CEO, Capitalmind AMC.

Mutual Fund: https://t.co/kHDM0LHo6G

PMS: https://t.co/nGD8QS7Dkh

Views personal, not of employer

Read: Money Wise https://t.co/JVSZENRUbj

44 subscribers

How to get URL link on X (Twitter) App

The big culprit, really, was Gold.

The big culprit, really, was Gold.

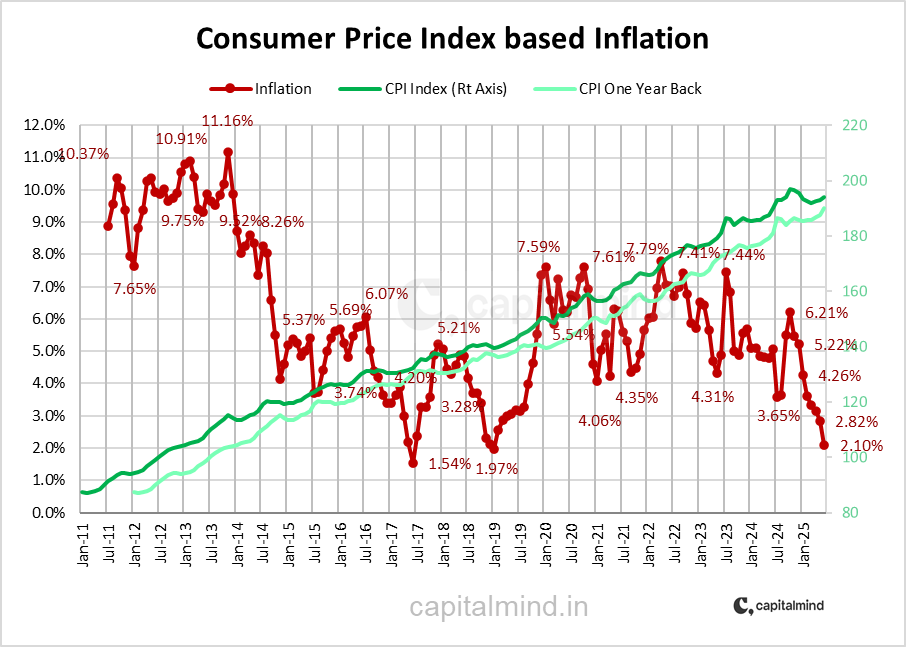

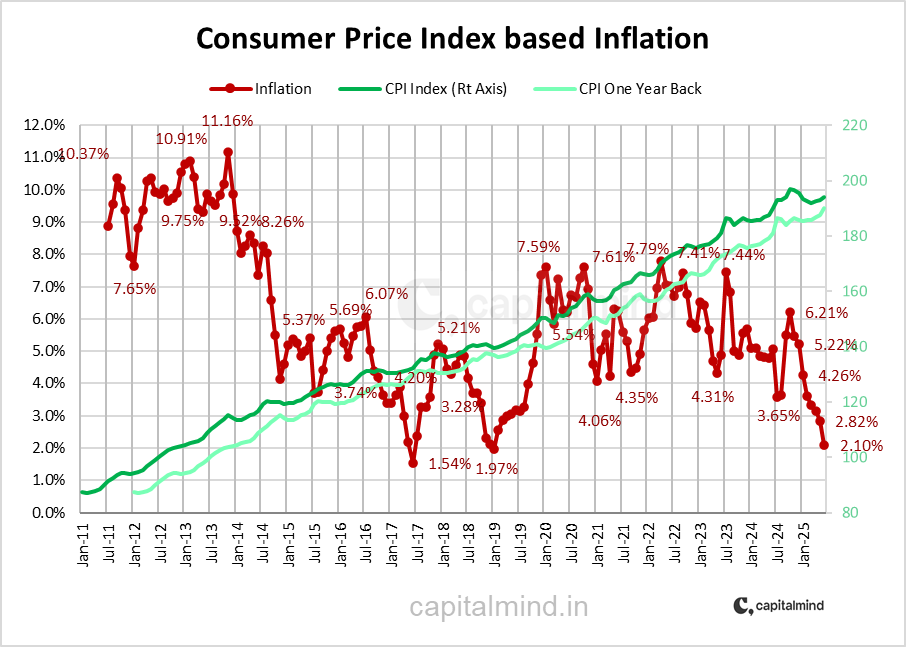

Compared to last year, we may be low enough, but there's a base effect because inflation went up big last year. The current year seems very nice.

Compared to last year, we may be low enough, but there's a base effect because inflation went up big last year. The current year seems very nice.

https://twitter.com/zerodhamarkets/status/1935321511314751953What is FDI? It's a foreign entity buying equity into an Indian company. Now you have FPI, which is portfolio investments by people like hedge funds and index funds and all that, into Indian listed companies. That is not fdi.

We now have the split by gender (male/female) and that's throwing some interesting changes in the last decade.

We now have the split by gender (male/female) and that's throwing some interesting changes in the last decade.

Note that in the previous quarter, the deficit was $16 bn. It was announced as $11bn and has now been revised UPWARDS by $5bn. So these figures can be revised.

Note that in the previous quarter, the deficit was $16 bn. It was announced as $11bn and has now been revised UPWARDS by $5bn. So these figures can be revised.

Well, of course, but there is a rule that you cannot issue shares below "par" so we have to cough up 50% more.

