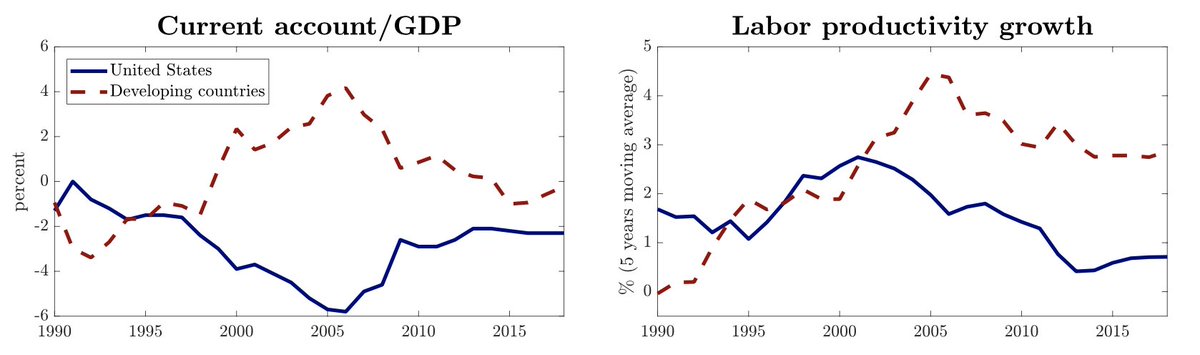

@helene_rey, helenerey.eu/Content/_Docum…), financial globalization generates superlow global rates (@benbernanke, federalreserve.gov/boarddocs/spee…) - as well as weak investment and

@johnvanreenen, economicstrategygroup.org/auth/john-van-…) can play a crucial role in shielding US - and more broadly global - productivity growth from the adverse impact of

financial globalization.