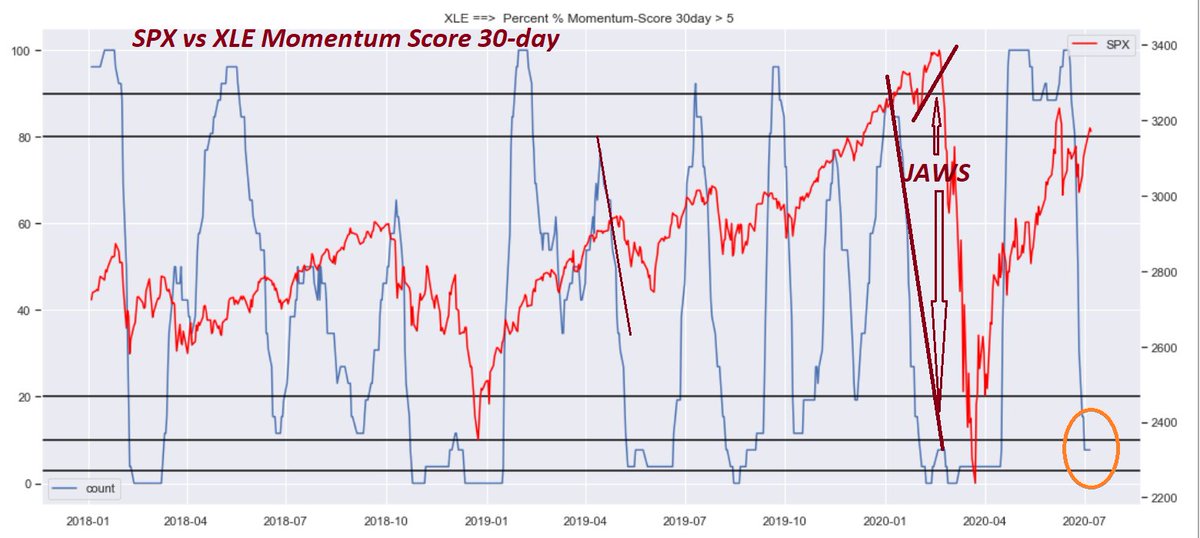

% of stocks having 30-day momentum score > 5

less than 8% & decr

We need a different scale for

Notice that Feb 18th "huge Jaws"- unprecedented - just before Feb/March plunge.

obvious? predicting May #CL front month -$40 🦃

&

Efficiency frontier tutorial.

Based on the Portfolio Sharpe ratio optimization.

Watch below...

investopedia.com/terms/e/effici…