To transform massive raw data into meaningful trading information which in turn enables one to build investment knowledge. This is for educational purposes only

64 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/kerberos007/status/15294544337671536656) same for VVIX

https://twitter.com/kerberos007/status/15292216835921838095) believing: Powell is always has your back

https://twitter.com/kerberos007/status/1228693443720962048

https://twitter.com/kerberos007/status/1228695755814293506

https://twitter.com/kerberos007/status/1420773861004619779

https://twitter.com/trader_joemama/status/1419681231168409601

https://twitter.com/kerberos007/status/1016463619792490497

https://twitter.com/kerberos007/status/1387016964988706820There are 4 different SMA related "breadth" indicators:

A. Tuesday Inflation Chart porn:

A. Tuesday Inflation Chart porn:

ORCL

ORCL

https://twitter.com/kerberos007/status/1384469683986915331Small cap (Rut & IWM) was down more than 1.5% Mon

WSK to da Moon screener

WSK to da Moon screener

https://twitter.com/kerberos007/status/1339742953716199425$USD up

https://twitter.com/kerberos007/status/1330349895853760520Dec 16th:

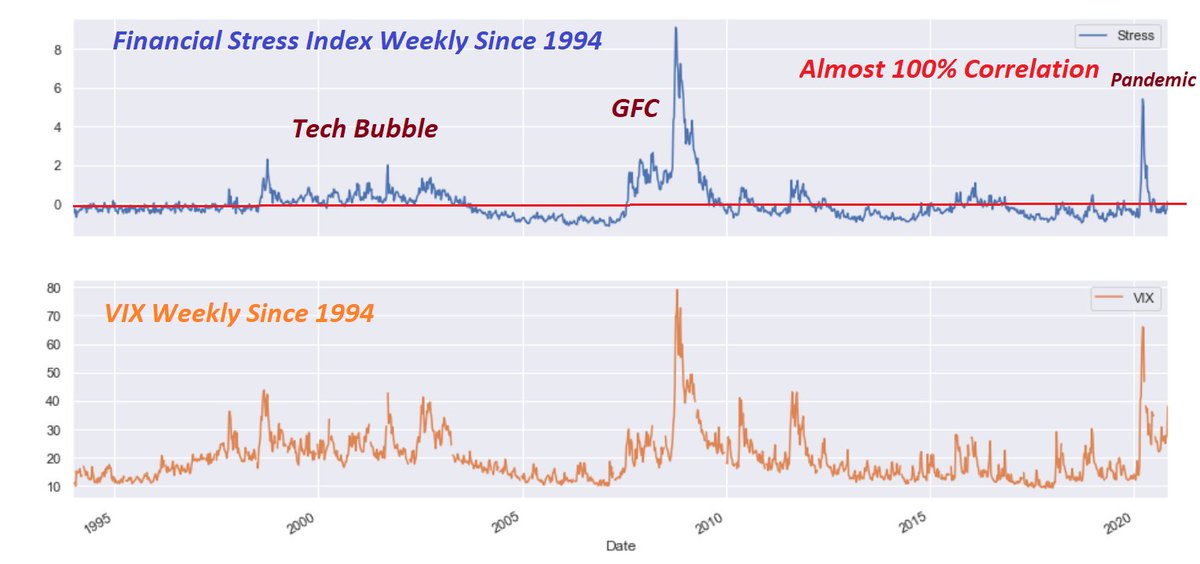

Shocking correlation between

Shocking correlation between

https://twitter.com/kerberos007/status/1318918295714750464$NQ support & strong resistance levels

https://twitter.com/kerberos007/status/1314040337946509317Read above post

https://twitter.com/kerberos007/status/1277812391741456384BTFD indicator #2

https://twitter.com/kerberos007/status/1300219067517882368

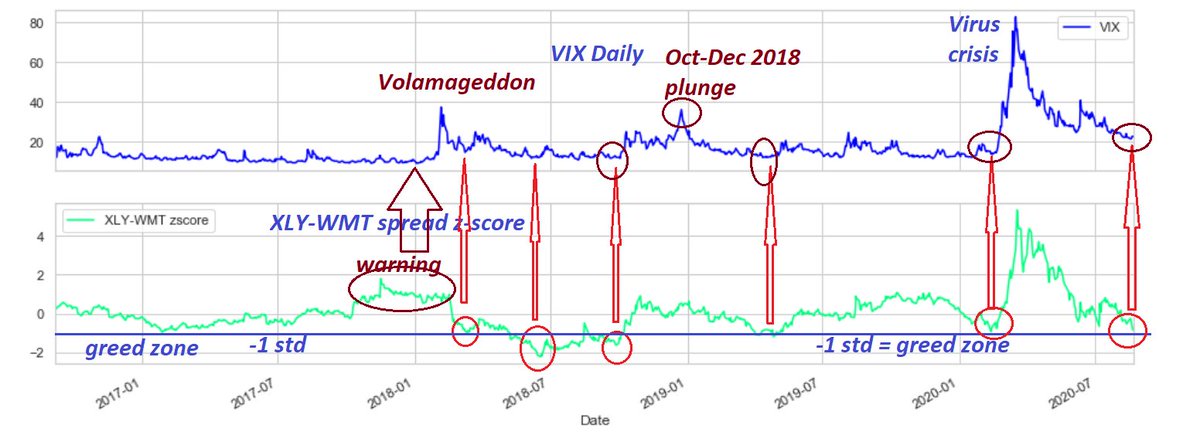

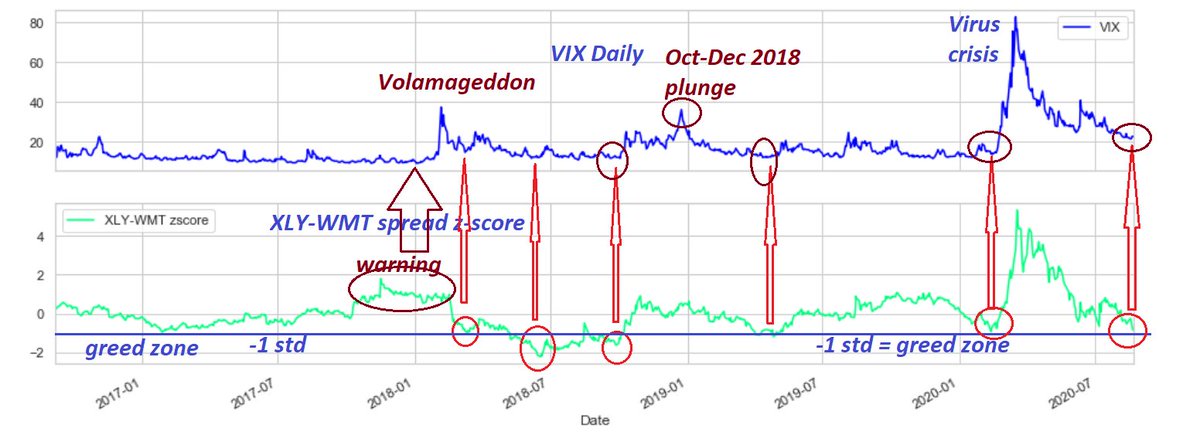

https://twitter.com/kerberos007/status/1298291837887746050XLY-WMT spread vs $VIX

https://twitter.com/kerberos007/status/1297364211031511040Hedging or pair trading with SPY, QQQ & SPY-500 sector ETFs