Good long term fixed income investment for the retired. (Thread)

Paid Jan 1, and July 1. First one will be at 7.15% (divide by 2 for the half year payment)

Held in electronic form, but it's not in a demat account.

Income is fully taxable, TDS at 10% deducted. You can't self-declare like Form 15G/H: any tax deduction needs a full certification from the IT department in original.

You can't trade them, you can't transfer them.

You can't take a loan against them.

If you die, your nominee will get them, but they also have to wait for maturity.

Lock in is reduced for age 80+ (4 years), 70-80 (5y) and 60-70 (6y)

More attractive is PMVVY from LIC - 7.4% annual floating (Max 15L, locked 7y)

Senior Citizen's Savings Scheme: 7.4% fixed (Max 15L, kinda locked 5y liquidity with penalty) ht @kallol68

1) SCSS: 15 lakh at 7.4% fixed

2) PMVVY : 15 lakh at 7.4% floating (with scss)

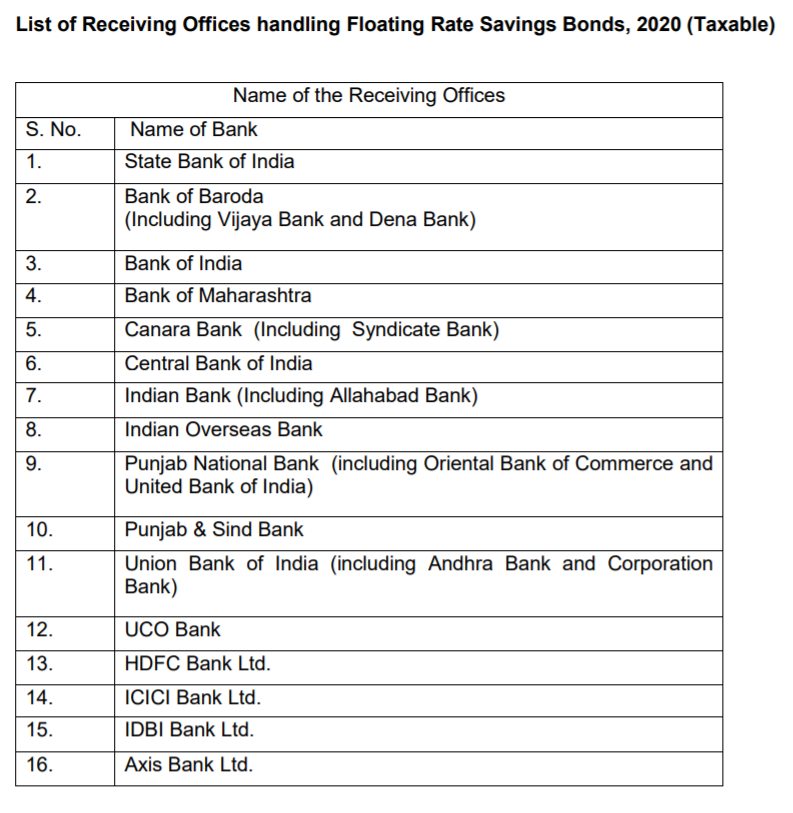

3) RBI bonds: No upper limit, 7.1% floating with NSC+0.35%

4) NSCs themselves (5y, 6.75%)

5) Do not buy bank bonds please they are toxic.