In preparation of @Lemonade_Inc's IPO, a motley crew of writers and investors dug into the company's S-1.

thegeneralist.substack.com/p/the-s-1-club…

Amazing working with @ByrneHobart @daveambrose @fkpxls @jon_hale @tanayj @mengxilu on this!

/Thread

This is a SoftBank business. Revenue and premiums have scaled fast. So has marketing spend.

The big question: can they grow *beyond* renters' insurance and capture share in higher value product lines?

- $5T global market

- 11% of US GDP

- 12 of the Fortune 100

- Employs 2.69MM domestic

- Price in solid margins

- Great cashflow profile

- Make money off the float

Massive, sleepy, fragmented, analog.

In homeowners' insurance, 93% is still sold by agents. Not to say online insurance isn't sufficiently large. Already a $31B industry in the US.

Lemonade's share is still small compared to @Allstate and @StateFarm.

Started in 2015 when @daschreiber decided to leave @powermat and wake up a sleeping giant. Added @shai_wininger shortly afterwards.

(How can 2 of the most interesting execs both have less than 10K followers? 👈👈)

I tipped my hand in the last tweet. But this is a baller team. Extremely talent communicators in an opaque market. And great paid marketing chops from @shai_wininger's time founding @fiverr.

Also, employees seem to really respect leadership. Per @Glassdoor.

Beyond founders, there are some skilled operators.

- Tim Bixby, CFO (f'mly @Shutterstock)

- John Peters, CIO (f'mly @LibertyMutual)

- Jorge Espinel, Chief BD Officer (@Spotify)

This last role is v interesting. Worth watching what Espinel does over the coming Qs.

The company holds the world-record for paying an insurance claim. It took "AI Jim" 3 seconds.

lemonade.com/blog/lemonade-…

Lemonade got into a spat w @TMobile who threatened to sue for using magenta.

Response from @daschrieber:

"𝗬𝗼𝘂’𝗿𝗲 𝘁𝗮𝗹𝗸𝗶𝗻𝗴 𝗮𝗯𝗼𝘂𝘁 𝗼𝗻𝗲 𝗼𝗳 𝘁𝗵𝗲 𝘁𝗵𝗿𝗲𝗲 𝗶𝗻𝗸 𝗰𝗮𝗿𝘁𝗿𝗶𝗱𝗴𝗲𝘀 𝗶𝗻 𝗲𝘃𝗲𝗿𝘆 𝗽𝗿𝗶𝗻𝘁𝗲𝗿 𝗶𝗻 𝘁𝗵𝗲 𝘄𝗼𝗿𝗹𝗱..." 😂

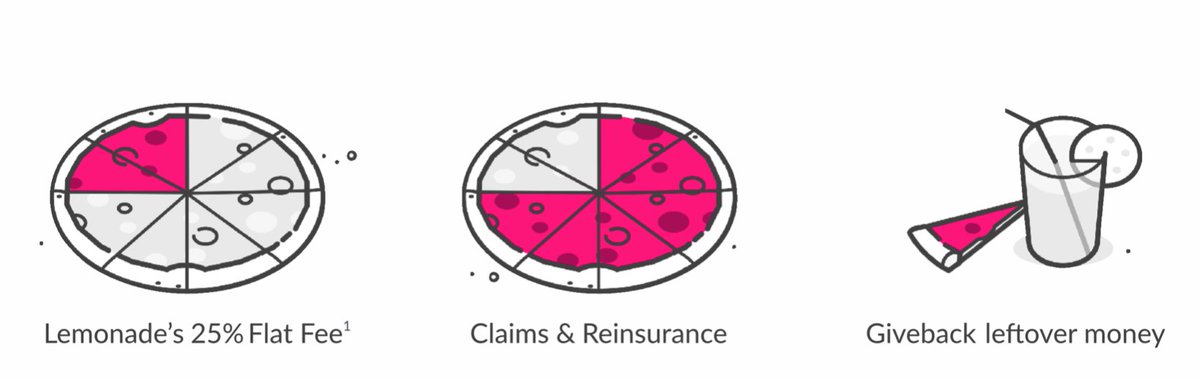

If you've used Lemonade, you'll know its slick and easy to use. Key differentiation is that UX + use of AI/ML. The behavioral economics of the "Giveback" program is also important. They've got @danariely to thank for that...

Three questions to ask:

- Is growth sustainable?

- Is there a path to profitability?

- Is the underlying business model working?

Our take? Yes. Yes. And...kind of.

Masa casts a long shadow. When you look at LMND's financing history, @SoftBank's fingerprints are all over it.

Of $480MM raised, 87.5% came from SB.

@daveambrose @ByrneHobart @jon_hale @fkpxls and I shared our takes on this fact, referencing @chamath.

Why not? The markets are friendly towards emerging growth co's (@vroomcars @ZoomInfo) and other insurtech plays are doing well (@SelectQuoteIns)

Plus, Lemonade's actually done well, despite #covid19.

"𝐈’𝐝 𝐜𝐨𝐧𝐬𝐢𝐝𝐞𝐫 𝐦𝐲𝐬𝐞𝐥𝐟 𝐚 𝐜𝐚𝐫𝐞𝐟𝐮𝐥 𝐛𝐮𝐥𝐥...[𝐁𝐮𝐭 𝐋𝐌𝐍𝐃] 𝐧𝐞𝐞𝐝𝐬 𝐭𝐨 𝐬𝐭𝐚𝐫𝐭 𝐚𝐜𝐪𝐮𝐢𝐫𝐢𝐧𝐠 𝐭𝐡𝐞 𝟒𝟎+ 𝐜𝐫𝐨𝐰𝐝 𝐬𝐨𝐨𝐧." @BUSlNESSBARISTA

"𝐓𝐡𝐞 𝐢𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐢𝐧𝐝𝐮𝐬𝐭𝐫𝐲 𝐢𝐬 𝐠𝐨𝐢𝐧𝐠 𝐭𝐨 𝐛𝐞 𝐰𝐞𝐚𝐤𝐞𝐧𝐞𝐝...𝐚𝐧𝐝 𝐡𝐞𝐫𝐞 𝐜𝐨𝐦𝐞𝐬 𝐭𝐡𝐢𝐬 𝐟𝐢𝐬𝐭 𝐨𝐟 𝐬𝐭𝐨𝐧𝐞 𝐜𝐚𝐥𝐥𝐞𝐝 𝐋𝐞𝐦𝐨𝐧𝐚𝐝𝐞." @profgalloway

Fast-growth in a sleepy industry. A business model that's improving. And a talented executive team. There's a lot to like here.

The biggest concerns are weak graduation rate, and the related LTV : CAC ratio.

There are so many awesome biz writers/podcasters out there. Thx for sharing amazing work + inspiring me to be better.

@BUSlNESSBARISTA

@packyM

@adam_keesling

@dburben

@nbt

@aashaysanghvi_

@TurnerNovak

@jamesbeshara

@lennysan

👉👉 Check out their stuff!