Well, of course, but there is a rule that you cannot issue shares below "par" so we have to cough up 50% more.

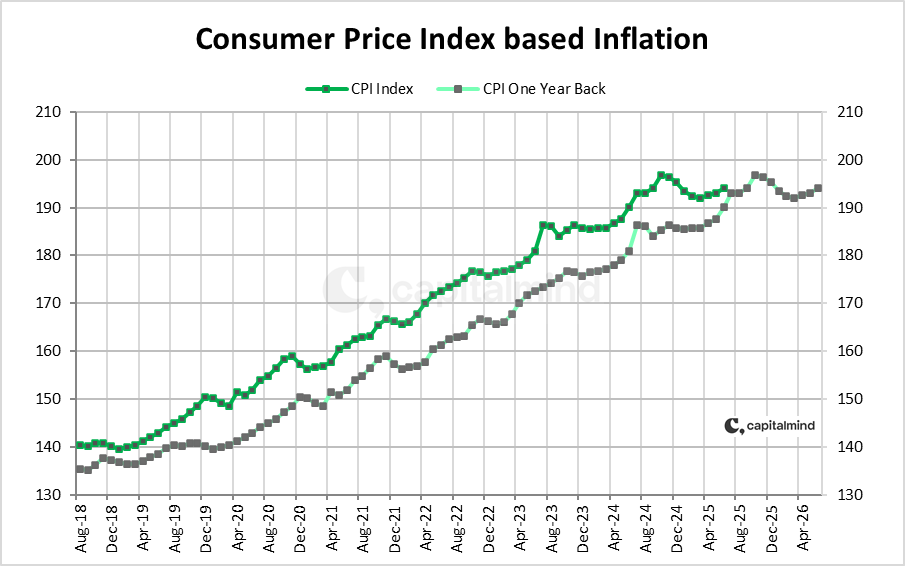

The difference between last year's numbers and this years is growing - that's what has caused the rise. Very steep.

The difference between last year's numbers and this years is growing - that's what has caused the rise. Very steep.

I had demonstrated the calendar spread impact here:

I had demonstrated the calendar spread impact here: https://x.com/deepakshenoy/status/1818275122580467941

Most IPO accounts were opened recently, which makes sense because of the increase in the number of brokers and the ability to apply easier online through some of them.

Most IPO accounts were opened recently, which makes sense because of the increase in the number of brokers and the ability to apply easier online through some of them.

On 31 May 2024, the same folks had said, when the price was 3300, to sell again with a 73% downside

On 31 May 2024, the same folks had said, when the price was 3300, to sell again with a 73% downside

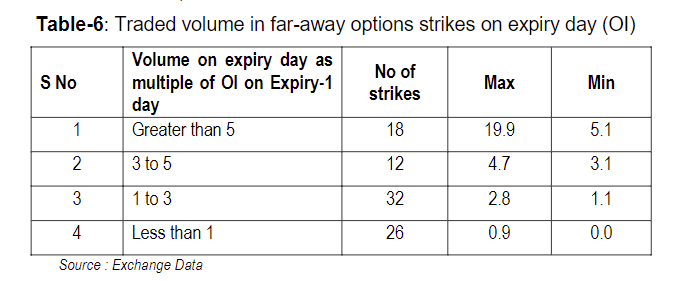

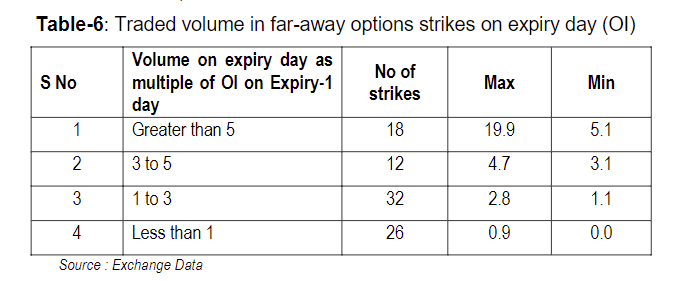

2. Option premium for buyers: Usually brokers demand it as cash, but intra-day, the brokers can use collateral (pledged shares/MF etc) given to the clearing corp as the margins at the broker level, not at the client level according to the paper.

2. Option premium for buyers: Usually brokers demand it as cash, but intra-day, the brokers can use collateral (pledged shares/MF etc) given to the clearing corp as the margins at the broker level, not at the client level according to the paper.

We wrote about this @capitalmind_in in 2018 and the exact nuances of how insanely much that number was, that RBI has in "excess". At that time, we estimated that they had over 300,000 cr. in excess, and today that number is way higher. (Links later)

We wrote about this @capitalmind_in in 2018 and the exact nuances of how insanely much that number was, that RBI has in "excess". At that time, we estimated that they had over 300,000 cr. in excess, and today that number is way higher. (Links later)

Credila was sold off in 2024 March, which pretty much made their bottomline. They also had an extra floating provision of 10,900 cr. (which would have brought down the profit) and that's likely because they see more issues in retail.

Credila was sold off in 2024 March, which pretty much made their bottomline. They also had an extra floating provision of 10,900 cr. (which would have brought down the profit) and that's likely because they see more issues in retail.

Oh, and deposit growth is only around 13%, versus credit growth of 19%.

Oh, and deposit growth is only around 13%, versus credit growth of 19%.