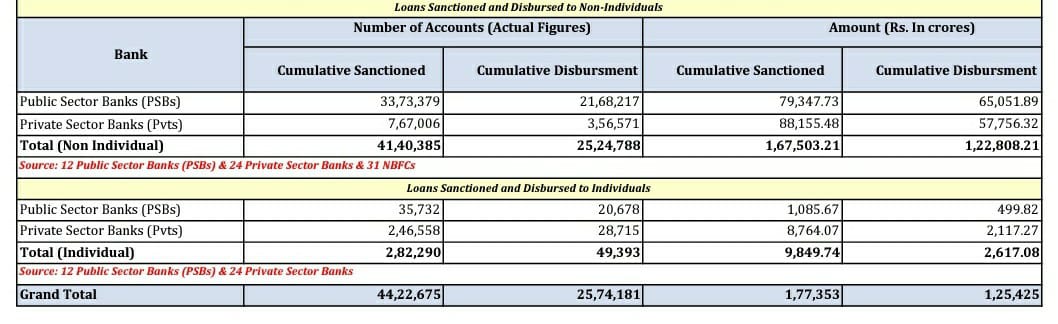

As of 4 July 2020, the total amount sanctioned under the 100% Emergency Credit Line Guarantee Scheme by #PSBs and private banks stands at Rs 1,14,502.58 crore, of which Rs 56,091.18 crore has already been disbursed. Here is the break-up: #AatmanirbharBharat #MSMEs

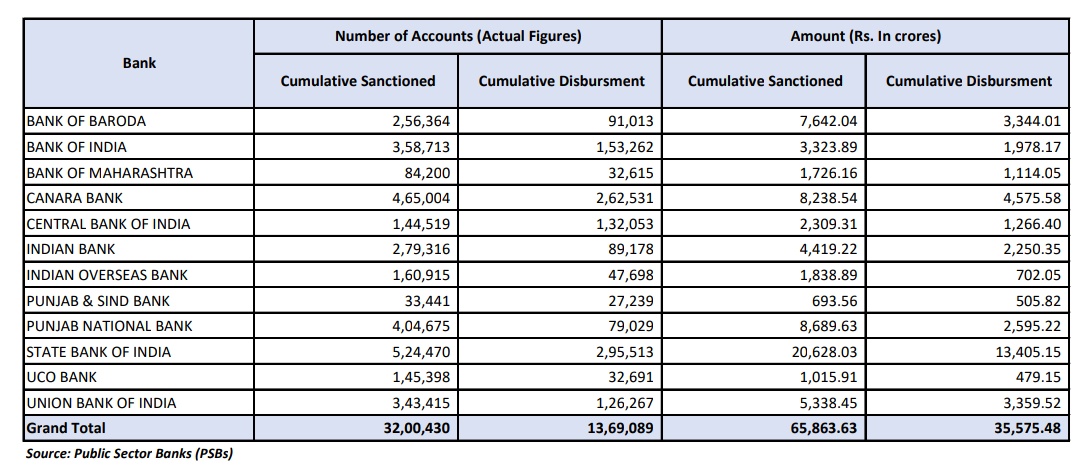

Under the 100% ECLGS, the loan amounts sanctioned by Public Sector Banks increased to Rs 65,863.63 crore, of which Rs 35,575.48 crore has been disbursed as of July 4. Here are the bank-wise & State-wise details: #AatmanirbharBharat #MSMEs

Compared to 1 July 2020, there is an increase of Rs 4,158.51 crore in the cumulative amount of loans sanctioned and an increase of Rs 3,835.65 crore in the cumulative amount of loans disbursed, by both #PSBs and private sector banks combined as on 4 July 2020.

• • •

Missing some Tweet in this thread? You can try to

force a refresh