max 1-2 % loss on your strategy , just exit and relax .

4. If ur breakeven is more than 8% on both side . you entered on Friday at 15:00 Hrs & Monday opening is flat then you will get 1% returns on Monday itself . So exit and book profit , wait for next Friday.

Risk :- BIG GAP UP OR GAP DOWN .

Risk :- BIG GAP UP OR GAP DOWN .

Good strategies : - Iron condor Ratio spreads on both call and put side . Bear Call and Bull Put spread based on view . Always create risk defined strategies .

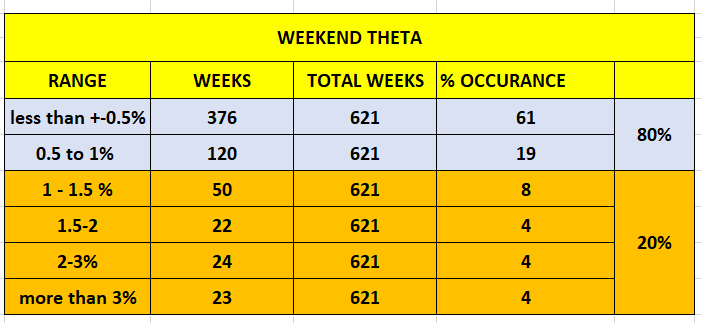

Those who wants to capture weekend Theta following data is for you : - As per data 80 % of the time Bank Nifty opened flat may be up 0.5% - 1% range from fridays closing .

see pic below

see pic below

COMBINE BOTH WEEKLY POSITIONAL AND WEEKEND THETA STRATEGY IN A SINGLE STRATEGY. CREATE ONE STRATEGY HAVING BREAKEVEN POINT MORE THAN 8 % ON BOTH SIDE . ENTRY – FRIDAY 15:00 HRS . EXIT – MONDAY 09:30 HRS. OR 2% LOSS SL EXIT.

RISK - BIG GAP-UP / GAP DOWN

RISK - BIG GAP-UP / GAP DOWN

Here is data for Pre-Expiry trade idea : -

That is Wednesday to Thursday. This data is important because if Banknifty opened Flat OTM as well as ATM option premium melts 35-40% in the opening itself . Far OTM premiums will get zero in the opening. Data Analysed for 621 weeks .

That is Wednesday to Thursday. This data is important because if Banknifty opened Flat OTM as well as ATM option premium melts 35-40% in the opening itself . Far OTM premiums will get zero in the opening. Data Analysed for 621 weeks .

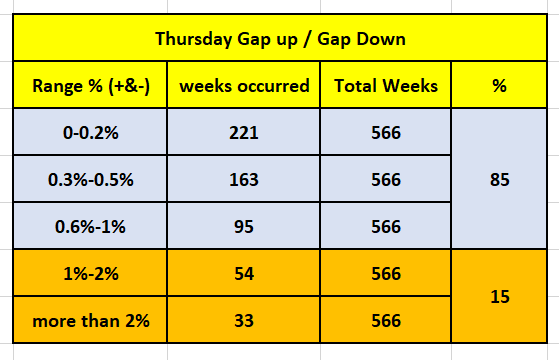

566 Weeks is 12 years data . Again focus on light blue area . I am considering +& -0.5% gap up or gap down as flat opening as per my previous experience. it may vary person to person. why this data is important . see next .

PIC

PIC

As per data Bank Nifty opened flat 80% of time . That meant 80% of time premium erode 40% in the opening itself . If we develop option strategy which can handle 1-2% gap easily , then we can mint some money here in every expiry

Here also big RISK is GAP UP / GAP DN beyond 2%

Here also big RISK is GAP UP / GAP DN beyond 2%

Initiate risk defined Strategies

Before initiating this strategy please buy first and then sell . some brokers like zerodha doesn’t allow to buy far OTM option . This is very important for hedge .

Enter on Wednesday after 15:00 Hrs and Exit on Thursday morning .

Before initiating this strategy please buy first and then sell . some brokers like zerodha doesn’t allow to buy far OTM option . This is very important for hedge .

Enter on Wednesday after 15:00 Hrs and Exit on Thursday morning .

On Thursday exit only option sold on Wednesday , option bought keep open till 15:00 hrs , some times if market went directional on Thursday it will give jackpot returns . Last Thursday it given good returns .

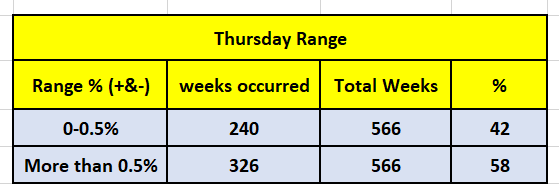

Following data is for thursday . Thursday expiry trading . Again 12 years data . 42 % of time market remains flat that is in the range of +&- 0.5% . These 42 % days are straddle and strangle days .

PIC

PIC

On other 58% days market went directional more than 1% to 5% move. on these days straddle and strangle players will lost huge if they didn’t controlled the risk .

Create Bull put spread or bear call spread or ratio spread on these days . Thread ends here . Thanks . Good luck.

Please share and Retweet .

Please share and Retweet .

• • •

Missing some Tweet in this thread? You can try to

force a refresh